Federal Budget - client presentation

advertisement

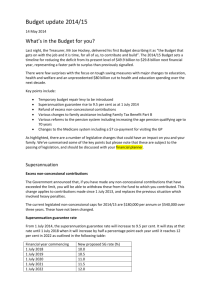

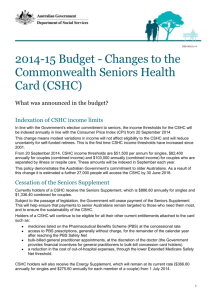

Federal budget update 2014/15 General advice Bridges Financial Services Pty Limited (Bridges). ABN 60 003 474 977. ASX Participant. AFSL No 240837. Part of the IOOF group. This is general advice only and has been prepared without taking into account your particular objectives, financial situation and needs. Before making an investment decision based on this article, you should assess your own circumstances or consult a financial planner. Bridges is not a registered tax agent. You should consider the appropriateness of this information having regard to your individual situation and seek taxation advice from a registered tax agent before making any decision based on this information. In referring members to Bridges, your financial institution does not accept responsibility for any acts, omissions or advice of Bridges and its authorised representatives. 2 “Contribute and build” • Toughest Budget since 1997 • Economic repair job to protect Australia’s living standard • Prepare for ageing population Did you know... in 1950 there were 17 taxpayers for every retiree, but by 2050 it is predicted that there will only be 2.7 workers per retiree. Source: Intergenerational report 2010. Forecast: Budget deficit reduction 4 How will the Budget affect you? • • • • • 5 Superannuation Taxation Centrelink and other Government benefits/ payment Health and education Questions Superannuation 6 Super guarantee (SG) increases Financial year commencing 1 July 2013 1 July 2014 1 July 2015 1 July 2016 1 July 2017 1 July 2018 1 July 2019 1 July 2020 1 July 2021 1 July 2022 7 New proposed SG rate (%) 9.25 9.5 9.5 9.5 9.5 10 10.5 11 11.5 12 Current legislated SG rate (%) 9.25 9.5 10 10.5 11 11.5 12 12 12 12 Non-concessional contributions • Have you made after tax super contributions that exceed the limit? Non-concessional contribution caps Current $150,000 per annum or $450,000 over three years (if 64 or under) 2014/15 $180,000 per annum or $540,000 over three years (if 64 or under) • You can withdraw the excess amount from your fund • Tax payable on investment earnings at your marginal rate rather than penalty tax (top Marginal tax rate) • Applies to contributions made since 1 July 2013 8 Concessional contributions • Similar refund mechanism applies to concessional contributions • Excess concessional contributions are taxed at marginal tax rates 9 Taxation 10 Budget repair levy Do you earn more than $180,000 pa? • For taxable income earned above $180,000, an additional 2 per cent levy applies. • Applies from 1 July 2014 to 30 June 2017. • Brings the top marginal tax rate to 49 per cent (including increases to Medicare levy of two per cent) • What could you consider? 11 Budget repair levy (Cont) Income bracket Current tax rates New tax rates Medicare SG tax levy (%) (%) Old tax saving (%) New tax saving (%) $0 - $18,200 0% 0% 0 0 0 0 $18,201 - $37,000 19% 19% 2 0 Variable Variable $37,001 - $80,000 $3,572 + 32.5% $3,572 + 32.5% 2 15 19.0 19.5 $80,001 - $150,000 $17,547 + 37% $17,547 + 37% 2 15 23.5 24.0 $150,001 - $180,000* $43,447 + 37% $43,447 + 37% 2 15 23.5 24.0 $180,001 - $274,599 $54,547 + 45% $54,547 + 47% 2 15 31.5 34.0 $274,600* - $300,000 $97,117 + 45% $99,009 + 47% 2 15-30 Variable Variable $300,000 + $11,0947 + 47% 2 30 16.5 19.0 $108,547 + 45% * Includes SG of 9.25 per cent. Does not take into consideration the maximum contribution base for SG calculation. 12 Fringe benefits tax (FBT) rate • The FBT rate will increase from 47 per cent to 49 per cent from 1 April 2015 until 31 March 2017 • Targets people earning over $180,000 • Cannot use salary packaging to avoid the budget repair levy • If you are currently packaging a car this may impact you 13 Medicare levy thresholds • The Medicare levy low-income threshold will be increased from the 2013/14 income year • No Medicare levy if taxable income is equal to or less than: Threshold 14 Individuals $20,542 Pensioners eligible for SAPTO $32,279 Couple (combined) $34,367 Additional for each dependent child/student $3,156 Tax offsets abolished Applies from 1 July 2014: 15 Mature age workers tax offset Dependent spouse tax offset Previously available if you were born before 1 July 1957 and receiving income from working Previously available for dependent spouses born before 1 July 1952 Fuel excise • Twice annual indexation of fuel excise based on CPI from 1 August 2014. • Likely will see fuel prices go up for consumers. • Government to invest the funds in roads and traffic conditions around the country. 16 title of presentation Centrelink and other government benefits/ payments 17 Increase to the age pension qualifying age to 70 Current legislation: Proposed legislation: The Age Pension qualifying age Continues the current rate will increase by six months every increase from 1 July 2025 until it two years starting 1 July 2017 reaches 70 years by 1 July 2035 until it reaches age 67 on 1 July 2023 No changes to superannuation preservation age at this stage – usually 5 years below age pension age. 18 Age pension example • If you are born after 1 January 1966 you won’t be able to apply for the age pension until age 70 Example: Kate was born on 1 January 1970 and is currently 44. Under current age pension legislation she was expecting to access the age pension at age 67. If the proposed changes come into effect, she will have to wait until age 70 • What will happen if Kate wants to retire at age 60? 19 Summary: proposed age pension qualifying age Date of birth between Current Proposed 20 1 July 1952 and 31 December 1953 Age eligible for age pension 65½ 1 January 1954 and 30 June 1955 66 1 July 1955 and 31 December 1956 66½ 1 January 1957 and 30 June 1958 67 1 July 1958 and 31 December 1959 67½ 1 January 1960 and 30 June 1961 68 1 July 1961 and 31 December 1962 68½ 1 January 1963 and 30 June 1964 69 1 July 1964 and 31 December 1965 69½ 1 January 1966 and later 70 Deeming rate thresholds • From September 2017, the Government propose to change the deeming rate thresholds: Current threshold New threshold Deeming rate for couples $77,400 $50,000 Deeming rate for singles $46,600 $30,000 • The government has not commented on including the family home in the means test (as initially speculated). 21 Indexing Pension and other payments by CPI The indexation of pension and other equivalent payments is proposed to be linked to the consumer price index (CPI). This will apply from: • 1 July 2014 to Parenting Payment Single recipients. • 1 September 2017 to Bereavement Allowance and pension payments such as age pension, disability support pension, carer payment and veterans’ affairs pensions. • What impact will this have? 22 Disability Support Pension (DSP) • If you are a DSP recipient, the amount of time you can leave Australia and still receive the DSP may be reduced • Maximum of four weeks in a 12 month period • Apply from 1 January 2015, to existing and new applicants • Under age 35 on DSP? Possible review of eligibility based on ability to work 8 hours per week 23 Commonwealth Seniors Health Card • From 1 July 2014, income levels for the Commonwealth Seniors Health Card (CSHC) will be indexed by CPI • Currently, you may apply for the CSHC as follows: Current adjusted taxable income per annum: 24 Single $50,000 Couple $80,000 Commonwealth Seniors Health Card (cont) • Account-based pension to be subjected to ‘deeming’ for assessment for new applicants from 1 January 2015 (previously not included). • From September 2014, Holders of CSHC will not be entitled to seniors supplement: Current seniors supplement (pa) 25 Single $876 Couple $660 Family payments • Family Tax Benefit Part B (FTB Part B) primary earner income limit reduces from $150,000 to $100,000 per annum • Limited to families whose youngest child is under six • Families with a youngest child aged six and over on 30 June 2015 will remain eligible for FTB Part B for two years • Pause on current FTB amount for part A and B for two years • New FTB allowance - $750 for each child aged 6-12 26 Newstart allowance • Increase the age of eligibility for Newstart Allowance from 22 to 24 years of age • If under 30, must demonstrate appropriate job search for six months and then participate in 25 hours per week Work for the Dole 27 title of presentation Health and education 28 Pharmaceutical benefits scheme In 2015, prescription costs will increase for pharmaceuticals on the PBS for: • general patients by $5.00 • concessional patients by $0.80 29 Patient contribution fee • $7 “patient contribution” fee each time you visit your GP • Concession card patients and children under 16 only pay for first 10 visits each year • Applies from July 1 2015 30 title of presentation University students – HECS/HELP • From 1 June 2016, the HELP (formally HECS) interest rate will be on the 10 year bond rate (rather than CPI) • Capped at six per cent • Repayments start once earning over approx $50,638 per annum • New repayment rate of 2 per cent applies to incomes over $50,638 per annum 31 Questions