News for Seniors issue 94 - Department of Human Services

advertisement

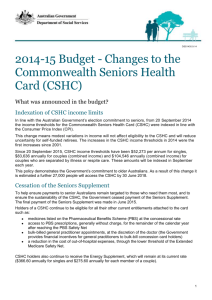

News For Seniors ISSUE 94 | APRIL 2015 A publication offering information, guidance and inspiration to Australian senior citizens News for Seniors subscription If you would like to receive a copy of News for Seniors, call 132 300. You can also change your address by writing to: Seniors Hub, PO Box 7808, Canberra BC, ACT 2610. Department of Veterans’ Affairs customers should call 133 254 or Freecall™ 1800 555 254. If you would like to receive News for Seniors in a language other than English, call 131 202. If you have a vision impairment and would prefer to receive an audio version, call 132 300. To view English and non-English versions, go to humanservices.gov.au/newsforseniors DISCLAIMER: The Australian Government has attempted to ensure the information in this publication is accurate. However, the government does not warrant that the information is accurate or complete nor will it be liable for any loss suffered by any person because they rely on it in any way. You should contact your local Department of Human Services office or Department of Veterans’ Affairs state office for full details of any entitlements and services to which you may be eligible, or how any pending changes in legislation, programs or services may affect you. © Commonwealth of Australia 2015. ISSN 1033-8365 A message from the Prime Minister I’m pleased to be able to update you on some important government actions to protect your savings and to support seniors. You may recall that in 2012 the period of time for inactive bank accounts to be declared unclaimed was reduced from seven years to three years. As a result, millions of dollars held in thousands of active savings accounts were transferred to the government. In 2012–13 more than 156 000 accounts worth about $550 million disappeared into the government’s coffers. People had to go through the time-consuming and costly process of reclaiming their money. In some cases this took six months. This caused real financial distress, especially for older Australians and community groups, who were not able to access their own funds when they needed them. Recently, I announced that the government would deliver on our commitment to restore the time bank accounts and life insurance policies can be inactive before they are transferred to the government to seven years. Children’s bank accounts will be exempt to ensure funds put aside in these accounts will never be transferred to the government. This recognises that many people choose to put money aside for their children’s future. We are also making changes to protect the privacy of individuals who have genuinely inactive accounts transferred to the Australian Securities and Investments Commission to address concerns around identity theft and to stop unscrupulous people from preying on vulnerable Australians. Some unscrupulous businesses have been using this information to charge fees as high as 25 per cent to reunite people with their own money. I am also pleased to confirm that Australia’s age pensioners receiving the maximum rate of payment are $51.80 per fortnight better off for singles and $78 per fortnight for couples since the government was elected. The recent indexing of the Age Pension provides single age pensioners a $5.90 boost to their fortnightly payment or $153.40 a year while couples will receive an extra $8.80 a fortnight or $228.80 a year. Electricity bills are also lower as a result of the abolition of the carbon tax. The carbon tax is gone and the government is continuing to pay the Energy Supplement—that’s an additional $14.10 per fortnight for single pensioners and $21.20 for couples. There is also good news for part pensioners. Income tested part-pensioners will receive a double boost to their payments as a result of the recent change to lower deeming rates. More than 770 000 Australians will receive, on average, an extra $83.20 a year as a result of this government decision. My government wants to do the right thing by Australian seniors—and especially to help pensioners keep up with the cost of living. A message from the Minister Welcome to the first 2015 edition of News for Seniors. In the previous edition of News for Seniors, we included a special supplement outlining the growing range of digital services the department has to offer. I hope you found this useful and perhaps were inspired to start using the department’s digital services. In this edition, some of our Service Officers have shared their stories about helping enthusiastic older Australians use our digital options, like the Express Plus mobile apps and myGov. Earlier this year I was pleased to officially open a myGov shopfront in Sydney. The government is committed to making it easier to access services you need and the new shopfront is a key part of that goal, bringing together the Department of Human Services and the Australian Taxation Office into one place. The opening of the Sydney myGov shopfront follows the success of the Brisbane shopfront, which opened in June 2014. The public response to the Brisbane myGov has been extremely positive. Older Australians who attended the Brisbane opening told me learning how to use the range of online options was a positive experience. If you don’t live close to a myGov shopfront, staff at all our service centres are happy to show you how to use our mobile apps and self service computers. They can show you how to create a myGov account if you haven’t done so already. The service now has over 6 million active users and you can read more about the new features and enhancements to the service on page 12. While we are meeting the demand for seamless and efficient technological services, the department continues to offer phone and face-to-face services to help Australians through different phases of their lives. Our Multicultural Service Officers (MSOs) are a prime example of this. For 25 years, MSOs have helped millions of customers access government programs and services. The relationship the MSOs have with groups and organisations in culturally and linguistically diverse communiti es is invaluable. I know our dedicated MSOs are proud to be out amongst the multicultural communities, helping people understand their options and the services available to them. There are a range of translated publications available on the Human Services website—including News for Seniors. Visit humanservices.gov.au/yourlanguage or to speak to someone in your language about Centrelink payments and services, call our Multilingual Phone Service on 131 202. Lastly, I want to reflect with you on the enormous sacrifice our parents and grandparents undertook for us. In April, I will join you in remembering the sacrifice made by Australian and New Zealand troops who landed and fought at Gallipoli 100 years ago. Lest we forget. Reporting your employment income Changes to your income may affect your payment. We need to know how much you have earned each fortnight so you’re paid the right amount. You need to tell us if your circumstances change, including any changes to your income. If you do not tell us about changes to your circumstances within 14 days, your payment may be affected. You can report your employment income by: • logging on to your Centrelink online account through myGov and selecting ‘Report employment income’ • using an Express Plus mobile app, or • calling 133 276 on your reporting day. If you tell us the wrong amount, you need to call or visit us as soon as possible to fix the mistake. This will ensure we pay you the right amount. You cannot use self service to change an amount you have already reported. For more information visit humanservices.gov.au and search for ‘income reporting’. Income Stream Reviews are now quicker Each year in August and February, we review certain types of income streams. When it’s time for you to complete an Income Stream Review, we will let you know. A quick and easy way to complete an Income Stream Review is online using your myGov account. To use your myGov account: 1. Log on to your Centrelink online account through my.gov.au 2. Select your ‘Income Stream Review reminder’ and be guided through the process step-by-step. If you can’t complete the review using your myGov account, a unique One Time Access Code is provided in your Income Stream Review letter. The One Time Access Code is secure, simple and easy to use. It will allow you, or your nominee, to complete the review online at humanservices.gov.au/incomestreamreviews If you cannot complete the review online, call us on 132 300. Make sure you have the information about your Income Stream Review products ready. Our website has a range of support tools including videos and guides to help you use our online services. Visit humanservices.gov.au/onlineguides If you don’t have a myGov account, you can create one at my.gov.au With a myGov account you can claim a range of payments, request income statements, update personal details and more. It’s easy to set up your Centrelink online account through myGov—select ‘Services’ and then the ‘link’ icon. For more information about myGov, see page 12. Champion marathon swimmer living life to the full... It was a decades-old promise to his former local swimming coach, Des Renford, and a personal pledge to raise funds for cancer research at the Melanoma Institute, which motivated Cyril Baldock to swim across the English Channel to France at the age of 70 years and 9 months. Cyril’s first swim across the English Channel was in 1985 when he was 41 years old. Completing the gruelling 34 km marathon swim in 12 hours and 45 minutes on 20 August 2014, Cyril broke the Guinness World Record as the oldest man in history to do so. With a support crew in the boat offering encouragement and sustenance, he arrived at Cap Gris Nez in France, exhausted but exhilarated. ‘I haven’t had that much fun in years,’ Cyril said after his marathon swim. ‘At the 10 hour mark I felt like I was going nowhere but my support crew was fantastic in their encouragement and inspired me to make it to the finish.’ A life member of Bondi Surf Club, with a patrol named after him for his dedication and commitment to the club, Cyril is still very active as he works to motivate and inspire younger swimmers. His passion and love for the ocean date back to his childhood. Cyril joined the surf club in 1958 at the age of 15. His grandchildren have followed his love of the ocean and are training as Nippers at their local Eastern Suburbs beach. His efforts and achievements have been noted by many near and far. Cyril was honoured to be nominated for Performance of the Year in 2014 by the World Open Swimming Association. He has raised over $13 000 for charity, and those who have donated to Cyril’s fundraising efforts describe him as an inspiring champion who makes them feel proud to be an Australian. Cyril acknowledges his swim would not have been possible without the sponsorship of an aged care facility in Bondi. The Director of the facility, Laurie Kresner, is also a former schoolmate of Cyril’s and said his old friend is a man who represents positive ageing and achievement. ‘Cyril and I go way back, so having an opportunity to support him in this endeavour is an honour. Cyril is a first class athlete and a proud Australian. We strive for excellence in aged care and Cyril strives to excel not only in his sporting field but by gracefully ‘ageing well’ and setting goals when naysayers say we [seniors] may be past our prime!,’ said Laurie. As a motivational speaker, Cyril gives talks to residents, staff and guests at aged care facilities in Bondi, Sutherland and Bankstown. He inspires them with tales of his dedicated training regime and the gruelling isolation of marathon swimming. Cyril’s advice is that age should not restrict living life to the fullest and that it can often be mind over matter. Ageing does not dampen the enthusiasm to live well and be positive! Cyril’s outlook on life and overcoming challenges is an inspiration to all. If you have a Twitter account, you can follow Cyril @BaldockCyril Anzac Day The Anzac Centenary, 2014 to 2018, is one of Australia’s most important periods of national commemoration. It’s a time for all Australians to remember and commemorate the service and sacrifice of those who have served in the Australian Defence Force over the last 100 years. Anzac Day 2015 marks the centenary of the Anzac landings on the Gallipoli Peninsula in Turkey. This battle was one of many significant battles fought by Australian and New Zealand troops during the First World War. As a nation, we pause on Anzac Day to remember the contribution of all Australians who served in the First World War, and those who paid the ultimate sacrifice. We also honour the contributions made by Australian service men and women from all wars, conflicts and peace-keeping operations over the last 100 years, and reflect on the families and communities that support them. There are lots of ways you can commemorate the Anzac Centenary, including: Attending a Dawn Service You can join in a local Dawn Service or watch the television broadcast of the Gallipoli and Villers-Bretonneux services on the ABC. Watching an Anzac Day March You can find out about marches in your area by contacting your local Returned and Services League (RSL). Anzac Centenary Photo App Experience how local communities are marking this significant milestone in our history by viewing and sharing images of commemorations from Australia and around the world using the Anzac Centenary Photo App at spirit.anzaccentenary.gov.au The assessment of account-based income streams has changed On 1 January 2015, the following changes to the assessment of account-based income streams took effect. Customers receiving income support payments The assessment of income from account-based income streams (also called account-based pensions or allocated pensions) for customers receiving pensions and allowances has changed. If you used superannuation to purchase account-based income stream products, the balance of these products is now assessed as if they are returning a certain percentage of income, regardless of the actual income being earned or drawn down. This is known as ‘deeming’, which is how we assess income from other financial investments for income support payments. Deeming means you do not have to advise actual returns and may reduce the extent to which your payments vary. For more information about deeming and the changes to the deeming rules for income support payments visit the Department of Social Services (DSS) website, dss.gov.au and go to the Seniors section, select ‘Benefits and payments’ and search for ‘Age Pension’. An e-Booklet is also available from the DSS website on the ‘Deeming Information’ page. Customers holding a Commonwealth Seniors Health Card The assessment for the Commonwealth Seniors Health Card (CSHC) has changed: • Account-based income streams will be assessed using the deeming rules. The deeming rules assume your financial assets are earning a certain amount of income, regardless of the income they actually earn. If these financial assets earn more than these amounts, the extra income is not assessed. • Account-based income streams you held before 1 January 2015 will not be assessed using the deeming rules, providing you remain eligible for the CSHC from 31 December 2014. • If you change products, or buy a new account-based income stream from 1 January 2015, the new product will be assessed using the deeming rules. • If you have a partner who is aged 60 or more and not the holder of a CSHC, any account-based income streams they hold, regardless of when they purchased the product, will be assessed under the deeming rules and may affect your entitlement to the CSHC. • If you’re no longer eligible for the CSHC from 1 January 2015, any account-based income streams you hold will be assessed under the deeming rules if you reapply for a CSHC. • If you’re a Low Income Health Care Card holder, the deemed income from your account-based income stream will be used to assess your entitlement. For more information about the CSHC, visit humanservices.gov.au/seniorshealthcard Greater control over your aged care services Freda Bishop has always been fiercely independent. At 101 years of age, she has overcome numerous obstacles over her lifetime and losing her independence has always been one of her greatest concerns. With her daughter, Helen, as her full time carer and with additional assistance through a home care package, Freda has been able to remain at home. ‘I became mum’s full time carer when mum was diagnosed with macular degeneration about 15 years ago,’ says Helen. ‘This was a difficult time for all of us, because mum had always enjoyed her independence.’ Over the last few years, Helen has taken on a greater carer role. Freda fell and broke her femur nine years ago, and Helen had to do most tasks for her. In 2013, Freda had another fall and broke her hip. At the time, Helen and her husband, Graham, were away on holiday. While they were away, Graham broke his ankle—leaving Helen with two people to care for. Aged 72 herself, Helen recognised the need for additional help. She called My Aged Care to find out what help was available. An Aged Care Assessment Team visited Freda and told her she would benefit from a home care package. Freda’s home care package was delivered under consumer directed care, which meant there was an allocated budget for the package, and Freda and Helen had more choice over the type of care and services they received. ‘I was so pleased that mum could choose the services she needed, such as help getting into bed four nights a week and having someone come to shower her twice a week,’ says Helen. ‘When my husband and I went to India last year, my mum went to stay with my brother in Sydney and had her provider broker services in Sydney to help her while she was there. ‘Just having this help has changed my mother’s life. It is wonderful to know that my mother can live a more independent and active life with just a little extra help.’ Because of their experience, Freda and Helen’s advice is to not wait until the last minute, such as a serious fall or emergency, to find out what aged care options are available. Visit myagedcare.gov.au or phone 1800 200 422 for more information. Important changes to consumer directed care Consumer directed care has been progressively introduced into home care packages since August last year. From 1 July 2015, consumer directed care will apply to all home care packages. With consumer directed care, your home care service provider holds on to your home care budget on your behalf and works with you and your carer to coordinate the services you want. You can make choices about the types of care and services you want, including how care is delivered, who delivers it to you, and when. Services include, but are not limited to, nursing, social support and domestic assistance. These can be provided as part of your package to help you stay independent in your own home for longer. You can also see how much funding is available for services and how the money is being spent. Planning ahead ensures help and support will be there when you need it. While they can be difficult conversations, the sooner you get to know what your options are, and can talk about them and begin planning, the better the outcomes will be. You can call My Aged Care on 1800 200 422 to talk to someone about your personal circumstances. Telling us about your overseas travel is now quicker and easier If you receive an Age Pension or hold a Commonwealth Seniors Health Card (CSHC) you no longer need to tell us you’re going overseas unless you: • will be away for longer than six weeks • are paid under the terms of a social security agreement with another country, or • were previously living overseas and have returned to live in Australia within the last two years and you started being paid Age Pension during this period. If you have a partner in receipt of Disability Support Pension, different portability rules apply to this payment. Visit humanservices.gov.au/paymentsoverseas to read about how travel affects Disability Support Pension payments. You can now also use your Centrelink online account, through myGov, to tell us about your overseas travel when and where it suits you. If you hold a CSHC you can also now travel overseas for up to 19 weeks before your card is cancelled. The Seniors Supplement and Energy Supplement can be paid for up to six weeks from the date of departure, provided your CSHC remains current. If you plan to travel outside Australia, visit humanservices.gov.au/paymentsoverseas to read about how travel affects all payments and cards. For more information about the CSHC, visit humanservices.gov.au/seniorshealthcard myGov enhancements Last issue, we gave you some handy tips and a step-by-step guide to help you sign up to myGov, which now has more than six million active accounts. Since then, new features and account enhancements have been added. Update your address myGov is trialling a new way for you to manage your home and/or postal address details using the Update Your Details trial. It allows you to quickly and easily update your home and/or postal addresses with Medicare, Centrelink and the Australian Taxation Office in one easy transaction. Enhance your account security You now have the option to enhance your account security by having a security code sent to your mobile phone each time you sign in to myGov. You need to have access to your mobile phone to use the security code feature. If you use the feature, you won’t have to answer secret questions when you sign in. Get mail from the Australian Taxation Office In your myGov Inbox, you can now receive, view, print and save mail from the Australian Taxation Office, as well as from Medicare, Centrelink and Child Support. When you create a myGov account, you automatically get access to your Inbox so you can get all your mail faster, in one secure place. Important information Soon, myGov will be the only way you can access your Centrelink online account. If you haven’t already, create a myGov account at my.gov.au and link your Centrelink online account. Connect with us using social media Did you know you can follow us on social media to keep up-to-date on important updates and information? You’ll find us on Facebook, Twitter, YouTube and Google+, with dedicated accounts for general information, students, families and myGov. You’ll even find Hank Jongen on Facebook and Twitter! Contrary to popular belief, social media is not only for teenagers. The number of older Australians joining social media continues to grow. About 58 per cent of internet users aged 50–64, and almost one third of users aged 65 years or over, use social media on a regular basis. Facebook is the most popular social media platform, but there are many different types, and new platforms are being developed all the time. Social media is not difficult to use and, following some simple tips, is a safe and secure way to interact with your friends, family, the wider community and us. Keen to get involved? Keep an eye out at local libraries and community centres for classes, or ask a friend or family member to run you through the basics. You can find out more about how the department uses social media, as well as links to our accounts, at humanservices.gov.au/socialmedia Hank’s top tips for using social media safely 1. PASSWORDS Have a different password for each of your social networking accounts and never use the same password that you have used for your bank or email. 2. FRIEND REQUESTS AND LINKS Don’t accept a ‘friend request’ from strangers and don’t click links in ‘friend request’ emails you receive—always type the social network’s website address into your browser. Genuine friend requests will appear on your home page on your social networking site. It is easy to create a fake profile online and people aren’t always who they say they are. 3. SHARING AND PRIVACY Be careful about how much personal information you reveal online. There are privacy settings you can use to control who has access to your information, so make sure you set your online profile to ‘private’. If you’re posting a question to the social media account of a business or organisation, keep it general and never share personal or identifying information such as your phone number, address or Customer Reference Number. We’ll never ask you to provide personal information via our social media accounts. 4. POSTS Before you write a message or post pictures, ask yourself if the information you’re sharing is something you want your friends or family to see. Even deleted posts can remain on the internet for years. 5. VERIFICATION Look for signs that you’re following and engaging with the official social media account for a business or organisation. Many business and government profiles will display a ‘verified’ checkmark—on Facebook and Twitter this will show as a tick in a blue circle. If you’re not sure if the page is official, check the website—most websites now include links to official social media accounts. Start your digital journey with us Reaching retirement can mean different things and different challenges for older Australians—it can be the time for making a sea change, learning something new or taking up a new hobby, travelling overseas or even just enjoying a less hectic time in your life. In this phase of your life, visiting one of our service centres to do something simple, like update your details, may not fit in with your new-found freedom. This is why the Department of Human Services continues to improve our services and transform the way we do business with you to suit your changing needs. We are delivering high quality, flexible and efficient services, such as myGov, Express Plus mobile apps and other online services. Using our online services gives you the freedom to do your business with us when and where it suits you. In the previous issue of News for Seniors we included a digital supplement about these online services. In this issue we want to share some experiences our Service Officers have had with customers who recently started their digital journey with us. Digitally capable An 82-year-old customer told Basil*, from the Morayfield Service Centre in Queensland, she was keen to ‘go digital’ after learning about the department’s online services. The customer said that she had been using computers longer than Basil had been alive! ‘Her pet hate was people (especially younger people) assuming she isn’t digitally capable. She was pleased at the ease with which she could do different things on the Express Plus mobile app like updating her details,’ says Basil. Six minutes to get started Paula*, from the Pagewood Medicare Service Centre in New South Wales, noticed a customer in her 80s had her mobile phone with her when she visited the service centre. She explained the benefits of using the Express Plus mobile app to the customer. ‘I helped the customer create a myGov account and then downloaded the Express Plus app,’ says Paula. ‘The customer was impressed that it only took about six minutes and said she would tell all her friends at the club about it!’ All set and ready to go Kate*, from the Townsville Willows Service Centre in Queensland, assisted an independent 89 year old who had not been in contact with Centrelink for years. The customer called the department to update her details, but was advised that there was a wait. ‘She decided to visit her local service centre, accompanied by her son,’ says Kate. ‘After I updated her records, the customer then asked for a phone self service PIN because she had read information about getting a return call if she had a PIN. I issued a temporary PIN and told the customer she could update her details and do other things through the department’s online accounts, like receiving online letters for example,’ she says. The customer left happy—Kate thinks she will now do her business quickly and easily using phone self service or an online channel. Benefits to setting up a myGov account Anna* from the Taree Service Centre in New South Wales, says they’re helping customers to set up email addresses as well as myGov accounts. ‘I assisted one customer with creating an email account, a myGov account, and linked their Medicare and eHealth online accounts—all in the one visit,’ says Anna. ‘The customer was very pleased and appreciative because the new email account will help her keep in touch with her daughter who had recently moved overseas.’ If you have a mobile phone or computer with internet access then you can give our online services a go—there is a range of things you can do including looking for lost super by linking the Australian Taxation Office, viewing your Medicare or Personally Controlled eHealth Record and much more! Even if you don’t feel confident navigating your way through the internet, you can pop into your local service centre and a Service Officer will be happy to help get you started—so that you have more time to spend on the things you enjoy in life. *Names have been changed. Marcia Hines—keeps an eye on her diabetes Popular singer Marcia Hines knows all about diabetes and the damage this disease can cause the body, including the eyes. Marcia has lived with type 1 diabetes for over 27 years. At the age of 60 she says managing her diabetes, which includes a healthy lifestyle and regular eye tests, is vital to maintaining good health and sight. Marcia is just one of almost 1.1 million Australians currently diagnosed with diabetes1. Of those diagnosed, one in three (over 300 000) will develop some form of diabetic eye disease2. Currently up to 50 per cent of Australians with diabetes do not have eye tests every two years as recommended2, 3. If you have diabetes, it’s important to have regular eye tests to avoid irreversible vision loss. A healthy lifestyle is important in maintaining your health. ‘For me to feel my best, a balanced, healthy diet is essential,’ says Marcia. ‘Oats, fruit and vegetables are some of my favourite healthy foods.’ Regular exercise is also a priority for Marcia. ‘Like most people, I have days where I have to motivate myself to exercise, but once I’m out and about, I feel absolutely fantastic,’ she says. Julie Heraghty, CEO of the Macular Disease Foundation Australia, says early detection of diabetic eye disease is critical. ‘There may be no symptoms, and damage can occur before there is any change to vision. Sometimes disease progression can be rapid, so early diagnosis and, if necessary, treatment, is critical to saving sight.’ Early diagnosis, management and treatment of diabetic eye disease can prevent over 90 per cent of vision loss2. ‘I cannot stress enough how important it is for all those living with diabetes to have a comprehensive eye examination at least every two years, or more often if recommended, and to follow your optometrist or ophthalmologist’s advice to reduce the risks of vision loss from diabetic eye disease,’ says Julie. Everyone with diabetes is at risk of developing diabetic eye disease. The longer you have diabetes, the more likely it is to develop. A free information booklet Diabetic Eye Disease is available from the Macular Disease Foundation Australia. Visit www.mdfoundation.com.au or freecall 1800 111 709. Three simple rules to follow: 1. If you have diabetes, visit an optometrist or ophthalmologist at least every two years for a comprehensive eye exam. 2. If you have existing diabetic eye disease, more regular checks may be required, even if vision appears to be perfect. 3. Be guided by your optometrist or ophthalmologist and do not cancel or delay appointments. References: 1. diabetesaustralia.com.au/Understanding-Diabetes 2. Guidelines for the management of diabetic retinopathy, 2008, National Health and Medical Research Council 3. Larizza M, Medical Journal of Australia 2013;198:97 Missed an important moment due to hearing loss? You’re not alone. While more people than ever are getting their hearing checked, research by Australian Hearing has revealed that thousands of Australians are still leaving their hearing loss untreated. Around 87 per cent of Australians with untreated hearing loss struggle to follow conversations and are missing out on special moments with family and friends. Almost a quarter of family and friends who have loved ones with hearing difficulties admit they choose not to confide in them. The research also found that around one third of sufferers have never had a hearing test, despite acknowledging that they have poor hearing. Principal Audiologist at Australian Hearing, Emma Scanlan, says hearing loss can be managed effectively with proper diagnosis and treatment. ‘Hearing is an essential element to communication and taking action can lead to an improvement in your overall quality of life,’ says Emma. And doing something about your hearing is easy. The Australian Government Hearing Services Program provides a range of hearing services for eligible seniors. ‘We support thousands of people with varying degrees of hearing loss, who continue to enjoy sound, despite their hearing loss,’ says Emma. Australian Hearing is one of over 230 providers that offer services through the Hearing Services Program nationally. To find out if you’re eligible, visit health.gov.au/hear or Freecall™ 1800 500 726. For more information about Australian Hearing visit hearing.com.au or call 1300 348 952. Scooting across the Nullarbor Plain Crossing Australia’s iconic Nullarbor Plain on a motor scooter is no easy ride, but a group of seniors from across Australia have proven that they’re up to the challenge. The 20 seniors travelled 2400 km on scooters from Port Augusta, South Australia to Fremantle, Western Australia in September 2014 to raise awareness of depression and anxiety, and raised more than $50 000 for beyondblue. The idea for the two-week ride, named the Scootabor Challenge, came from 73 year old Queenslander Ian ‘Jake’ Jacobsen, a former pilot and Antarctic explorer. Jake is passionate about encouraging other seniors to live an active lifestyle to help maintain their mental health, and to seek support when they may be struggling. It’s thought that between 10 and 15 per cent of older people experience depression and approximately 10 per cent experience anxiety. While extreme activities might not be suitable for everyone, maintaining good health can also be achieved through measures like eating well, exercising regularly and being involved in community activities. ‘The Scootabor Challenge was about inspiring Aussie seniors to get the most out of their lives, by keeping active and tapping in to their sense of adventure,’ says Jake. ‘It was also about promoting the value of older people to the broader community. Our age makes us an asset, not a liability. ‘All of the Scootabor Challenge riders have been affected by depression or anxiety, either because we have experienced these conditions personally or someone close to us has, so we’re thrilled to support beyondblue,’ he says. For information on the signs and symptoms of depression and anxiety, available treatments, and details of where to get help, go to beyondblue.org.au Trained mental health counsellors are available via the beyondblue Support Service on 1300 224 636 or webchat or email at beyondblue.org.au/get-support BreastScreen Australia program Breast cancer is the second leading cause of cancer-related deaths in women and getting older is the biggest risk factor for developing the disease. Research shows that early detection through regular screening can reduce the rates of illness and death from breast cancer. Early detection allows women to access a wider range of treatment options before the symptoms progress. The BreastScreen Australia program invites women aged between 50–74 to have free screening mammograms. If you’re aged 50–74 you’ll receive a reminder from BreastScreen Australia every two years to book an appointment. You can find out more at cancerscreening.gov.au or call 132 050 to book a mammogram at your nearest BreastScreen Australia service. Donating dos and don’ts Supporting different charities through donations is a great thing to do but you should always do some research about the charity before you donate. It’s also important to make sure that the charity is actually receiving your donation. Here are some things to think about before you donate. Check the charity Even if you’ve heard of the charity, you should check that the person who contacts you is authorised to represent that charity. If you’ve been approached face-to-face, ask to see some identification and a copy of the charity’s pledge form. These should contain the: • full name of the organisation • corporate registration number such as an Australian Business Number • business address, and • organisation’s logo. You should also call the charity directly to verify their contact details. Be sure to cross-check their phone number in the telephone directory. You can visit acnc.gov.au to see if the charity is registered with the Australian Charities and Not-for-profits Commission. Be wary of giving credit card details If you’ve been contacted by phone, don’t give out your credit card or banking details. If it’s a reputable charity, there’ll be other ways to donate. Ask about these options and make sure you check the validity of any website or social media page you’re directed to. To find out about the latest charity scams, visit scamwatch.gov.au/charityscams Check if it’s tax deductible A donation is only tax deductible if it’s given to a charity that has been endorsed by the Australian Taxation Office (ATO) as a deductible gift recipient (DGR) organisation. You can check if an organisation is a DGR by visiting abr.business.gov.au or calling the ATO on 132 861. To receive a deduction, the donation must be $2 or more and must be claimed in your tax return for the income year in which the donation was made. In some circumstances, you can choose to spread the tax deduction over five income years. For more information visit ato.gov.au and search for ‘gifts and donations’. Visit the Australian Securities and Investments Commission’s MoneySmart website at moneysmart.gov.au for more tips and information that will help you make informed financial decisions. Donating may affect your payment You or your partner can make a donation in the form of money or other assets to any value you choose at any time. Before you make a donation, you should carefully consider how it may affect your payment. If you donate or make gifts of more than $10 000 in one financial year or $30 000 in any five financial year period, we’ll assess the excess as a deemed asset as if you still owned it for the next five years. Your pension may not increase, and in some circumstances may decrease, even though you now own less. You must tell us about any donations or gifts within 14 days of when they have been made. More information is available by searching for ‘gifting’ at humanservices.gov.au The Financial Information Service is celebrating 25 years For 25 years, the Financial Information Service (FIS) has been helping customers understand their finances. The FIS provides free, confidential information about investment and financial issues and can help you to learn more about preparing for retirement as well as understanding your pension and the options you may have. It’s estimated the service has helped 6.8 million customers since it was established in 1989 by the Department of Social Security. It started with 20 FIS officers and now has 120 officers around Australia. Their role was, and still is, to provide information and education services to the community. Today FIS is also providing help to an increasing number of customers under 55 years of age. In 2013–14, FIS officers: • responded to over 82 500 phone calls • conducted more than 67 900 interviews, and • held 2600 seminars for over 77 800 participants. Kathleen and Robyn are two of our longest serving FIS officers, each with over 20 years of experience. They both became FIS officers in 1993 and have been helping people ever since. ‘I like being able to provide people with information for the best financial outcome. Sometimes if people don’t understand the options available to them they can make choices that give them less income than they might have otherwise. No two situations are ever the same,’ says Kathleen. ‘I love helping people to understand complex concepts. So many people benefit from hearing about their financial options in plain English, and with some humour. It helps things make sense,’ says Robyn. A typical day for Kathleen and Robyn includes customer interviews, presenting FIS Seminars or answering calls to the FIS phone service. ‘Being a FIS officer is interesting and challenging. It’s so rewarding helping people to understand their financial options. I have never wanted to do anything else,’ says Robyn. ‘It’s the best job in the department,’ says Kathleen. FIS officers like Kathleen and Robyn can help you to: • increase your confidence in dealing with investments • understand your own financial affairs and options • understand the levels of risk for each financial product type • understand the roles of financial industry professionals and show you how to use expert information • use credit in a sensible way • plan for your retirement, and • understand the financial implications when you, or someone close to you, is considering moving into residential care. You can speak with one of our FIS officers by calling 132 300. Or, for a list of upcoming seminars in your area, visit humanservices.gov.au/fis Booking is essential and can be made by calling 136 357 or emailing fis.seminar.bookings@humanservices.gov.au Centrepay and the Deduction Statement helps you manage your money Centrepay is a free service where we can deduct regular amounts from your Centrelink payments to pay bills and meet ongoing expenses such as rent, utilities, nursing home fees and medical expenses. These deductions are made directly from your Centrelink payments so you don’t need to do anything. You can also keep track of your Centrepay deductions through your Deduction Statement. On your Deduction Statement you can view your next regular payment, all the amounts being deducted from your payment and the money you’ll have remaining. The statement can include some or all of the following: • weekly payments (if you receive your payments weekly) • Centrepay deductions • participation penalty amounts and non-payment periods • urgent and advance repayment amounts • debt repayments • • • • child support payments tax deductions amounts directed to your Income Management account rent deductions as part of the Rent Deduction Scheme. The easiest and quickest way to get your Deduction Statement is to view and print it using the ‘Request a Document’ service from your Centrelink online account through myGov, or you can request it using phone self service by calling 136 240. If you don’t have a Centrelink online account or a myGov account, visit humanservices.gov.au/register If you’re unable to access your online account, our staff will be able to assist you with your Deduction Statement. Call us on 132 300 or visit your local service centre. It’s a good idea to check your Deduction Statement regularly to track deductions and make sure your financial arrangements are correct. Visit humanservices.gov.au/deductionstatement for more information and a step-by-step tutorial on how to request a Deduction Statement using your Centrelink online account. Letter from the General Manager Dear readers, The 25th of April 2015 marks the 100th anniversary of the Gallipoli landings and it’s estimated that 10 500 people will attend the Anzac Day Dawn Service in Turkey. More than four times that number applied for a place at the Dawn Service ceremony to pay respect to our soldiers who fought so valiantly. If you were one of the people selected in the ballot, you have a rare opportunity to participate in an important moment in Australia’s history. Thinking about this anniversary and Australians travelling to Turkey, reminded me about the changes we have made to simplify what you need to do if planning a trip overseas. You can now travel outside Australia for up to 19 weeks before your Commonwealth Seniors Health Card (CSHC) is cancelled. Remember to contact us if you’re planning on travelling for longer than six weeks though so we can discuss how your quarterly supplements might be affected. There’s more information about travelling overseas, including tips on what to do before you travel, on our website at humanservices.gov.au/goingoverseas and also at humanservices.gov.au/paymentsoverseas While you’re there, it’s also a good idea to register for our online services (if you don’t already have an account) so you can quickly and easily manage your business. Registering an online account means you can take advantage of our Express Plus mobile apps, which is great if like me you prefer using a tablet or mobile device. You can read more about registering online at humanservices.gov.au/register Several other changes to the CSHC have come into effect, including rules around account-based income streams. I encourage you to read the article on page 9 and visit humanservices.gov.au/seniorshealthcard I also want to remind you that several Budget changes also come into effect this year. One of the main changes that could affect you is that from 1 January 2015, the Energy Supplement (formerly the Clean Energy Supplement) will be paid and remain fixed at the 20 September 2014 payment rate. I hope this information helps to clarify some of the recent and upcoming changes. All the best, P.S. It would be great to keep in touch via my Facebook page at facebook.com/officialhankjongen RATES VALID FROM 20 MARCH TO 30 JUNE 2015 Pension and Rent Assistance Rates and Thresholds SINGLE COUPLE combined COUPLE one eligible partner COUPLE separated due to ill health How much pension Per fortnight Per fortnight Per fortnight Per fortnight each $782.20 $1,179.20 $589.60 $782.20 $63.90 $96.40 $48.20 $63.90 Maximum basic rate 1 Maximum pension supplement Energy Supplement $14.10 $21.20 $10.60 $14.10 TOTAL $860.20 $1,296.80 $648.40 $860.20 Rent Assistance2 Per fortnight Per fortnight Per fortnight Per fortnight each Maximum rate $128.40 $120.80 $120.80 $128.40 You will be eligible for the maximum rate of rent assistance if your fortnightly rent is more than $285.20 $346.47 $346.47 $285.20 You will not be eligible for rent assistance if your fortnightly rent is less than $114.00 $185.40 $185.40 $114.00 Allowable Income1a Per fortnight Combined Combined Combined Full pension up to $160.00 up to $284.00 up to $284.00 up to $284.00 Part pension less than $1,880.40 less than $2,877.60 less than $2,877.60 less than $3,724.80 Allowable Assets3 Single Combined Combined Combined Full pension—Home owner $202,000 $286,500 $286,500 $286,500 Full pension—Non-home owner $348,500 $433,000 $433,000 $433,000 Part pension—Home owner less than $775,500 less than $922,000 less than $1,151,500 less than $1,298,000 less than $1,433,500 Part pension—Non-home owner less than $1,151,500 less than $1,298,000 Deeming Rates and Thresholds Single Combined Combined Combined Threshold $48,000 $79,600 $79,600 $79,600 Rate below threshold 1.75% 1.75% 1.75% 1.75% Rate above threshold 3.25% 3.25% 3.25% 3.25% Commonwealth Seniors Health Card (CSHC) Single Combined Combined Combined Income limit (per annum)4 $51,500 $82,400 $82,400 $103,000 Energy Supplement (per annum) $366.60 $551.20 $275.60 $366.60 each Seniors Supplement (per annum)6 $894.40 $1,346.80 $673.40 $894.40 each 5 Pension Bonus Scheme Maximum Rates Indexed 20 March and 20 September SINGLE PARTNERED (each) Maximum Bonus after Year 1 $1,966.20 $1,486.20 Maximum Bonus after Year 2 $7,864.80 $5,944.80 Maximum Bonus after Year 3 $17,695.80 $13,375.80 Maximum Bonus after Year 4 $31,459.20 $23,779.10 Maximum Bonus after Year 5 $49,155.00 $37,154.90 less than $1,580,000 Registration in the Pension Bonus Scheme* is limited to those who met the age and residence requirements for Age Pension before 20 September 2009 and lodged an application to register prior to 1 July 2014. *If you are receiving or have received Age Pension, you are not eligible for a Pension Bonus. Pension Reform Transitional Arrangements Rates and Thresholds SINGLE COUPLE combined COUPLE one eligible partner COUPLE separated due to ill health How much pension Per fortnight Per fortnight Per fortnight Per fortnight each Maximum rate $711.70 $1,149.60 $574.80 $711.70 Energy Supplement $14.10 $21.20 $10.60 $14.10 Total $725.80 $1,170.80 $585.40 $725.80 Allowable Income Per fortnight Combined Combined Combined Full pension up to $160.00 up to $284.00 up to $284.00 up to $284.00 Part pension less than $1,974.50 less than $3,211.00 less than $3,211.00 less than $3,913.00 Allowable Assets Single Combined Combined Combined Full pension—Home owner $202,000 $286,500 $286,500 $286,500 Full Pension—Non-home owner $348,500 $433,000 $433,000 $433,000 Part Pension—Home owner less than $686,000 less than $1,067,500 less than $1,067,500 less than $1,254,500 Part Pension—Non-home owner less than $832,500 less than $1,214,000 less than $1,214,000 less than $1,401,000 The transitional arrangements apply to certain pensioners who were receiving part pensions as at 19 September 2009 and only applies until they would get an equal or higher rate under the new rules. Rates are indexed by Consumer Price Index only. These figures are a guide only. Effective 20 March 2015 unless otherwise stated. 1. Rate of payment is calculated under both the income and assets tests. The test that results in the lower rate (or nil rate) is the one that is applied. There is no income or assets test for customers who are permanently blind, unless they wish to apply for Rent Assistance. Some assets are deemed to earn income and there are special rules for other types of income. a. Income over allowable amounts for full pension reduces pension by 50 cents in the dollar for singles and 25 cents in the dollar each for couples; for those paid under the transitional arrangements, the pension reduces by 40 cents in the dollar for singles and 20 cents in the dollar each for couples. These limits may be higher if Rent Assistance is paid with your pension. Contact the Department of Human Services on 132 300 for information on transitional arrangements. b. Each fortnight, the Work Bonus disregards up to $250 of employment income earned by eligible pensioners over age pension age (unless paid Parenting Payment Single). If employment income is less than $250, the unused Work Bonus accrues up to a maximum amount of $6500. This bank then discounts future employment income that exceeds $250 per fortnight. If eligible for a transitional rate, we will compare the transitional rate (which has no Work Bonus) to the new rate (which has the Work Bonus). The transitional rate will continue until it no longer pays a higher rate. 2. Rent Assistance is not payable to people paying rent to a government housing authority. Special rules apply to single sharers, people who pay board and lodging or live in a retirement village. There are additional rates for those who have dependent children. Rent Assistance is generally paid with Family Tax Benefit if there are dependent children, or with the pension if there are no children. For temporarily separated rates, call 132 300. 3. Single and combined couple rates are reduced by $1.50 per fortnight for every $1000 of additional assets above the allowable assets limits for full pension. Certain assets, including a person’s home, are not included in the assets test. These limits may be higher if Rent Assistance is paid with your pension. 4. Income test for the Commonwealth Seniors Health Card (CSHC) includes adjusted taxable income plus deemed income from account-based income streams. The current account balance of an account-based income stream is subject to deeming where it is: • purchased or changed on or after 1 January 2015 • owned by someone granted CSHC on or after 1 January 2015 • owned by a card holder’s partner who is aged 60 or more. 5. The Energy Supplement for CSHC holders is paid quarterly. To calculate the quarterly amount, obtain the daily rate of the supplement by dividing the annual amount by 364. The quarterly amount is then calculated by multiplying the daily rate by the number of days the supplement is payable in that quarter. 6. As part of the 2014–15 Budget, the Seniors Supplement for CSHC holders will no longer be paid. This is subject to the passage of legislation. CSHC holders will continue to receive Seniors Supplement each quarter until this legislation is passed. Note: Absences from Australia may affect your payments. If you are planning on travelling outside Australia and would like information as to how this may affect your payment then please contact the Department of Human Services on 132 300. For more information call 132 300. CONTACTS SELF SERVICE OPTIONS There are several ways you can manage your business with us, including: • Online account—create a myGov account at my.gov.au with one username and password to access your Centrelink and Medicare accounts online and do things like claim a payment or concession card, view your claims history and receive online letters. • Express Plus Centrelink mobile app—if you have online access to your Centrelink account and have level 3 access, you can use the Express Plus Centrelink mobile app. You can update your details, receive online letters, read News for Seniors and much more. • Phone self service—call 136 240 to request a replacement card, Income Statement or have other documents sent to you in the mail. If you prefer to visit us, skip the queue at a service centre and use our self service computers. You can access your Medicare and Centrelink online accounts or view other government and community websites. You can also print your documents, look for payments and services or search for a job. Register or find out more about online services at humanservices.gov.au/selfservice You can call us between 8 am and 5 pm, Monday to Friday, to talk to us about: Older Australians ............................................................ 132 300 Age Pension, deeming, income and assets tests, Financial Information Service, Pension Bonus Scheme and Commonwealth Seniors Health Card. International Services ...................................................... 131 673 Pensions paid outside Australia, claiming pensions from other countries, pensions paid under International Agreements. Disabilities, Sickness and Carers .................................... 132 717 Languages other than English ....................................... 131 202 Feedback and complaints ................... Freecall™ 1800 132 468 TTY* enquiries ................................... Freecall™ 1800 810 586 TTY* Customer Relations ................. Freecall™ 1800 000 567 *TTY is only for people who are deaf or have a hearing or speech impairment. A TTY phone is required to use this service. Department of Veterans’ Affairs Call 133 254 or Freecall™ 1800 555 254 from regional Australia. Go to dva.gov.au Department of Social Services Call 1300 653 227 (call rates from landline and mobile providers may vary. Please check with your current service provider). Go to dss.gov.au My Aged Care Freecall™ 1800 200 422. Go to myagedcare.gov.au Note: calls from your home phone to our ‘13’ numbers from anywhere in Australia are charged at a fixed rate. That rate may vary from the price of a local call and may also vary between telephone service providers. Calls to ‘1800’ numbers from your home phone are free. Calls from public and mobile phones may be timed and charged at a higher rate. News for Seniors advertising enquiries Contact: dtb! Advertising Email: newsforseniors@dtb.com.au The Department of Human Services and the Commonwealth of Australia do not endorse and are not responsible for the views, products or services offered or provided by advertisers. News for Seniors Editor Email: editornfs@humanservices.gov.au Write: PO Box 7788, Canberra BC ACT 2610 RT010.1503