American Eagle Outfitters

advertisement

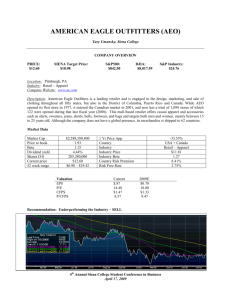

American Eagle Outfitters Liu Yi Xu Wenqiang (Wayne) Nov 7, 2013 Agenda • • • • • • • Introduction & Holding Review Macroeconomic Factors & Industry Overview Company Overview Management Outlook Financial Analysis Valuation Conclusion & Recommendation Introduction: Founded in 1977 and went public in 1994, AEO is an apparel retailer targeting teenagers and young adults 2007: Traded on NYSE 2001: Annual sales surpass $ 1 bn; Cross the border to Canada 1999: First flagship store in San Francisco 1977: The first AE store opens Source: Company Website 2010: Expands internationally 2006: Aerie, an intimates brand just for her, launches 2000: AE opens its 500th store 1994: AE goes public on Nasdaq Holding Review: We’ve been holding AEO for a long time • Transaction history – – – – – – – – – – – – – • • Dec 1999 – Buy 200 @ $44 Jan 2000 – Buy 200@ $27 Mar 2000 – Buy 600 @ $15.63 Feb 2001 – 3:2 Split Mar 2005 – 2:1 Split Apr 2005 – Sell 600 @ $26.284 Nov 2005 – Sell 700@ $23.33 Nov 2006 – Sell 400 @ $47.15 Dec 2006 – 3:2 Split Nov 2007 – Sell 450 @ $22 Dec 2008 – Buy 1000 @ $9.07 Nov 2010 – Sell 500 @ $17.00 Apr 2011 – Sell 500 @ $16.04 Current Price: $ 14.65 Current Position: Long 1500 shares of AEO with a weighted average price of $5.2252 Source: Yahoo Finance Macroeconomic Factors: Disposable personal income, retail sales, and etc. are key drivers to apparel retail industry United States Disposable Personal Income YOY %, 2003 – 2012 8 7 6 5 4 3 2 1 0 -1 2003 2004 2005 2006 2007 2008 2009 Disposable Personal Income Growth: % Source: US Bureau of Economic Analysis 2010 2011 2012 Macroeconomic Factors: Disposable personal income, retail sales, and etc. are key drivers to apparel retail industry (cont’) United States Retail Sales YOY %, 2003 – 2013 Source: US Census Bureau, www.tradingeconomics.com Industry Overview: US apparel retail industry is growing at 4.7%, with women’s wear as the largest segment United States apparel retail industry value $ billion, 2008 – 2017 450 400 350 300 250 200 150 100 50 0 United States apparel retail industry category segmentation % share, by value, 2012 6% 5% 4% 16.6% 3% Women's Wear 2% 51.7% 1% 0% Industry Value: $ Billion Growth: % CAGR (2012 - 2017): 4.7% Source: Market Line Apparel Retail in the United States, Feb 2013, P8 - P11 31.8% Men's Wear Children's Wear Industry Overview: Fairly fragmented market, moderate growth and independent consumers result in a moderate level of competition in the industry Apparel Retail Industry Five Forces Analysis Rivalry Competition •Strong (4.3)1 The US apparel retail market is fairly fragmented All kinds of players are in this market, such as branded retailers, department stores, hypermarkets, discount stores and etc. Fast pace of change in fashion and low level of product differentiation add to competition Buyers’ Bargaining Power •Medium (3) All buyers are large amount of individual consumers Low switching cost among brands Retailers can differentiate themselves through styles, price ranges Retailers need to offer what buyers want Suppliers’ Bargaining Power •Weak (2.7) Suppliers are clothing manufacturers and wholesalers, who usually are small to medium sized businesses Branded retailers usually source from Asia Substitutes •Medium (3) Though there is no substitute to apparel, there are some to retail. One option is buying online Major retailers are all building their online stores There are growing number of online fashion stores Home made and custom made clothing are niche alternatives Threat of New Entrants •Strong (4) Barriers to entry are not high There is little regulation in this industry Low switching costs and low level of product differentiation make it easier for new entrants to compete with existing players Footnote: 1. Number in the brackets is the overall rating for this factor, larger number means stronger power Source: Market Line Apparel Retail in the United States, Feb 2013, P12 – P17 Company Overview: AEO operates 2 major brands, while it also has a fast growing online business • AEO Brand – Targets 15 to 25-year old men and women – Denim is the cornerstone of the brand’s assortment – Gaining market share through differentiated fashion in key categories is a primary focus – 921 stores by first half 2013 • aerie by AEO – Collection of intimates and personal care product for AEO girl – 135 stores by first half 2013 • AEO Direct (Online business) – An extension of the lifestyle conveyed in the stores – Currently ship to 81 countries – Comparable sales increased 25% in 2012 Source: 2012 10-K, P3 Company Overview: AEO’s business model focuses on the two ends of the value chain Business Model of AEO Manufacture Sell • Through 1044 stores and online channel, as of end of 2012 – 950 stores in US – 94 stores in Canada • Co-branded credit card (AEO Visa Card) and private label credit card (AEO Credit Card) • During fiscal year 2012, purchase all of the merchandise from nonNorth-American suppliers • Rely on a small number of foreign sources for a significant portion of purchase Ship & Distribute • • • • • Merchandise shipped directly from vendors and routed through 3rd party trans loaders US distribution centers in Pennsylvania and Kansas Canada distribution centers in Ontario Jan 2013 newly opened 3rd party distribution center in Mexico City to support Mexican stores and e-commerce Certain products shipped directly to stores Source: 2012 10-K, P5 – P7 Company Overview: With number of stores at a ceiling, comparable sales growth is the key for future growth Total Comparable Sales1 Growth Revenue 3600 15% 3400 10% 3200 15% 5% 3000 2800 0% 10% 2600 -5% 5% 2007 2008 2009 2010 Total Revenue: $ million 2011 2012 0% Growth Rate 2006 Number of stores 500 2008 2009 2010 2011 2012 -5% 1500 1000 2007 -10% 3 39 116 137 148 158 151 135 903 929 954 938 929 911 893 921 0 AE Total Comparable Sales Increase Merchandise improvement, service improvement, store remodeling and etc. are the drivers to increase comparable sales. aerie Footnote: 1. Comparable sales provide a measure of sales growth for stores and channels open at least one year over the comparable prior year period. Source: 2012 10-K, P17, 2011 10-K, P17, 2010 10-K, P16 Management Outlook: The story in 2013 is not that promising Management Outlook • Store opening plan 2013 – Approximately 50 AEO stores, primarily in North America, Mexico and China • Remodel and refurbish plan 2013 – Remodel and refurbish approximately 45 to 55 existing AEO stores and close approximately 20 to 30 AEO stores and 15 to 20 aerie stores Source: 2012 10-K, P4, Second Quarter 2013 Financial Results, P5, P10 Results • 19 net openings for the whole company, as of Aug 3, 2013 – 10 in US, 1 in Canada – 3 in China, 3 in HK, 2 in Mexico • Total comparable sales declined 6% as of Aug 3, 2013 – AE declined 7%, aeire increased 1%, AEO Direct increased 17% SWOT Analysis Strengths • Strong brand with no debt • aerie gains a niche in underserved teen intimate apparel market • Strong in a few categories, such as denim Opportunities • International expansion – American Eagle Outfitters and aerie merchandise is available at 49 international franchise store locations in 13 countries, by end of 2012 • Online sales – AEO Direct comparable sales increased 25% in 2012, increased 17% in the first half of 2013 Source: 2012 10-K, P23, 2013 Second Quarter 10-Q, P5 Weaknesses • Target customer base is small and has limited consumption capability • Relatively small scale Threats • Potential raw material inflation and increase in labor cost • Weak back-to-school and holiday sales this year Financial Analysis – Ratios Profitability Net Margin % Asset Turnover (Average) Return on Assets % Financial Leverage (Average) Return on Equity % Return on Invested Capital % Liquidity/Financial Health Current Ratio Quick Ratio Financial Leverage Efficiency Days Sales Outstanding Days Inventory Payables Period Cash Conversion Cycle Receivables Turnover Inventory Turnover Fixed Assets Turnover Asset Turnover Source: Morning Star 2009-01 5.99 1.56 9.35 1.39 13.03 12.62 2009-01 2.3 1.31 1.39 2009-01 4.48 58.47 31.17 31.78 81.45 6.24 4.38 1.56 2010-01 5.65 1.46 8.24 1.35 11.32 10.93 2010-01 2.85 1.79 1.35 2010-01 4.65 61.88 30.93 35.6 78.47 5.9 4.12 1.46 2011-01 4.74 1.48 7 1.39 9.6 9.5 2011-01 3.03 1.99 1.39 2011-01 4.4 63.76 33.14 35.01 83.05 5.72 4.38 1.48 2012-01 4.8 1.65 7.92 1.38 10.96 10.96 2012-01 3.18 1.94 1.38 2012-01 4.45 61.06 31.58 33.93 82.04 5.98 5.16 1.65 2013-01 TTM 6.68 6.43 1.88 1.93 12.52 12.41 1.44 1.48 17.6 18.36 17.6 18.36 2013-01 Latest Qtr 2.62 2.31 1.54 0.97 1.44 1.48 2013-01 TTM 3.4 4.89 62.21 80.67 31.56 51.11 34.05 34.45 107.23 74.71 5.87 4.52 6.37 5.78 1.88 1.93 Financial Analysis – Dupont DuPont Analysis 250.00% 200.00% Tax burden Interest Burden 150.00% 100.00% Operating Margin Asset Turnover Leverage ratio 50.00% ROE 0.00% 2009-01 2010-01 2011-01 2012-01 2013-01 TTM Tax burden 59% 72% 44% 66% 57% 64% Interest Burden 1 1 1 1 1 1 Operating Margin 10.11 7.97 10.69 7.31 11.35 10.01 Asset Turnover 1.56 1.46 1.48 1.65 1.88 1.93 Leverage ratio 1.39 1.35 1.39 1.38 1.44 1.48 ROE 13.03 11.32 9.6 10.96 17.6 18.36 Source: 2012 10-K Dividend Signaling For the Quarters Ended February 2,2013 October 27,2012 July 28,2012 April 28,2012 January 28,2012 October 29,2011 JuLy 30,2011 April 30,2011 Market Price High Low $21.45 $18.49 $23.80 $19.89 $20.92 $17.89 $18.43 $13.58 $15.72 $12.89 $13.60 $10.17 $15.71 $12.49 $16.18 $14.46 Cash Dividends Per Common Share $ 0.22 $ 1.61 $ 0.11 $ 0.11 $ 0.11 $ 0.11 $ 0.11 $ 0.11 • During Fiscal year 2012, and Fiscal 2011. American Eagle paid quarterly dividends as shown in the table above. Included in the above table for the quarter ended October 27, 2012 AEO paid a special cash dividend of $1.50 per common share. • During Fiscal year 2013, American Eagle paid quarter dividends 0.125 each on June 27, 2013 and September 30, 2013. Source: 2012 10-K Recent Stock Performance 20 & 200 Day Moving Average Stock Chart • • After March, 2013 American Eagle’s stock price has consistently been below the 200 day moving average While the trend of the 200 day moving average is going downward, there is a slightly increase trend for 20 day moving average Source: Yahoo Finance Valuation – WACC Calculation WACC Calculation Component Weight Explaination Realized return 12.18% 0.35 5 years realized return CAPM 9.40% 0.65 Formula Company Beta 0.96 5 years regression Risk free Rate 2.70% U.S. 10 years treasury Market Risk Premium 7% Assumption Cost of Equity 10.37% Formula Cost of Debt N/A No debt WACC 10.37% Premium 0% • We believe there is not that much volatility in this industry; therefore we add 0% premium into the WACC • No debt Source: 2012 10-K Valuation – Discounted Cash Flow Cumulative Present Value of FCF $1,354.6 Enterprise Value Terminal Value 2022 FCF $256.2 3.00% Growth Rate Terminal Value $2,790.7 Less: Total Debt - Less: Preferred Securities - Plus: Cash And Equivalents - $3,578.7 Discount Factor 0.40 Present Value of Terminal Value Implied Equity Value $2,790.7 $1,436.1 % of Enterprise Value 51.5% Enterprise Value $2,790.7 Number of Shares Outstanding 192.70 Implied Share Price $14.48 Sensitive Analysis Discount Factor Growth Rate $14.48 8.87% 9.37% 9.87% 10.37% 10.87% 11.37% 11.87% 2.00% 16.01 16.77 17.65 18.69 19.95 15.06 15.68 16.41 17.26 18.26 14.24 14.76 15.37 16.06 16.88 13.53 13.97 14.48 15.06 15.73 12.91 13.29 13.72 14.21 14.77 12.37 12.70 13.07 13.48 13.95 11.89 12.18 12.50 12.85 13.25 2.50% 3.00% 3.50% 4.00% Source: 2012 10-K Valuation – Comparable Analysis Company Name Ticker P/E P/B 2.34 P/S 0.83 EV/EBITDA 4.94 American Eagles Outfitters, Inc AEO 13.17 Abercrombie and Fitch ANF 10.95 1.50 0.59 4.34 Aeropostale, Inc ARO -29.61 1.77 0.28 7.22 Urban Outfitters, Inc URBN 21.51 3.76 1.91 9.58 GPS 14.01 5.14 1.11 6.07 Mean 4.22 3.04 0.97 6.80 Median 12.48 2.76 0.85 6.64 High 21.51 5.14 1.91 9.58 Low -29.61 1.50 0.28 4.34 Weight Weighted price Gap, Inc Multiple Price P/E P/B 4.68 19.00 0.25 1.17 0.25 4.75 P/S 17.17 0.25 4.29 EV/EBITDA 17.94 0.25 4.48 14.70 Value Source: 2012 10-K Comparable Stock Chart AEO Comparables Abercrombie & Fitch Co. (NYSE:ANF) Aéropostale, Inc. (NYSE:ARO) Urban Outfitters Inc. (NasdaqGS:URBN) Gap, Inc. (NYSE:GPS) • • American Eagle’s recent stock performance has been underperformed to S&P 500 and underperformed most of its competitors. Retailers catering to the teen set are navigating a rough back-to-school season. Source: Yahoo Finance Decision Drivers • Strengths – Strong brand with no debt – Above average capability of inventory control • Concerns – Nov 15, 2013 quarterly results could miss expectation – International expansion risk – Quickly changing fashion trends of teens Recommendation • Valuation – Current Price $14.65 per share – Analyzed Price $14.48 based on Discounted Cash Flow – $14.70 based on Comparable Analysis • Recommendation – Hold Q&A Thank you ,any questions?