American Eagle Outfitters, Inc.

advertisement

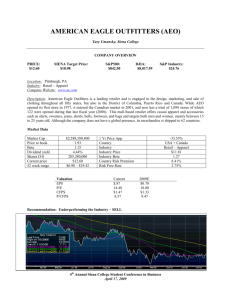

American Eagle Outfitters, Inc. By, Pratik Kamdar Rajani Meka Raj Dhawle Patil Shih-Wei Huang Presented April 5, 2011 RCMP Portfolio • Currently, Portfolio holds 2000 shares • 1500 shares are held, remaining from three different purchases beginning in December 1999, at the split adjusted price of $5.23 per share. Currently, the position has an unrealized gain of 203% as on 3rd April, 2011 • Multiple sales of these three original purchases have been made since then, each producing sizable capital gains • 500 shares were bought at the price of $9.07 per share on 3rd Dec. 2008. Currently, the position has an unrealized gain of 75% as on 3rd April 2011 • At present, AEO represents 28% of our portfolio holdings by Market Value The Company • An American clothing and accessories retailer based in Pittsburg, PA • Sells its merchandise through stand-alone stores in malls and online through www.ae.com • Key Facts: • Founded in 1977 • Headquarters: Pittsburg, PA • Currently operates 1086 stores in US & Canada; Avg. store size-4700 selling sq.ft. • CEO: James V. O'Donnell • Employs around 39,900 people • Stock trades on NYSE under symbol ‘AEO’ Recent News: • On 9th March’ 2011, Company CEO James V. O’Donnell expressed his intention to retire. Search for New CEO is on • Recent Speculation regarding Company being an attractive LBO target; Reason: Company posted negative comparable sales growth during quarter fiscal 2010 but still cash rich • On 31st July’ 2010, Completed Closure of its brand ‘M+0’; Reason: brand was not achieving performance levels commensurate with investments. History • 1977-Funded by Mark & Jerry Silverman as a subsidiary of Retail Ventures, Inc., which operated ‘Silverman’s Menswear’ • 1989- Bothers sold other businesses & decided to focus only on AEO • 1991-Schottensteins, 50% owner in AEO bought out remaining 50% interest from Silverman family • • 2001-Opened AEO’s 1st Canadian Store 1994- Company went Public • 2006-Company launched new brand ‘M+O’ for Adults and Aerie for Women • 2008-Launched new brand 77Kids for children • 2010-Closed ‘M+O’; Opened first International Store in Dubai, UAE What it Does & How? AEO Distribution Centre Garment Manufactures AEO Headquarters AEO Designers AEO Stores Business Segments ‘AE’ Apparels & Accessories for Men & Women aged 15-25; Total 929 stores across US & Canada ‘aerie’ ‘AE Direct’ Sells All Merchandise Online; Ships to 76 Countries worldwide AEO, Inc. Apparel & Intimates Collection for college going Girls; 148 Stores across US & Canada ‘77Kids’ Clothing & Accessories for Babies & Kids aged 0-10 years ; 9 Stores across US & Canada Management Outlook • Company expects an improvement in sales on the basis of solid product line up, continued cost cuts & better managed Inventory • Company Expects to Mitigate Rising Product Costs with Targeted Reduction in Mark-downs, Selective Price Increases & On-going Cost Savings • Internal Development of New Brands • Expansions Overseas though Franchise route while keeping an eye on Acquisition Opportunities Growth Strategy: • • • • • • International Expansion: The company is entering into Multiple Franchise Agreements to open Series of AE Stores at International Locations: Year Party Region 2009 Alshaya Trading Co. Middle East, North Africa, Eastern Europe 2010 Dickson Concepts Ltd. China, Macau (commences 2011) 2011 Sumikin Bussan Co. & Fox Wizel Ltd. Japan, Israel (commences 2012) * No Capital/ Operational Involvement Opening New Stores: Depending on Geography and Demographics Remodel Old Stores to Current Store Format to Offer Unique Shopping Experience Strengthen e-commerce Operation Cut Costs & Manage Inventory Key Performance Indicators • Comparable Store Sells: Provides measure of Sales Growth for Stores open more than a Year • Net Sales Per Average Square Feet: Provides Measure of Store Productivity and Operational Efficiency • Inventory Turnover: Measure how Productively Inventory is Bought & Sold. Slow Moving Inventory affects Profitability • Gross Profit: Provides Measure of whether or not Company is optimizing the Price & Inventory Levels to Achieve Optimal Sales Levels • Sufficient Cash Levels Recent Financial Performance Fiscal Year ended Jan 29th ’2011 • Net Sales were up 1% over 2009 figures • Annual Comparable Store Sales were down 1% over comparable figure in 2009 • Net Income (from Cont. Operations) was 6% against 7% of Sales in 2009owed to loss from selling Inv. Securities • Cash Decreased by $155.8 million to $740.6 million • Overall Results were affected by Loss Recognized from Closure of “M+O” & Selling Investment Securities • Company Paid a Quarterly Dividend of $0.11 per share and Special Dividend of $0.50 per share in Fiscal 2010 • Repurchased 15.5 million shares in fiscal 2010. • New Store openings were Funded by Operating Cash Flows Recent Stock Performance Source: finance.yahoo.com SWOT Analysis Strengths: Weaknesses: • Affordability • Fickle Customer Base/Low • Solid Geographical Presence Pricing Power • No Financial Leverage, High • Excessive Dependence on Operating Cash Flow One Supplier • Good Product Assortment • Seasonality • Slow Moving Inventory Opportunities: Risks: • International Expansion • Internal Development of New Brands • Economic Recovery • Cotton Prices • Inventory Risk due to Misidentification of Trends • Economic Condition and Growth Discretionary Spending • Failure of New Brand Offerings MARKET OVERVIEW MARKET VALUE: The global apparel retail industry grew by 2.1% in 2009 to reach a value of $1,078.2 billion. MARKET VALUE FORECAST: In 2014, the global apparel retail industry is forecast to have a value of $1,222.7 billion, an increase of 13.4% since 2009. MARKET SEGMENTATION: Women's wear is the largest segment of the global apparel retail industry, accounting for 51.3% of the Industry’s total value. GEOGRAPHIC SEGMENTATION: The Americas account for 35.7% of the global apparel retail industry value. MARKET RIVALRY: Despite the current global economic downturn, the apparel retail industry continues to grow at a healthy rate and this, coupled with the absence of switching costs for consumers and great product differentiation, means that rivalry within the industry is no more than moderate. http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 Historic Growth TABLE 1: Global Apparel Industry Value :$ billion Year $billion 2005 954.1 2006 1003.4 5.2 2007 1040.8 3.7 2008 1056.0 1.5 2009 1078.2 2.1 CAGR 2005-09 % Growth 3.1 http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 Historic Growth http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 Key Revenue Driver • Consumer Sentiment Index – Higher the consumer confidence higher is the spending on retail on clothing. • Number of Youth • Disposable Household Income Segmentation by Age http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 Forecasted Growth http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 Forecasted Growth http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 MARKET SEGMENTATION http://www.ibisworld.com/search/default.aspx?st=american+eagle+outfitters&srtid=0 PORTERS FIVE FORCE MODEL • Rivalry among competitors (High) • Low entry barriers • Extensive price competition • Bargaining Power of Buyers (Moderate) • Individual consumers • High Product differentiation • Price Sensitive • Retailers cannot forward integrate • Bargaining power of Suppliers(low) • Liberization of trade. • Industry is mostly labor intensive • Low switching cost for retailers PORTERS FIVE FORCE MODEL • Threat of New Entrants ( Low to Moderate) • Setting up single store does not require large capital outlay. • It might trigger a price war with players with multiple stores and brands. • Economies of scale • Threat of New Substitutes(Low) • Signifier of socio economic class • Substitutes for apparel retail include buying directly from manufacturers, which is facilitated by the growth of online sales. • Home-made and custom-made (couture) clothing are also niche alternatives to retail of ready-made clothes Sales Per Square Feet American Eagle Abercrombie and Fitch GAP Aeropostale 2010 2011 2010 2011 2009 2010 2009 2010 $422 $420 $339 $390 $365 $383 572 624 Same Store Sales Growth American Eagle (%) Abercrombie and Fitch(%) GAP (%) Aeropostale (%) 2010 2011 2010 2011 2009 2010 2009 2010 -4 -1 -23 7 -3 1 8 10 Competitors Abercrombie and Fitch, Inc (Ticker: ANF) • Presence in North America, Europe and Asia • FY 2010 Revenue : 3.47B Aeropostale, Inc (Ticker: ARO) • Presence only in North America • FY 2010 Revenue: 2.40B Urban Outfitters (Ticker: URBN) • Core operating location: US • FY 2010 Revenue: 2.27B Gap, Ins (Ticker: GPS) • • Presence in United States, Canada, the United Kingdom, France, Ireland, and Japan. FY 2010 Revenue: $14.66B Stock Price Movements 2006 Jan 01 - 2011 Apr 01 Source: http://www.google.com/finance Key Ratios of Retailers Inventory and A/R Management Receivables Turnover 1/31/2009 80.35 1/30/2010 77.17 1/29/2011 83.13 Industry 32.93 Receivables Days Sales 4.54 4.73 4.39 11.08 Inventories Turnover 6.03 5.69 5.72 4.46 Inventories Days Sales 60.58 64.19 63.76 81.84 Operational Asst Utilization Net Sales/Working Capital Net Sales/Net Plant&Equip Net Sales/Current Assets Net Sales/Total Assets 1/31/2009 1/30/2010 1/29/2011 5.63 3.88 3.77 3.98 4.12 4.61 3.19 2.52 2.53 1.50 1.38 1.58 Source: http://globalbb.onesource.com/homepage.aspx Ratio Comparisons with Competitors Inventory and A/R Management ANF ARO URBN GPS AEO Receivables Turnover 40.29 136.09 62.48 - 83.13 Receivables Days Sales 9.06 2.68 5.84 - 4.39 Inventories Turnover 3.61 10.46 6.43 5.67 5.72 Inventories Days Sales 101.16 34.89 56.72 64.41 63.76 Operational Asset Utilization ANF ARO URBN GPS AEO Net Sales/Working Capital 8.01 9.47 3.83 8.01 3.77 Net Sales/Net Plant&Equip 5.72 8.02 3.88 5.72 4.61 Net Sales/Current Assets Net Sales/Total Assets 3.74 2.08 5.11 3.05 2.84 1.27 3.74 2.08 2.53 1.58 Source: http://globalbb.onesource.com/homepage.aspx Other Ratio Comparisons Other Ratio Comparables Industry 13.42% AEO 10.65% 12.00% 8.21% 6.13% 9.11% 30.64% 15.11% 16.35% 9.06% 14.81% ROE 8.08% 53.36% Payout Ratio 42.00% N/A PEG Ratio(5 yr expected) 1.08 0.84 20.16% N/A 0.89 26.84% 21.00% 1.15 12.42% 101.71% 1.15 28.29% 19.60% N/A ANF ARO URBN GPS Operating Margin 8.15% 16.11% 18.21% Net Margin 4.33% 9.64% ROA 6.12% 14.49% Source: http://globalbb.onesource.com/homepage.aspx Float Number ANF ARO URBN GPS AEO Shares Outstanding 87.25 87.46 164.41 606 194.69 Float 86.1 86.6 127.7 526.73 172.02 % Available for 98.68% 99.02% 77.67% 86.92% 88.36% Trading Source: http://finance.yahoo.com DuPont Analysis with Competitors Tax Burden*Interest Burden*Operating Profit Margin*Asset Turnover*Leverage = ROE 2008 2009 2010 2011 ANF 0.63*1.02*0.21*1.44*1.70=33.01% 0.60*1.02*0.14*1.22*1.64=17.79% 0.66*1.01*0.04*1.04*1.54=4.30% 0.66*0.99*0.07*1.18*1.59=8.08% ARO 0.62*1.03*0.13*3.09*2.02=50.73% 0.60*1.00*0.13*2.87*2.38=54.09% 0.60*1.00*0.17*2.81*2.01=58.13% 0.60*1.00*0.16*3.05*1.81=53.35% URBN 0.68*1.04*0.15*1.32*1.49=20.93% 0.64*1.03*0.16*1.38*1.39=20.91% 0.64*1.02*0.17*1.18*1.39=18.71% 0.65*1.01*0.18*1.27*1.32=20.16% GPS 0.62*1.07*0.08*2.01*1.66=18.35% 0.61*1.02*0.11*1.92*1.75=22.33% 0.61*1.00*0.13*1.78*1.72=23.76% 0.61*1.01*0.13*2.08*1.58=26.84% AEO 0.63*1.06*0.20*1.64*1.35=28.99% 0.61*1.05*0.12*1.50*1.43=16.70% 0.70*0.98*0.11*1.38*1.43=14.26% 0.62*0.93*0.11*1.58*1.28=12.42% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% ANF ARO URBN GPS AEO 2008 2009 2010 2011 Source: http://globalbb.onesource.com/homepage.aspx Comparable Approach Ticker Market Cap ($mm) Price American Eagles Outfitters, Inc AEO 3,080 15.84 0.7 Abercrombie and Fitch ANF 5,220 59.7 Aeropostale, Inc ARO 2,120 Company Name Urban Outfitters, Inc URBN Gap, Inc GPS Diluted Book Value EPS Per Share ($/Share) Revenue Per Share EV ($mm) EBITDA ($mm) 6.95 14.8 2410 462.81 1.67 21.67 39.39 2310 506.21 24.31 2.49 4.95 26.18 1,900 442.67 4,970 30.24 1.6 8.58 13.63 4820 514.01 13,650 22.71 1.88 6.73 23.06 1,168 253 Source: http://globalbb.onesource.com/homepage.aspx Comparable Approach (Con.) Company Name Ticker P/E P/B P/S EV/EBITDA American Eagles Outfitters, Inc AEO 22.63 2.28 1.07 5.21 Abercrombie and Fitch ANF 35.75 2.75 1.52 4.56 Aeropostale, Inc ARO 9.76 4.91 0.93 4.29 URBN GPS 18.90 12.08 3.52 3.37 2.22 0.98 9.38 4.62 19.12 3.64 1.41 5.71 Urban Outfitters, Inc Gap, Inc Average Multiple Triangulation P/E P/B P/S DCF Value Price 13.4 25.31 20.95 15.49 Weight 0.20 0.05 0.05 0.70 Triangulated Value Weighted price 2.68 1.27 1.05 10.84 $15.83 Ave P/E* EPS(AEO) 13.39 Ave P/B* BPS(AEO) 25.31 Ave P/S*RPS(AEO) 20.95 Source: http://globalbb.onesource.com/homepage.aspx Discounted Cash Flow Results 1/29/2012 1/29/2013 1/29/2014 1/29/2015 1/29/2016 Net Income 210.51 229.45 245.51 257.79 265.52 D&A 148.93 162.33 173.70 182.38 187.85 Capex (90.00) (96.19) (102.80) (109.87) (117.42) (7.77) (9.09) (7.70) (5.89) (3.71) 261.67 286.51 308.71 324.41 332.24 Changes in NWC Cash Flow Terminal Value Free Cash Flow Enterprise Value Net Debt Outstanding 3644.42 261.67 $3,098.00 0 Shares Outstanding 199.98 Share Price $15.49 286.51 308.71 324.41 3976.66 Discount Rate 12.39% Terminal Growth Rate 3.00% Sensitivity Analysis Terminal Growth Rate Discount Factor 15.49 11% 11.50% 12% 12.39% 12.5% 13.00% 13.5% 14.0% 2% 16.7 15.8 15.0 14.4 14.3 13.6 13.0 12.4 2.5% 17.4 16.4 15.6 14.9 14.8 14.0 13.4 12.8 3% 18.2 17.1 16.2 15.5 15.3 14.5 13.8 13.2 3.5% 19.1 17.9 16.9 16.1 15.9 15.1 14.3 13.6 4% 20.2 18.8 17.6 16.8 16.6 15.7 14.8 14.1 4.5% 21.4 19.8 18.5 17.6 17.4 16.3 15.4 14.6 DuPont Analysis DuPont Analysis 2009 2010 2011 2012 2013 2014 Tax Interest Burdan Burden 0.61 0.93 0.7 0.98 0.62 0.93 0.62 1.00 0.62 1.00 0.62 1.00 Operating Asset Levera Profit Margin Turnover ge ROE 0.11 1.58 1.28 16.70% 0.11 1.38 1.43 14.26% 0.11 1.58 1.28 12.42% 0.11 1.55 1.43 14.88% 0.11 1.55 1.42 14.80% 0.11 1.53 1.41 14.41% 200% 180% 160% 140% 120% 100% 80% 60% 40% 20% 0% Tax Burdan Interest Burden Operating Profit Margin Asset Turnover Leverage 2009 2010 2011 2012 2013 2014 Source: http://globalbb.onesource.com/homepage.aspx Recommendation • DCF Valuation Range: $13.08- $19.45 with Base case share price at $15.49 • Triangulated Value at : $15.83 • Current Market Price: $16.22 • Sell 500 shares @ current market price Current Portfolio Allocation 6.33% 27.51% 17.70% AEO DO JKHY MCD MOS 14.08% 10.03% WAG WFR 12.98% 11.37% Unrealized Gains 210.42% 78.83% Initial Position 500 shares @ $9.07 1500 shares @ $5.23 Recommendation Sell 500 shares