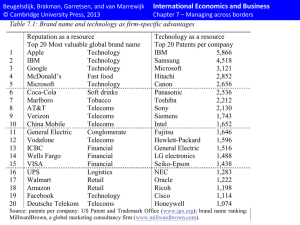

International Economics and Business

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

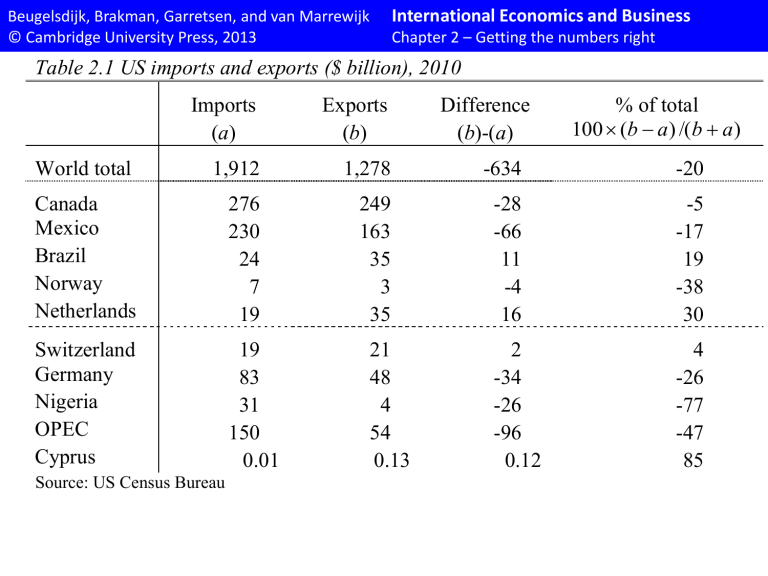

Table 2.1 US imports and exports ($ billion), 2010

100

% of total

(

b

a

) /(

b

a

)

Imports

(

a

)

Exports

(

b

)

World total 1,912 1,278

Canada

Mexico

276 249

230 163

Brazil 24 35

Norway 7 3

Netherlands 19 35

Difference

(

b

)-(

a

)

-634

-28

-66

11

-4

16

Switzerland 19 21

Germany 83 48

Nigeria 31 4

2

-34

-26

OPEC 150 54 -96

Cyprus 0.01 0.13 0.12

Source: US Census Bureau

-20

-5

-17

19

-38

30

4

-26

-77

-47

85

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

Table 2.2 A firm’s statement of income

1

International Economics and Business

Chapter 2 – Getting the numbers right

Revenue

Cost of sales

Gross profit

Selling, administrative, and other expenses

Research and development

Other income

Other expenses

Operating profit

Interest income

Interest expenses

Currency exchange gains or losses

Income before taxation

Taxation

Minority interests

Income after taxation

Income from discontinued operation (net of taxes)

Income on disposal of discontinued operations (net of taxes)

Cumulative effects of changes in accounting principles

Net income

1

Neither the terminology nor the complete set-up need be similar across countries, firms and periods. For example, gross profit is often referred to as gross margin, and many firms list special items (such as merger or reorganization costs). In this table we list a “common denominator”.

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

Table 2.3 Funding options for multinationals

International Economics and Business

Chapter 2 – Getting the numbers right

Location Internal

Source

External

Parent country Retained earning of the multinational parent

Local (host country) Retained earnings of local subsidiary

Equity or debt raised by the multinational parent

Equity or debt raised by multinational parent or by local subsidiary

Third country Retained earnings of the third country based subsidiary

Equity or debt raised by multinational parent or by 3 rd country based subsidiary

Source: Root (1994, p. 584); the shaded box is excluded in FDI statistics.

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

Table 2.4 Inward FDI stock; US $ bn, 2009

International Economics and Business

Chapter 2 – Getting the numbers right a. USA inward FDI stock

Total 2,253

United Kingdom

Japan

Netherlands

Canada

Germany

Switzerland

France

Luxembourg

Australia

Spain

454

264

238

226

218

189

189

128

46

44

% b. Germany inward FDI stock

Total

20.1 Netherlands

11.7 Luxembourg

10.6 United States

10.0 France

9.7 Switzerland

8.4 United Kingdom

8.4 Italy

5.7 Austria

2.0 Japan

1.9 Sweden

909

230

127

98

96

75

73

47

25

20

18

%

25.3

14.0

10.7

10.5

8.2

8.1

5.1

2.8

2.2

2.0

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right c. Japan inward FDI stock

Total 189 % d. Australia inward FDI stock

Total 224 %

United States

Netherlands

Cayman Islands

France

Singapore

United Kingdom

Germany

Switzerland

75

36

17

15

11

7

7

5

39.7

19.1

9.0

8.0

5.6

3.9

3.8

2.6

United States

United Kingdom

Japan

Netherlands

Switzerland

Germany

France

Canada

66

42

25

17

14

10

9

7

Luxembourg

Hong Kong

4

3

2.3

1.4

Singapore

Hong Kong

7

7

3.1

2.9

Source: OECD Foreign Direct Investment Position database; German and Australian data for 2008.

29.5

18.6

11.1

7.7

6.0

4.2

4.1

3.1

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.5 Foreign Direct Investment (FDI), stocks and flows; $ bn (%), 2011

World

Flows

1,524

(100)

FDI in

Stock

20,438

(100)

Flows

FDI out

Stock

1,694

(100)

21,168

(100)

Developed economies

Europe

North America

Other developed ec.

Developing economies

748

(49.1)

425

(27.9)

268

(17.6)

55

(3.6)

684

(44.9)

13,056

(63.9)

8,081

(39.5)

4,104

(20.1)

870

(4.3)

6,625

(32.4)

1,238

(73.0)

651

(38.4)

446

(26.3)

140

(8.3)

384

(22.6)

Africa

Asia

43

(2.8)

423

(27.8)

570

(2.8)

3,991

(19.5)

4

(0.2)

280

(16.6)

126

(0.6)

2,573

(12.2)

Latin America

Oceania

217

(14.2)

2

(0.1)

2,048

(10.0)

17

(0.1)

10

(0.6)

0

(0.0)

1,006

(4.8)

1

(0.0)

Source: based on data from UNCTAD (2012), World Investment Report 2012; % in parentheses.

17,056

(80.6)

10,444

(49.3)

5,170

(24.4)

1,442

(6.8)

3,705

(17.5)

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.6 Analytic presentation: balance of payments, 2007 (billion US dollars)

A current account goods: exports fob goods: imports fob balance on goods services: credit services: debit balance on goods and services income: credit income: debit balance on goods, services, and income current transfers: credit current transfers: debit

B capital account capital account: credit capital account: debit total: groups A plus B

C financial account direct investment abroad direct investment in Germany/USA portfolio investment assets portfolio investment liabilities financial derivatives other investment assets other investment liabilities total: groups A through C

D net errors and omissions total: groups A through D

E reserves and related items overall balance

Source IMF Balance of Payments Statistics Yearbook

Germany

255.53

1,354.12

-1,075.43

278.69

214.96

-254.23

239.41

318.01

-260.12

297.31

25.43

-67.21

.24

4.75

-4.51

255.77

-301.46

-169.37

50.94

-178.42

370.43

..

-440.27

164.39

-45.69

46.93

1.24

-1.23

0.00

USA

-731.21

1,152.57

-1,967.87

-815.30

493.16

-378.11

-700.26

817.78

-736.03

-618.50

22.33

-135.03

-1.84

1.8

-3.65

-733.05

774.47

-333.27

237.54

-294.57

1,145.14

..

-661.89

675.02

41.42

-41.29

0.13

-0.13

0.00

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.7 FDI inflows and outflows, as % of total flows

Period

Developed economies Developing economies Transition economies

In Out In Out In Out

1980-89

1990-99

74.7

68.1

2000-09

Source: UNCTAD

65.1

94.0

88.0

85.0

25.3

30.8

31.3

6.0

11.7

13.2

0.0

1.0

3.9

0.0

0.4

1.8

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.8: U.S. outward multinational activity in 2010

Ranking FDI Affiliate sales Affiliate value added

5

6

7

8

1

2

3

4

Netherlands

United Kingdom

Canada

Luxemburg

Bermuda

Ireland

UK Island, Caribbean

Switzerland

United Kingdom

Canada

Germany

Singapore

Switzerland

Ireland

Japan

Netherlands

United Kingdom

Canada

Germany

Japan

France

Ireland

Australia

Brazil

9

10

Australia

Japan

France

Mexico

Switzerland

China

Source: BEA. The value added and sales data refer to majority owned all foreign affiliates in 2009. The

FDI data reflect the direct investment position in 2010 based on a historical costs basis.

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.9 Top 10 non-financial multinationals 2011, ranked according to TNI

4

5

6

2

3

7

Rank Corporation

1 Nestlé SA

Anglo American plc

Xstrata PLC

Anheuser-Busch InBev NV

Nokia OYJ

ABB Ltd.

Home country

Switzerland

UK

Switzerland

Belgium

British American Tobacco PLC UK

Finland

Switzerland

Sector

Food, beverages and tobacco

Mining & quarrying

Mining & quarrying

Engineering services

8

9

ArcelorMittal

Linde AG

Luxembourg

Germany

Metal and metal products

Chemicals

10 Vodafone Group Plc UK Telecommunications

Source: UNCTAD World Investment Report 2012; * TNI = TransNationality Index

TNI

*

96.9

93.9

93.5

Food, beverages and tobacco

Food, beverages and tobacco

92.4

91.7

Electrical & electronic equipment 91.4

91.2

90.5

90.2

90.2

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.10: Country of origin of Global 500 between 2005-2010

Country

United States

Japan

France

Germany

Britain

China

Netherlands

Canada

BRIC total

Other

Total

2005

176

81

39

37

35

16

14

13

27

78

500

2006

170

70

38

38

35

20

14

14

35

86

500

2007

162

67

38

37

33

24

14

16

39

94

500

2008

153

64

39

37

34

29

13

14

46

100

500

2009

140

68

40

39

26

37

12

14

58

103

500

2010

139

71

39

37

29

46

13

11

67

94

500

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.11: GDP, sales and profits in 2009 (in US$ bn)

Country GDP

Sweden: 406

Honduras: 14.3

Firm sales

Walmart (1): 408

Dai Nippon Printing (500): 17

Firm profits

Walmart (1): 14.3

Dai Nippon Printing (500): 0.3

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.12 Size of net capital flows; selected countries, 1870-2010

Period Arg Aus Can Fr Ger It Jap UK USA

1870-1889 18.7 9.7 7.2 2.9 1.9 1.8 0.5 4.5 1.5

1890-1913 6.2 6.3 7.6 2.3 1.4 1.9 2.2 4.5 0.8

1914-1918 2.7 7.6 3.5 3.1 - 11.7 6.6 2.9 3.5

1919-1926 4.9 8.8 2.3 1.1 2.2 4.2 2.1 2.9 1.7

1927-1931 3.7 12.8 3.6 1.8 1.8 1.5 0.6 2.0 0.8

1932-1939 1.6 3.7 1.6 3.7 0.4 0.7 1.1 1.1 0.6

1940-1946 4.8 7.1 6.5 1.8 - 3.4 1.0 7.3 1.0

1947-1959 3.1 3.4 2.3 2.0 2.0 1.4 1.3 1.2 0.6

1960-1973 1.0 2.3 1.2 1.5 1.0 2.1 1.0 0.8 0.5

1974-1989 1.7 3.7 2.6 0.8 1.9 1.4 2.0 1.4 1.3

1990-2000 2.9 4.5 2.3 1.1 1.3 1.9 2.3 1.9 1.8

2001-2010 3.3 4.9 1.8 1.1 4.6 1.8 3.4 2.3 4.6

Source: Obstfeld (1998), update Obstfeld and Taylor (2004), Table 2.2. Updated for the period 2001-2010 using World Bank Development Indicators data. Size of net capital flows measured as mean absolute value of current account as a percentage of GDP, annual data; - = data not available; Arg = Argentina,

Aus = Australia, Can = Canada; Fr = France, Ger = Germany It = Italy, Jap = Japan, UK = United

Kingdom, and USA = United States of America.

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2.13 Gross financial stocks, ratios and shares

1825 1855 1870 1900 1914 1930 1938

Assets / GDP

Liabilities / GDP

-

-

-

-

0.07 0.19 0.18 0.08 0.11

- 0.14 0.21 - 0.11

Foreign assets: UK share 0.56 0.78 0.64 0.51 0.50 0.44 0.43

Foreign assets: US share 0.00 0.00 0.00 0.02 0.06 0.36 0.22

1945 1960 1980 1985 1990 1995 2000

Assets / GDP

Liabilities / GDP

0.05 0.06 0.25 0.36 0.49 0.62 0.92

- 0.02 0.30 - 0.60 0.79 0.95

Foreign assets: UK share 0.40 0.21 0.20 0.19 0.17 0.16 0.15

Foreign assets: US share 0.43 0.51 0.28 0.29 0.21 0.22 0.25

Source: Obstfeld and Taylor (2004, pp. 52-53); - = data not available; Sample size increases from 7 in

1900 to 63 in 2000.

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

Table 2A.1 Overview of tax havens:

International Economics and Business

Chapter 2 – Getting the numbers right

The Caribbean and

Americas

Anguilla

Antigua and Barbados

Aruba the Bahamas

Barbados

Belize

Bermuda

British Virgin Islands

Costa Rica

Domini

Grenada

Montserrat

Netherlands Antilles

New York

Africa

Liberia

Mauritius

Melila the Seychelles

Soa Tome e Principe

Somalia

South Africa

Middle East and Asia

Bahrain

Dubai

Hong Kong

Labuan

Lebanon

Macau

Europe

Aldernay

Andorra

Belgium

Campione d'Italia

City of London

Cyprus

Gibraltar

Guernsey

Hungary

Iceland

Ireland (Dublin)

Ingushetia

Isle of Man

Jersey

Liechtenstein

Panama

Saint Lucia

St. Kitts & Nevis

Saint Vincent and the

Grenadines

Turks and Calcos Islands

Uruguay

US Virgin Islands

Singapore

Tel Aviv

Taipei

Indian and Pacific Ocean

The Cook Islands

The Maladives

The Marianas

Luxembourg

Madeira

Malta

Monaco

Netherlands

Sark

Switzerland

Trieste

Marshall Islands

Nauru

Niue

Samoa

Tonga

Turkish Republic of Nothern

Cyprus

Frankfurt

Vanuatu

Source: offshore business magazine (20 Sep 2006, pp. 66-7) and Tax Justice network "tax us if you can".

Beugelsdijk, Brakman, Garretsen, and van Marrewijk

© Cambridge University Press, 2013

International Economics and Business

Chapter 2 – Getting the numbers right

Table 2A.2 Global 500: Top 20 largest firms of the world; in US $ bn,,2010

Rank Company Country

1

2

3

4

5

Wal-Mart Stores

Royal Dutch Shell

Exxon Mobil

BP

Toyota Motor

U.S.

Netherlands

U.S.

Britain

Japan

6

7

8

9

Japan Post Holdings

Sinopec

State Grid

AXA

Japan

China

China

France

10 China National Petroleum China

11 Chevron

12 ING Group

13 General Electric

14 Total

15 Bank of America Corp.

U.S.

Netherlands

U.S.

France

U.S.

16 Volkswagen

17 ConocoPhillips

18 BNP Paribas

19 Assicurazioni Generali

20 Allianz

Source: Fortune Global 500

Germany

U.S.

France

Italy

Germany

Revenues

408

285

285

246

204

202

188

184

175

165

164

163

157

156

150

146

140

131

126

126

Profits

14.3

12.5

19.3

16.6

2.3

4.8

5.8

-0.3

5.0

10.3

10.5

-1.3

11.0

11.7

6.3

1.3

4.9

8.1

1.8

6.0