Dairy Crest*s Strategy

advertisement

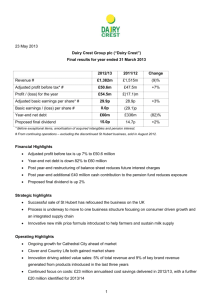

Dairy Crest Group plc Annual Results 2012 24 May 2012 1 DAIRY CREST GROUP plc Preliminary Results For the year ended 31 March 2012 24 May 2012 DAIRY CREST GROUP plc Agenda 20011/12 Mark Allen, Chief Executive Financial Review Alastair Murray, Finance Director Looking Forward Mark Allen, Chief Executive 2011/12 Mark Allen Chief Executive Good performance in challenging trading conditions Sales up – adjusted profits stable – dividend up Strong growth in Foods, continuing progress with key brands – Revenue +10% Decisive action in Dairies – restore profitability in medium term – Revenue -2% Adjusted profit before tax maintained at £87.4m (2011: £87.6m) Increased shareholder returns – dividend up 4% to 20.4p per share 5 Our broadly based business provides stability Strong performances from Spreads and Cheese have compensated for a difficult year in Dairies Operating Profit by Segment 120 100 102 8 106 27 36 34 17 60 109 10 35 80 108 Dairies 28 Cheese Spreads 40 60 54 53 08/09 09/10 10/11 20 63 0 11/12 6 Despite an even more challenging year for consumers, retailers and dairy processors alike For consumers Who faced real increases in food prices FOOD INFLATION +5% For retailers RETAIL MILK PRICE April 2011 £1.25 / 4 pts March 2012 £1.18 / 4 pts Intense competition Falling consumption PRICE WARS BULK CREAM PRICES March 2011: £1.55/litre June 2011: £1.85/litre March 2012: £1.08/litre For dairy processors Increasing commodity costs Falling returns from dairy commodity markets DAIRY CREST: COMMODITY COSTS +£80 MILLION YOY 7 Against this background Dairy Crest maintained adjusted profit at £87.4 million Our consistent strategy proves its worth Build market leading positions in branded and added value markets Focus on cost reduction and efficiency improvements 11% increase in sales of key brands 10% increase Foods revenues milk&more weekly sales > £1.2 million Efficiency projects have delivered £22 million Further £20 million in pipeline for 2012/13 Plans to close two non-core Dairies Foods Revenues up to 34% of Group Improve quality of earnings and reduce commodity risk Generate growth and focus the business through acquisition & disposals (2007: 29%) Successful innovation: 10% of sales from products and services <3 years old Strategic Review of St Hubert Purchase of MH Foods 8 Key brands: another year of strong growth Core Brand Market Brand Growth 11/12* Market Size (£bn) Market Growth 11/12** 5 Year Brand Growth 11/12 v 06/07 *** UK Cheese 12% 2.5 4% 100% UK Butter Spreads Margarine 16% 1.3 1% 12% 1% 60% -1% 1.3 12% 54% French NonButter Spread 19% 0% 0% 6% 0.3 0% 0% 6% 84% Fresh Flavoured Milk 7% 0.1 27% 35% UK Butter Spreads Margarine * DC value sales 12 months to 31 March 2012v 12 months to 31 March 2011 ** Nielsen, IRI data 52 weeks to 31 March 2012 *** DC value sales 12 months to 31 March 2012 v 12 months to 31 March 2007 9 Innovation: delivering for consumers and retailers Achieved target to have 10% of sales from products and services launched within the last three years Recent innovation: milk&more, Jugit and ‘lighter’ products have provided a strong base… …that exciting new products launched in 2011/12 have built on 10 Cost reduction – an essential part of the mix Ongoing focus on cost reduction has contributed to a solid year and allowed increased marketing investment £million 10/11 11/12 12/13 Production efficiencies 5 7 Overheads 5 3 Purchasing 5 9 Distribution 5 3 Total 20 22 20 (minimum) £75 million three year investment programme for liquid dairies on track Consultations on closures of Aintree and Fenstanton underway 11 St Hubert – review progressing to plan Strategic review of French spreads business progressing to plan - A successful business but Dairy Crest was unable to make further synergistic acquisitions as envisaged in 2007 Strength of St Hubert confirmed during the year ended 31 March 2012 - Record high profits - Record market share Disposal would reduce debt and provide alternatives - Releasing some proceeds to shareholders - Investing in core business - Making strategic UK branded chilled and dairy acquisitions 12 Acting responsibly across the supply chain Continue to make progress with Corporate Responsibility - 40 pledges developed during the year to add transparency and aid reporting - Highlights include a reduction in workplace accidents and a significant reduction in carbon footprint Take practical approach and align with commercial strategy - Environmental savings improve profits - Increase number of women by targeting return to work after maternity leave BITC – Gold Award – highest new entry in BITC Index 2012 13 Working with dairy farmers Increasing amount of milk bought direct Introducing flexible new contracts - Fixed price - ‘Farm business’ Paying fair, market-related milk prices - Milk prices have increased steadily during the last two years - Recent cuts disappointing but unavoidable given weak markets since year-end Strengthened support package - Water conservation - Herd health improvements 14 Financial Review Alastair Murray Finance Director Financial highlights Adjusted profit before tax* maintained at £87.4m (2011: £87.6m) Adjusted earnings per share* up 5% to 49.4p (2011: 47.1p) Exceptional non-cash impairment charges in Dairies lead to reported loss Final dividend up 4% to 14.7p (2011: 14.2p) – total dividend 20.4p (2011: 19.7p) Net debt increased by £24.8m to £336.4m (2011: £311.6m) * Before exceptional items, amortisation of acquired intangibles and pension interest. 16 Income Statement £m 2011/12 2010/11 Profit on operations* 108.7 108.4 Finance costs (21.0) (20.6) Share of associate net loss (0.3) (0.2) Adjusted profit before tax* 87.4 87.6 Other finance income - pensions 5.5 - Exceptional items (93.9) (1.1) Amortisation of acquired intangibles (9.1) (8.7) (Loss)/Profit before tax (10.1) 77.8 Taxation (7.0) (20.3) (Loss)/Profit after tax (17.1) 57.5 * Before exceptional items and amortisation of acquired intangibles 17 Segmental analysis – Cheese £m 2011/12 2010/11 Revenue 229.6 223.1 Profit 35.5 28.0 15.5% 12.6% Margin Volume growth despite pack size reduction Revenues up - comparative includes three months of Wexford Cathedral City clear leader in the branded everyday cheese category New Davidstow cheddar brand growing Chedds launch and strong NPD pipeline Improved efficiencies at Davidstow and Nuneaton 18 Segmental analysis – Spreads £m 2011/12 2010/11 Revenue 328.7 285.5 Profit 63.0 53.3 19.2% 18.7% Margin Strong sales growth for St Hubert Omega 3 and Clover Successful launch of two new products in France Continued efficiency improvements delivered with more to come Strong profit delivery and increased A&P 19 Segmental analysis – Dairies £m 2011/12 2010/11 Revenue 1,069.0 1,089.8 Profit 10.2 27.1 Margin 1.0% 2.5% Tough trading conditions exacerbated in H2 by falling cream realisations Continue to focus on cost, quality and service Increased sales of new products – milk&more, FRijj The Incredible and 1%milk Action taken to restore Dairies’ margins by increasing efficiency and capacity utilisation Significant exceptional impairment of fixed assets and goodwill 20 Exceptional Items £m P&L Charge Cash Impact Depot rationalisation costs (5.3) (5.3) Impairment of Dairies assets and goodwill (81.7) - Clover rationalisation costs (2.6) (0.2) Bad debt provision (4.3) - OFT settlement (incl costs) - (7.3) Wexford onerous contract costs - (0.9) (93.9) (13.7) Total 21 Balance Sheet £m Mar-12 Mar-11 Change Fixed assets, goodwill & intangibles 713.4 799.6 (86.2) Inventories 187.8 164.5 23.3 Debtors less creditors (134.9) (124.2) (10.7) Pension deficit (79.8) (60.1) (19.7) Deferred tax (69.4) (86.3) 16.9 Net debt (336.4) (311.6) (24.8) Other (6.4) (16.4) 10.0 Net assets 274.3 365.5 (91.2) 22 Pensions IAS-19 deficit as of March 2012 - £79.8m (2011: £60.1m) Annual contributions of £20m agreed for 2010-2013 Benefits from asset outperformance and cash contributions offset by reduced discount rate for calculating liabilities Continued work on de-risking the Scheme - ETV exercise removed £14.6m of liabilities 23 Operating Cash Flow £m 2011/12 2010/11 Adjusted profit on operations* 108.7 108.4 Depreciation & amortisation** 33.5 33.9 Exceptional Items (13.7) (3.7) Pensions (21.0) (21.7) Other*** (2.4) (0.5) Working capital (20.6) 11.7 84.5 128.1 (53.1) (48.5) 31.4 79.6 Cash generated from operations Capital expenditure (net of grants) Operating cash flow * Before exceptional items, amortisation of acquired intangibles and share of associates ** Including amortisation of grants *** Share based payments and profits on asset disposals 24 Net Cash Flow £m 2011/12 2010/11 31.4 79.6 Interest (23.6) (19.8) Tax (14.1) (16.1) (6.3) 43.7 (26.5) (25.4) Proceeds from disposal of assets 12.6 2.5 Acquisition/disposal of businesses (12.3) 3.9 0.1 (0.1) (32.4) 24.6 7.6 1.0 Movement in net debt (24.8) 25.6 Opening net debt (311.6) (337.2) Closing net debt (336.4) (311.6) Operating cash flow Dividends paid Other Net cash flow Foreign exchange movements 25 Net Debt history £m Net debt history 550 3.2 Net debt 491 500 3 475 Net debt / EBITDA 450 2.8 416 400 380 365 350 337 2.6 336 335 312 2.4 300 2.2 250 200 2 Mar 08 Sep 08 Mar 09 Sep 09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12 26 Summary Adjusted profit before tax maintained in a tough year Pre-tax loss mainly caused by non-cash goodwill impairment Small increase in IAS-19 pension deficit Good year-end net debt position despite cash outflows for - 2nd year of Dairies investment - Acquisition of MH Foods - Additional cheese stock to allow further growth - OFT fine Business has renewed long term facilities and has 1.3 turns of headroom in important net debt: EBITDA covenant 27 Looking Forward - Restoring Dairies - Building on UK Foods Mark Allen Chief Executive Looking forward We will continue with consistent strategy Build market leading positions in branded and added value markets Focus on cost reduction and efficiency improvements Improve quality of earnings and reduce commodity risk Generate growth and focus the business through acquisitions and disposals We plan to restore our Dairies business to a satisfactory level of profitability in the medium term And build on the strength of our Foods business 29 Restoring Dairies – a clear plan in a market with potential UK liquid milk – a large, complex, cyclical market that Dairy Crest can benefit from - 6 billion litres of milk consumed each year - Annual retail milk sales alone over £3 billion - A multi-layered supply chain where expertise counts Dairy Crest has around 25% market share Dairy Crest has a clear vision of success - Strategy driven by profitability - Right volumes at right price Decisive action since year end to build on ongoing operational improvements - Two dairies to close (subject to consultation) - Depot closures - Head Office reorganisation - Reduced milk purchase prices 30 A clear vision of where we want to go Focused well invested dairies supplying major retailers, residential customers and selective ‘middle ground’ customers Efficient distribution from the right dairy and depot network Leaders in flavoured milk – FRijj and retailer own brand Grow milk&more With a strong, profitable farmer supply base And what we have to do to get there Ongoing drive for efficiencies Complete our three year, £75 million investment programme Use depot network to minimise distribution costs Grow our brands and innovation Focus on key customers 31 Operational Improvements We have driven significant improvements in our Dairies operations over recent years Dairies efficiencies (OEE) Accident rates (per 100,000 employees) 4,675 64.40% 61.60% 65.50% 62.60% 2,575 1,452 08/09 09/10 10/11 11/12 Milk processed per employee (‘000 litres) 331 08/09 09/10 10/11 1,035 11/12 Depot costs (ppl) 332 15.8 297 263 15.0 15.2 13.9 08/09 09/10 10/11 11/12 08/09 09/10 10/11 11/12 32 Dairies processing – a balanced footprint…. Our focus is on 3 core wellpositioned, well invested liquid dairies Processing milk with the same equipment operated by our competitors Backed up by specialist cream and glass bottling dairies We compete on cost, quality and service 33 With market-leading distribution…. Focus and transparency improved by organisational changes Annual cost of milk collection and distribution > £120 million Projects underway to implement advanced planning tools Collaboration with key customers to tackle higher costs Extensive depot network makes Dairy Crest different Ongoing projects to reduce cost of operating depots 34 And with 2 strong branded propositions…. FRijj The UK’s leading flavoured milk brand with retail sales c. £50 million In strong growth after investment in capacity With more innovation coming soon milk&more Continuing to grow despite challenging economic environment >200,000 active customers generating weekly sales consistently over £1.2 million Focus on customer service 35 Restoring Dairies – summary This business operates in a large market with potential It has a good market share and brings critical mass to Dairy Crest We have a well-invested solid base and strong brands to build on With a track record of driving operational improvements Short-term market weakness has resulted in unsatisfactory profits We have a clear plan to remedy this We will continue to manage the business to make progress in challenging markets Our target is to be able to restore Dairies to a satisfactory level of profits in the medium term Aiming to achieve 3% on sales 36 Building on UK Foods We have created the UK’s leading portfolio of dairy brands in large, mature markets 37 Our focus is on the consumer Investment in consumer understanding leads our decision making - Promotional background - Smaller packs v higher prices Ongoing communication with consumers - TV advertising core - Supplemented by other media - Promotions “We want to earn consumers’ loyalty by providing healthy enjoyable, convenient products. We aim to meet consumers’ needs and go where this takes us” Dairy Crest Vision Continuous new product development - Cathedral City big slice - Clover seedburst - Selections 38 Supported by a well invested strong supply chain It is not just about marketing ..... success requires continuous investment in supply chain - Consistent quality - Record packing speeds and efficiencies at Nuneaton - Increased flexibility at Frome - Investment in modern tools to help sales force - Packaging innovation – for example single spreads tubs 39 Resulting in strong growth in sales of key brands Retail sales of Dairy Crest’s 3 key UK foods brands have increased by 51% From £266 million to £401 million in 4 years of unbroken growth 401 400 Value Sales (£m) 350 300 266 250 200 150 100 50 0 MAT WE 19.04.08 MAT WE 18.04.09 MAT WE 17.04.10 Cathederal City Source: Nielsen. 31 March 2012 Clover MAT WE 02.04.11 MAT WE 31.03.12 Country Life 40 We will keep building on our UK Foods success • Virtuous circle of growth and investment • Skillful execution of a well-established strategy • Strong key brands • Wide customer base Our proven ability to develop brands in mature markets leaves us well set for further profitable growth in our foods businesses • We expect to achieve market leading growth and long term margin improvement 41 Summary and current year outlook Summary Sales up – adjusted profits stable – dividend up Strategic review of French spreads business Clear plan for Dairies Build on UK Foods Current year outlook Continued cost discipline Strong momentum in our branded Foods businesses Expect Dairies to benefit from decisive actions 42 Questions A video interview with Mark Allen, Group Chief Executive is available at www.dairycrest.co.uk & www.cantos.com