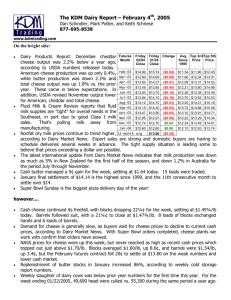

Consolidated income statement

advertisement

23 May 2013

Dairy Crest Group plc (“Dairy Crest”)

Final results for year ended 31 March 2013

2012/13

2011/12

Change

Revenue #

£1,382m

£1,515m

(9)%

Adjusted profit before tax* #

£50.6m

£47.5m

+7%

Profit / (loss) for the year

£54.5m

£(17.1)m

Adjusted basic earnings per share* #

29.9p

28.9p

Basic earnings / (loss) per share #

0.0p

(29.1)p

Year-end net debt

£60m

£336m

(82)%

Proposed final dividend

15.0p

14.7p

+2%

+3%

* Before exceptional items, amortisation of acquired intangibles and pension interest.

# From continuing operations – excluding the discontinued St Hubert business, sold in August 2012.

Financial Highlights

Adjusted profit before tax is up 7% to £50.6 million

Year-end net debt is down 82% to £60 million

Post year-end restructuring of balance sheet reduces future interest charges

Post year-end additional £40 million cash contribution to the pension fund reduces exposure

Proposed final dividend is up 2%

Strategic highlights

Successful sale of St Hubert has refocused the business on the UK

Process is underway to move to one business structure focusing on consumer driven growth and

an integrated supply chain

Innovative new milk price formula introduced to help farmers and sustain milk supply

Operating Highlights

Ongoing growth for Cathedral City ahead of market

Clover and Country Life both gained market share

Innovation driving added value sales: 5% of total revenue and 9% of key brand revenue

generated from products introduced in the last three years

Continued focus on costs: £23 million annualised cost savings delivered in 2012/13, with a further

£20 million identified for 2013/14

1

BITC Platinum Big Tick Award reflects ongoing strong Corporate Responsibility commitment

Commenting on the results, Mark Allen, Chief Executive, Dairy Crest Group plc said:

"This has been an important year in the history of Dairy Crest. The sale of our French spreads business

and subsequent restructuring of our balance sheet has strengthened our financial position and leaves us

well placed to invest for growth in the UK, either internally or through acquisitions.

In line with our long term strategy we have continued to manage proactively the business and remain

focused on driving efficiencies. Taken together, our four key brands have increased their market share in

the face of falling UK consumption. We have also started to restore profits in our Dairies business.

Dairy Crest is today a more streamlined business, and all three of our product categories have

encouraging medium-term profit growth prospects. Whilst we expect the consumer environment to

remain subdued, we have strong foundations in place and trading in the current financial year has started

in line with our expectations.”

For further information:

Dairy Crest

Arthur Reeves

01372 472236

Brunswick

Simon Sporborg

020 7404 5959

A video interview with Mark Allen will be available from 07:00 (UK time) from the investor section of the

Group’s website investor.dairycrest.co.uk. There will be an analyst and investor meeting at 10:30 (UK

time) today at The Lincoln Centre, 18 Lincoln’s Inn Fields, and London, WC2A 3ED. An audiocast of the

presentation will be available from the investor section of the Group’s website investor.dairycrest.co.uk

later today.

2

Chairman’s statement

Against the background of a trading environment which remained extremely challenging, this was a

transformational year for Dairy Crest. The Board has overseen the sale of our French spreads business,

St Hubert; a rationalisation of our Dairies business; a reorganisation of our head office and support

functions; and the introduction of a ground-breaking milk supply contract which initiated a new

relationship between the business and its supplying dairy farmers.

At the same time, in line with our established long-term strategy, we have continued to support our key

brands and drive costs out of the business.

We finish the year in a much improved financial position and with a clear plan for growth which will benefit

everyone associated with the business.

Well-established Vision and Values

The Group’s well-established Vision and Values continue to provide the Board with a framework in which

to operate. They reflect the fact that consumers come first for Dairy Crest and that we are well aware of

our links to rural Britain and the responsibility we have to our farmers, our employees, our franchisees

and the communities in which we operate. Balancing these groups’ different interests is never easy,

especially at times when the need to make change is at its greatest, but the clarity provided by our Vision

and Values helps us make the right decisions.

Corporate responsibility

Dairy Crest is a responsible business and has demonstrated its commitment to corporate responsibility

by improving its Business in the Community rating from Gold to Platinum Big Tick in the year, the only

food business to achieve this prestigious ranking. We are also delighted to have been shortlisted to be

Business in the Community’s Company of the Year 2013. During the year we have focused our

corporate responsibility commitments on 40 pledges, making it easier to align our corporate responsibility

and commercial strategies.

Employee, Board and other senior management changes

The transformation overseen by the Board has resulted in a smaller workforce which has reduced by

around 20% over the year. As a responsible employer, we have endeavoured to support people who

have left the business as best we can. On behalf of the Board I would like to thank all of them and all of

the people who continue to work for Dairy Crest directly or indirectly for the contribution they have made

to the success of the Group.

On 23 May 2013, after nearly ten years as Finance Director, Alastair Murray will leave to pursue other

business interests. In his time with Dairy Crest Alastair has been a Finance Director of the highest quality

with an excellent reputation both within the business and outside. He leaves Dairy Crest with our very

best wishes for the future.

3

Alastair’s successor as Finance Director is Tom Atherton who has been Dairy Crest’s Director of

Financial Control for the past four years and has worked for Dairy Crest for over seven years in total.

In addition Toby Brinsmead who was Managing Director of the Dairies business before we reorganised

into a unified structure left the business earlier this month. I thank him for all he has done, in particular

for his important work in creating a more focused Dairies business.

Increased dividend recommended

The Board is recommending a final dividend of 15.0 pence per share, making a full year dividend of 20.7

pence, up 1.5% from last year. This dividend is covered 1.4 times by adjusted basic earnings per share.

The reorganisation of our balance sheet since the year end will lower interest charges and result in an

improved dividend cover in the future. The Board has reviewed its dividend policy and, given the Group’s

improved cash position, is of the view that, going forward, the current progressive dividend policy should

be maintained and the target cover range should be 1.5 to 2.5 times.

Summary

We have made significant progress this year through disciplined execution of our strategy. Dairy Crest is

now a simpler, more focused business which is well positioned to generate growth and good returns for

shareholders.

Anthony Fry

Chairman

22 May 2013

4

Chief Executive’s review

Summary

This has been an important year in the history of Dairy Crest. The transformational sale of our French

spreads business, St Hubert, resulted in proceeds of £341 million and generated a post-tax profit of £47.7

million. This sale and subsequent reorganisation of our balance sheet leaves us well placed to meet the

challenges of the tough consumer environment and to invest in growth in the UK.

Taken together our four key brands have increased their value market share. This is a solid performance

and reflects our consistent strategic focus on brand equity and innovation.

A sustainable supply of milk is of vital importance to Dairy Crest. In the face of some of the most

challenging weather ever experienced by our farmers, and higher feed costs that have put pressure on

their businesses, we were first to adopt a government-sponsored voluntary code of practice. In addition,

we increased the milk prices we paid to farmers and introduced a ground-breaking contract which

allowed them to opt for a formulaic milk price mechanism that provides greater transparency and reduces

volatility.

Higher farmgate milk prices have put pressure on our Dairies business. Nevertheless we have made

progress in rebuilding profitability. We have completed our three-year £75 million investment programme;

closed two dairies; driven down costs; extended our major liquid milk contract with Sainsbury’s through to

2017 and reduced our exposure to less profitable contracts.

Last year we set a medium-term target of a 3% return on sales for this business. Despite the additional

support we provided to our farmers in the year, we have made some progress towards our target.

Second half margins, which are usually higher than those in the first half, rose to 1.7%.

St Hubert

It was not an easy decision to sell St Hubert. This was a strong business that had performed extremely

well under Dairy Crest’s ownership and had made a significant contribution to the profitability of the

business. However it did not provide the platform for further expansion into continental Europe that we

anticipated.

The successful disposal of St. Hubert has reduced significantly the Group’s gearing. Following the sale

our year-end net debt is at its lowest level since 2000. This strong position has allowed us to reduce our

exposure to the pension fund by making a one-off contribution of £40 million subsequent to the year end

and provides us with exciting opportunities to invest for growth.

Market background

The year has seen generally lower food consumption reflecting fragile consumer confidence.

5

Changes elsewhere in the market place have left us as the largest UK-owned dairy foods company. We

are proud to be in this position and recognise the onus it places on us to provide leadership to the UK

dairy sector. We have fulfilled this role by being the first major milk buyer to fully implement the

Government’s voluntary code of practice for milk supply contracts and by introducing a formula based

milk purchasing contract. We are also taking the lead in calling for clearer country of origin labelling for

dairy products so that British consumers can support British farmers.

Looking forward we are hoping for a more benign climate for farming. However we expect consumers to

remain cautious and demand to remain subdued.

Long-term strategy

We remain clear that our long-term strategy to grow branded and added value sales, become more

efficient, reduce risk and improve the quality of our earnings and make value-enhancing acquisitions and

disposals is the right one for the business. We have made good progress with the execution of this

strategy during the last year.

The rationalisation of our Dairies business, which has involved a three year programme of investment in

three key dairies and the closure of the Fenstanton and Aintree dairies as well as 28 distribution depots,

demonstrates our determination to create a sustainable business. We retained our contract to supply

liquid milk to Sainsbury’s through to 2017 in the face of fierce competition and new processing capacity

coming on stream elsewhere in the dairy sector. This was a good result and vindicates the difficult

decisions we have made in this part of our business.

The work we have done over recent years to focus the business and remove complexity has allowed us

to initiate a reorganisation into one management and operating structure. The new structure is focused

on consumer-driven growth with an integrated supply chain and is consistent with our long-term strategy

to build added value sales and drive efficiencies.

Cutting costs is an embedded part of our strategy and cost reductions have been important in achieving

our targets this year. We maintained our record of implementing cost saving initiatives of at least £20

million per annum, achieving £23 million in the year. Our employees, including Board members and

senior management, have contributed by accepting below-inflation pay increases.

In addition to the initiatives in our Dairies business and our reorganisation into one structure, we are also

consolidating our two British spreads manufacturing facilities onto one site as we target a further £20

million of savings in the new financial year. These efficiency measures help us to support our key

brands, meet profit expectations and pay our farmers more.

6

Trading performance and financial summary

A solid performance from our four key brands, Cathedral City, Clover, Country Life and FRijj, particularly

in the first half of the year, coupled with an accelerated programme of efficiency measures, resulted in a

strong trading performance and we delivered results for the year in line with our expectations.

As the table below shows, total revenue from our four key brands is flat year on year with Cathedral City

and FRijj growth being offset by lower Clover and Country Life sales. Retail sales of these brands as

measured by Nielsen have grown in total by 3% and Cathedral City, Clover and Country Life have all

grown market share. Although FRijj has lost market share in the face of strong competition from new

brands introduced by competitors, its own growth reflects the expansion of the overall market.

We continue to invest behind our key brands and are committed to their ongoing success. Our marketleading cheddar brand, Cathedral City, goes from strength to strength and has become one of the UK’s

major food brands. In 2012 it was the only food brand voted into the top ten of YouGov's Brand Index,

alongside BBC iPlayer, John Lewis and Amazon.

Brand

Market

Dairy Crest

Market Statistics**

sales growth*

Brand growth

Market growth

Cathedral City

UK cheese

+3%

+5%

+2%

Clover

UK butter,

(5)%

(1)%

(3)%

(3)%

+1%

(3)%

+5%

+5%

+10%

-%

+3%

spreads,

margarine

Country Life

UK butter,

spreads,

margarine

FRijj

Flavoured

milk

Total

* Dairy Crest sales 12 months to 31 March 2013 v 12 months to 31 March 2012

** Nielsen data 52 weeks to 30 March 2013

New products launched in the last few years such as FRijj The Incredible, Chedds and Cathedral City

Selections contributed to this performance and we continue to focus on bringing new products to the

market. This year around 5% of our total revenue and 9% of our key brand revenue has come from

products introduced in the last three years. We have an ambitious target of 10% for such sales which we

achieved last year but have missed this year as new products introduced three years ago dropped out of

the calculation.

7

Adjusted Group profit before tax increased by 7% to £50.6 million (2012: £47.5 million). Adjusted basic

earnings per share increased by 3% to 29.9 pence (2012: 28.9 pence).

Group net debt at 31 March 2013 was £60 million (2012: £336 million), principally reflecting the proceeds

from the sale of St Hubert.

Future prospects

We believe that we can generate profit growth in all three of our product categories over the medium

term. We believe we can continue to grow sales and profits in our cheese business; that the

consolidation of our spreads manufacturing footprint onto one site will improve the profitability of that

business; and that our dairies business will continue to benefit from the work we are doing to move

towards our medium-term target of 3% return on sales.

In addition, the post year-end debt restructure will result in lower interest charges in the future.

We are focused on generating cash from the business as well as growing profits, albeit we expect net

debt to rise in the year ending 31 March 2014 as a result of our one off cash contribution to the pension

fund and investment in our new Spreads manufacturing facility.

Once the Spreads project is completed we will have well-invested, modern facilities across our business

and we would expect capital expenditure in the existing business to fall back towards the level of annual

depreciation. We will also continue to sell properties we no longer require and, in the absence of

acquisitions or internal investment in new growth opportunities, would expect net debt to fall after

2013/14.

Our strong financial position and our confidence that we can generate cash from our existing product

categories means we have the capability to invest in attractive growth opportunities, either internally or

through acquisition.

We are excited about an opportunity to increase profits from whey, a by-product of the cheese

manufacturing process. At present we manufacture whey powder which is mainly sold to food

manufacturers, but we believe there now may be an opportunity to add greater value to our high quality

whey stream and enter other, more attractive markets. A project is underway to scope the opportunity.

Current trading

The current financial year has started in line with our expectations. We have announced higher milk

prices for our farmers but have demonstrated in the past that we can do this without damaging

profitability. Key to achieving this is the ongoing implementation of our strategy to reduce controllable

costs and we are again on track to meet our targeted £20 million saving during the year.

8

Operating Review

Spreads

We make and sell butter and spreads at two locations in the UK, but are currently in the process

of consolidating manufacturing onto one of our existing sites at Kirkby, Merseyside.

The UK butter and spreads market declined during the year with values around 3% lower and

volumes around 2% lower overall. Clover and Country Life, our two key brands in this sector,

both increased value and volume share. Promotions are at a historically high level across the

category but are not driving category growth.

Looking forward we expect the trading environment for butter and spreads to remain challenging.

The work we are doing to rationalise our manufacturing capability will make us more efficient and

allow us to continue to compete strongly.

Reported revenue for the year ended 31 March 2013 fell by 8% to £194.5 million. Segment profits

increased 11% to £25.7 million, resulting in a segment margin of 13% (2012: profit £23.2 million,

margin 11%).

Two of Dairy Crest’s four key brands operate in the butter and spreads product category.

Clover, our main spreads brand, saw a small increase in volume but a 5% reduction in value sales. It

remains the UK’s leading dairy spread. Previously introduced innovation such as Clover Lighter

continues to boost the brand’s performance. Towards the end of the year we introduced a brand new

product, Clover Seedburst, into the market. This is a spread containing a blend of seven healthy seeds

and whole grains and is targeted at more health-focused consumers. We have more innovation planned

for the Clover brand.

Country Life is the leading British butter brand. Sales volumes remained broadly flat year on year,

although a reduction in price, reflecting lower input costs, primarily cream, resulted in sales values falling

by 3%.

Our other spreads brands, Utterly Butterly, Vitalite and Willow, experienced small reductions in volume

and value shares.

Our Spreads business is also home to MH Foods which we purchased in 2011. This business

manufactures and markets ‘one-spray’ cooking oils. Under our ownership the business has rationalised

its product range and improved manufacturing efficiencies and is making good progress. MH Foods

demonstrates the contribution that small acquisitions can make over time to the profitability and growth of

the Group.

9

During the year we moved production of Clover from our factory in Crudgington, Shropshire to Kirkby,

Merseyside and also commenced a project that will see Crudgington close completely in 2014 with all

production being moved to Kirkby. This £38 million project has attracted a £5 million grant from the

Regional Growth Fund.

Looking forward we expect the profits of this business to benefit from the cost savings that will arise from

a more efficient supply chain.

Cheese

Dairy Crest produces and markets the UK’s leading cheese brand, Cathedral City. Named in an

independent survey as one of the UK’s top ten positively viewed brands, the only food brand to

achieve this standing, Cathedral City is made at our Davidstow creamery in Cornwall from milk

supplied by around 450 local dairy farmers before being matured in Nuneaton and cut and

wrapped at either our state of the art facility there or our highly flexible site in Frome.

We also make and sell the premium Davidstow brand cheddar, which can justifiably claim to be

the best cheddar in the UK after it again won the Danisco Grand Prix trophy for consistently

topping the judges’ lists at cheese shows around the country.

Consumer-led marketing, including innovation in the form of new products and range extensions

has led to significant growth in our branded cheese sales in recent years.

Reported revenue for the year ended 31 March 2013 grew by 1% to £ 231.3 million. Segment

profits fell 6% to £33.3 million (as stock profits recorded last year were not repeated), resulting in

a segment margin of 14% (2012: profit £35.5 million, margin 15%).

UK retail cheese market volumes fell by 2% in the year with values increasing by 2% to £2.6 billion.

Cathedral City sales grew by 3%, with volumes up 1%. It has again increased its market share and

remains by far the largest brand in the total everyday cheese sector, although its sales account for only

16% of this sector, reflecting the dominance of retailer own label.

Over recent years we have widened the appeal of Cathedral City and now have four taste variants (mild,

mature, extra mature and vintage) as well as Lighter (reduced fat) Cathedral City, and Chedds, a snack

brand for children. Chedds was launched in 2011 and has made a significant impact in the children’s

cheese market.

Innovative packaging continues to be important to the brand’s growth and the launch of Cathedral City

Selections, packs containing bite-sized pieces of cheese, has been extremely successful, bringing new

10

consumers to the cheese market, boosting sales in its own right and giving consumers an opportunity to

sample the range of taste variants.

The long-established mature variant accounted for 57% of total Cathedral City sales, down from 65% last

year, reflecting the progress we have made in broadening the range.

We have continued to advertise and promote Cathedral City strongly and have worked with key retailers

to increase the brand’s in-store presence. For example, working with Tesco, we set up a trial in 36 of

their stores. A whole bay of the cheese fixture was dedicated to Cathedral City, ensuring the full range

was on offer to consumers and allowing increased in-store branding. The trial was successful and

Cathedral City bays will be rolled out to more Tesco stores in the year ending 31 March 2014.

The strong performance of Cathedral City has been acknowledged externally. The Grocer has placed it

as Britain’s 15th biggest grocery brand (up from 21st last year) and in a recent YouGov poll Cathedral City

was ranked as Britain’s tenth most positively viewed brand and was the only food brand in the top ten.

In addition to the performance of Cathedral City we have made good progress with our premium

Davidstow brand. We continue to widen distribution, replacing Davidstow products that have carried the

name of specific retailers. This has encouraged us to increase the investment behind this brand and we

expect to see further progress going forward.

We also continue to achieve increased efficiencies throughout the supply chain and have reduced

packing costs during the year.

The growth in our cheese sales has encouraged us to expand Davidstow’s production capacity in the

year and we have further plans for expansion in the future.

Profits in this business have been supported by strong returns from whey – the by-product of cheese

manufacture. The whey stream at Davidstow is particularly valuable because of its size and quality and

because it contains no colouring. We are excited about an opportunity to increase whey profits by

extending manufacturing into higher value products which are in demand world-wide and have initiated a

project to scope this opportunity.

The farmers supplying their milk to our cheese business have shared in its improved performance

through higher milk prices. We are happy to continue to pay a premium for our milk at Davidstow to

ensure we get a top-quality supply and since the year end have announced a further increase in the price

we pay.

Looking forward we are well positioned to increase market share and profits from cheese sales. The

opportunity to boost returns from whey only adds to the future prospects of this product category.

11

Dairies

The Dairies business processes and delivers fresh conventional, organic and flavoured milk to

major retailers, ‘middle ground’ customers (including, for example, smaller retailers, coffee shops

and hospitals) and residential customers.

We also manufacture and sell FRijj, the leading fresh flavoured milk brand, cream and milk

powders.

Reported revenue fell by 11% to £951.6 million (2012: £1,069 million). Segment profit rose slightly

to £10.3 million (2012: £10.2 million), resulting in a margin of 1.1% (2012: 1.0%).

A clear plan to restore Dairies profitability

2012/13 was another tough year for the Dairies business. Following the drop in profits in 2011/12 we

have created and started to implement a plan to restore the returns from our Dairies business to an

acceptable level. We believe this business can deliver a 3% return on sales and have set this as a

medium-term target.

Returns in the second half of the year increased to 1.7% compared to 0.4% in the first half reflecting both

the usual seasonal factors and initial results from the actions we have taken.

Profits will be increased by a combination of higher FRijj and other added-value sales, reduced costs and

a greater willingness to only supply those customers who will pay a fair price.

We expect that our actions will lead to higher margins to offset cost inflation and lower residential sales

that command an above average margin.

At the same time we will continue to pay a fair milk price to the farmers who supply their milk to us and

provide high quality products and cost efficient services to our customers.

FRijj – one of the drivers behind the plan

FRijj operates in the flavoured milk product category. This comprises fresh flavoured milk and long-life

flavoured milk. FRijj is predominately in the fresh category but we have developed a new long life

product which will allow us to push the brand into convenience and other outlets where refrigerated

storage is less available.

The flavoured milk category is growing strongly. Total sales are up 5% in volume and 10% in value.

Fresh flavoured milk sales are up 8% in volume and 16% in value as new brands introduced by

competitors have proved popular.

12

FRijj sales grew by 5% in value in the year, boosted by the innovative FRijj The Incredible premium range

of flavours but declined 2% in volume.

We advertised FRijj on television with encouraging results, although we expect to continue to use social

media and other alternative forms of marketing to support this brand going forward, reflecting the age of

its target consumer.

We expect to see further material growth in this brand in the future and are continuing to invest at our

Severnside production facility to ensure there is sufficient headroom to allow unfettered growth.

Efficiency improvements and cost reductions are also key

During the year we have completed the three year £75 million investment programme. As anticipated,

the investment has allowed us to pack milk more efficiently and has provided an opportunity to focus

polybottle production at three sites and glass bottling on one site. As a result we closed the Aintree and

Fenstanton dairies during the year with the regrettable loss of 450 jobs. We expect the resultant full-year

cost savings to contribute to future profit growth.

We have made further efficiencies including introducing a new design of polybottle in partnership with our

supplier Nampak. This uses up to 15% less plastic – good for costs and good for the environment.

Our Dairies business also benefits from our ongoing company-wide cost saving projects. As the largest

of our businesses it covers the highest proportion of central overheads and the decision to move to one

business, which is anticipated to save over £5 million annually, will contribute to the restoration of

profitability in this area.

Getting the right customer mix

During the year we retained our contract to supply liquid milk to Sainsbury’s - one of our largest

customers - and now have an agreement to supply them through to 2017.

We also strengthened our offering to retailers by buying Proper Welsh Milk, a small dairy business that

packs Welsh milk in Wales. Several key retailers are customers of this business which we will look to

expand.

We had to negotiate higher milk prices with customers so that we could pay our farmers more and

compensate them for the difficulties they faced from the poor weather and higher animal feed costs. We

also need to make an acceptable return for ourselves. Many of our customers were willing to pay higher

but fair prices. However we chose to stop supplying some smaller customers who were not prepared to

do so. Going forward we will continue to review our customer mix, particularly in the middle ground.

13

Residential sales still important

Delivering milk to customers’ doorsteps remains a key part of our business. We have 850,000 residential

customers and have a network of 1,800 milkmen delivering to them. However sales in this area continue

to fall as financial pressures lead to customers choosing to buy their milk from shops rather than have it

delivered. The rate of decline was lower amongst customers who use our internet doorstep delivery

proposition, milk&more, where we have maintained over 200,000 customers who use the service every

week. However overall residential volume sales of milk fell 12% compared to last year. As a result we

closed 28 local depots, finishing the year with 92. We also closed our residential delivery product

distribution centre in Sunbury during the year, moving this operation to our National Distribution Centre in

Nuneaton.

Profits from the sale of depots closed in earlier years as well as 2012/13 were £7.7 million. We anticipate

that property profits from the sales of depots will continue into the future and contribute to our mediumterm target of 3% margin.

Ingredients

Our ingredients operation continues to provide us with a valuable balancing solution for seasonal raw

milk supplies and cream.

We aim to minimise throughput in this business to reduce our exposure as far as possible to dairy

commodity markets. However our Dairies business generates more cream than that required by our

Spreads business. Prices for dairy ingredients were low during the early months of the year then rose

towards the middle of the range seen in recent years. Since the year end they have increased further.

14

Financial review

Overview

The successful sale of St Hubert in August 2012 has significantly strengthened the company’s financial

position. The Group received cash consideration of £341.1 million and net debt at 31 March 2013 of

£59.7 million is the lowest since 2000. Since 31 March 2013, the Group has restructured its debt facilities,

repaying £100 million of loan notes early and has also made a one-off cash contribution to the pension

fund of £40 million.

These actions leave the Group well placed to fund growth in its core UK market. Key projects for 2013/14

include the ongoing major £38 million investment in consolidating UK spreads production onto one site in

Kirkby, Merseyside.

Segment Revenue

2013

2012

Change

Change

£m

£m

£m

%

Cheese

231.3

229.6

1.7

0.7

Spreads

194.5

211.3

(16.8)

(8.0)

Dairies

951.6

1,069.0

(117.4)

(11.0)

Other

4.2

4.8

(0.6)

(12.5)

Total segment revenue

1,381.6

1,514.7

(133.1)

(8.8)

Group revenue excluding St Hubert decreased by 8.8% to £1,381.6 million, predominantly as a result of

lower revenues in the Dairies business. These lower revenues reflect the decision to reduce sales in the

middle ground following the closure of the Fenstanton and Liverpool dairies, and also the on-going

reduction in residential sales. Spreads revenue also decreased by £16.8 million due to lower average

realisations on Clover and butter (following a reduction in vegetable oil and cream costs) and reduced

sales of Utterly Butterly. Cheese revenues increased slightly.

Segment Operating Profit

2013

2012

Change

Change

£m

£m

£m

%

Cheese

33.3

35.5

(2.2)

(6.2)

Spreads

25.7

23.2

2.5

10.8

Dairies

10.3

10.2

0.1

1.0

Share of associates

-

(0.3)

0.3

n/a

Total segment profit

69.3

68.6

0.7

1.0

Remove share of associates

-

0.3

(0.3)

n/a

Acquired intangible amortisation

(0.4)

(0.8)

0.4

50.0

Group profit on operations (pre-exceptionals)

68.9

68.1

0.8

1.2

15

Segment profit excluding St Hubert increased by £0.7 million to £69.3 million. Cheese profits recorded a

small decrease to £33.3 million, reflecting increased costs of milk in 2011/12 translating into higher cost

of sales in 2012/13. Spreads profits increased by £2.5 million to £25.7 million due to the benefit of cost

savings initiatives and lower vegetable oil costs. Dairies profits of £10.3 million were effectively flat yearon-year, with the benefit of on-going cost savings being offset by the impact of residential decline and the

higher cost of raw milk. Within Dairies, property profits were £7.7 million (2012: £4.6 million).

Sale of St Hubert

In August 2012 the St Hubert business was sold for cash consideration of £341.1 million, resulting in a

profit on disposal of £47.7 million after fees and estimated tax costs. This profit has been classified within

discontinued operations as exceptional. The results of St Hubert until the date of sale have also been

disclosed as discontinued operations and prior year comparatives have been restated accordingly.

The sale of St Hubert has resulted in a UK-focused business which has subsequently been reinforced by

a reorganisation resulting in the removal of divisional operating and management structures. The cash

proceeds have allowed the Group to restructure its debt after the year end and make a one-off

contribution to the pension fund as well as retain capacity for future investment in the UK business.

Exceptional Items

Pre-tax exceptional charges of £56.5 million have been recorded in the year (2012: £93.9 million).

In September 2012 we announced the potential closure of the Crudgington site with production moving to

Kirkby. This project, now confirmed, will give significant savings in future years. Exceptional costs of

£13.8 million have been recorded in the year, the majority of which are non-cash asset write-downs.

Cash expenditure in the year was £2.6 million.

In April 2012 we also announced a major restructuring of Dairies manufacturing, which ultimately led to

closure of the Fenstanton and Aintree dairies. An exceptional cost of £21.3 million has been recorded

against this project, of which £9.0 million represents redundancy costs. Cash expenditure in the year was

£17.8 million and the project is now complete.

During the year we completed the restructuring of depot administration activities in the Dairies division.

This project has delivered more streamlined and centralised back-office support functions and generated

significant cost savings. Exceptional costs in the period were £9.2 million (predominantly redundancy)

with a cash expenditure in the year of £8.5 million.

In February 2013 the company announced a management restructure, leading to a unified business.

Exceptional costs of £3.5 million have been charged in the year being accruals for redundancy costs.

Some further exceptional costs will be incurred in 2013/14 as the reorganisation is completed.

16

On 18 April 2013 the company repaid £100 million of loan notes ahead of their normal maturity date and

reduced its revolving credit facility (“RCF”) by €60 million. The associated costs (primarily make-whole

premium payable to note holders) resulted in an exceptional charge of £8.7 million in the year to 31

March 2013 and the cash impact will be reflected in 2013/14. These costs are considered exceptional

due to their size and nature, and were charged in 2012/13 because having given notice of repayment to

noteholders in March 2013, the Group was irrevocably committed to repaying the loan notes at the year

end.

Finance costs

Finance costs have reduced by £2.4 million to £18.7 million. This primarily reflects the reduction in net

debt following the sale of St Hubert in August 2012 at which point all borrowings under the revolving

credit facility were repaid. The balance of the St Hubert proceeds were largely held on short-term cash

deposit prior to the loan note repayments noted in the “Borrowing Facilities” section below. The quantum

of the interest reduction during the year was limited due to the very low interest rates available on sterling

and euro deposits.

Other finance income of £5.9 million (2012: £5.5 million) comprises the net expected return on pension

scheme assets after deducting the interest cost on the defined benefit obligation. This is based on

assumptions made at the start of the financial year. This amount can be highly volatile year on year as it

comprises the net of expected returns and interest costs, both of which are dependent upon financial

market conditions at 31 March each year. We therefore exclude this item from headline adjusted profit

before tax.

Interest cover excluding pension interest, calculated on total segment profit, remains comfortable, at 3.7

times (2012: 3.3 times).

Profit before tax

2013

2012

Change

Change

£m

£m

£m

%

Total segment profit

69.3

68.6

0.7

1.0

Finance costs

(18.7)

(21.1)

2.4

11.4

Adjusted profit before tax

50.6

47.5

3.1

6.5

Amortisation of acquired tangibles

(0.4)

(0.8)

0.4

50.0

Exceptional items

(56.5)

(93.9)

37.4

39.8

Other finance income – pensions

5.9

5.5

0.4

7.3

Reported loss before tax

(0.4)

(41.7)

41.3

n/a

Adjusted profit before tax (before exceptional items and amortisation of acquired goodwill) increased by

6.5% to £50.6 million. This is management’s key Group profit measure. The reported profit before tax

was a loss of £0.4 million as a result of exceptional items. However, this measure excludes the

17

exceptional pre-tax profit of £51.4 million recorded on the sale of St Hubert, and the pre-tax profits from

St Hubert up to the date of its disposal (£11.3 million).

Taxation

The Group’s effective tax rate on profits from continuing operations (excluding exceptional items) was

20.7% (2012: 19.5%). The effective tax rate continues to be kept below the corporation tax rate by profits

from property disposals, on which the tax charges are sheltered by brought forward capital losses or roll

over relief. We expect the effective tax rate to decrease next year in line with the reduction in the rate of

UK corporation tax.

Group result for year

The reported Group profit for the year amounted to £54.5 million (2012: £17.1 million loss) reflecting the

profit on sale of St Hubert.

Earnings per share

The Group’s adjusted basic earnings per share increased by 3% to 29.9 pence per share (2012: 28.9

pence per share).

Basic earnings per share from continuing operations, which includes the impact of exceptional items,

pension interest income and the amortisation of acquired intangibles, amounted to nil pence per share

(2012: 29.1 pence loss per share).

Dividends

The proposed final dividend of 15.0 pence per share represents a 0.3 pence per share increase

compared to last year. Together with the interim dividend of 5.7 pence per share this brings the total

dividend to 20.7 pence per share for the full year, 1.5% higher than last year (2012: 20.4 pence per

share). The final dividend will be paid on 1 August 2013 to shareholders on the register on 28 June

2013.

Pensions

During the year, the Group paid £20 million into the (closed) defined benefit scheme in line with the

schedule of contributions agreed in June 2011. Contributions at this rate will continue until a new

agreement is reached following the actuarial valuation due as of 31 March 2013.

Following the sale of St Hubert, the Group entered into discussions with the Pension Fund Trustee about

the impact of this transaction on the employer covenant. Consequently, on 18 April 2013 the Group

made an additional one-off contribution to the Fund of £40 million. At the same time the Group granted

the Trustee a floating charge over maturing cheese inventories, with a maximum realisable value of £60

million. This charge was put in place to protect the Fund in the unlikely event of an insolvency of Dairy

Crest Limited.

18

The reported IAS19 pension liability at 31 March 2013 was £67.2 million comprising an IAS 19 deficit of

£56.3 million and a £10.9 million additional liability reflecting an unrecoverable notional surplus. The

reported deficit at 31 March 2012 was £79.8 million. Asset returns were strong during the year; however

bond yields declined again increasing the discounted level of pension liabilities.

Cash Flow

Cash generated from operations was £19.1 million in the year (2012: £84.5 million). This includes a

working capital outflow of £40.0 million (2012: £20.6 million outflow) due mainly to the higher value of

cheese stocks compared to March 2012 - £155.5 million in March 2013 versus £129.8 million last year.

Stock value increases are a result of increased manufacturing to support future volume growth and milk

cost increases during 2012. As was the case last year, we received some early settlement of invoices

from customers at March 2013.

Capital expenditure of £50.9 million was £2.4 million below last year (2012: £53.3 million). Significant

investment continued across our core milk processing sites, Severnside, Chadwell Heath and Foston.

The investment has allowed these sites to absorb volume from the Liverpool and Fenstanton dairies,

which have now closed. We now operate as a smaller, well invested Dairies manufacturing base with

improved efficiencies and higher levels of capacity utilisation. In February 2013, we received a grant of

£5.3 million from The Department for Communities and Local Government to be applied towards capacity

expansion at our spreads site at Kirkby. Proceeds from the sale of closed depots amounted to £10.1

million.

Cash interest and tax payments amounted to £18.0 million and £4.7 million respectively. (2012: £23.6

million and £14.1 million). Interest payments are £5.6 million lower as net debt reduced following the sale

of St Hubert in August 2012, at which point, all borrowings under the revolving credit facility were repaid.

Furthermore, upfront fees in relation to the renewal of the revolving credit facility were paid in the prior

year.

Net Debt

Following the sale of St Hubert, net debt decreased by £276.7 million to £59.7 million at the end of the

year. Net debt as defined includes the fixed Sterling equivalent of foreign currency loan notes subject to

swaps and excludes unamortised facility fees. At 31 March 2013, gearing (being the ratio of net debt to

shareholders’ funds) was 19% (2012: 123%).

Borrowing Facilities

At the start of the financial year, the group’s borrowing facilities comprised: £337 million of loan notes (at

the effective swapped exchange rate) maturing between April 2013 and November 2021, and a £170

million plus €150 million revolving credit facility expiring in October 2016.

19

In November 2012, £7.5 million of notes were voluntarily redeemed at par by investors. Facilities at 31

March 2013 therefore comprised £330 million of loan notes and a £170 million plus €150 million revolving

credit facility.

On 4 April 2013, £60 million of notes from the 2006 series which had reached their maturity were repaid.

On 18 April 2013, a further £100 million of loan notes were repaid from the 2007 series. Of these notes,

the majority (£69 million) were due for repayment in April 2014 with the balance due in April 2017. This

will reduce the Group’s interest payments going forward. The repayment was effected by exercising the

Group’s right to early redemption on payment of a make-whole premium.

Following these repayments, the Group has £170 million of notes outstanding which mature between

2014 and 2021.

On 18 April 2013 the Group also reduced its revolving credit facility by €60 million to £170 million plus

€90 million (approximately £246 million).

Borrowing facilities are subject to covenants which specify a maximum ratio of net debt to EBITDA of 3.5

times and a minimum interest cover ratio of 3.0 times. The Group remains very comfortably within its

covenants with a net debt to EBITDA ratio of 0.6 times as of 31 March 2013 (March 2012: 2.2 times)

Treasury Policies

The Group operates a centralised treasury function, which controls cash management and borrowings

and the Group’s financial risks. The main treasury risks faced by the Group are liquidity, interest rates

and foreign currency. The Group only uses derivatives to manage its foreign currency and interest rate

risks arising from underlying business and financing activities. Transactions of a speculative nature are

prohibited. The Group’s treasury activities are governed by policies approved and monitored by the

Board.

Going concern

The financial statements have been prepared on a going concern basis as the Directors are satisfied that

the Group has adequate financial resources to continue its operations for the foreseeable future. In

making this statement, the Group’s Directors have: reviewed the Group budget, strategic plans and

available facilities; have made such other enquiries as they considered appropriate; and have taken into

account ‘Going Concern and Liquidity Risk: Guidance for Directors of UK Companies 2009’ published by

the Financial Reporting Council in October 2009.

Alastair Murray, Finance Director

22 May 2013

20

Consolidated income statement

Year ended 31 March 2013

2013

2012

Before

Before

exceptional

Exceptional

exceptional

Exceptional

items

items

Total

items

items

Note

£m

£m

£m

£m

£m

£m

Group revenue

2

1,381.6

-

1,381.6

1,514.7

-

1,514.7

Operating costs

3,5

(1,320.4)

(47.8)

(1,368.2)

(1,451.2)

(93.9)

(1,545.1)

4

7.7

-

7.7

4.6

-

4.6

68.9

(47.8)

21.1

68.1

(93.9)

(25.8)

(21.1)

Other income - property

Profit / (loss) on operations

Total

Finance costs

6

(18.7)

(8.7)

(27.4)

(21.1)

-

Other finance income - pensions

6

5.9

-

5.9

5.5

-

5.5

-

-

-

(0.3)

-

(0.3)

(41.7)

Share of associate's net loss

Profit / (loss) before tax

Tax (expense) / credit

7

56.1

(56.5)

(0.4)

52.2

(93.9)

(11.6)

12.0

0.4

(10.2)

13.1

2.9

44.5

(44.5)

-

42.0

(80.8)

(38.8)

6.8

47.7

54.5

21.7

-

21.7

51.3

3.2

54.5

63.7

(80.8)

(17.1)

Profit / (loss) from continuing operations

Profit from discontinued operations

16

Profit / (loss) for the year attributable to equity shareholders

As a result of its disposal in August 2012, the results of the St Hubert business have been classified as discontinued operations and prior period

comparatives have been restated accordingly. The post-tax profit relating to discontinued activities is further analysed in Note 16.

2013

2012

Earnings per share

Basic earnings / (loss) per share from continuing operations (pence)

9

-

(29.1)

Diluted earnings / (loss) per share from continuing operations (pence)

9

-

(29.1)

Adjusted basic earnings per share from continuing operations (pence)*

9

29.9

28.9

Adjusted diluted earnings per share from continuing operations (pence)*

9

29.5

28.4

Basic earnings per share from discontinued operations (pence)

9

40.5

16.3

Diluted earnings per share from discontinued operations (pence)

9

39.9

16.0

Basic earnings / (loss) per share on profit / (loss) for the year

9

40.5

(12.8)

Diluted earnings / (loss) per share on profit / (loss) for the year

9

39.9

(12.8)

2013

2012

19.6

Dividends

Proposed final dividend (£m)

8

20.5

Interim dividend paid (£m)

8

7.8

7.6

Proposed final dividend (pence)

8

15.0

14.7

Interim dividend paid (pence)

8

5.7

5.7

* Adjusted earnings per share calculations are presented to give an indication of the underlying operational performance of the Group. The

calculations exclude exceptional items, amortisation of acquired intangibles and pension interest in relation to the Group's defined benefit

pension scheme, the latter being highly dependent upon market assumptions at 31 March each year.

Consolidated statement of comprehensive income

Year ended 31 March 2013

Note

Profit / (loss) for the year

Net investment hedges:

Exchange differences on foreign currency net investments

Exchange differences on foreign currency borrowings designated as net investment hedges

Exchange differences reclassified to income statement on sale of subsidiary

Actuarial losses and recognition of liabilities for unrecoverable notional surpluses

Cash flow hedges - reclassification adjustment for gains in income statement

Cash flow hedges - gains / (losses) recognised in other comprehensive income

Exchange difference on investment in associate

Tax relating to components of other comprehensive income

Other comprehensive loss for the year, net of tax

Total comprehensive gain / (loss) for the year, net of tax

All amounts are attributable to owners of the parent

21

14

7

2013

£m

54.5

2012

£m

(17.1)

(15.3)

6.0

(9.3)

11.4

(13.5)

(9.5)

10.0

7.6

(3.3)

51.2

(19.3)

7.7

(11.6)

(46.2)

4.3

(8.3)

(0.2)

11.9

(50.1)

(67.2)

Consolidated balance sheet

At 31 March 2013

Consolidated

2013

£m

2012

£m

270.3

74.3

30.5

0.3

0.5

1.4

14.5

391.8

282.9

260.0

170.5

0.5

1.3

16.6

731.8

208.2

98.8

9.6

276.1

592.7

984.5

187.8

131.5

0.3

79.4

399.0

1,130.8

(184.3)

(3.9)

(67.2)

(14.6)

(9.6)

(279.6)

(419.7)

(8.7)

(79.8)

(69.4)

(6.9)

(584.5)

Total liabilities

(221.8)

(167.5)

(2.3)

(2.6)

(1.6)

(1.7)

(397.5)

(677.1)

(266.4)

(2.0)

(0.7)

(0.6)

(2.3)

(272.0)

(856.5)

Shareholders' equity

Ordinary shares

Share premium

Interest in ESOP

Other reserves

Retained earnings

Total shareholders' equity

Total equity and liabilities

(34.1)

(77.5)

0.6

(51.4)

(145.0)

(307.4)

(984.5)

(33.3)

(70.9)

0.6

(49.0)

(121.7)

(274.3)

(1,130.8)

Note

Assets

Non-current assets

Property, plant and equipment

Goodwill

Intangible assets

Investments

Investment in associate using equity method

Deferred consideration

Financial assets - Derivative financial instruments

10

11

12

Current assets

Inventories

Trade and other receivables

Financial assets - Derivative financial instruments

Cash and short-term deposits

Total assets

2

Equity and Liabilities

Non-current liabilities

Financial liabilities

- Long-term borrowings

- Derivative financial instruments

Retirement benefit obligations

Deferred tax liability

Deferred income

Current liabilities

Trade and other payables

Financial liabilities

13

13

14

7

- Short-term borrowings

- Derivative financial instruments

13

13

Current tax liability

Deferred income

Provisions

15

22

Consolidated statement of changes in equity

Year ended 31 March 2013

Attributable to owners of the parent

Ordinary

Share

Interest

Other

Retained

Total

shares

premium

in ESOP

reserves

earnings

Equity

2013

At 31 March 2012

Profit for the year

Other comprehensive gain / (loss):

Net investment hedges

Amounts reclassified to income statement

on sale of subsidiary

Cash flow hedges

Actuarial losses

Tax on components of other

comprehensive income

Other comprehensive gain / (loss)

Total comprehensive gain

Issue of share capital

Share based payments

Equity dividends

At 31 March 2013

2012

At 31 March 2011

Loss for the year

Other comprehensive gain / (loss):

Net investment hedges

Cash flow hedges

Actuarial losses

Exchange difference on investment

in associate

Tax on components of other

comprehensive income

Other comprehensive loss

Total comprehensive loss

Issue of share capital

Share based payments

Equity dividends

At 31 March 2012

23

£m

£m

£m

£m

£m

£m

33.3

-

70.9

-

(0.6)

-

49.0

-

121.7

54.5

274.3

54.5

-

-

-

(9.3)

-

(9.3)

-

-

-

11.4

0.5

-

(13.5)

11.4

0.5

(13.5)

0.8

34.1

6.6

77.5

(0.6)

(0.2)

2.4

2.4

51.4

7.8

(5.7)

48.8

1.9

(27.4)

145.0

7.6

(3.3)

51.2

7.4

1.9

(27.4)

307.4

33.3

-

70.8

-

(0.6)

-

64.1

-

197.9

(17.1)

365.5

(17.1)

-

-

-

(11.6)

(4.0)

-

(46.2)

(11.6)

(4.0)

(46.2)

-

-

-

(0.2)

-

(0.2)

33.3

0.1

70.9

(0.6)

0.7

(15.1)

(15.1)

49.0

11.2

(35.0)

(52.1)

2.4

(26.5)

121.7

11.9

(50.1)

(67.2)

0.1

2.4

(26.5)

274.3

Consolidated statement of cash flows

Year ended 31 March 2013

Consolidated

2013

£m

19.1

(18.0)

(4.7)

(3.6)

2012

£m

84.5

(23.6)

(14.1)

46.8

(50.9)

5.3

(0.4)

10.1

(0.6)

330.8

(53.3)

0.2

12.6

(12.3)

-

294.3

(52.8)

18

18

18

(7.5)

(68.7)

(27.4)

7.4

(1.7)

(97.9)

192.8

79.4

3.9

276.1

(155.2)

165.2

54.5

(0.1)

(26.5)

0.1

(2.4)

35.6

29.6

49.9

(0.1)

79.4

18

(59.7)

(336.4)

Note

17

Cash generated from operations

Interest paid

Taxation paid

Net cash (outflow) / inflow from operating activities

Cash flow from investing activities

Capital expenditure

Grants received

Grants repaid

Proceeds from disposal of property, plant and equipment

Purchase of businesses and investments

Sale of discontinued operation (net of cash disposed of and fees)

16

16

Net cash generated from / (used in) investing activities

Cash flow from financing activities

Repayment and cancellation of bank facilities and loan notes

New bank facilities advanced

Proceeds from issuance of loan notes

Net repayment of borrowings under revolving credit facilities

Dividends paid

Proceeds from issue of shares

Finance lease repayments

Net cash (used in) / generated from financing activities

Net increase in cash and cash equivalents

Cash and cash equivalents at beginning of year

Exchange impact on cash and cash equivalents

Cash and cash equivalents at end of year

8

18

Memo: Net debt at end of year

24

Notes to the preliminary announcement

1 Basis of preparation

The consolidated financial statements have been prepared in accordance with the Disclosure and Transparency Rules of the UK Financial

Services Authority, International Financial Reporting Standards (“IFRS”) and International Financial reporting Interpretation Committee (“IFRIC”)

interpretations as endorsed by the European Union, and those parts of the Companies Act 2006 applicable to companies reporting under IFRS.

Except as described below, the accounting policies applied are consistent with those of the annual financial statements for the year ended 31

March 2012, as described in those financial statements.

The following accounting standards and interpretations became effective for the current reporting period:

IFRS 7 – Amendments to IFRS 7: Disclosures – Transfers of Financial Assets

IAS 12 – Amendments to IAS 12 ‘Income Taxes’ – deferred tax: recovery of underlying assets

The application of these standards and interpretations has had no impact on the net assets, result and disclosures of the Group in the year

ended 31 March 2013.

The financial information set out in this document does not constitute the statutory accounts of the Group for the years ended 31 March 2013 or

31 March 2012 but is derived from the 2013 Group Annual Report and Financial Statements. The Group Annual Report and Financial

Statements for 2013 will be delivered to the Registrar of Companies in due course. The auditors have reported on those accounts and have

given an unqualified report, which does not contain a statement under Section 498 of the Companies Act 2006.

2 Segmental analysis

IFRS 8 requires operating segments to be determined based on the Group’s internal reporting to the Chief Operating Decision Maker (“CODM”).

The CODM has been determined to be the Company's Board members as they are primarily responsible for the allocation of resources to

segments and the assessment of performance of the segments.

The CODM uses trading profit, as reviewed at monthly business review meetings, as the key measure of the segment's results as it reflects the

segment's underlying trading performance for the period under evaluation. Trading profit is a consistent measure within the Group and the

reporting of this measure at the monthly business review meetings, which are organised according to the product types, has been used to

identify and determine the Group’s operating segments. Trading profit is defined as profit on operations before exceptional items and

amortisation of acquired intangible assets, but includes the Group share of post-tax results of associates.

The Group’s operating segments at 31 March 2013 were ‘Cheese’, ‘Spreads’, 'MH Foods', ‘Dairies', 'Share of Associates' and ‘Other’.Certain of

these operating segments have been aggregated and the Group reports on five continuing segments within the business: ‘Cheese’, 'Spreads',

'Dairies', 'Share of Associates' and 'Other'. At 31 March 2012 'St Hubert' was an operating segment which was aggregated into the Spreads

segment. St Hubert was sold in August 2012 and therefore St Hubert has now been disclosed as a Discontinued Operation for 2012 and 2013.

In years up to 2011, the Liquid Products and Customer Direct segments were aggregated into one reportable segment being Dairies. During the

year ended 31 March 2012, these two businesses were merged with one senior management team responsible for the whole of the Dairies

segment. Since the restructuring, discrete financial information for the former Liquid Products and Customer Direct divisions is no longer

available or reviewed by either the Dairies senior management team or the CODM (in the past, segment information was based on allocations of

the combined cost base which is not now necessary). The Dairies segment principally comprises the sale of non-branded fresh milk in the UK to

a number of customers including major retail, foodservice and residential customers. The segment is managed on a combined basis including

milk sourcing, production volumes, demand planning, technical, quality and distribution. The factories process and pack milk for a mix of

customers which varies depending on customer and demand mix. Having considered these factors, management has judged that this business

now comprises one operating segment under IFRS 8.

The Spreads segment incorporates the MH Foods business acquired in June 2011. This business is branded, has similar end-customers as

Spreads and shares the same input cost risks. Therefore management judges that this meets the IFRS 8 aggregation criteria. Furthermore, its

revenue, result and assets do not represent more than 10% of the Group so the quantitative criteria for a reportable segment are not met.

The Cheese segment has not been aggregated with any other segment. This business manufactures predominantly branded cheese in the UK

and sells mainly to retail customers.

Share of Associates forms a separate segment whose results are reviewed on a post-tax basis.

The Other segment comprises revenue earned from distributing product for third parties and certain central costs net of recharges to the

operating segments. Generally, all central costs less external other revenue are recharged to the operating segments such that their result

reflects the total cost base of the Group. Other segment profit therefore is nil.

The segment results for the year ended 31 March 2013 and for the year ended 31 March 2012 and the reconciliation of segment measures to the

respective statutory items included in the financial statements are as follows:

25

Notes to the preliminary announcement

2 Segmental analysis (continued)

Note

Segment external revenue

Cheese

Spreads

Dairies

Other

Total segment external revenue

Year ended 31 March

2013

2012

£m

£m

231.3

194.5

951.6

4.2

1,381.6

229.6

211.3

1,069.0

4.8

1,514.7

33.3

25.7

10.3

69.3

(18.7)

50.6

(0.4)

(56.5)

5.9

(0.4)

35.5

23.2

10.2

(0.3)

68.6

(21.1)

47.5

(0.8)

(93.9)

5.5

(41.7)

Discontinued operations

Unsegmented assets

Total assets

237.7

138.0

268.1

2.2

38.3

684.3

300.2

984.5

216.2

136.5

279.0

1.8

39.5

673.0

361.5

96.3

1,130.8

Inter-segment revenue

Cheese

Spreads

Elimination

Total

11.3

2.8

(14.1)

-

9.9

4.7

(14.6)

-

6.7

3.2

17.2

4.5

31.6

0.8

32.4

6.0

4.2

19.4

2.5

32.1

2.0

34.1

6.9

12.5

23.7

4.8

47.9

1.1

49.0

5.5

25.5

30.5

3.1

64.6

3.3

67.9

(13.8)

(30.5)

(3.5)

(47.8)

(2.6)

(91.3)

(93.9)

Segment profit

Cheese

Spreads

Dairies

Share of associate’s net loss

Total segment profit

Finance costs

Adjusted profit before tax

Acquired intangible amortisation

Exceptional items

Other finance income - pensions

Group loss before tax

6

12

5

6

Segment total assets

Cheese

Spreads

Dairies

Investments and share of associate

Other

Segment depreciation and amortisation (excluding amortisation of acquired intangible assets)

Cheese

Spreads

Dairies

Other

Continuing operations

Discontinued operations

Total

Segment additions to non-current assets

Cheese

Spreads

Dairies

Other

Discontinued operations

Total

Segment exceptional items

Cheese

Spreads

Dairies

Unsegmented

Total exceptional operating costs

5

26

Notes to the preliminary announcement

2 Segmental analysis (continued)

Interest income and expense are not included in the measure of segment profit reviewed by the CODM. Group treasury is centrally managed and

external interest income and expense is all incurred in the UK following the sale of St Hubert and is not allocated to segments. Where interest is

reviewed by the CODM it is done so on a net basis. Further analysis of the Group interest expense is provided in Note 6.

Tax costs are not included in the measure of segment profit reviewed by the CODM. Tax is centrally managed and the group effective tax rate,

not individual segment tax rates, is reported.

Segment assets comprise property, plant and equipment, goodwill, intangible assets, inventories, receivables, assets in disposal group held for

sale and investments in associates and joint ventures using the equity method and deferred consideration but exclude cash and cash

equivalents, derivative financial assets and deferred tax assets as these items are managed on a Group basis. Other segment assets comprise

certain property, plant and equipment that is not reported in the segments. Total segment liabilities have not been presented as this measure is

not regularly reviewed by or provided to the CODM.

Inter-segment revenue comprises the sale of finished Cheese and Spreads products to the Dairies segment on a cost plus basis and is included

in the segment result. Other inter-segment transactions principally comprise sales of cream from the Dairies segment to the Spreads segment for

the manufacture of butters. Cream sold into Spreads is priced by reference to external commodity markets and is adjusted regularly so as to

reflect the costs that the Spreads segment would incur if it were a standalone entity. Revenue from inter-segment cream sales is not reported as

revenue to the CODM but as a reduction to the Dairies segment's input costs.

Segment depreciation and amortisation excludes amortisation of acquired intangible assets of £0.4 million (2012: £0.8 million) as these costs are

not charged in the segment result.

Segment additions to non-current assets comprise additions to goodwill, intangible assets and property, plant and equipment through capital

expenditure and acquisition of businesses.

Geographical information - continuing operations

Year ended 31 March

2013

2012

£m

£m

1,336.3

1,450.1

45.3

64.6

1,381.6

1,514.7

External revenue attributed on basis of customer location

UK

Rest of world

Total segment revenue (excluding joint ventures)

Non-current assets* based on location

UK

France

Rest of world

Total

375.1

0.8

375.9

370.5

338.0

5.4

713.9

* Comprises property, plant and equipment, goodwill, intangible assets and investments in associate.

The Group has two customers which individually represent more than 10% of revenue from continuing operations in the year ended 31March

2013 (2012: one). These customers account for £327.1 million (2012: £175.7 million) of revenue from continuing operations being 23.7% (2012:

11.6%).

The business segmentation above is based upon similar product groupings, namely Cheese, Spreads and Dairies, and therefore the analysis of

Group revenue by product and services is consistent with the revenue analysis presented above with the exception of non-milk product sales in

the Dairies segment, which amounted to £81.3 million (2012: £100.1 million).

3 Operating costs – continuing operations

Cost of sales

Distribution costs

Administrative expenses

Year ended 31 March 2013

Before

exceptional

Exceptional

items

items

Total

£m

£m

£m

1,008.2

44.3

1,052.5

229.1

229.1

83.1

3.5

86.6

1,320.4

47.8

1,368.2

Year ended 31 March 2012

Before

exceptional

Exceptional

items

items

£m

£m

1,106.5

13.6

259.0

85.7

80.3

1,451.2

93.9

Total

£m

1,120.1

259.0

166.0

1,545.1

4 Other income – property

Profit on disposal of depots

Year ended 31 March 2013

Before

exceptional

Exceptional

items

items

£m

£m

7.7

-

Total

£m

7.7

Year ended 31 March 2012

Before

exceptional

Exceptional

items

items

£m

£m

4.6

-

Total

£m

4.6

The Group continues to rationalise its Dairies operations as a result of the ongoing decline in doorstep volumes. This rationalisation includes the

closure of certain depots (the profit on which is shown above) and rationalisation of the ongoing Dairies operations. These activities represent a

fundamental part of the ongoing ordinary activities of the Dairies operations.

27

Notes to the preliminary announcement

5 Exceptional items

Exceptional items comprise those items that are material and one-off in nature that the Group believes should be separately disclosed to assist

in the understanding of the underlying financial performance of the Group.

Operating costs

Depot administration restructuring costs (Dairies)

Costs associated with closure of Dairy processing sites (Dairies)

Spreads restructuring costs (Spreads)

Business reorganisation

Impairment of goodwill, property, plant and equipment (Dairies)

Provision for bad debts (Dairies)

Finance costs

Repayment of loan notes and associated costs (Note 6)

Tax relief on exceptional items

Post-tax gain on disposal of St Hubert (Discontinued operations - Note 16)

Year ended

31 March 2013

£m

(9.2)

(21.3)

(13.8)

(3.5)

(47.8)

Year ended

31 March 2012

£m

(5.3)

(2.6)

(81.7)

(4.3)

(93.9)

(8.7)

(56.5)

12.0

(44.5)

47.7

3.2

(93.9)

13.1

(80.8)

(80.8)

Exceptional items in the year ended 31 March 2013 comprise:

-

£9.2 million of costs associated with the rationalisation of administrative activities and other structural changes in the Dairies depot

network. This restructuring results in centralisation of back office activities supporting the depot network. These costs relate to

redundancies (£7.4 million), incremental operating costs associated with delivery of the project (£1.1 million) and write downs of

property, plant and equipment (£0.7 million). The project has now completed.

-

During the year the Group has closed two processing sites at Aintree in Liverpool and Fenstanton in Cambridgeshire. The closure of

the sites and resultant changes in the supply chain, volume requirements and customer channels has resulted in exceptional costs of

£21.3 million. These costs relate to redundancies (£9.0 million), duplicate running costs (£6.2 million), asset write downs (£0.7 million)

and other costs (£5.4 million), including stock write-offs and duplicate running costs.

-

In September 2012 the Group announced that it was to consult with employees on plans to consolidate spreads production into a

single UK location at its site in Kirkby, Liverpool. As a result of this consolidation the site at Crudgington, Shropshire will close in 2014.

Following the transfer of Clover manufacture to Kirkby in the first half of 2012, the Crudgington cash generating unit ("CGU") does not

generate material cash flows from the remaining site production. Subsequent to this decision, value in use calculations have been

prepared to 2014 rather than in perpetuity using a discount rate of 8.7%. As a result we have impaired the carrying value of property,

plant and equipment by £12.3 million. This impairment has resulted in a carrying value of nil for plant and equipment and £1.0 million

for land and buildings. The relevant CGU for goodwill testing purposes is Spreads which encompases both the Crudgington and Kirkby

sites. This restructure will result in a more efficient Spreads supply chain and Spreads goodwill has not been impaired.

In addition to the impairment of property, plant and equipment, £1.5 million of costs were incurred during the year both to complete the