Tim Tozer - ASE Global

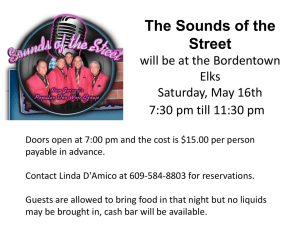

advertisement

Presentation to: ASE Financial Conference May 16, 2013 What we needed from our Finance community to run car retail in Central Europe Tim Tozer, CEO 1 16th May 2013 What we “high level” needed from our Finance community Management information chasing managers – not the other way around. To see the business in detail through the balance sheet and KPI’s – allowing management to direct their focus. A “measure it to move it” mantra. Finance control fulfilling and interpreting their role to be: – Guardians of the balance sheet. – Commercially involved challengers to the operational activities. – Financial controllers of risk management. 2 16th May 2013 Overview of AutoBinck 104 year history in the automotive business Privately owned - Lauret family 100% shareholder Businesses in 7 countries: – The Netherlands – Belgium – Czech Republic – Slovakia – Poland – Hungary – Slovenia € 1.1 billion turnover (60% Benelux, 40% Central Europe) 1,650 employees 3 16th May 2013 Recent history Mazda from 1968 - 2008 Distribution in The Netherlands and then Czechoslovakia (1991) More than 655,000 Mazda’s sold in our 40 year relationship. Hyundai from 1999 – to date Distribution in The Netherlands and Czech Republic and Slovakia (2000). Factory take over of CZ and SK in 2008 (Hyundai factory set up), replaced by Slovenia and Hungary. More than 250,000 Hyundai’s sold to date in our 13 year relationship. Other: 1996: acquisition of Business Lease NL, thereafter entering Czech Republic (1996), Slovakia (1998), Poland (2001) and Hungary (2003). 2000: acquisition of Brezan NL. 2004: Mitsubishi distribution in Czech Republic and Slovakia. 2005 on: retail growth into multi franchise then restructured in 2010. 2011: Jaguar Land Rover distribution in Hungary. 4 16th May 2013 AutoBinck organisational structure Car Distribution Car Retail Financial Services Parts & Accessories 28,593 cars in 2012 16,110 cars in 2012 39,600 lease contracts and 5,400 financed units € 96.3 M sales in 2012 130 outlets Czech Republic Hungary Poland Slovakia The Netherlands Belgium The Netherlands Czech Republic Hungary Slovakia Slovenia The Netherlands Czech Republic Hungary Slovakia Slovenia The Netherlands 5 16th May 2013 Figures Balance Sheet (Euro * 1,000,000) Sales per Division 0.2% 800 Business Lease 600 400 784 765 24.0% 790 19,1% Brezan Group 9.7% Car Distribution Car Retail 200 26.1% 26.9% 27.7% 2009 2010 2011 47.0% Other - Solvency Total assets Total Sales 2011: € 1,051 million Sales per Country Profit before tax (Euro * 1,000,000) 20,000 5.2% 17.9 15,000 5.1% 1.9% The Netherlands 5.3% Belgium Czech Republic 13.1 10,000 22.1% 5,000 1.0 Slovakia Slovenia 2009 Hungary 59.5% 2010 0.9% 2011 6 Poland 16th May 2013 The AutoBinck way Commercial and entrepreneurial local management trusted to act in the best interest of the business, delivering mission and strategy. Controlled through central funding and performance management of balance sheet, kpi’s and P&L. Long term perspective. Small HQ listening to the frontline, delivering action and energising the company. Synergies between the operating divisions, a family feeling. 7 16th May 2013 AutoBinck: 2012 Distribution and Retail volume Retail Distribution Country Brand Netherlands Hyundai Czech Mitsubishi Czech Infiniti Slovakia Mitsubishi Slovenia Country New cars Used cars Total 983 1,940 2,923 7,241 2,377 9,618 Slovakia 952 421 1,373 0.7% Slovenia 161 90 251 2,273 4.7% Hungary 1,677 268 1,945 1,234 2.3% 115 0.2% Volume * Market share 23,540 4.6% Netherlands 1,015 0.7% Czech 63 0.07% 416 Hyundai Hungary Hyundai Hungary Jaguar/LR Total 28,593 Total 8 16,110 16th May 2013 Central Europe total industry volumes Country 2007 2012 174,456 173,997 Slovakia 59,700 69,195 Hungary 171,661 53,008 Slovenia 68,719 50,091 474,536 346,291 Czech Republic Total 9 16th May 2013 Our retail past Our retail business existed historically to underpin brands we distributed and was run by wholesalers. In consequence we built palaces, had no detailed idea how to manage and control a customer service business, lost significant amounts of money and destroyed much shareholder value. The only available, reliable management information was the monthly P&L and balance sheet (at high level) – all else came ad hoc and heavily filtered by local management. If we were to continue with retail we needed a strong financial control based platform. 10 16th May 2013 An “Auto Palace” 11 16th May 2013 Our future General pressure upon financeability choices have to be made. Resources will be allocated to areas of core competence which can deliver the highest returns. “Stick to the knitting”. Within this context we had to decide if car retail really was a core competence for us, justifying funding on the basis of attractive ROE’s? Yes, but only with: – Retail management competence. – A very robust strategy and business plan. – A new risk managed world under control. 12 16th May 2013 Retail Strategy Decrease dependency upon manufacturers: – Recognising used cars as a business within a business. – Improving after sales activity and sale of ancillary products. – Optimise brand portfolio (one site per brand, unless very “retail”). Minimise capital employed. Optimise market penetration for brands represented. Adopt an “AutoBinck Way” for retail: – Operational consistency across all sites. – Service first. – Share best practice - visible through 24 kpi’s. Deliver 15% ROE on 30% normalised solvency. 13 16th May 2013 Retail strategy - how Manage each business through the balance sheet and KPI’s into the P&L with daily operating controls for all activities. Focus intensively upon used cars ROI - sweat purchasing and sales processes and stock turn. Focus intensively on after sales: – Parts stock turn – make more by losing less – CRM – customer retention builds after sales – Service sales advisors (not receptionists) Sales department process, productivity and team development. Internal communication - vision and values, results, recognition. 14 16th May 2013 Retail brands represented 2011 Czech Republic - Prague (4 sites) - Brno Slovakia - Bratislava (2 sites) Hungary - Budapest Slovenia - Ljubljana The Netherlands - Rotterdam 15 16th May 2013 Retail brands represented 2014 Czech Republic - Prague (3 sites) 2 TBA - Brno Slovakia - Bratislava Hungary - Budapest Slovenia - Ljubljana The Netherlands - Rotterdam 16 16th May 2013 What we needed from our Finance community Management information chasing managers – not the other way around. To see the business in detail through the balance sheet and KPI’s – allowing management to direct their focus. A “measure it to move it” mantra. Fulfilling and interpreting their role to be: – Guardians of the balance sheet. – Commercially involved challengers to the operational activities. – Financial controllers of risk management across the complete business. 17 16th May 2013 Retail Finance Director Job Description Interpret role at high level to be: – “the guardian of the balance sheet” – a commercially involved “challenger” to the operational activities – financial “controller” in the sense of risk management of the complete business. An active involvement with MD and site managers, pro-actively assisting them in achieving their goals. Timely and accurate reporting of DOC’s, KPI’s and management accounts with high level interpretation to the Board. Assisting line management with interpreting DOC’s , KPI’s and management accounts, determining appropriate management follow up and corrective actions. Focus line management on the balance sheet in order to reduce working capital, acting as the catalyst for them to take appropriate corrective management action. Treasury and cash management. Overseeing and managing all regulatory and statutory obligations. Adherence to AutoBinck accounting manual. Resolving any issues within the annual auditors management letter and AutoBinck internal audit. 18 16th May 2013 Example – management reporting Auto Palace Hungary Our Jaguar Land Rover Budapest flagship retailer 19 16th May 2013 Example – management reporting Auto Palace Hungary 20 16th May 2013 Example – management reporting Auto Palace Hungary 21 16th May 2013 Auto Palace Hungary* - Balance sheet 31-3-2013 31-3-2013 ACTUAL LAND BUILDINGS DEMONSTRATORS DEMONSTRATORS - UNITS RENTAL FLEET RENTAL FLEET - UNITS BUYBACK CARS BUYBACK CARS - UNITS OTHER TANGIBLE FIXED ASSETS TOTAL FIXED ASSETS VEHICLE RECEIVABLES AFTER SALES RECEIVABLES OVERHEAD RECEIVABLES 26.235 360.474 25 3.216.357 304 278.918 758.775 -2.303 756.473 53 14.273 USED VEHICLE STOCK-VALUE 624.118 INTERCOMPANY RECEIVABLES TAXES AND SOCIAL SECURITIES OTHER RECEIVABLES AND PREPAYMENTS -22.533 USED VEHICLE STOCK-BOOKVALUE 601.585 USED VEHICLE STOCK-UNITS USED VEHICLE STOCK-AVERAGE BOOKVALUE TOTAL VEHICLE STOCK 2.569.060 2.151.603 344.665 TOTAL NON TRADE RECEIVALBLES 2.496.268 CASH IN HAND AND AT BANKS 1.326.735 UNDERFUNDING VS 30% SOLVENCY 2.473.716 TOTAL ASSETS USED VEHICLE STOCK-PROVISION 2.145.649 215.736 248.558 TOTAL TRADE RECEIVABLES 3.881.984 NEW VEHICLE STOCK-VALUE NEW VEHICLE STOCK-PROVISION NEW VEHICLE STOCK-BOOKVALUE NEW VEHICLE STOCK-UNITS NEW VEHICLE STOCK-AVERAGE BOOKVALUE 31-3-2013 ACTUAL 14.353.235 67 8.979 1.358.058 PARTS STOCK-VALUE PARTS STOCK-PROVISION 312.851 -65.436 PARTS STOCK-BOOKVALUE TOTAL PARTS STOCK 247.415 247.415 * 2 sites, 1 legal entity 22 16th May 2013 Auto Palace Hungary - Balance sheet ageing analysis 31-3-2013 ACTUAL AGEING NEW CAR STOCK BETWEEN 0 AND 180 DAYS BETWEEN 180 AND 360 DAYS OLDER THAN 360 DAYS TOTAL NEW CAR STOCK CURRENT PROVISION Amount 599.884 53.573 105.318 758.775 2.303- Units AGEING USED CAR STOCK BETWEEN 0 AND 60 DAYS BETWEEN 60 and 90 DAYS OLDER THAN 90 DAYS TOTAL USED CARS STOCK CURRENT PROVISION Amount 67.745 128.579 427.794 624.118 22.533- Units AGEING PARTS STOCK BETWEEN 0 AND 6 MONTHS BETWEEN 6 AND 12 MONTHS BETWEEN 12 AND 24 MONTHS OLDER THAN 24 MONTHS TOTAL PARTS STOCK CURRENT PROVISION (Stock turn 0-6 months = 41) AGEING TRADE RECEIVABLES BETWEEN 0 AND 30 DAYS BETWEEN 30 AND 60 DAYS BETWEEN 60 AND 90 DAYS BETWEEN 120 AND 180 DAYS BETWEEN 180 AND 360 DAYS OLDER THAN 360 DAYS SUBTOTAL TRADE RECEIVABLES 43 3 7 53 Provision policy USED CARS ABOVE 60 DAYS - MONTHLY REVIEW OF TRADE PRICES (EXTERNAL REFERENCE) 10 14 43 67 PARTS PROVISION * 167.315 43.940 94.290 7.306 312.851 65.436DIFFERENCE VEHICLES 2.129.482 13.864 2.303 2.145.649 BETWEEN 6 AND 12 MONTHS 10.98547.1457.30665.436- 25% BETWEEN 12 AND 24 MONTHS 50% OLDER THAN 24 MONTHS 100% 0AFTER SALES OTHER TOTAL 119.183 58.504 2.307.169 24.242 22.476 46.718 17.890 11.401 12.175 14.194 215.736 11.199 34.528 80.362 26.810 248.558 29.089 59.793 94.839 41.005 2.609.944 PROVISION ON DOUBTFULL RECEIVABLES BANKRUPT RECEIVABLES - 2.116- 38.769- 40.884- PROVISION ON BANKRUPT RECEIVABLES - - - - * Provi s i on a ccordi ng group Pol i cy 23 16th May 2013 Budapest Hyundai & Opel - P&L Summary and absorption x MARCH 2013 YTD ACTUAL € % SALES TURNOVER: VEHICLE NEW RETAIL VEHICLE NEW FLEET VEHICLE EXPORTS VEHICLE USED RETAIL CAR RENTAL SERVICE BODYSHOP PARTS INTERNAL TOTAL SALES TURNOVER 401.685 647.851 6.763.941 571.068 291.820 59.956 33.394 290.090 4,46% 7,19% 75,03% 6,33% 3,24% 0,67% 0,37% 3,22% x MARCH 2013 YTD ACTUAL € % DIRECT PROFIT BY DEPARTMENT: CAR RENTAL SERVICE BODYSHOP PARTS 38.101 1.945 12.052 41.284 13,06% 3,24% 36,09% 14,23% SUBTOTAL DIRECT PROFIT A/S + RENTAL 93.382 1,04% (109.462) 1,21% TOTAL OVERHEADS OVERHEAD ABSORPTION % (44.839) 9.014.966 100,00% VEHICLE NEW RETAIL VEHICLE NEW FLEET VEHICLE EXPORTS VEHICLE USED RETAIL CAR RENTAL SERVICE BODYSHOP PARTS 31.490 28.228 40.732 34.983 54.523 17.842 24.473 53.016 7,84% 4,36% 0,60% 6,13% 18,68% 29,76% 73,28% 18,28% TOTAL GROSS PROFIT 285.287 3,16% GROSS PROFIT: 85,3% VEHICLE NEW RETAIL (INCL. EXPORTS) VEHICLE NEW FLEET VEHICLE USED RETAIL 47.099 12.073 24.558 0,66% 1,86% 4,30% SUBTOTAL DIRECT PROFIT VEHICLES 83.730 0,75% PROFIT BEFORE TAX 67.650 0,75% INTEREST (OVER)/UNDERFUNDING 12.369 PROFIT BEFORE TAX (NORMALISED) 80.018 24 0,89% 16th May 2013 Budapest Hyundai & Opel - KPI’s Q1 2013 GENERAL KPI Profit before tax / total revenue * Return on equity (normalised) * Sales department efficiency * Overhead absorption Gross Profit / FTE * Total personnel expenses as % of total gross profit * TARGET ACTUAL 2,0% 15,0% 55,0% 100,0% 50.000 40,0% 0,9% 2,3% 38,2% 76,2% 42.265 40,5% TARGET ACTUAL 100,0% 160,0 750,0 45,0 80,0% 700,0 77,8% 84,8 152,9 70,1 24,5% 431,9 SALES KPI New sales as a % of used sales (excl. export) Sales per sales person Average gross profit per new car sold * Used vehicle stock turn in days Return on investment used stock Average gross profit per used car sold * KPI's heavily dependent upon quarterly manufacturer bonus. 25 16th May 2013 Budapest Hyundai & Opel - KPI’s Q1 2013 AFTER SALES KPI Service efficiency (sold / attended) Service time utilisation (worked / attended) Bodyshop efficiency Gross profit % on service labour sales Gross profit % on body and paint labour sales Workshop direct expenses as % of gross profit Hours per job card (Retail Service) Hours per job card (Retail Bodyshop) Retail proportion of labour sold Retail recovery rate (retail labour sales / retail hours) Parts & accessories gross profit % Parts & accessories direct expenses as % gross profit Parts & accessories stock cover (0-6 months) 26 TARGET ACTUAL 110,0% 95,0% 130,0% 63,0% 73,0% 50,0% 2,4 8,0 70,0% 40,0 22,0% 30,0% 30,0 86,1% 69,8% 101,3% 54,9% 73,3% 54,7% 1,2 4,1 65,9% 33,3 18,3% 22,1% 41,0 16th May 2013 Waterfall chart – direct profit variances vs MAP €K Direct profit - March Year-to-date variance versus MAP 70 4 60 50 40 63 30 68 20 10 -10 -14 17 -18 18 -9 8 -5 4 -20 27 16th May 2013 30 Day forecast April 2013 AutoBinck Car Retail interim result 2013 Month: April (EUR) Version 1.6 Auto Palace Hungary - Hyundai & Opel 10th day Currency rate YTD 20th day 283,00 30th day 283,00 Full month Forecast TO DO 283,00 283,00 283,00 Budget (MAP) Actuals + Forecast Variance Budget (MAP) Variance 283,00 -4,6% 741 300 1.046 76.994 9.997 86.991 54.922 33.659 88.581 441 22.072 -23.662 -1.590 -15 -2.583 58 94 42.427 -2.583 42.427 46.944 0 46.944 283,00 283,00 46 9.461 296,10 New Cars 1 Hyundai 2 3 4 5 # # # # # # # # # # # Units GM excl bonus Bonus GM incl bonus Opel Units GM excl bonus Bonus GM incl bonus TOTAL NEW CARS Units Gross Margin Gross Margin other Total gross margin # Used Cars # # Units Gross Margin 25 130 128 0 128 82 4.735 0 4.735 24.735 0 24.735 26.237 26.237 0 0 0 26.237 0 26.237 16.776 8.415 25.191 5 9 14 0 14 29 3.570 0 3.570 8.376 0 8.376 11.943 11.943 0 0 0 11.943 0 11.943 14.527 0 14.527 30 139 142 0 142 111 8.305 33.111 38.180 38.180 8.305 33.111 38.180 0 0 0 39.717 3.276 42.993 38.180 31 -1.537 799 394 -4.813 129.418 7.524 136.942 135.525 13.102 148.627 -36 -4.517 -4.517 405 -6.107 -5.578 -11.686 9 9 21 0 21 23 78 5.283 9.519 0 9.519 7.442 -2 2.077 102 5.283 44.081 22.071 24 22.010 0 0 20.091 20.091 20.091 0 73.726 80.365 -6.639 2.468 5.223 11.489 0 11.489 10.472 1.018 28.823 39.070 -10.247 211 1.412 6.908 0 6.908 6.661 246 31.075 27.177 3.898 3.745 7.982 19.089 0 19.089 17.225 1.864 71.260 63.087 8.173 20.011 53.011 85.185 20.091 105.277 104.884 392 385.906 380.398 5.508 # # Car rent # Gross Margin # # Service # Gross Margin # # Body Shop # Gross Margin # # Parts # Gross Margin # # TOTAL # Gross Margin # # # 28 16th May 2013 Summary We have the information now to direct management attention. We have a team of retailers running the businesses to UK criteria. We have used our financial strength, this management team and the BER June 1st moment to radically revisit our franchise/site portfolio. We now see 2013 as a mid point “year of transition” to 2015 ROE of 10% minimum, on the platform of a business which: – Trebles its used car business. – Puts service first. – Optimises sales of a more balanced new car franchise portfolio. – Works from a much smaller balance sheet and one less site (Prague). Our finance community are at the heart of the business, ensuring standards of commercial robustness, control and management of risk that we could only dream of two years ago. 29 16th May 2013