A global economic and market outlook

advertisement

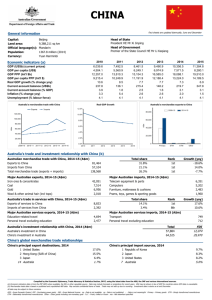

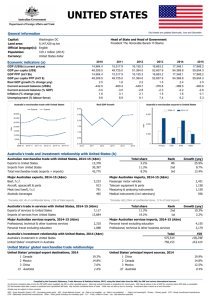

A global economic and market outlook Dr Chris Caton May 2014 Australia simply doesn’t have a government debt problem (general govt net debt as a proportion of GDP) 1 And here’s a longer-term perspective on our public debt (% of GDP) 2 The path back to balance is gradual (deficit as a % of GDP) 3 For those who would like more detail 4 The economic forecasts behind the Budget appear reasonable 5 The Budget’s implication for debt; still no problem 6 QE matters– the Fed buys bonds, investors buy stocks 7 Source: Minack Advisors Euro-area government bond spreads (to German bonds) 8 The two that matter continue to improve(long-term bond yields (%)) 9 Emerging markets have massively underperformed 1800 Developed Index Asian Emerging Markets Index 1700 600 567 1600 533 World Developed Index (LHS) 1500 500 1400 467 1300 433 1200 400 1100 Asian Emerging Markets Index (RHS) 1000 900 333 300 12 Source: Datastream 10 367 13 14 Emerging markets tend to reflect commodity prices 11 2014 Growth Forecasts (%) Month of Forecast M-13 J-13 J-13 A-13 S-13 O-13 N-13 D-13 J-14 F-14 M-14 A-14 Australia 3.0 2.8 2.7 2.6 2.6 2.6 2.7 2.7 2.7 2.7 2.8 2.8 New Zealand 3.0 3.1 3.1 3.1 3.1 3.1 3.1 3.1 3.2 3.3 3.5 3.5 US 2.7 2.7 2.7 2.6 2.7 2.6 2.6 2.6 2.8 2.9 2.8 2.7 Japan 1.5 1.5 1.5 1.5 1.7 1.7 1.6 1.6 1.7 1.6 1.4 1.3 China 7.9 7.8 7.6 7.5 7.4 7.4 7.5 7.5 7.5 7.5 7.4 7.3 Germany 1.6 1.6 1.6 1.7 1.7 1.7 1.7 1.8 1.8 1.8 1.8 1.9 UK 1.6 1.7 1.7 1.9 2.1 2.2 2.3 2.5 2.6 2.7 2.7 2.8 “World” 3.2 3.2 3.1 3.1 3.1 3.1 3.1 3.0 3.1 3.1 3.0 2.9 Source: Consensus Economics 12 Financial Market Forecasts Now (13 May) End-Jun 2014 End-Dec 2014 0.934 0.89 0.84 Official cash rate (%) 2.50 2.50 2.75 10 Year Bond yield (%) 3.83 4.00 4.40 ASX 200 5498 5500 5700 AUD/USD 13 The Australian Dollar and US Trade Weighted Index Index AUD/USD 180 1.12 AUD/USD (RHS) 161 1.00 142 0.88 122 0.76 US TWI inverted (LHS) 103 0.64 84 0.52 64 0.40 99 00 Source: Datastream 14 01 02 03 04 05 06 07 08 09 10 11 12 13 14 The volatility of the currency has fallen significantly 15 Australian Share market Performance – ASX200 7000 6500 6000 5500 5000 4500 4000 3500 3000 2500 2000 1500 1000 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 Source: Bloomberg 16 The Australian market is now close to fair value 17 The p/e by sector. Resources the best value? 18 There’s no sign of a bubble in global markets 19 Source Minack Advisors We are in almost perfect sync with the United States market 20 Source :Minack Advisors Real GDP growth in Australia and the US Year to % change 10 US Australia 7.5 5 2.5 0 -2.5 -5 80 82 Source: Datastream 21 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14 The terms of trade should continue to decline 22 Unemployment has risen significantly..but has it peaked? 000’s % 12000 7.5 11500 7.0 Employment (LHS) 11000 6.5 10500 6.0 10000 5.5 9500 5.0 9000 4.5 Unemployment Rate (RHS) 8500 00 Source: ABS 23 01 02 03 04 05 06 07 08 09 10 11 12 13 4.0 14 Two speeds or not two speeds, that is the question 24 Australian Inflation has risen % 7 Headline CPI BT Forecasts Underlying inflation 6 5 GST Effect 4 3 2 1 0 00 01 Source: ABS 25 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 Household financial ratios 26 House Prices - Australia v Sydney 700 Index (1987 = 100) 650 Sydney Australia 03 07 600 550 500 450 400 350 300 250 200 150 100 87 Source: ABS 89 91 93 95 97 99 01 05 09 11 13 We are very expensive compared with the United States 28 But not otherwise! 29 House prices are rising everywhere, particularly in Sydney and Melbourne 30 Prices have been rising rapidly in just two cities in the past year (% increase year to April 2014) 31 Source :RPData Where’s the bubble? Average house price increase in the past ten years 32 Gross Domestic Product % 8 Qtly growth 7 Year-to growth Non-farm year-to growth BT Forecasts 6 GST Effect 5 4 3 2 1 0 -1 -2 -3 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 Source: ABS 33 Global Medium-Term Economic Growth and Inflation Prospects (20142024) GDP Inflation Australia 2.9 2.6 New Zealand United States Norway Sweden Canada United Kingdom Spain Switzerland Netherlands Germany France Eurozone Japan Italy 2.7 2.6 2.4 2.3 2.2 2.2 1.9 1.8 1.6 1.6 1.5 1.5 1.2 1.0 2.2 2.2 2.0 1.6 1.9 2.4 1.7 1.1 1.8 1.9 1.6 1.7 1.8 1.7 34 Source: Consensus Economics Asia-Pacific Medium-Term Economic Growth and Inflation Prospects (2014-2024) GDP Consumer Prices India 6.8 5.9 China 6.5 3.0 Indonesia 5.6 5.3 Philippines 5.6 4.1 Malaysia 5.0 3.0 Thailand 4.1 3.1 Singapore 3.9 2.3 Taiwan 3.4 1.8 Hong Kong 3.2 3.1 South Korea 3.2 2.5 Australia 2.9 2.6 New Zealand 2.7 2.2 Japan 1.2 1.8 Source: Consensus Economics 35 Summary Tapering of quantitative easing in the US has added to market volatility. Eurozone debt is still a serious issue; it will drag on for a long time but is unlikely to end in catastrophe. We will always worry about China. The Australian economy should continue to experience only moderate growth. The mining investment boom has ended but the downside may not be too steep. The cash rate’s next move is up. The exchange rate may eventually fall again. The Australian share market is close to fair value. 36 Disclaimer This presentation has been prepared by BT Financial Group Limited (ABN 63 002 916 458) ‘BT’ and is for general information only. Every effort has been made to ensure that it is accurate, however it is not intended to be a complete description of the matters described. The presentation has been prepared without taking into account any personal objectives, financial situation or needs. It does not contain and is not to be taken as containing any securities advice or securities recommendation. Furthermore, it is not intended that it be relied on by recipients for the purpose of making investment decisions and is not a replacement of the requirement for individual research or professional tax advice. BT does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this presentation. Except insofar as liability under any statute cannot be excluded, BT and its directors, employees and consultants do not accept any liability for any error or omission in this presentation or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise noted, BT is the source of all charts; and all performance figures are calculated using exit to exit prices and assume reinvestment of income, take into account all fees and charges but exclude the entry fee. It is important to note that past performance is not a reliable indicator of future performance. This document was accompanied by an oral presentation, and is not a complete record of the discussion held. No part of this presentation should be used elsewhere without prior consent from the author. For more information, please call BT Customer Relations on 132 135 8:00am to 6:30pm (Sydney time) 37