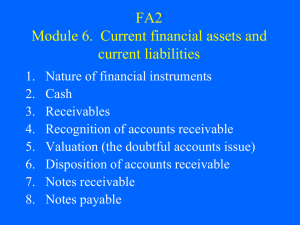

Chapter 7

advertisement

Chapter 7 Cash and Receivables ACCT-3030 1 1. Cash Few problems ◦ easy valuation and classification ◦ requires significant controls (Appendix 7A) Petty cash (Appendix 7A) Bank reconciliations (Appendix 7A) ◦ BE 7-15 Restrictions on cash ◦ disclosure ◦ presentation ◦ compensating balances Cash equivalents ◦ highly liquid investments ◦ 3 months or less maturity ACCT-3030 2 1. Cash Illustration 7-2 ACCT-3030 3 2. Accounts and Notes Receivable Receivables ◦ claims held against customers and others for money, goods, or services A/R – oral promises to pay N/R – written promises to pay ◦ a negotiable instrument Trade vs. Nontrade receivables ◦ trade – customers ◦ nontrade – officers, stockholders, affiliates, deposits ACCT-3030 4 3. A/R – Bad Debts Bad debts ◦ uncollectible accounts receivable Two methods of accounting ◦ direct write-off method (not GAAP) does not apply matching ◦ allowance method (GAAP) correctly applies matching reflects proper YE carrying value of A/R ACCT-3030 5 3. A/R – Bad Debts Direct write-off method ◦ expense recorded when account deemed uncollectible ◦ easy to apply ◦ entry Bad Debts Expense Accounts Receivable ACCT-3030 X X 6 3. A/R – Bad Debts Allowance method ◦ requires YE adjusting entry ◦ can be based on percentage of sales or percentage of receivables ◦ accounts in the entries are same with either method the methods only affect the amounts for the entries ACCT-3030 7 3. A/R – Bad Debts Allowance method ◦ YE adjusting entry Bad Debts Expense X Allowance for Uncollectibles X ◦ entry to write off specific A/R Allowance for Uncollectibles X Accounts Receivable X entry does not create an expense entry does not change net receivables ACCT-3030 8 3. A/R – Bad Debts Examples ◦ BE 7-4 ◦ BE 7-5 Collection of previously written-off A/R ◦ reinstate account balance ◦ record collection as normal ACCT-3030 9 4. Other Valuation Allowances Discounts ◦ YE adjustment needed to estimate amount of outstanding transactions with possible discounts or returns ◦ e.g., entry for estimated returns Sales Returns and Allowances Allowance for Returned Merchandise ACCT-3030 X X 10 4. Other Valuation Allowances Discounts ◦ trade reduction off list price used to determine sales price not recognized in books ◦ cash discount for prompt payment e.g., 2/10, n/30 can be accounted for by gross or net methods ACCT-3030 11 4. Other Valuation Allowances Example – cash disc net and gross methods Make all entries under: (a) gross method (b) net method Date Oct. 1 Sell $1,000 of merchandise to customer, 2/10, n/30 Oct. 7 Customer returns $100 of merchandise Oct. 10 Customer pays in full Assume Oct. 10 payment did not occur Oct. 27 Customer pays in full ACCT-3030 12 5. Pledging, Assigning, & Factoring A/R Reasons ◦ obtain cash now rather than wait for collection ◦ obtain relief from burden of carrying receivables Can be accomplished by ◦ secured borrowing pledge receivables as collateral for a loan ◦ sale of receivables with recourse (seller still has risks of collection) without recourse (purchaser assumes risks) ACCT-3030 13 5. Pledging, Assigning, & Factoring A/R Secured borrowing on receivables A borrowing type arrangement ◦ can be general receivables pledged as collateral for loan (all receivables or certain dollar amount) ◦ can be specific receivables pledged as collateral for loan (then must identify receivables pledged) Company continues to collect A/R Bank usually ◦ charges a finance charge against receivables ◦ charges interest on the loan ACCT-3030 14 5. Pledging, Assigning, & Factoring A/R Example – Secured Borrowing ◦ You pledge all your receivables as collateral for a bank loan. The balance of A/R is $75,000 and bank loan amount is $50,000. The bank charges a 1% fee on the receivables and interest on the loan is 10%. Record the entries for this transaction. ACCT-3030 15 5. Pledging, Assigning, & Factoring A/R Date 1/1/year 1 Accounts Cash Dr. Cr. 49,250 Interest Expense (75,000 x .01) 750 Notes Payable 50,000 You collect $45,000 of A/R on 3/31/year 1 3/31/year 1 Cash 45,000 A/R 45,00 ACCT-3030 16 5. Pledging, Assigning, & Factoring A/R Date Accounts Dr. Cr. You remit collections to bank plus interest on loan. 3/31/year 1 Interest Expense (50,000 x .1 x 1/4) Notes Payable 1,250 45,000 Cash 46,250 You collect remainder of A/R on 6/30/year 1 6/30/year 1 Cash 30,000 A/R 30,000 ACCT-3030 17 5. Pledging, Assigning, & Factoring A/R Date Accounts Dr. Cr. You pay remainder of loan to bank plus interest on loan. 6/30/year 1 Interest Expense (5,000 x .1 x 1/4) Notes Payable 125 5,000 Cash 5,125 ACCT-3030 18 5. Pledging, Assigning, & Factoring A/R Selling (factoring) receivables ◦ ◦ ◦ ◦ usually for all receivables usually continuous arrangement fee usually 1% - 3% usually a holdback (for returns and allowances) Factoring without recourse ◦ a sale and record loss Factoring with recourse ◦ a sale, but follows financial components approach ◦ must assign a liability to the recourse provision to compute the loss ACCT-3030 19 5. Pledging, Assigning, & Factoring A/R Example ◦ A company factors its A/R balance of $40,000 with a factoring fee of 2% and a 10% holdback. Record the entries if the transaction is (a) without recourse (b) with recourse ACCT-3030 20 5. Pledging, Assigning, & Factoring A/R (a) without recourse Accounts Dr. Cash Cr. 35,200 Receivable from Factor (40,000 x .1) 4,000 Loss on Sale of A/R (40,000 x .02) 800 A/R 40,000 ACCT-3030 21 5. Pledging, Assigning, & Factoring A/R (b) with recourse; assume the recourse obligation has a fair valued of $2,000 Compute net proceeds: Cash received $35,200 Add: Holdback 4,000 Less: Recourse obligation Net Proceeds $39,200 2,000 $37,200 Compute Loss on Sale: BV of A/R Net Proceeds Loss on Sale $40,000 37,200 $ 2,800 ACCT-3030 22 5. Pledging, Assigning, & Factoring A/R (b) With recourse Accounts Dr. Cash Cr. 35,200 Due From Factor 4,000 Loss on Sale of A/R 2,800 A/R 40,000 Recourse Liability 2,000 ACCT-3030 23 6. Notes Receivable Recognition of N/R ◦ short-term N/R recorded at face value ◦ long-term N/R recorded at PV of future cash flows Notes can be received for ◦ loaning money ◦ selling goods or services Notes can have a stated interest rate or no interest rate ◦ Stated interest rate on N/R can be equal to market rate, greater than market rate, or less than market rate ACCT-3030 24 6. Notes Receivable Interest-bearing notes Example You received a $1,000, two year, 6% note receivable in exchange for merchandise. Make entries to record this transactions if the market interest rate is: (a) 6% (b) 8% ACCT-3030 25 6. Notes Receivable (a) market interest rate is 6% PV of 2 year, 6%, $1,000 note discounted at 6% = 1,000 (n=2, i=6, PMT=60, FV=1000, CPT PVA-ord) PV of interest payments PVA-ord(2, 6%) = 60 x 1.83339 = 110 PV of principle payment PV = 1,000 x .89000 = 890 1,000 ACCT-3030 26 6. Notes Receivable (a) market interest rate is 6% Date 1/1/year 1 Accounts Notes Receivable Dr. 1,000 Sales 12/31/year 1 1,000 Cash 60 Interest Revenue 12/31/year2 60 Cash 60 Interest Revenue 12/31/year2 Cr. 60 Cash 1,000 Notes Receivable 1,000 ACCT-3030 27 6. Notes Receivable (b) market interest rate is 8% PV of 2 year, 6%, $1,000 note discounted at 8% = 964 (n=2, i=8, PMT=60, FV=1000, CPT PVA-ord) PV of interest payments PVA-ord(2, 8%) = 60 x 1.78326 = 107 PV of principle payment PV = 1,000 x .85734 = 857 964 ACCT-3030 28 6. Notes Receivable Date 1/1/year 1 Accounts Notes Receivable Dr. 1,000 Discount on N/R 36 Sales 12/31/year 1 964 Cash 60 Discount on N/R 17 Interest Revenue (964 x .08) 12/31/year 2 77 Cash 60 Discount on N/R 19 Interest Revenue (964 + 17 = 981; 981 x .08 = 79) 12/31/year 2 Cr. Cash 79 1,000 Notes Receivable 1,000 ACCT-3030 29 6. Notes Receivable Non-interest-bearing note ◦ ◦ ◦ ◦ zero percent interest is unreasonable must impute interest rate use imputed rate to amortize note Also interest rate in arm’s length transaction is considered reasonable unless zero interest rate clearly unreasonable interest rate face amount of note significantly differs from cash sales price ACCT-3030 30 6. Notes Receivable Example You accept a $12,500, three year, noninterest-bearing note for the sale of merchandise. The merchandise has a cash price of $10,000. ACCT-3030 31 6. Notes Receivable Example N =3 i =? PV = $10,000 FV = $12,500 i = 7.7% ACCT-3030 32 Date Accounts 6. Notes Receivable Notes Receivable 1/1/year 1 Dr. 12,500 Discount on N/R 2,500 Sales 12/31/year 1 10,000 Discount on N/R 770 Interest Revenue (12500-2500=10000; 10000 x .077 = 770) 12/31/year 2 Discount on N/R 770 829 Interest Revenue (2500 – 770 = 1730; 12500-1730 =10770; 10770 x .077 = 829) 12/31/year 3 Discount on N/R 829 901* Interest Revenue (1730 – 829 = 901; 901* 12500-901=11599; 11599x .077 ≈ 901) 12/31/year 3 Cr. Cash *= rounded 12,500 Notes Receivable 12,500 ACCT-3030 33 7. Fair Value Option FASB allows financial instruments to be valued at fair value If company chooses fair value option ◦ adjust notes to FV at year-end ◦ unrealized holding gains or losses included in net income Once elected must always continue to be used ACCT-3030 34