Investment Analysis: What Investments Should I Make?

advertisement

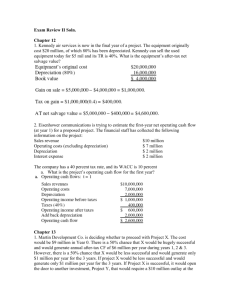

Strategic Business Planning for Commercial Producers Investment Analysis: What Investments Should I Make? Objectives • What are the important issues/considerations in making investment decisions? • What is capital budgeting? • How do we analyze a project? Investment Issues/Concepts • Growth Strategies • Capital Budgeting – Economic Profitability – Financial Feasibility • Risk • Portfolio Considerations • Tax Considerations Capital Budgeting Decisions • Managers are responsible for identifying investments that create value • Impact cash flows over multiple periods • Factors to consider: – Strategic Direction – Estimation of future benefits – Uncertainty of future benefits Capital Budgeting • Two Questions: – Economic profitability – Does it earn a profit above all costs? – Financial feasibility – Will it cash flow? Economic Profitability Time Value of Money • Money has a time value – “The sooner, the better.” • Money preferred to inventory – Can be invested • Benefit of investments are in the future – Adjust for cost of waiting $100 Today or $100 Tomorrow • Why $100 today – Opportunity costs/earnings foregone • Adjust for cost of waiting – Discount /penalize future income Present and Future Values P r e s e n t Compounding Discounting F u t u r e What is Discounting? 7% Year 1 0.9346 $43,670 $50,000 2 $50,000 3 4 5 0.8734 0.8163 0.7629 0.7130 $35,650 $79,320 = Present Value of Net Cash Flows What is NPV? • Converts money flows in the future into a single current value • Used to evaluate alternative investments and the effects of the timing of cash flows and opportunity costs on the decisions Net Present Value • Rationale for NPV approach is related to the “value of the firm” • If take on a project with NPV<0, value of the firm falls – owners are worse off. • However, if we accept a project with NPV>0, then the value of the firm increases – owners are better off. Steps in Economic Profitability (NPV analysis) 1. 2. 3. 4. 5. 6. Compute discount rate Calculate present value of cash outlay Calculate annual net cash flows Calculate present value of net cash flows Compute net present value Accept or reject investment Specialty Grain and On-Farm Storage • • • • • • • • • Purpose: add on farm storage to store specialty grain Build from scratch Investment outlay $76,800 5 year life with $30,000 salvage value Will store 60,000 bushels IP corn Finance with 40% debt, 60% equity 35% tax bracket Target ROE is 15.1% (9.8% after tax) Borrow funds at 8.3% (5.3% after tax) Step 1. Compute the Discount Rate • Discount rate is the price at which a dollar of cash flow is exchanged between periods – Exchange price between present and future dollars • Essential element in any present value analysis Step 1: Compute the Discount Rate • Penalty of delay in receiving cash is the cost of financing • So the discount rate is the cost of capital Step 1. Calculating Cost of Capital (discount rate) Marginal Income Tax Rate Federal A 30% State B 5% Total [A + B] C 35% Cost of debt capital D 8.1% After-tax cost of debt capital [D x (1 - C)] E 5.3% Rate of return on investment opportunities F 15.1% After-tax cost of equity [F x (1 - C)] G 9.8% Percent of assets financed with debt * H 40% Percent of assets financed with equity [1 - H] I 60% After-tax cost of capital [(E x H) + (G x I)] J 8.0% Cost of Borrowed Funds After Tax Cost of Equity Capital Weighted Cost of Capital Step 2. Calculate the NPV of cash outlay • Purchase price is $76,800 • No additional working capital needed and sale is completed immediately • Present value of outlay = $76,800 Step 3. Calculate the Annual Net Cash Flows Calculate for each year . . . cash revenue less cash expenses less taxes plus terminal value = Net Cash Flows Cash flows: exclude depreciation Ignore unpaid labor and management Two Sources of Income • Specialty grain revenue • Storage revenue Calculate Cash Revenue Revenue of IP crop over #2 yellow Revenue from Storage Net Cash Revenue $23,68 0 18,352 $42,032 Calculate Cash Expenses Expenses of IP crop over #2 $12,960 yellow Expenses of Storage 7,341 Net Cash Expenses $20,30 1 Calculate Cash Income Revenue $42,032 Expenses - 20,301 Net Cash Income $21,731 Calculate Taxes Cash Revenue $42,032 Cash Expenses - 20,301 Depreciation - 5,760 Net Income $15,971 Net Income x tax rate = taxes $15,971 x .35 = $5,590 Calculate Net Cash Flow: year one Cash Revenue $42,032 Cash Expenses - 20,301 Taxes Net Cash Flow - 5,590 $16,141 Step 3. Calculate the Annual Net Cash Flows Year Cash Revenue Cash Expenses Terminal Value Taxes Net Cash Flow 1 $42,032 $20,301 -- $5,590 $16,141 2 42,360 20,910 -- 3,777 17,673 3 42,122 21,242 -- 4,139 16,741 4 41,887 21,583 -- 4,413 15,891 5 41,654 21,932 $30,000 15,054 34,669 Step 4. Calculate the present value of the net cash flows • This is the sum of the discounted annual net cash flows (net cash flow times discount factor) for each year Discount Factors (present value of $1) Interest Rate Period 1 7% .9346 7.5% .9302 8.0% .9259 8.5% .9217 2 3 4 5 .8734 .8163 .7629 .7130 .8653 .8050 .7488 .6966 .8573 .7938 .7350 .6806 .8495 .7829 .7216 .6650 What’s the Present Value of Net Cash Flows? 8% $16,141 Year $14,945 1 0.9259 $15,151 $13,289 $11,680 $23,592 $78,658 = Present Value of Net Cash Flows $17,673 $16,741 2 3 $15,891 4 $34,669 5 0.8573 0.7938 0.7350 0.6806 Step 4. Annual Net Cash Flows Present Value of Annual Net Cash Flow Year Annual Net Cash Flow Discount Factor @ 8% 1 $16,141 .9259 $14,945 2 17,673 .8573 15,151 3 16,741 .7938 13,289 4 15,891 .7350 11,680 5 34,669 .6805 23,592 Present value of the net cash flows $78,658 Step 5. Compute the NPV NPV = Present value of the net cash flows minus the present value of the cash outlay $78,658 - $76,800 = $1,858 Step 6. Accept or Reject NPV > 0 NPV < 0 Accept Reject Interpretation of NPV 1. If NPV is positive Invest Rate or return greater than minimum acceptable rate (hurdle rate) Return exceeds cost of financing 2. Maximum Bid price Outlay plus/minus NPV Feasibility Analysis Feasibility Analysis Will the project cash flow? Steps in Financial Feasibility Analysis 1. 2. 3. 4. 5. Calculate annual net cash flow Calculate loan repayment schedule Calculate tax savings from interest deductibility Calculate after tax payment schedule Calculate surplus or deficit each year Step 1. Calculate the Annual Net Cash Flow • Already calculated as part of economic feasibility when doing NPV Step 1. Calculate the Annual Net Cash Flows Year Cash Revenue Cash Expenses Terminal Value Taxes Net Cash Flow 1 $42,032 $20,301 -- $5,590 $16,141 2 42,360 20,910 -- 3,777 17,673 3 42,122 21,242 -- 4,139 16,741 4 41,887 21,583 -- 4,413 15,891 5 41,654 21,932 $30,000 15,054 34,669 Step 2. Calculate loan repayment schedule • Calculate annual principal and interest payments based on loan repayment schedule Step 3. Calculate tax savings from interest deductibility • Net cash flows are after-tax, but the payment schedule is pre-tax • Payment schedule must be adjusted to after-tax by calculating tax savings from deductibility of interest Step 3. Calculate tax savings from interest deductibility Year Loan Balance 1 $76,800 Interest @ 8.3% $6,374 2 63,787 5,294 1,853 3 4 5 49,694 34,431 17,902 4,125 2,858 1,486 1,444 1,000 520 Income Tax Savings (interest x tax rate) $2,231 Step 4. Calculate after tax payment schedule Year Payment Tax Savings 1 $19,387 $2,231 After tax payment $17,156 2 19,387 1,853 17,534 3 19,387 1,444 17,944 4 19,387 1,000 18,387 5 19,387 520 18,867 Step 5. Calculate surplus/deficit each year • Compare annual net cash flow to after-tax annual principal and interest payments to find a surplus or deficit • A surplus means the project is financially feasible • A deficit means loan servicing problems are likely The Financial Feasibility: On-Farm Storage for Specialty Crops Year Annual Net Cash Flow Payment Schedule Principal Payment ScheduleInterest Payment ScheduleTotal Tax Savings from Interest Deductibility After-Tax Payment Schedule Surplus (+) or Deficit (-) 1 $16,141 $13,013 $6,374 $19,387 $2,231 $17,156 - 1,015 2 17,673 14,093 5,294 19,387 1,853 17,534 + 139 3 16,741 15,263 4,125 19,387 1,444 17,944 - 1,203 4 15,891 16,530 2,858 19,387 1,000 18,387 - 2,496 5 34,669 17,902 1,486 19,387 520 18,867 + 15,802 Dealing with Deficits • Extend the loan terms • Increase the amount of the down payment • Increase cash flow of the project by controlling costs • Subsidize with cash from another project (the feasibility test will indicate the amount of the subsidy) • Lease/outsourcing Strategic Business Planning for Commercial Producers