APICS Corporate PPT Template - APICS

advertisement

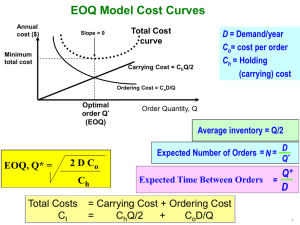

1 Increasing Competitive Advantage and Agility through Lean Operations APICS Seminar: May 20, 2011 Lean Overview What is Lean all about? How many “wastes” can you name? How many Lean tools/techniques can you name? 2 Lean Overview Lean = Eliminating Waste 7 Wastes: Transportation Over-Production Waiting Inventory Rework Over-Processing Excess Motion (Unused 3 Intellect) Lean Overview Lean Tools & Techniques: 5S Process Mapping Balancing to Takt Spaghetti Diagrams Visual Management Hour-by-Hour Boards VSM Kaizen Pull Systems 5 Whys Presentation Focus: Over-Production, Inventory, Pull Systems 4 Setting The Stage (Q1/2010) Recession ending or over; slow growth ahead APICS and ISM indices showing growth Inventory levels near historic lows Production increasing (at least to match demand) Future volumes and mix uncertain (forecasting challenge) Where are we (you!) today? Agility will be a key competitive advantage 5 Balancing Key Metrics Service Level Optimal Target Assigned by ABC Productivity Inventory Turns Right Product Utilization Right Time Efficiency P&IC Challenge: Finding the Optimal Balance Discuss inventory first, then capacity utilization See how each affects ability to best-serve customers & business needs. 6 Components of Inventory Safety Stock – Protects against variability Demand through Lead Time Determines But… Order Point minor contributor to inventory Lot Size – Major contributor to inventory Average Inventory = SS + ½ Lot Size Focus Here… 7 Lot Sizing Debate Fulcrum: Setup Time * Traditional Operations Lean Advocates Inventory is an Asset Inventory is Muda (Waste) Larger Lot Sizes Smaller Lot Sizes Minimize No. Setups Minimize Setup Time Maximize Capacity Use Capacity to Maximize Agility Common Objectives: Minimize Cost and Maximize Customer Service * As setup times approach zero, the differences between the two views diminish or disappear. 8 Total Cost View Example: A= S= C= I = EOQ = 10000 $ 50 $ 100 11% 302 Total Annual Cost $14,000 2AS IC EOQ = $12,000 $10,000 $8,000 Inventory Carrying Cost Assumption of 11%... Reasonable? EOQ $6,000 $4,000 $2,000 $0 1 101 201 301 401 501 Total Cost 601 701 Setup Cost 801 901 1001 1101 1201 Carrying Cost Lean Direction: Choose lot size around 200 Caution: Don’t arbitrarily cut LS too far (cost penalty) 9 1301 1401 1501 Class Exercise Create EOQ Calculator – Table Version A= S= c= i= EOQ = Create EOQ Calculator – Worksheet Version Part Number Annual Demand (A) Setup Cost (S) Part Cost (C) Carrying Cost (i) EOQ EOQ (Rounded) Open “EOQ Calculators.xls”… Follow Demo 10 Inventory Carrying Cost Audience feedback to Inventory Carrying Cost questionnaire. Count of Participant Responses to Carrying Cost Question Count of Name What inventory carrying cost rate does your company use? No Response < 10% 10-15% 15-20% 20-30% > 30% Grand Total 11 Total 7 50 28 16 13 3 117 71% Annual Inventory Carrying Cost Elements Category Interest/opportunity cost Percentage 10-15% Handling and storage (people and space) 4-8% Damage and shrinkage (scrap and obsolescence) 1-2% Taxes and insurance 1-2% Redistribution cost (in the wrong location) 1-2% Transactions (counting, moving, planning, issuing, reconciling) General and administrative staff (managers, planners, physical mgmt.) Total Source: SC Council, APICS, Best Practice and Industry Experience Inventory – How Do You Attack It? Used with permission: RSM McGladrey 12 5-10% 5-7% 27-46% Revised Total Cost (I=35%) Example: A= S= C= I = EOQ = 10000 $ 50 $ 100 35% 169 Validate EOQ Calculation… Setup Cost… (Return Can it beto EOQ reduced? Calculator.xls) Total Annual Cost $14,000 $12,000 $10,000 Old EOQ $8,000 EOQ $6,000 $4,000 $2,000 $0 1 101 Total Cost 201 301 Setup Cost 401 Carrying Cost Increase carrying cost from 11% to 35%; better represents total costs. 13 501 Setup Reduction Impact Example: A= S= C= I = EOQ = 10000 $ 15 $ 100 35% 93 Total Annual Cost $10,000 $9,000 EOQ (I = 11%) $8,000 $7,000 $6,000 2/3 Reduction in Setup Cost EOQ Old EOQ $5,000 $4,000 $3,000 $2,000 $1,000 $0 1 101 201 Total Cost Setup Cost 301 401 Carrying Cost Setup and inventory carrying costs have a significant impact on total cost and lot sizing decisions. 14 501 “Homework” Challenge Take the Inventory Carrying Cost Study to your management Evaluate each element for your business What is the true cost of carrying inventory? What Lot Sizing decisions might need to be re- evaluated? What are the potential savings? (Cash Flow and recurring annual cost) 15 Stretch 16 Available Capacity Considerations (Q1/2010): Structural capacity… likely exceeds current demand Staffing… layoffs, furloughs, reduced hours Recent cross-training Enables flexibility and/or surge capability 17 Capacity Utilization Audience feedback to capacity questionnaire Count of Participant Responses to Two Capacity Questions Do you anticipate the need to add capacity during 2010? What percentage of your capacity is consumed by current (Q1/2010) demand? No Response < 50% 50-60% 60-70% 70-80% 80-90% 90-100% Grand Total No Strongly Response Agree Agree 7 12 1 14 1 1 5 1 2 3 1 1 8 4 5 21 9 36 38% 18 Disagree Strongly Disagree 12 5 6 10 3 3 39 5 2 2 2 1 12 44% Grand Total 7 44 14 9 15 15 13 117 70% Capacity Utilization Step 1: Understand and quantify current capacity Capacity Variables 1 Shift (40 Hrs/Wk) Wkly Maint (4 Hrs/Wk) Annual Maintenance Available Capacity Hrs/Yr 2080 208 40 1832 Exercise: Open “EOQ Capacity Exercise.xls” 19 Capacity Utilization (Before) EOQ Variables Setup Time Minutes SU Cost ($/Hr) $ Setup Cost: (S) $ Production Cost ($/Hr) $ Inv. Carrying Cost: (I) 90 50.00 75.00 25.00 11% Part Demand Run Time Material Number Forecast (A) (Hrs) Cost A 45,000 0.0042 $0.10 B 12,000 0.0167 $0.25 C 60,000 0.0083 $0.12 D 35,000 0.0133 $0.05 E 16,000 0.0167 $0.15 Avg. Inv. (1/2 EOQ): Calculations: 1. Setup Cost = 1.5 hrs x $50/hr = $75 (Assumed fixed for each PN) 2. Cost/Part = Run Time x $25/hr 3. EOQ = Sqrt(2AS/IC) 4. Ann. Load = Sum of S/U + (Run x EOQ) Cost /Part (C) $0.21 $0.67 $0.33 $0.38 $0.57 27,715 Setups EOQ /Year 17,300 2.6 4,950 2.4 15,810 3.8 11,170 3.1 6,200 2.6 Total Load: Annual Load (Hrs/Yr) 193 204 504 470 271 1,642 Cap: 1,832 Inflexible work center; no more than 2 jobs/month Poorly positioned to meet unexpected demand 20 Total Run Time (Hrs per Job) Days 74.16 9.3 84.17 10.5 132.72 16.6 150.06 18.8 105.04 13.1 Avg Days 13.7 Capacity Utilization (After) New EOQ Variables New Setup Time (Mins) 15 New Setup Cost $ 12.50 New Inv. Carrying Cost 35% Part Number A B C D E Demand Run Time Material Forecast (Hrs) Cost 45,000 0.0042 $0.10 12,000 0.0167 $0.25 60,000 0.0083 $0.12 35,000 0.0133 $0.05 16,000 0.0167 $0.15 Avg. Inv. (1/2 EOQ): Similar setup and carrying cost assumptions as before. Cost /Part $0.11 $0.42 $0.21 $0.33 $0.42 7,945 Setups EOQ /Year 5,530 8.1 1,430 8.4 4,540 13.2 2,740 12.8 1,650 9.7 Total Load: Annual Load (Hrs/Yr) 191 202 501 469 270 1,633 Cap: 1,832 More agile… able to run every PN every month. Virtually no change in load… ample capacity. Inventory reduced from 27,715 to 7,945 21 Total Run Time (Hrs per Job) 24.73 25.38 39.18 37.94 29.06 Avg Days Days 3.1 3.2 4.9 4.7 3.6 3.9 Class Exercise Create Capacity Utilization Worksheets Current State (Before) What-If Revised States (After) Graph Results Return to “EOQ Capacity Exercise.xls” Follow Demo… 22 Assembling the Pieces Ample structural capacity Flexible, cross-trained workforce Properly accounting for carrying cost Lot sizes reduced Setup times reduction… further LS reduction … Operation now capable of greater agility How do we capture that agility? 23 Additional Keys to Agility Sales and Operations Planning (S&OP) Forecast consensus… Plans flow from the forecast Capacity ahead of demand Adequate financial inventory plan Purchase orders for long lead items… But… Execute by PULL Pull Systems linked across the supply chain Discard long firm-planning and order-release horizons Execute to actual demand, not forecast Execute by hours or shifts, not days or weeks 24 25 Kanban Basics 26 The Missing Link Need a mechanism to start pull Key is to synchronize pull signals Based on real customer demand (not forecast) Prioritized to maximize customer service Recommend two mechanisms (similar but not identical) One for Make To Stock (MTS) One for Make To Order (MTO) ASAPS: Assembly Scheduling And Prioritization System 27 Assembly Scheduling & Prioritization (ASAPS) Make to Stock Prioritize by relative inventory position and ABC MTS OP SS In-Tran Zero MTO Do Not Produce Low Priority Moderate Priority High Priority Urgent > 10 Days 6 – 10 Days 3 – 5 Days 0 – 2 Days Past Due Make to Order Prioritize by Due Date and ABC Pass priority codes to ERP for scheduling 28 ASAPS Priority Matrix: Make to Stock (MTS) MTS Priority – By ABC and Relative Inventory Position ABC >Max >OP >=SS <SS <0 A 10 6 3 2 1 B 10 7 4 3 2 C 10 8 5 4 3 D 10 9 6 5 4 Priority Scores: 1 = Highest, 10 = Lowest. Top priority assigned to stocked out A-Items Next priority is for stocked-out B-Items AND A-Items below Safety Stock. Similar prioritization rules apply, working right-to-left through the matrix. 29 Priority Matrix: Make to Order (MTO) MTO Priority – By ABC and Days to Due Date ABC > 10 6 to 10 3 to 5 0 to 2 Past Due A 10 6 3 2 1 B 10 7 4 3 2 C 10 8 5 4 3 D 10 9 6 5 4 Priority Scores: 1 = Highest, 10 = Lowest. Top priority assigned to A-Items which are past due. Next priority is for past due B-Items AND A-items within 2 days of their due dates. Similar prioritization rules apply, working right-to-left through the matrix. Priority assignments must consider relative importance of MTS vs. MTO products 30 Pull Systems (Make to Stock) Raw Material Finished Goods Material Flow SIOP MTS ASAPS Supplier Supplier Production Move Production Kanban Kanban Kanban Orders 31 others! NOTE: Each operates independently of the Customer Orders Pull Systems (Make to Order) Raw Material Finished Goods Material Flow MTO ASAPS SIOP Supplier Supplier Production Production Kanban Kanban Orders NOTE: Each operates independently of 32 the others! Customer Orders Class Exercise ASAPS Tables (MTO & MTS) Use VLOOKUP to obtain priority score Use MATCH to obtain VLOOKUP Column Reference Open “ASAPS Tables (MTO & MTS).xls” Follow Instructor Demo… 33 Summary Agility will be a competitive advantage Keys to agility include: Full accounting for inventory carrying costs Quick setups Small lot sizes Flexible capacity Pull systems, synchronized by ASAPS Supported by sound S&OP 34 Agility Through Lean Operations 35