Chapter 9

advertisement

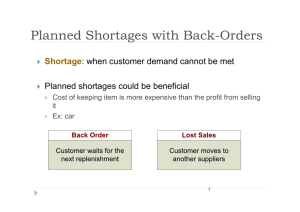

Chapter 9 Inventory management 库存管理 AIMS OF THE CHAPTER UNDERSTAND why organizations hold stocks ANALYSE the costs of holding stock CALCULATE economic order quantities CALCULATE associated lead times, costs and cycle lengths DO ABC analyses of inventories 9.1REASONS FOR HOLDING STOCK 9.1.1 what is stock and inventory? Stock are supplies of goods and materials that are held by an organization. They are formed whenever the organization's inputs or outputs are not used at the time they become available. An Inventory is a list of things held in stock. 9.1REASONS FOR HOLDING STOCK 9.1.2 functions of the inventory The main purpose of STOCKS is to act as a buffer between supply and demand. They allow operations to continue smoothly and avoid disruptions. To be more specific, stocks: 9.1REASONS FOR HOLDING STOCK act as a buffer allow for unexpected times allow for deliveries that are delayed or too small take advantage of price discounts on large orders allow the purchase of items when the price is low and expected to rise allow the purchase of items that are going out of production or are difficult to find allow for seasonal operations make full loads and reduce transport costs for emergencies. 9.1REASONS FOR HOLDING STOCK 9.1.3 Types of stock Raw materials – the materials, parts and components that have been delivered to an organization, but are not yet being used. Work in process – materials that have started, but not yet finished their journey through the production process. Finished goods – goods that have finished the process and are waiting to be shipped out to customers 9.1REASONS FOR HOLDING STOCK Types of stock 9.1REASONS FOR HOLDING STOCK two additional types: ● Spare parts for machinery, equipment, and so on ● Consumables such as oil, fuel, paper, and so on. 9.1REASONS FOR HOLDING STOCK 9.1.4 Costs of carrying stock Point1:Some definitions of cost: 1. 2. Unit cost: the price for an item charged by the supplier, or the cost to the organization of acquiring one unit of the item. Reorder cost: the cost of placing a repeat order for an item. 9.1REASONS FOR HOLDING STOCK 3. Holding cost: the cost of holding one unit of an item in stock for a unit period of time 4.Shortage cost: occurs when an item is needed but it cannot be supplied from stock 9.1REASONS FOR HOLDING STOCK Point 2: In practice, the most common costing is based on the amount paid and can use: ● FIFO – first in, first out, which assumes that stock is sold in the order it was bought, so the remaining stock is valued at the current replacement cost ● LIFO – last in, first out, which assumes that the latest stock is used first, so the remainder is valued at earlier acquisition costs ● Average cost – which uses a moving average cost over some period. Worked example Worked example How to calculate the cost in different ways? FIFO LIFO AVERAGE COST Worked example 9.2 ECONOMIC ORDER QUANTITY 9.2.1 Finding the order size Imagine a single item, a constant demand of D per unit time. Assume that unit cost (U), reorder cost (R) , holding cost (H) while the shortage cost is so high that all demands must be met and no shortages are allowed. We want to find the best order quantity, Q, and always place orders of this size. 9.2.1 Finding the order size 9.2 ECONOMIC ORDER QUANTITY 9.2 ECONOMIC ORDER QUANTITY At some point an order of size Q arrives. This is used at a constant rate, D, until no stock is left. We can find the total cost for the cycle by adding the four components of cost – unit, reorder, holding and shortage. No shortages are allowed, so we can ignore this cost. Then we can show that the cost per unit time is: C = total reorder costs + total holding costs = RD/Q + HQ/2 9.2 ECONOMIC ORDER QUANTITY From the consequence we can get that: ● the total holding cost rises linearly with order size ● the total reorder cost falls as the order quantity increases ● large infrequent orders give high total holding costs and low total reorder costs ● small frequent orders give low total holding costs and high total reorder costs ● adding the two costs gives a total cost curve that is an asymmetric ‘U’ shape with a distinct minimum ● this minimum cost shows the optimal order size – which is the economic order quantity, EOQ. 9.2 ECONOMIC ORDER QUANTITY The standard analysis of EOQ: The cost changes with different order quantity Worked example John Pritchard buys stationery for Penwynn Motors. The demand for printed forms is constant at 20 boxes a month. Each box of forms costs £50, the cost of processing an order and arranging delivery is £60, and holding cost is £18 a box a year. What are the economic order quantity, cycle length and costs? Worked example Solution Listing the values we know in consistent units: D = 20 × 12 = 240 units a year U = £50 a unit R = £60 an order H = £18 a unit a year. Worked example Worked example You can see that the total reorder costs equal the total holding costs. This is always true if we order the economic order quantity, so we can simplify the calculation to twice the total holding cost or:C = HQ = 18 × 40 = £720 We also have to consider the fixed cost of buying boxes, which is the number of boxes bought a year, D, times the cost of each box, U. Adding this to the variable cost above, gives the total cost of stockholding: total cost = UD + C = 50 × 240 + 720 = £12,720 a year Worked example We buy 40 boxes at a time, and use 20 boxes a month, so the stock cycle length is 2months. In general, we can find the stock cycle length from T = Q/D: T = Q/D = 40/240 = 1/6 years or 2 months The best policy – with total costs of £12,720 a year – is to order 40 boxes of paper every 2 months. 9.2 ECONOMIC ORDER QUANTITY 9.2.3 Sensitivity analysis One problem with the economic order quantity is that it can give awkward order quantities. It might, for example, suggest buying impossible figures, such as 88.39 tires. We could round this to 88 tires, but might prefer to order 90 or even 100. But does this rounding have much effect on overall costs? The cost curve is shallow around the economic order quantity 9.2 ECONOMIC ORDER QUANTITY Weaknesses of EOQ ● takes a simplified view of inventory systems ● assumes demand is known and constant ● assumes all costs are known and fixed ● assumes a constant lead time and no uncertainty in supplies ● gives awkward order sizes at varying times ● assumes each item is independent of others ● does not encourage improvement, in the way that JIT does. 9.3 PERIODIC REVIEW SYSTEMS The EOQ analysis uses a fixed order quantity for purchases, so an order of fixed size is placed. Such systems need continuous monitoring of stock levels and are best suited to low, irregular demand for relatively expensive items. But there is an alternative periodic review approach, which orders varying amounts at regular intervals. Supermarket may refill its shelves every evening to replace whatever it sold during the day. The operating cost of this system is generally lower and it is better suited to high, regular demand of low value items. 9.3 PERIODIC REVIEW SYSTEMS 9.3 PERIODIC REVIEW SYSTEMS 9.3 PERIODIC REVIEW SYSTEMS Supermarkets traditionally use periodic review, and with EDI you can imagine a store where the tills pass messages every night to replenish products that were used during the day. But the system becomes more responsive and reduces stock levels, if it sends messages, say, two or three times a day. Suppliers consolidate these orders and send deliveries as often as necessary. Order placed at A has to cover demand until B 9.4 EFFORT OF STOCK CONTROL An ABC analysis puts items into categories that show the amount of effort worth spending on inventory control. This is a standard Pareto analysis or ‘rule of 80/20’, which suggests that20% of inventory items need 80% of the attention, while the remaining 80% of items need only 20% of the attention. ABC analyses define: 9.4 EFFORT OF STOCK CONTROL ● A items as expensive and needing special care ● B items as ordinary ones needing standard care ● C items as cheap and needing little care. 9.4 EFFORT OF STOCK CONTROL Typically an organization might use automated system to deal with all B items. an The system might make some suggestions for A items, but decisions are made by managers after reviewing all the circumstances. C items might be excluded from the automatic system and controlled by special methods. 9.4 EFFORT OF STOCK CONTROL An ABC analysis starts by calculating the total annual use of each item by value. We find this by multiplying the number of units used in a year by the unit cost. Usually, a few expensive items account for a lot of use, while many cheap ones account for little use. If we list the items in order of decreasing annual use by value, A items are at the top of the list, B items are in the middle and C items are at the bottom. We might typically find: 9.4 EFFORT OF STOCK CONTROL Consequence of ABC method Disscusion What factors in real inventory control are not included in the economic order quantity model? If the costs of holding stock are so difficult to find, how reliable are the results from this kind of analysis?