File

advertisement

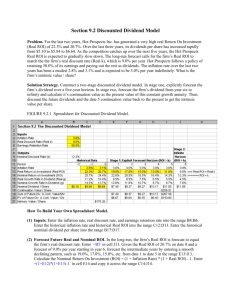

Assets Valuation Methods Valuation Techniques • Using fundamental techniques analysis, there are two 1. Discounted cash flow techniques 1. 2. 3. Dividend Discounted Model (Income Method) Free Cash flow to equity (Cash Flow Analysis) Free Cash flow to firm (Cash Flow Analysis) 2. Relative Valuation technique [these techniques measure the stocks while comparing with some bench mark (such as the market, industry) or stocks own history over time] – – Tobin’s q (Asset-based Approach) Price/Earning Ratio (Market-based Technique) Fundamental analysis • Fundamental analysis is a term for studying a company’s accounting statements and other financial and economic information to estimate the economic value of a company’s stock. • The fundamental analysis was formally used to analyze and evaluate the balance sheets, annual reports, trend analysis, profitability ratios and profit & loss figures in order to beat the market. • The basic idea is to identify ‘undervalued’ stocks to buy and ‘overvalued’ stocks to sell. Intrinsic Value Vs Market Value • Intrinsic Value (IV) is the estimated value of the stock today derived from discounting the future cash flows for a stock • Market value (MV) is the current share price. • If IV > MV = the assets is undervalued and should be purchased. • If IV < MV = the assets are overvalued and should be sold • If IV = MV, the assets are correctly valued. Dividend Discounted Model (DDM) • The basic idea behind the discounting model is: • Present Value = Future Value 1+ Interest Rate • OR • Intrinsic Value of security = Cash flow 1+RRR Intrinsic Value • As already mentioned that Intrinsic value of a share is the present value of all cash payments to the investor in the stock • To calculate intrinsic value we need, – All cash flows (dividend + closing price) – Discount rate (required rate of return) The Dividend Discount Model • The Dividend Discount Model (DDM) is a method to estimate the value of a share of stock by discounting all expected future dividend payments. The DDM equation is: D(1) D(2) D(3) D(T ) IV 2 3 1 k 1 k 1 k 1 k T • In the DDM equation: – IV (Intrinsic Value) = the present value of all future dividends – D(t) = the dividend to be paid t years from now – k = the appropriate risk-adjusted discount rate 6-7 Three Foms of DDM 1. Zero Growth Model 2. Constant Growth Model 3. Multi-growth rate model Zero Growth Model of DDM • If share produces same dividend over an infinite period of time; then its become perpetuity. IV = D K Where IV = Intrinsic Value; D is the series of equal dividend; K is the discounting rate Constant Growth Model of DDM • If there is constant forever growth in the dividend; then the dividend will increase on the basis of compound rate; • Hence, the dividend next period (t + 1) is: Constant Growth Model of DDM • If there is constant forever growth in the dividend; then the dividend will increase on the basis of compound rate; • Hence, the dividend next period (t + 1) is: Dt 1or D1 Dt 1 g • As D(1) D(2) D(3) D(T ) IV 2 3 1 k 1 k 1 k 1 k T 6-11 Constant Growth Model of DDM • Or it can be calculated like: Do (1 g) Do (1 g) 2 Do (1 g) 3 D0 (1 g) T IV 2 3 1 k 1 k 1 k 1 k T • Using limit Theorem, the DDM formula for constant growth becomes: Do (1 g ) IV kg D1 IV kg • Or • Where, K g is the growth factor 6-12 Estimating the Growth Rate • The growth rate in dividends (g) can be estimated in a number of ways. – Using the company’s historical average growth rate. – Using an industry median or average growth rate. 6-13 The Multi growth rate model Or Two-Stage Dividend Growth Model • The firm grow at the faster rate in the beginning years and then slow down to normal growth (constant growth) • The two-stage dividend growth model assumes that a firm will initially grow at a rate g1 for T years, and thereafter grow at a rate g2 < k during a perpetual second stage of growth. • The intrinsic value is calculated while calculating the PV of different growth stages and sum up both PV. The Multi growth rate model • D1 D2 D3 Dt P IV ... 2 3 1 k (1 k ) (1 k ) (1 k )t • Where P is calculated using the constant growth model of DDM Dt (1 G ) P (k g ) Example... • Suppose a firm current dividend is Rs. 8 per share, the dividend increases at 7% in the first stage for 5 years and grows at a constant growth of 4% thereafter, required rate of return (discount rate) is 9%, calculate the intrinsic value of the firm? Relative Valuation Methods Tobin’s Q: – Tobin’s q is the ratio of the market value of a firm to the replacement cost of its assets – The replacement cost of an asset is the cost of acquiring an asset of identical characteristics, such as the production capacity of a plant: Market value of firm Tobin’s q = Replacement cost of its assets or Total Assets Value – For example the market value of a firm is Rs. 500 and the replacement cost of its assets is Rs. 250, its q is 2 Relative Valuation Methods Tobin’s Q (cont…): • Tobin’s q has been used in investment context to spot undervalued companies • For example, a low Q (between 0 and 1) means that the cost to replace a firm's assets is greater than the value of its stock. This implies that the stock is undervalued. • Conversely, a high Q (greater than 1) implies that a firm's stock is more expensive than the replacement cost of its assets, which implies that the stock is overvalued. • This measure of stock valuation is the driving factor behind investment decisions in Tobin's model. Relative Valuation Methods Price/Earning Ratio: – Price/Earning Ratio (PER) also known as the earnings multiplier, expresses the relationship between a firms earnings for equity market capitalization – P/E ratio means how much price investors are willing to pay for one rupee of earning – In practice, equity value is proxied by the market value of companies equity: PER or PER = = Market value of equity Earnings for equity Share price Earnings per share (EPS) For Example • OGDCL P/E ratio is = 500/50 = 10 • It means for one rupee earnings investors are willing to pay Rs.10 for buying one share of OGDCL • High P/E ratio refers that investors are paying for money for shares for the same one rupee of earnings. Similarly; • Low P/E shares are cheap, investors have to pay lesser price for the same one rupee of earnings, • So it will be feasible for bidder to target the low P/E ratio firm. Relative Valuation Methods • There are two decision criteria – On the basis of firm’ own earnings estimates – On the basis of industry P/E Relative Valuation Methods • Suppose OGDCL current earnings is Rs. 50 Million and current market price is Rs. 500 Million. It is expected that coming year earnings will be Rs. 100 million. On the basis of P/E ratio, whether OGDCL is suitable for investment or not. • OGDCL P/E ratio is = 500/50 = 10x On the basis of firm’ own earnings estimates • Current P/E is 10x • Price = (P/E)x future Earnings • = 10x 100 = 10,00 • Current price is 500, so buyer should invest in OGDCL. On the basis of industry P/E • Analysts usually calculate P/E ratio for an industry or whole market • An individual stocks’ P/E is compared with others in the industry • If it is traded at discount in relations to others, then the stock is recommended for buying Example on P/E ratio • Firm’ OGDCL P/E ratio Vs Industry’ P/E ratio 10 10 10 = Vs Vs 10 (Correctly Valued) 15 (Under-Valued) 7 (Over-Valued)