Equity Linked Deposit Notes

advertisement

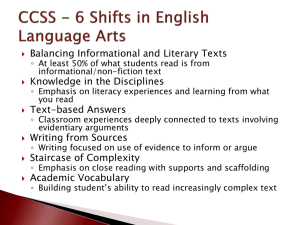

Equity Linked Deposit Notes For Advisor Use and Informational Purposes Only Recap of the Equity Markets Structural Discussion on Principal Protected Notes Current New Issues For Advisor Use and Informational Purposes Only For About 5 Years Investing Seemed Easy For Advisor Use and Informational Purposes Only 2 Then This Happened For Advisor Use and Informational Purposes Only 3 The Recovery For Advisor Use and Informational Purposes Only 4 Depending On How Large A Portfolio Is Down… Asymmetry of Negative Returns If a portfolio lost (%) It has to generate (%) 10 11 20 25 30 43 40 68 50 100 60 150 70 233 80 400 90 900 100 Impossible For Advisor Use and Informational Purposes Only 5 Especially If Investors Fled To “SAFETY” 1 YR 1.75% 2 YR GIC 1.80% 3 YR GIC 2.35% 5 YR GIC 3.25% Subtract for inflation? Then for taxes where they apply ? What is left? Where is the “Real” return? For Advisor Use and Informational Purposes Only 6 A Permanent “Flight To Safety” Will Not Work Today Reality Check: An investor sells for a loss and buys a 5 year GIC at 3.25% If a portfolio lost (%) # of years to recoup 10 3.29 20 6.98 30 11.15 40 15.97 50 21.67 60 28.65 70 37.64 80 50.32 90 71.99 100 Impossible For Advisor Use and Informational Purposes Only 7 Recap of the Equity Markets Structural Discussion on Principal Protected Notes Current New Issues For Advisor Use and Informational Purposes Only Market Exposure with Capital Protection CPPI & Option Based Notes – There is a Difference For Advisor Use and Informational Purposes Only 9 CPPI/ Dynamic Allocation Structure Allocation is determined by the difference between the value of the basket and the value of a theoretical zero coupon bond (DT) If… Increasing Exposure to the Underlying Asset Value Basket NAV Distance (DT ) Initial Investment $100 Bond Price Time Decreasing Exposure to the Underlying Asset Maturity For Advisor Use and Informational Purposes Only 10 Weighting in the Fund Portfolio DT > 40% 200% 35% < DT =< 40% 180% 30% < DT =< 35% 160% 25% < DT =< 30% 140% 22% < DT =< 25% 120% 14% < DT =< 22% 100% 10% < DT =< 14% 80% 7% < DT =< 10% 60% 4% < DT =< 7% 30% 2% < DT =< 4% 15% DT =< 2% 0% The CPPI Structure in Summary Plus’s Minus’s More robust tracking to underlying Ability to create distribution paying products Potential hedge against a rising interest rate environment Potential for >100% participation Less inputs into determining notes NAV For Advisor Use and Informational Purposes Only 11 ‘Ejection’ risk Path dependency Distributions, if any, may be variable Performance in a rebounding market Volatile underlying asset may be problematic Benefits Of An Option Based Structure Contains two inputs, a Zero Coupon Bond and a Call Option The bond delivers the guarantee of $100.00 at maturity and the option provides the performance participation into the underlying basket Zero risk of de-leveraging or encountering a Capital Preservation Event Exposure level to the underlying is pre-determined and set for the entire term of the note Lower volatility Structure generally lends to lower volatility than owning the basket of stocks outright Clean structure For Advisor Use and Informational Purposes Only 12 Pricing Dynamics Interest rate influences Principal protection is effectively provided by a “zero coupon bond”, thus the secondary price will be affected by interest rates Equity market influences The payout on maturity is determined by the performance of the underlying index, thus during the term the value of the note will be affected by fluctuations in equity markets Option valuation influences Participation in the index is provided via an option, thus the value of the note will be influenced by traditional option pricing metrics like volatility and “delta” For Advisor Use and Informational Purposes Only 13 The Option-based Structure $100 Option Zero Coupon Bond Maturity When the Investor buys an option-based principal protected note, they are effectively buying a package. They are buying effectively a strip bond which provides the principal protection, and an option that provides the participation in the underlying investment For Advisor Use and Informational Purposes Only 14 The Option-based Structure Price of the Note $100 Maturity The price of the Note can be determined by a number of different factors including interest rates, the price of the underlying investment, volatility and the inherent characteristics of the option. However, it is important to recognize that with the option-based model despite what happens to the markets, there is no risk of levering and de-levering For Advisor Use and Informational Purposes Only 15 The Impact of Changes in Interest Rates $100 Zero Coupon Bond Maturity Since the instrument that provides the protection of capital is effectively a zero coupon bond, as interest rates fluctuate, so does the value of the zero coupon bond and in turn the note. If interest rates go up, all things being held equal the price of the note will generally go down. However, just like a bond, as the note gets closer to maturity it will become less sensitive to changes in interest rates For Advisor Use and Informational Purposes Only 16 The Tracking issue of Option-based notes Price of the Underlying Asset Price of the Note $100 Option Maturity Inherent characteristics of option-based principal protected notes are such that the full value of the performance of the note is reflected the closer we get to maturity. This attribute also means that the note will generally have lower volatility than the underlying asset. In this example, the note paid 100% of the price performance on maturity which is why the lines converged at maturity. However, this payout profile is not the case with every deposit note For Advisor Use and Informational Purposes Only 17 For Advisor Use and Informational Purposes Only 18 Feb-11 Dec-10 Oct-10 Aug-10 Jun-10 Apr-10 Feb-10 Dec-09 Oct-09 Aug-09 Jun-09 Apr-09 Feb-09 Dec-08 Oct-08 Aug-08 Jun-08 Apr-08 Feb-08 Dec-07 Oct-07 Aug-07 Jun-07 Apr-07 Feb-07 Dec-06 Oct-06 Aug-06 Jun-06 Apr-06 Feb-06 Dec-05 -10% Oct-05 Aug-05 Jun-05 Apr-05 Real Life Example – JHN204 Total Return 2005-2011 50% 40% 37.93% 34.43% 30% 20% 10% 0% BMO CI C.A.P.I.T.A.L Deposit Note CI Fund Basket -20% The Option-based Structure in Summary Plus’s No risk of levering and de-levering Generally lower volatility than the underlying asset Calculating variable interest can be more easily determined Minus’s For Advisor Use and Informational Purposes Only 19 Inherent characteristics of option-based principal protected notes are such that the full value of the performance of the note is reflected the closer we get to maturity Interest rate sensitivity Recap of the Equity Markets Structural Discussion on Principal Protected Notes Current New Issues For Advisor Use and Informational Purposes Only BANK OF MONTREAL CI C.A.P.I.T.A.L. DEPOSIT NOTES CALLABLE CLASS, SERIES 4 Term of 6 years Callable: by Bank of Montreal (Issuer) on May 5th, 2014 at $133.10 which is equivalent to a 10% compound rate of return. If not called: by Bank of Montreal on May 5th, 2014 the holder will receive a return at maturity equal to the percentage increase, if any, of the Reference Portfolio from the Closing Date to and including the Final Valuation Date. Fees: An all-in fee of 2.95% is charged to the Reference Portfolio which represents a cost of 0.905% above the average current MER of the Class A unites of the underlying CI Funds 100% Principal Protected by Bank of Montreal, as issuer, if held to maturity. Selling Commission: 3.00% FundServ Code: JHN232 For Advisor Use and Informational Purposes Only 21 For Advisor Use and Informational Purposes Only 22 Feb-11 Dec-10 Oct-10 Aug-10 Jun-10 Apr-10 Feb-10 Dec-09 Oct-09 Aug-09 Jun-09 Apr-09 Feb-09 Dec-08 Oct-08 Aug-08 Jun-08 Apr-08 Feb-08 Dec-07 Oct-07 Aug-07 Jun-07 Apr-07 Feb-07 Dec-06 Oct-06 Aug-06 Jun-06 Apr-06 Feb-06 Dec-05 -10% Oct-05 Aug-05 Jun-05 Apr-05 Total Return 2005-2011 50% 40% 37.93% 34.43% 30% 20% 10% 0% BMO CI C.A.P.I.T.A.L Deposit Note CI Fund Basket -20% Advantages of Principal Protection Traditional Asset Allocation is redefined Improve the growth dynamics of the portfolio and lower the risk too Can be positioned as either fixed income or equity Investors that do not require cash-flow or fear investing in equities again Cost effective Lower portfolio volatility Help investors avoid damaging/unnecessary Asset Allocation shifting Position for market recovery with the comfort of a guarantee “Tracking” forces investors to take a longer term view Stop worrying about the markets For Advisor Use and Informational Purposes Only 23 Disclaimer This summary is issued for information purposes only to provide an overview Deposit Notes and does not constitute investment advice or an offer to sell or a solicitation to purchase. Bank of Montreal makes no assurances, representations or warranties with respect to the accuracy, reliability or completeness of information contained herein. Furthermore, Bank of Montreal makes no recommendation of investing in securities generally or Deposit Notes in particular. No person has been authorized to give any information or to make any representation not contained in the Information Statements relating to the Deposit Notes and Bank of Montreal does not accept responsibility for any information not contained in the Information Statement. “BMO Capital Markets” is a trademark of Bank of Montreal used under license. For Advisor Use and Informational Purposes Only 24