Exchange Rates Theories

advertisement

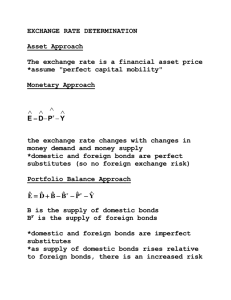

Exchange Rates Theories Asset Approach Goods flows and Capital flows When there is not much international capital flows, TB>0 Currency appreciation TB<0 Currency depreciation These exchange rate movements eliminate trade imbalances. The ex rate adjusts to equilibrate transaction of goods and services Goods flows and Capital flows International capital transaction has recently become much larger than international transaction of goods services. Asset approach 1. Financial assets prices adjust more quickly than goods prices. 2. Exchange rates are much more variable than goods prices. Ex rates are responding to conditions in financial-asset markets. Perfect Capital Mobility No transaction costs and no capital controls so that capital flows freely between nations. Under this assumption, Covered Interest Parity (CIP) holds, or i - i* = (F - E)/E. Changes in interest rates Changes in ex rates. Asset approach 1. Monetary approach (MAER) 2. Portfolio Balance approach (PB) 1. assumes that domestic and foreign bonds are perfect substitutes. 2. assumes imperfect substitutability. MAER and PB which implies, respectively 1. No risk premium Uncovered Interest Parity (UIP) holds. 2. Risk premium UIP does not hold. PB approach According to PB approach, relative supplies of domestic and foreign bonds, in addition to domestic and foreign money, determine the ex rate. Remember, MAER equation is -E^ = P*^ + L^ - w•DC^ PB approach (cont’d) Let B = supply of domestic bonds B* = supply of foreign bonds B*^ - B^ < 0 risk premium on B E^ > 0 or E (depreciation) E today & Ee unchanged expected rate of depreciation (expected rate of appreciation ) PB approach (cont’d) B*^ E^ appreciate at a faster rate B^ E^ depreciate at a faster rate The PB approach is summarized by -E^ = P*^ + L^ - w•DC^ + B*^ - B^ Sterilization According to MABP, Excess money supply IR BOP < 0 Excess money demand IR BOP > 0 Is there any way to neutralize IR flows induced by monetary policy? Sterilization Sterilization (cont’d) With sterilization, the monetary authorities can determine the money supply in the SR without having reserve flows offset their goal. If there are barriers to int’l capital mobility, int’l asset return differential would persist. The central bank can change the money supply growth in the SR without inflicting reserve flows. Sterilization (cont’d) Is it possible without barriers? By, for example, decreasing DC by an amount equal to an increase in IR. The MABP equation with E^ = 0 is given by IR^ = [1/(1-w)]•(P*^ + L^) - [w/(1-w)]•DC^ (+) (-) Sterilization in a floating exchange rate system Let E = E¥/$. Suppose E or the yen is appreciating against the dollar. The BoJ intervenes in the FX market to stop the yen appreciation. buy the dollar-denominated bonds DC MS demand for $ E sell the yen-denominated bonds DC MS Sterilized intervention A FX market intervention that leaves the domestic money supply unchanged. In essence, sterilized intervention is an exchange of domestic bonds for foreign bonds. How does it have an effect on the spot exchange rate? Under the PB approach, Sterilized intervention (supply of dollar assets relative to yen assets) the yen depreciates. Sterilized intervention -E^ = P*^ + L^ - w•DC^ + B*^ - B^ (1): FX market intervention (2): open market sale (1) + (2): sterilized intervention (1) (2) Exchange Rates and the Trade Balance When KA is not either increasing or decreasing, Trade deficits Holdings of foreign money relative to domestic money E (depreciation) Trade surplus Holdings of foreign money relative to domestic money E (appreciation) Ex rate and the Trade Balance Expected future trade deficits expected future holdings of foreign currency Ee Future oil price increase people anticipate a decrease in holdings of foreign currency Ee F expected rate of depreciation people try to shift from domestic to foreign money immediately E (an immediate depreciation of domestic currency) Ex rate and TB Changes in expectations about future trade flows a change in the current spot rate. Currency Substitution An advantage of flexible exchange rates = independence of monetary policy Fixed exchange rates country A must follow a monetary policy similar to country B and vice versa. What if currencies are substitutable? Currency Substitution Perfectly substitutable currencies: people are indifferent between the use of one currency or another all currencies would have to have the same inflation rates (why?) People believe that the relative value of currency A to currency B will not change They are indifferent between holding A or B no change in exchange rate Currency Substitution (cont’d) However, suppose inflation rate is higher for country A. Then, the cost of holding currency A rises relative to the cost of holding B demand shifts from A to B currency A depreciates against B even more than justified by the inflation differential. Currency Substitution (cont’d) This creates volatile exchange rates. A high degree of currency substitution more volatile ex rates a need for int’l coordination of monetary policy currency unions Currency Substitution (cont’d) Examples of a high degree of currency substitution: Among European currencies before the euro. Between the US dollar and the local currencies in many Latin American countries. The Role of News News = unpredictable shocks or surprises faced by int’l economy Difficulty in predicting future spot rates ex rates are affected by news. News have an immediate impact on ex rates, while prices of goods and services are slow to be affected Large deviations from PPP during periods dominated by news.