A. What is the contribution margin per unit?

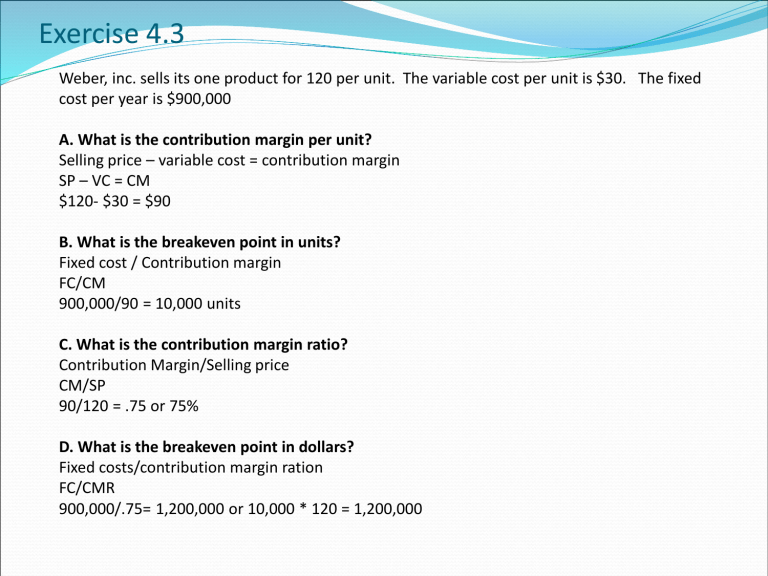

Exercise 4.3

Weber, inc. sells its one product for 120 per unit. The variable cost per unit is $30. The fixed cost per year is $900,000

A. What is the contribution margin per unit?

Selling price – variable cost = contribution margin

SP – VC = CM

$120- $30 = $90

B. What is the breakeven point in units?

Fixed cost / Contribution margin

FC/CM

900,000/90 = 10,000 units

C. What is the contribution margin ratio?

Contribution Margin/Selling price

CM/SP

90/120 = .75 or 75%

D. What is the breakeven point in dollars?

Fixed costs/contribution margin ration

FC/CMR

900,000/.75= 1,200,000 or 10,000 * 120 = 1,200,000

Exercise 4.4

Meeker Company is developing a new product. The selling price has not yet been determined, nor are the variable costs per unit known. The fixed costs are

$600,000. Management plans to set the selling price so that variable cost is 55 percent of the selling price.

A. What is the contribution margin ratio?

The formula is CM/SP but it hasn’t been determined. What you do know is that they are going to spend 55 cents on every dollar.

1-.55 = .45 (contribution margin ratio)

B. What is the breakeven point in dollars?

Fixed costs/contribution margin ratio

FC/CMR

600,000/.45= $1,333,333 c. If management desires a profit of $50,000, what will total sales be?

Fixed cost + Profit / contribution margin ratio

FC + Profit /CMR

600,000+50,000/.45= $1,444,444.44

Exercise 4.5

Crow, Inc. a not-of-profit company, has a product contribution margin of $40. The fixed costs are $800,000. Crow, Inc. has set a target profit of $35,000 per year.

A. What is the breakeven points in units?

Fixed costs/contribution margin

FC/CM

800,000/40= 20,000

B. How many units must be sold to achieve the target profit?

Fixed costs + Profit/ contribution margin

FC + Profit/CM

800,000 + 35,000 / 40 = 20,875

C. If fixed costs decrease 10 percent, how many units must be sold to achieve the target price?

Fixed cost is 800,000 and to decrease it by 10 percents – 800,000 *.10 = 80,000

800,000 – 80,000 = 720,000

FC + Profit / CM

720,000 + 35,000 / 40 = 18,875

Exercise 4.6

Longpre Company distributes insect repellent. Each can of repellent sells for $4.00. The variable cost per can of repellent is $.75. The fixed selling and distribution costs are $80,000. The after-tax target profit level is $15,000. Longpre Company is subject to an income tax rate of 20 percents.

A. What is the breakeven point in units?

Fixed cost/ contribution margin

FC/CM

80,000/3.25 = 24,615.38 – you can’t have .38 and you can’t go below because you won’t break even so you have to round up 24, 616

B. What is the breakeven point in dollars?

Fixed costs/contribution margin ratio --- CMR (CM/SP) 3.25/4.00 = .8125

FC/CMR

80,000/.8125 = $98,461.54

C. To achieve the profit goal, what must the before-tax profit be?

If the tax rate is 20% and it is $15,000 after the 20%

$15,000/ (1-.20) = $18,750

D. How many units must be sold to achieve the profit goal after taxes?

Fixed cost + Profit before taxes/Contribution margin

FC + Profit before taxes/CM

(80,000 + $18,750)/3.25 = 30,384.6 or 30,385

Exercise 4.7

Gorman Company has the following cost-volume

– profit relationships.

Breakeven point in units sold 1,000

Variable cost per unit

Fixed cost per period

$2,000

$750,000

A. What is the contribution margin per unit?

SP – Variable Costs

SP – VC = CM

Breakeven is

FC/CM = Breakeven

750,000/CM= 1,000

750,000/1000 = 750

750= contribution margin

B. What is the selling price per unit?

Selling Price

– 2,000 = Contribution Margin

SP

– 2,000 = 750

SP = 750+2000

SP = 2750

C. What is the total profit if 1,001 units are sold?

If 1000 is breakeven, 1001 has to be 750

Exercise 4.8

Ukaegbu, Inc. currently sells its product for $3.25 per unit. The variable cost per unit is $0.60 and fixed costs are $90,000. Purchasing a new machine will increase fixed costs by $6,000, but variable costs will be cut by 20 percent.

A.

What is the breakeven point before the new machine is purchased?

FC/CM = Breakeven

90,000/2.65 = 33,962.26 (33,963 units)

B.

What is the breakeven point after the new machine is purchased?

(90,000 + 6,000 = 96,000)

(3.25 - .48) = 2.77

96,000 / 2.77 = 34,657.04 (34,658)

C.

Should Ukaegbu, Inc., purchase the new machine? Why or why not?

We must determine when the costs of the two machines are equal:

2.65 * Q – $90,000 = $2.77 * Q - $96,000

Q – 90,000 = 2.77 – 2.65 – 96,000

Q = .12 – 6000

6000 = .12

6000/ .12 = 50,000

If the company believes it will sell more than 50,000 units, it should purchase the new machine because the variable costs are less.