23

Cost Behavior Analysis

Cost Behavior and Management

OBJECTIVE 1: Define cost behavior, and

identify variable, fixed, and mixed costs.

Figure 1: A Common Variable Cost

Behavior Pattern: A Linear Relationship

Figure 2: Examples of Variable, Fixed, and

Mixed Costs

Figure 3: A Common Fixed Cost Behavior

Pattern

Figure 4: Behavior Patterns of Mixed

Costs

Figure 5: The Relevant Range and Linear

Approximation

Cost Behavior and Management

• Cost behavior refers to the way costs

respond to changes in volume or activity.

Cost Behavior and Management

• Managers use assumptions about cost

behavior in almost every decision they

make.

– When planning, managers use cost behavior to

determine how many units of products or

services must be sold to generate a targeted

amount of profit and how changes in planned

activities will affect operating income.

Cost Behavior and Management

• Managers use assumptions about cost

behavior in almost every decision they

make. (cont.)

– When performing their duties, managers use

cost behavior to determine the impact of their

decisions on operating income.

– When evaluating and reporting on

performance, managers analyze how changes

in costs and sales affect profitability.

Cost Behavior and Management

• The behavior of costs

– Total costs that change in direct proportion to

changes in productive output (or other volume

measures) are called variable costs.

– However, on a per unit basis, variable costs

remain constant as volume changes.

– Operating capacity is the upper limit of an

organization’s productive output capability,

given its existing resources.

Cost Behavior and Management

• The behavior of costs (cont.)

– There are three common measures of operating

capacity:

• Theoretical (ideal) capacity

• Practical capacity

• Normal capacity

Cost Behavior and Management

• The behavior of costs (cont.)

– The traditional definition of variable costs

assumes that a linear relationship exists

between costs and the measure of capacity

chosen.

– Many costs vary with operating activity in a

nonlinear fashion; this cost behavior can be

approximated within the relevant range using

linear approximation.

Cost Behavior and Management

• The behavior of costs (cont.)

– Fixed costs are total costs that remain constant

within a relevant range of volume or activity.

Fixed unit costs vary inversely with changes in

activity or volume.

– Mixed costs have both variable and fixed cost

components.

• Many mixed costs vary with operating activity in a

nonlinear fashion.

• Accountants use linear approximation to allow the

inclusion of nonlinear costs in cost behavior

analysis.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Mixed Costs and the Contribution Margin

Income Statement

OBJECTIVE 2: Separate mixed costs into

their variable and fixed components, and

prepare a contribution margin income

statement.

Figure 6: Scatter Diagram of Machine

Hours and Electricity Costs

Table 1: Comparison of Income

Statements

Table 2 Contribution Margin Income

Statement

Mixed Costs and the Contribution Margin

Income Statement

• Mixed costs are a combination of variable

and fixed cost components.

– For cost planning and control purposes, mixed

costs must be divided into their variable and

fixed components.

Mixed Costs and the Contribution Margin

Income Statement

• Engineering method

– Separates costs by performing step-by-step

analysis of tasks, costs and processes involved.

– Also called a time and motion study.

Mixed Costs and the Contribution Margin

Income Statement

• Scatter diagram method

– Used when there is doubt about the behavior

pattern of a particular cost.

– If the diagram suggests a linear relationship, a

cost line can be imposed.

Mixed Costs and the Contribution Margin

Income Statement

• High-low method

– Three-step approach to determining variable

and fixed components.

• Find the variable rate.

• Find the total fixed costs.

• Express the cost formula to estimate total costs

within the relevant range.

Mixed Costs and the Contribution Margin

Income Statement

• High-low method (cont.)

– Its disadvantage is that if one or both data

points are not representative of the remaining

data set, the estimate of variable and fixed

costs may not be accurate.

– Its advantage is that it can be used when only

limited data are available.

Mixed Costs and the Contribution Margin

Income Statement

• Statistical methods, such as regression

analysis

– Mathematically describe the relationship

between costs and activities

– Because all data observations are used, the

resulting linear equation is more representative

of cost behavior than either the high-low or

scatter diagram methods.

Mixed Costs and the Contribution Margin

Income Statement

• Contribution margin income statements

– A contribution margin income statement is

formatted to emphasize cost behavior rather

than organizational functions.

– Contribution margin (CM) is the amount that

remains after all variable costs are subtracted

from sales.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Cost-Volume-Profit Analysis

OBJECTIVE 3: Define cost-volume-profit

(C-V-P) analysis and discuss how managers

use it as a tool for planning and control.

Cost-Volume-Profit Analysis

• C-V-P analysis

– C-V-P analysis is an examination of the cost

behavior patterns that underlie the relationships

among cost, volume of output, and profit.

– Sales Revenue – Variable Costs – Fixed Costs

= Profit

Cost-Volume-Profit Analysis

• C-V-P analysis (cont.)

– Tool for both planning and control.

• Can calculate net income when sales volume is

known

• Can determine the level of sales need to reach a

targeted amount of income.

Cost-Volume-Profit Analysis

• C-V-P analysis (cont.)

– Only used under certain conditions and when

certain assumptions hold true.

• The behavior of variable and fixed costs can be

measured accurately.

• Costs and revenues have a close linear

approximation.

• Efficiency and productivity hold steady within the

relevant range.

Cost-Volume-Profit Analysis

• C-V-P analysis (cont.)

– Only used under certain conditions and when

certain assumptions hold true. (cont.)

• Cost and price variables hold steady during the

period being planned.

• The product sales mix does not change during the

period being planned.

• Production and sales volume are approximately

equal.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

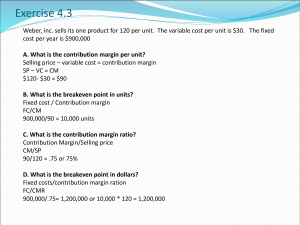

Breakeven Analysis

OBJECTIVE 4: Define breakeven point and

use contribution margin to determine a

company’s breakeven point for multiple

products.

Figure 7: Graphic Breakeven Analysis for

My Media Place

Figure 8: Sales Mix for My Media Place

Breakeven Analysis

• The breakeven point is the point of zero

profit, where S – VC – FC = 0.

– The margin of safety is the number of sales

units or amount of sales dollars by which

actual sales can fall below planned sales

without resulting in a loss.

– A scatter graph can be used to make a rough

estimate of the breakeven point.

Breakeven Analysis

• Contribution margin equals sales minus

total variable costs.

– Profit equals contribution margin minus fixed

costs.

– Contribution margin per unit equals selling

price minus variable cost per unit.

Breakeven Analysis

• Contribution margin equals sales minus

total variable costs. (cont.)

– Breakeven point in units equals fixed costs

divided by the contribution margin per unit.

– Breakeven point in sales dollars equals

breakeven point in units times the selling price

per unit.

• When an organization sells more than one

product, a sales mix is used to calculate the

breakeven point for each product.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Using C-V-P Analysis to Plan Future Sales,

Costs, and Profits

OBJECTIVE 5: Use C-V-P analysis to project

the profitability of products and services.

Exhibit 1: Comparative Summary of

Alternatives at My Media Place

Using C-V-P Analysis to Plan Future Sales,

Costs, and Profits

• C-V-P analysis enables managers to

determine how changes in volume, selling

price, and costs will affect the profitability

of a product.

• The following formula is used to determine

the number of units that must be sold to

produce a certain profit:

– Targeted sales in units = (FC + P) ÷ (CM per

Unit)

Using C-V-P Analysis to Plan Future Sales,

Costs, and Profits

• A service business can use C-V-P analysis

to separate the mixed costs of service

overhead into their variable and fixed

components, calculate a breakeven point,

and determine how changes in cost,

volume, or price will affect the profitability

of a service.

©2011 Cengage Learning All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.