Mr. Mayer AP Macroeconomics

MPC, MPS, and

Multipliers

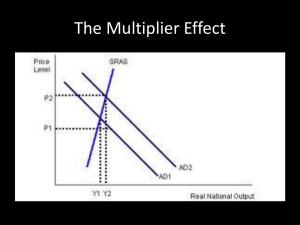

• Any increase in spending will result in an even larger increase in GDP due to the fact that every dollar spent is spent again multiple times .

• Any money spent is someone else’s income and therefore subject to spending.

Decisions to Save and Spend

• How strong the multiplier effect will be is determined by our decisions to save and spend.

• As our income changes we will spend a portion and save a portion of this change.

Marginal Propensity to

Consume

• The portion we spend is known as our

Marginal Propensity to Consume (MPC)

• It is found by dividing the change in

Consumption by the change in Disposable

Income

• For example if we receive a $10 an hour raise and we spend $9 of it and save $1, then our MPC is .9

C / DI = MPC so 9/10 = .9

Marginal Propensity to Save

• The portion we save is known as our

Marginal Propensity to Save (MPS)

• It is found by dividing the change in

Savings by the change in Disposable

Income

• For example if we receive a $10 an hour raise and we spend $9 of it and save $1, then our MPS is .1

S / DI = MPS so 1/10 = .1

• The MPC + MPS is always equal to 1

• The limiting factor for the multiplier effect is savings.

• For every additional dollar spent a portion of it will be saved (the MPS ).

• The multiplier is the reciprocal of the MPS or 1/MPS or 1/1- MPC.

• The larger the MPC (the smaller the MPS) the larger the multiplier will be.

Spending Multiplier = 1/MPS

MPC 1/MPS = M

.90

1/.10

.80

.75

.60

.50

1/.20

1/.25

1/.40

1/.50

= 10

= 5

= 4

= 2.5

= 2

The First Round of Government

Spending Causes The Biggest Splash

MPC of 75%

G spends $ 200 billion on the highways .

Highway workers save 25% of $200 billion [$50 billion] & spend 75% or $150 billion on boats.

Boat makers save 25% of $150 bil.

[$37.50 bil.]

& spend 75% or $112.50 bil. on iPod Minis, etc.

Total Saving has reached $87.50

USING MULTIPLIERS

• The multiplier can be used to calculate how any change in spending will change total spending (AD) or income (GDP) .

• The formula used is: Change in

Spending x Multiplier = Change in

AD/GDP.

• Ex: G $1b x 4 = $4b in AD/GDP

USING MULTIPLIERS

• Since any change in GDP is the result of the change in spending x multiplier, you can find the multiplier by dividing the change in AD/GDP by the change in spending.

• Ex: $4b AD/GDP / $1b in G = multiplier of 4

USING MULTIPLIERS

• Knowing that any change in spending will have a multiplied effect government can calculate how much to change spending by dividing the needed change in GDP by the multiplier.

• Ex: GDP is $4b below full employment

$4b needed / 4 = $1b in G

• A change in taxes also has a multiplied effect, but the tax multiplier is smaller than the spending multiplier.

• Tax Multiplier (note: it’s negative because tax increases reduce spending)

-

MPC /

1-MPC or

-

MPC /

MPS

• If there is a tax-CUT, then the multiplier is +, because there is now more money in the circular flow

Tax Multiplier = MPC/MPS

MPC MPC/MPS = M

.90

-MPC/.10= -9

.80

-MPC/.20= -4

.75

-MPC/.25= -3

.60

-MPC/.40= -1.5

.50

-MPC/.50= -1

Spending Multiplier

=

1/MPS

MPC

.9

.8

.75

Multiplier

10

5

-4

4

-3

Tax Multiplier = -MPC/MPS

Tax Multiplier

-9

.60 2.5

-1.5

.5

2

-1

The tax multiplier is always smaller than the spending multiplier because a portion of the change in income due to taxes is saved, reducing the overall impact on spending.

The Balanced Budget Multiplier

• When government spending increases are matched with equal size increases in taxes, the change ends up being = to the change in government spending

• Why?

• 1 /

MPS

+ -MPC /

MPS

= 1- MPC /

MPS

= MPS /

MPS

= 1

• The balanced budget multiplier always = 1

Multiplier Practice

• Assume US citizens spend $.90 for every extra $1 they earn.

• Further assume that the real interest rate

(i) decreases, causing a $50 billion increase in Investment (I).

• Calculate the effect of this increase in spending on AD.

Step 1: Calculate the MPC and MPS

MPC =

C

/

DI

MPS = 1- MPC =

Step 2: Determine which multiplier to use, and whether its + or –

The problem mentions an increase in I, use a (+) spending multiplier

Step 3: Calculate the Spending and/or Tax

Multiplier

Step 4: Calculate the Change in AD

( C, I, G or NX) * Spending or Tax Multiplier

More Practice

• Assume Germany raises taxes on its citizens by 200b.

• Assume that Germans save 25% of the change in their disposable income.

• Calculate the effect of these taxes on the

German economy.

More Practice

• Assume the Japanese spend 4/5 of their disposable income.

• Assume that the Japanese government increases its spending by 50 trillion and in order to maintain a balanced budget simultaneously increase taxes by 50t.

• Calculate the effect of these changes on the Japanese Aggregate Demand.