Income

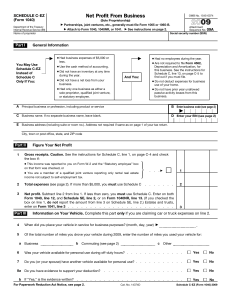

advertisement

Chapter 8, 9, 11, 13, 14, and 15 Requirement Types of Income Income types we experience in the past. Samples of forms that we will see How to enter them in TWO All income must be reported except those that are exempt from tax by law. Taxable Income o Earned – You worked for it • Wages • Self-employment / Business o Unearned – you did not worked for it • • • • Interest Social Security Alimony Gambling Non-Taxable / Exempt Income o Child Support o Gifts o Inheritance Line 07 – Wages (W-2) Line 08 – Interest Income (1099-INT) Line 09 – Dividend Income (1099-DIV) Line 10 – Taxable Refunds (State Tax Refund - Itemized TP only) Line 11 – Alimony Received Line 12 – Business Income (1099-Misc) Line 15 – IRA Distributions (1099-R) Line 16 – Pensions / Annuities (1099-R) Line 19 – Unemployment Compensation (1099-G) Line 20 – Social Security Benefits (SSA-1099) Line 21 – Other Income (W-2G) Input the amounts as shown in the W-2 Form into TWO. “KEY IT AS YOU SEE IT” Note o If the taxpayer’s job is one in which tips are received, ask if he/she receive any tips and enter the amount in box 7 even if the information is not reported on the W-2 o Double check employer name and address – change them manually if necessary o Box 14 Other Item: California State Disability Insurance (CASDI) • Must be entered at the bottom of TWO’s W-2 form to be transferred to Schedule A (Itemized Deduction) to State Tax Paid • Must use correct literal “CASDI” • Deductible because it is mandatory. Thus VPDI is not deductible since it is voluntary. Enter via Schedule B > Interest Statement List name of institution as much as it will fit If there is an amount shown in Box 8: o Enter “E” in NAEOB column o Enter Box 8 Amount in NAEOB amount Enter other amounts as applicable. Enter on TWO via Dividend Statement in Schedule B Enter information from the form 1099-DIV based on the description of the box. Only applicable to tax payer that itemized in the previous year Use State Tax Refund Worksheet We use Schedule C-EZ only!!!!! (See next slide for details) Sole Proprietor (Business Owner) If the taxpayer owns their own business or works out of their home or is an independent contractor, he/she will tell you that about the amount of income and expenses related to the business. I.E., Courtney has a small home-based word processing business. Her gross income was $6,570. Her expense for materials was $878. Had business expenses of $5,000 or less Used the cash method of accounting Did not have an inventory at any time during the year Did not have a net loss from the business Were the sole proprietor for only one business (each spouse on a joint return may use a separate Schedule C-EZ to report business income from separately owned soleproprietor business if other conditions for filing Schedule CEZ are met) Had no employees during the year Did not deduct expenses for business use of their home Did not have prior-year un allowed passive activity losses from their business Self-employed (Independent Contractor – receive 1099MISC) You will see this form when a taxpayer works for someone but is not consider an employee. Business Type & Business Code (NAICS Code*) Business Name (If different than tax payer name) Employer ID Number (If tax payer have employee) Business Address (If different than tax return address) Was 1099 issued to others (contracted work out to others) Income (Credit Card, Other than credit card) Expenses (See more info next page) Net Profit Business Miles * http://www.naics.com/search.htm We use only schedule C-EZ to complete business income!!!!! Using schedule C is out of scope of VITA If they have business loss it is also out of scope of VITA If they still want to file with us we will use schedule C-EZ and reduce their expense to match their income so they will have no profit. *** Make sure taxpayer is ok with not claiming business loss. Advertising Car and truck expenses Commissions and Fees Insurance Other Interest 50% of business meals and entertainment Utilities (including telephone) Legal and professional services and fees Office expenses Rent or lease expenses Repairs and maintenance Supplies Taxes and licenses Travel Part I: General information Line A, Principal business or profession Line B, Business code Line D, Employer ID number Line E, Business address Part II: Figure Net Profit Enter the amount as stated in each line Use the standard mileage rate method: Multiply the business miles by the applicable mileage rate Add that amount to the business-related parking, tolls, and other deductible business expenses Business Mileage The 2011 rate for business use of a vehicle is: 51 cents per mile from January 1, 2011, through June 30, 2011 55.5 cents per mile from July 1, 2011, through December 31, 2011 Gross Income Less Total Expenses Line 3, Net profit, is the difference between gross receipts (line 1) and total expenses (line 2). If net profit is less than $400, enter the amount on line 12 of Form 1040 and attach Schedule C-EZ to the return. Schedule SE is not required unless there is a profit of $400 or more Insert 1099-R form Enter data to TWO from original form as seen in each box Things to note: o If box 7 “IRA/SEP/Simple” box is check, it will transfer the data to line 15. Otherwise it will goes into line 16 of form 1040 Use 1099G Work Sheet to enter information in TWO Enter information in 1040 Worksheet 1 Information to be entered: (as applicable) o Social Security received this year o Medicare Part B, C, and D (use scratch pad to sum up the amounts) o Federal tax withheld What if tax payer does not have the form? o www.socialsecurity.gov will allow you to request a copy of the most recent SSA-1099 and will arrive in about 10 days via mail. o Or they can go to the local Social Security Office to have them print it out. The type of income that will be reported on this line: o Foreign earned income o Prizes and awards o Gambling Winnings o Jury Duty Fees DO NOT report 1099-MISC in this line as it should be reported with schedule C or C-EZ DO NOT report non-taxable income in this line (they are not supposed to be reported at all) o i.e., Child Support, Roth IRA distributions, Gifts The type of income description is very specific. o i.e., if you have gambling winning of any type you must use “GAMBLING WINNINGS” as the description exactly as spelled in the quotation. Gambling Losses o Gambling losses can be deducted up to the amount of gambling winnings. o Gambling losses will not be considered if you are not itemized o Best practice is just to enter the loss on the form on TWO and if taxpayer does itemized you will not have to go back to re-enter the information. Webster Return