Measuring Financial Performance

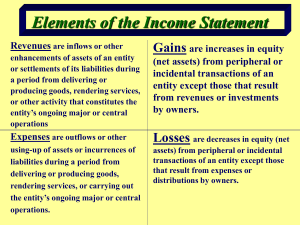

advertisement

Finance Program Management Department Faculty of Economic Petra Christian University Surabaya 2009 MEASURING FINANCIAL PERFORMANCE LEARNING OBJECTIVES Describe the process for obtaining and recording resources needed for an early-stage venture Describe and prepare a basic balance sheet Describe and prepare a basic income statement Explain the use of internal statements as they relate e to formal financial statement LEARNING OBJECTIVES Briefly describe two important internal operating schedules the cost of production schedule and the inventories schedule Prepare a cash flow statement and explain how it helps monitor a venture’s cash position Describe operating breakeven analysis in terms of NOPAT breakeven revenues OBTAINING AND RECORDING THE RESOURCES NECESSARY TO START AND BUILD A NEW VENTURE DEVELOPMENT STAGE IN LIFE CYCLE BALANCE SHEET INCOME STATEMENT Assets: Revenues: STARTUP STAGE IN LIFE CYCLE BALANCE SHEET INCOME STATEMENT Assets: Revenues: Acquire initial assets (e.g., No sales (consequently initial cash, office furniture, no money computer, etc) Is coming in) Acquire production assets (e.g., inventories and equipment to produce products and give credit to customer) Making sales (money begins flowing in) Liabilities and Equity: Expenses: Liabilities and Equity: Obtain seed financing (e.g., (e.g., rent, utilities, entrepreneur’s subsistence salary for Assets, family, and friends) entrepreneur) Obtain startup financing (e.g., business angels and venture capitalists in addition to seed financing sources) Expenses: (additional expenses to produce and market products and to record business transactions) BUSINESS ASSETS, LIABILITIES, AND OWNERS’ EQUITY Assets: •Financial, physical, and intangible items owned by the business Balance sheet assets •Lists assets in declining order of liquidity, or how quickly the asset can be converted into cash ASSETS Cash and marketable securities Receivables LIABILITIES AND EQUITY $30,000 0 Payables $10,000 Accrued wages 0 Inventories 10,000 Bank loans 0 Total current assets 40,000 Other current liabilities 0 Gross equipment Less: Accumulated depreciation Net equipment 20,000 0 20,000 Building 0 Other long-term assets 0 Total assets $60,000 Total current liabilities 10,000 Long –term debts 10,000 Capital leases 0 Total long-term liabilities 10,000 Owners’ equity 40,000 Total liabilities and equity EXAMPLE OF INITIAL BALANCE SHEETS $60,000 SALES, EXPENSES, AND PROFITS Net sales $120,000 - Cost of goods sold (78,000) Gross earnings 42,000 - Marketing expenses (12,500) - Administrative expenses (18,000) - Building rental (6,000) - Depreciation expenses (1,000) Earning before interest and taxes 4,500 -Interest (500) Earning before taxes (taxable income) 4,000 - Taxes (25%) Net income (earning after tax) (1,000) $ 3,000 STATEMENT OF CASH FLOWS Cash flow from operating activities Net income $ + Depreciation 3,000 1,000 - Increase in receivables (50,000) - Increase in inventories (16,000) + Increase in payables 5,000 + Increase in accrued wages 3,000 Net cash flow from operating activities (54,000) Cash flow from investing activities - Increase in gross equipment 0 Cash flow from financing activities + Increase in other short-term liabilities 25,000 Net change excluding cash account (29,000) Beginning cash and marketable securities Ending cash and marketable securities 30,000 $ 1,000 OPERATING BREAKEVEN ANALYSES Year 1 Number of units sold Revenues - Cost of goods sold Year 2 5,000 $ 500,000 15,000 Year 3 25,000 $1,500,000 $ 2,500,000 (325,000) (975,000) (1,625,000) 175,000 525,000 875,000 - Administrative expenses (200,000) (200,000) (200,000) - Marketing expenses (180,000) (180,000) (180,000) EBITDA (205,000) 145,000 495,000 (25,000) (25,000) (25,000) (230,000) 120,000 470,000 (20,000) (20,000) (20,000) (250,000) 100,000 450,000 75,000 (30,000) (135,000) Gross profit - Depreciation EBIT - Interest expenses EBT - Taxes Net income $ (175,000) $ 70,000 $ 315,000 SURVIVAL BREAKEVEN “TERMS” EBITDA = earning before interest, taxes, depreciation, and amortization EBDAT = earning before depreciation, amortization, and taxes EBDAT breakeven = amount of revenues needed to cover a venture’s cash operating expenses Cash flow break even = cash flow at zero for a specific period (EBDAT = 0) EXAMPLE OF EBDAT EXPERIENCE Year 1 Number of units sold Revenues - Cost of goods sold (65% of revenues) Year 2 5,000 $ 500,000 15,000 Year 3 25,000 $1,500,000 $ 2,500,000 (325,000) (975,000) (1,625,000) 175,000 525,000 875,000 - Administrative expenses (200,000) (200,000) (200,000) - Marketing expenses (180,000) (180,000) (180,000) (20,000) (20,000) (20,000) 125,000 $ 475,000 Gross profit - Interest expenses EBDAT Percent of revenues $ (225,000) $ -45% 8.3% 19% SURVIVAL REVENUES (SR) Amount of revenues just offsetting variable and cash fixed costs (EBDAT breakeven) EBDAT = revenues ( R ) – variables costs (VC) – cash fixed costs (CFC) VC = variable costs revenues ratio (VCRR) x (R ) Survival revenues (SR) = VC + CFC CFC = SR – VC CFC = SR – (VCRR) x (SR) CFC = SR[1 – (VCRR)] SR = [CFC/(1 – VCRR)] COUNTING OF SURVIVAL BREAKEVEN SR = [CFC/(1 – VCRR)] CFC = adm exp + marketing exp + financing exp CFC = $200,000 + $180,000 + $20,000 C FC = $400,000 VCRR = cost of goods sold/revenues SR = $400,000/(1- 0.65) SR = $400,000/0.35 SR = $1,142,857 = $1,143,000 (rounded) CHECKING OF SURVIVAL BREAKEVEN Survival revenues - COGS (65%) Gross profit $1,143,000 (743,000) 400,000 - Administrative expenses (200,000) - Marketing expenses (180,000) - Interest expenses EBDAT (20,000) 0 NOPAT BREAKEVEN NOPAT net operating profit after taxes or EBIT times one minus the firm’s tax rate = EBIT (1 – tax rate) NOPAT breakeven revenues (NR) amount of revenues needed to cover a venture‘s total operating costs = Total operating fixed costs (TOFC)/(1 – VCRR) OPERATING BREAKEVEN ANALYSES Year 1 Number of units sold Revenues - Cost of goods sold 5,000 $ 500,000 Year 2 15,000 Year 3 25,000 $1,500,000 $ 2,500,000 (325,000) (975,000) (1,625,000) 175,000 525,000 875,000 - Administrative expenses (200,000) (200,000) (200,000) - Marketing expenses (180,000) (180,000) (180,000) EBITDA (205,000) 145,000 495,000 (25,000) (25,000) (25,000) (230,000) 120,000 470,000 69,000 (36,000) (141,000) (161,000) 84,000 329,000 (32.2%) 5.6% 13.2% Gross profit - Depreciation EBIT - Taxes (at a 30% effective rate) NOPAT Percent of revenues SELESAI