The CAPM is CRAP

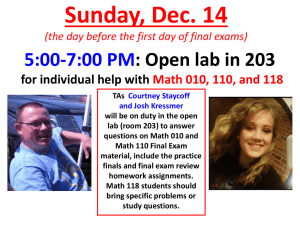

advertisement

Empirical testing of the CAPM on the JSE Mike Ward, Chris Muller Gordon Institute of Business Science University of Pretoria NERSA Conference August 2012 An economic return on the RAB? Shareholder Capital The cost of equity “The CAPM” Re = Rf + β.MRP Debt Capital The cost of debt Regulatory Asset Base The Capital Asset Pricing Model Return High beta shares are more risky, so give better returns Rf = 11% MarketRiskPremium = 5% Rf = 7% 0.8 Beta = 1.0 Risk (beta) Prior Research Data: All US Shares 1928 - 2009 Betting Against Beta, Andrea Frazzini and Lasse H. Pedersen, Oct 2011 Data: 18 International Markets 1984 - 2009 Betting Against Beta, Andrea Frazzini and Lasse H. Pedersen, Oct 2011 Fama and French (2004) estimated betas for every share on the NYSE, AMEX and NASDAQ from 1923 – 2003 using 2-5 years prior data and compared with their return over the next 12 months: Prior research on the JSE • Strugnell, Gilbert & Kruger (2011) IAJ – “Beta has no predictive power for returns on the JSE” – Data from 1994 – 2007 – Included too many small shares • van Rensburg & Robertson (2003) IAJ – “If anything, beta is inversely related to returns!” – Data from 1990 – 2000 – Included too many small shares Rational for research • The CAPM is a pillar of financial theory: – taught on all finance courses – found in all finance text books – used regularly in the financial services industry – Markowitz, Miller & Sharpe shared a Nobel prize • We have 25 years of JSE data – 1985 to 2011 • We can improve on the methodology Methodology • Select the largest 160 companies in Dec 1984 • Estimate betas using prior years return data – OLS beta • 60 monthly data points – Dimson • Multiple regression (+1,0,-1,-2,-3,-4) • • • • Rank betas Construct 5 equal weighted portfolios of 32 shares Measure portfolio return over the next 3 months Repeat for next quarter 99% of JSE’s market capitalisation Presentation of findings • We track the daily value of each portfolio (quintile) • We re-balance each portfolio quarterly – We retain the value of the portfolio – Equally weight – We ignore transaction costs • We graph the results • We benchmark against the ALSI total return index • We plot a price relative versus the J203 Results OLS Betas - monthly 256.000 128.000 64.000 32.000 16.000 8.000 BetaOLS60m1 BetaOLS60m2 BetaOLS60m3 BetaOLS60m4 BetaOLS60m5 Relative J203T Relative to J203T 21.6% 20.4% 18.1% 15.8% 12.1% 7.7% 4.000 2.000 1.000 0.500 0.250 0.125 0.063 -6.9% -10.5% 0.031 0.016 Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 OLS Betas - weekly 256.000 128.000 64.000 32.000 16.000 8.000 BetaOLS104w1 BetaOLS104w2 BetaOLS104w3 BetaOLS104w4 BetaOLS104w5 Relative J203T Relative to J203T 20.4% 19.9% 19.3% 15.8% 15.4% 4.000 4.6% 2.000 1.000 0.500 0.250 0.125 0.063 0.031 -9.6% -12.3% 0.016 Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Dimson Betas - monthly 256.000 128.000 64.000 32.000 16.000 8.000 BetaDimson60m1 BetaDimson60m2 BetaDimson60m3 BetaDimson60m4 BetaDimson60m5 Relative J203T Relative to J203T 19.3% 19.0% 17.4% 16.3% 15.8% 7.9% 4.000 2.000 1.000 0.500 0.250 0.125 -6.8% -8.1% 0.063 0.031 0.016 Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Dimson Betas - weekly 256.000 128.000 64.000 32.000 16.000 8.000 BetaDimson104w1 BetaDimson104w2 BetaDimson104w3 BetaDimson104w4 BetaDimson104w5 Relative J203T Relative to J203T 20.8% 19.5% 19.0% 15.8% 15.3% 4.000 5.7% 2.000 1.000 0.500 0.250 0.125 -8.7% 0.063 0.031 -12.5% 0.016 Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec- Dec84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Volatility - Daily Summary of Results Annualised returns for equal weighted portfolio quintiles over the period 31Dec1986 31Dec2011 Number Risk Measure of Obs OLS Monthly Beta 60 OLS Weekly Beta 104 Dimson Monthly Beta 60 Dimson Weekly Beta 104 Volatility Daily Average annualised Return 60 ALSI Highest Lowest Index Beta Quintile Quintile Quintile Beta R203 Quintile 2 3 4 Quintile 15.7% 7.7% 12.1% 18.1% 21.6% 20.4% 15.7% 4.6% 15.4% 20.4% 19.9% 19.3% 15.7% 7.9% 16.3% 19.3% 19.0% 17.4% 15.7% 5.7% 15.3% 19.0% 19.5% 20.8% 15.7% 9.7% 13.5% 17.7% 20.8% 18.2% 15.7% 7.1% 14.5% 18.9% 20.2% 19.2% Style: BetaOLS60m Characteristic: BetaOLS60m 1.80 Portfolio 1 (Beta VH) Portfolio 2 (Beta H) 1.60 Portfolio 3 (Beta M) Portfolio 4 (Beta L) 1.40 Portfolio 5 (Beta VL) 1.20 1.00 0.80 0.60 0.40 0.20 Dec 11 Dec 10 Dec 09 Dec 08 Dec 07 Dec 06 Dec 05 Dec 04 Dec 03 Dec 02 Dec 01 Dec 00 Dec 99 Dec 98 Dec 97 Dec 96 Dec 95 Dec 94 Dec 93 Dec 92 Dec 91 Dec 90 Dec 89 Dec 88 Dec 87 Dec 86 Dec 85 Dec 84 0.00 Conclusion: High risk (beta) = Low return Ben Graham once argued that: "Beta is a more or less useful measure of past price fluctuations of common stocks. What bothers me is that authorities now equate the beta idea with the concept of risk. Questions… • For those interested: • The full paper will be published in the forthcoming: – Investment Analyst Journal – http://www.iassa.co.za/journals/