PepsiCO+v2

advertisement

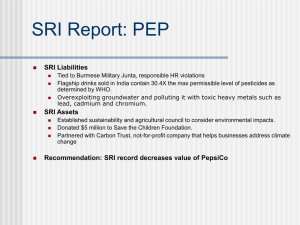

Primary Question for PepsiCo Can PepsiCo continue their strong performance in the North America market, and also strengthen their presence in developing markets, while at the same time responding to changes in consumers’ preferences? Secondary Questions • • • What has PepsiCo done in the past to grow? How is Pepsi structured and what are the relative performances of those divisions? How are those divisions performing in various markets? • How is Pepsico performing in the snack foods industry? Keys to PepsiCo’s Success and Growth Soft Drinks Strategic Acquisition Complementary Goods Salty Snacks Ability to Build Strong Brands Strong Relationships with Retail Partners Growth PepsiCo Growth • PepsiCo’s growth strategy has been mainly external focused. – Several successful mergers and acquisitions over the years. • Adapting to changes in the external environment are critical to sustainable growth. External Environment: PEST Category Political Economic Social Technological Threats/Opportunities Ranking (1-5) FTC stipulations to merger of Quaker Oats Threat- not allowing PepsiCo to utilize Power of One Strategy with Gatorade. May impact their ability to acquire other companies in future. 4 Rising incomes in BRIC countries Opportunity – increase in discretionary income will raise spend on drinks and snacks 5 Change in customer preferences to healthier food and drink options in developed countries Threat to many of PepsiCo’s existing products. Opportunity for Quaker brands and new product innovation 4 IT improvements in distribution network. Opportunity – improved relationships with retailers, less chance of stock outs. 3 Issue US Liquid Refreshment Market Beverage Share of Total US Beverages Volume Growth Rate Pepsi Brand Pepsi Market Share Pepsi Market Position Carbonated Soft Drinks 48% -2.6% Several 31.1% #2 behind Coke (41.6%) Bottled Water 29% 6.9% Aquafina 15% #1 Fruit Beverages 13% -3.3% Tropicana 30% #1, Coke Brand Minute Maid #2 at 25% Sports Drinks 4.4% 2.5% Gatorade 76% #1 RTD Tea/Coffee 3% 14.3% Lipton and Frappuccino 39.5% #1, 4x Coke’s Nestea Enhanced Water 1.7% 30.5% Propel 40% #1 Energy Drinks 1% 24.6% SoBe Negligible Negligible (Red Bull #1 at 40%) Pepsi trailing Coke in large but negative growth carbonated soft drinks. Also little presence in high growth energy drinks. Possibly look to acquire Red Bull. Pepsi dominating in the rapidly growing non-carbonated beverage categories which position it well in North American market as consumers look for healthier drink options. PepsiCo International Markets Country Country/Region Carbonated Market Share Salty Snack Market Share Carbonated Soft Drinks per month Salty Snacks per month India 49% 46% United States 60 servings 6.6 servings Russia 24% 43% Other Developed 23 servings 4.0 servings China 36% 16% Brazil N/A 46% Developing 6 servings Mexico N/A 75% 0.4 servings 1. Great opportunity for growth in both developed and developing international markets, especially Brazil and China. Strong market share in many today, with exception of China 2. Pepsi should be focused on growing market share in China Salty Snacks, predicted to be largest market by 2010. 3. Power of One strategy could play well in international markets. Quaker Foods Brands Weak International Sales ($500 million total, 75% from 6 countries) Strong sales (over ½) in better-for-you and good-for-you products With exception of Gatorade, Quaker brands have limited success internationally. Opportunity for growth in US and developed countries as consumers shift to eating healthier. Quaker Foods North America Product Volume Growth Rate Market Share Market Position Quaker Oats N/A 58% #1 Quaker Ready to Eat Cereal Mid single digits 14% #3 behind Kellogg’s (30%) and General Mills (26%) Aunt Jemima Slight decline N/A #1 Rice-A-Roni Double digit decline 33% N/A Many Quaker Foods brands have strong market share, but not in the salty food or beverage markets. Majority of brands compete in Ready to Eat Cereal space, against wellestablished competitors Kellogg’s and General Mills. PepsiCo Organizational Structure 2007 PepsiCo Inc. Frito Lay North America (FLNA) PepsiCo Beverages North America (PBNA) Quaker Foods North America (QFNA) PepsiCo International (PI) 29% Net Revenue 26% Net Revenue 5% Net Revenue 40% Net Revenue 36% Operating Income 28% Operating Income 7% Operating Income 29% Operating Income 28% Capital Expenditures 20% Capital Expenditures 2% Capital Expenditures 50% Capital Expenditures 22% Total Assets 24% Total Assets 3% Total Assets 50% Total Assets PepsiCo after 2008 Realignment PepsiCo Inc. PepsiCo Americas Beverages PepsiCo Americas Foods Frito Lay North America PepsiCo International UK and Europe Quaker Foods North America Middle East Latin America Foods Africa and Asia Appears goal of realignment of divisions was to put more focus on growth outside North America. Question we have is did PepsiCo go far enough? Does not appear to be much of a change. Question Facing PepsiCo DOES NonCarbonated Drinks Healthy Snacks Complementary Goods How is Pepsico Performing in the Snack Foods Industry? Salty Snack Food Industry – Key Trends Convenience • Due to these 3 key industry trends, Pepsico started developing new flavors of salty snacks, using healthier oils in chips, & packaging snacks in smaller bags. •Pepsico should differentiate its products while staying committed to the industry trends. Indulgent Snacking Growing Awareness of nutritional content Frito Lay’s Commitment to Industry Trends • Eliminating trans fats & acquiring Flat Earth showed FLNA’s commitment to the publics growing awareness of nutritional content. •Introduction of new chip flavors was a commitment to the indulgent snacking trend. Acquired Flat Earth (fruit & vegetable snacks) Eliminated Trans Fats from popular chips (Lays, Fritos, Cheetos, Doritos, etc.) •Did these commitments to industry trends help or hurt Pepsico’s market share of convenience food? Introduced indulgent Doritos & Sun Chips flavors. U.S. Convenience Food Market Share • Pepsico is the leading manufacturer in the market due to its commitment to industry trends. •Their only close competition seem to be from Kraft Foods & Hershey. But you cannot count out the 37% of the market that “other” manufacturers currently have. 21% 37% 12% 9% Pepsico Kraft Foods Hershey Kellogg Master Foods General Mills P&G Private Label Others Pepsico’s International Salty Snack Food Market Share by Country Country 2006 % of Market Share 2010 Market Sizes (projected) Mexico 75 #4 Holland 59 South Africa 57 Australia 55 Brazil 46 India 46 United Kingdom 44 #3 Russia 43 #5 Spain 41 China 16 #1 or #2 #1 or #2 There is significant growth opportunity in international markets. Pepsico will need focus on gaining more market share in the top 3 markets in 2010. They will also benefit from an increase in servings per month in both developed and developing international countries.