Presentation

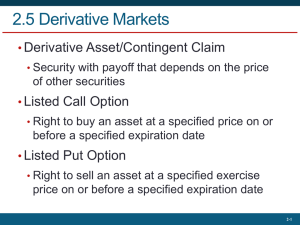

advertisement

Understanding Derivative – Beyond Accounting Presented By Safwat Khalid Session Objective • Understand characteristics of different types known derivative tools and its application • How derivative instrument can be an effective tool to manage risk and enhance our investment portfolio returns • Provide sufficient understanding such that the user can make an informed and intelligent decision regarding the role of derivatives in a particular situation and to identify the need for better understanding before proceeding Topic Coverage • • • • • • WHAT IS DERIVATIVE TYPES OF DERIVATIVE DERIVATIVE UTILITY DERIVATIVE FUNDAMENTALS VALUATION BASICS DERIVATIVE MARKET Forward Ahmad is the owner of Healthy Hen Farms Risk – Price Volatility of the chicken market. Bird Flu Scare Enter into Forward Contract. Pay off MP > SAR 10 - the investor will get the benefit as he will be able to buy the birds for less than market cost and sell them on the market at a higher price for a gain. MP< SAR 10 - Ahmad will get the benefit because he will be able to sell his birds for more than the current market price. Decision to mitigate risk Terms of the contract The investor agrees to pay SAR 10 per bird when the birds are ready for slaughter in six months' time Summary By hedging with a future contract, Ahmad is able to focus on his business and limit her worry about price fluctuations Swap Ahmed aspiration is to grow the business Ahmed obtained huge variable interest loan for acquiring small farms Acquire loan SAR 50 million at 3 months Sibor. Interest payment quarterly Risk – Anticipates increase in varaible rate Decision to mitigate risk Enter into Swap agreement with dealer or borrower who has similar terms except interest payments is fixed Pay off Sibor > Fixed – Ahmad will benefit because his cost of fund is less than the market Sibor < Fixed – Dealer or other borrower will benefit because his cost is less than fixed. Terms – Ahmed - Pay Fixed Rec. Sibor Dealer – Rec Fixed Pay Sibor Options Healthy Hen Farms (HEN) is a publicly traded corporation Decision to mitigate risk Sami is one of the major investor in HEN invested SAR 1 million Enter into Option contract with Option writer Pay off Stock price > SAR 25 – Sami will not be exercise option. Stock price < SAR 25 – Sami will exercise option . Similar to insurance protection Risk – Sami is nervous as he anticipates dip in stocks because of bird flu scare Terms – Sami – pay option premium Writer – protects Sami from loss if Stock price fall below SAR 25. (Put Option) WHAT IS DERIVATIVE A derivative is a contract between two or more parties whose value / payoff is based on an agreed-upon underlying financial instrument, index or security. Common underlying instruments include bonds , commodities, currencies, interest rates, market indexes and stock A derivative's value is based on an asset, but ownership of a derivative doesn't mean ownership of the asset. Types of Derivatives Most common derivative products are • Forward / Future Contract • Options • Swaps • Credit Derivative Derivative Utility Derivatives can be used either • for risk management (i.e. to “hedge” by providing offsetting compensation in case of an undesired event, “insurance”) or • for speculation (i.e. making a financial "bet"). Enhance returns Risk Management Derivatives are used for different type of risk management purpose. It includes • • • • Currency Risk Interest Rate Risk Price Risk i.e stocks, commodities Credit Risk Market Risk Currency Risk • A form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged. • For example, if you are a U.S. investor and you have stocks in Canada, the return that you will realize is affected by both the change in the price of the stocks and the change in the value of the Canadian dollar against the U.S. dollar. So, if you realize a 15% return in your Canadian stocks but the Canadian dollar depreciates 15% against the U.S. dollar, this will amount to no gain at all. Interest Rate Risk • The risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape of the yield curve or in any other interest rate relationship. Such changes usually affect securities inversely and can be reduced by diversifying (investing in fixed-income securities with different durations) or hedging (e.g. through an interest rate swap). • Interest rate risk affects the value of bonds more directly than stocks, and it is a major risk to all bondholders. As interest rates rise, bond prices fall and vice versa. The rationale is that as interest rates increase, the opportunity cost of holding a bond decreases since investors are able to realize greater yields by switching to other investments that reflect the higher interest rate. For example, a 5% bond is worth more if interest rates decrease since the bondholder receives a fixed rate of return relative to the market, which is offering a lower rate of return as a result of the decrease in rates. Price Risk • The risk of a decline in the value of a security or a portfolio. Price risk is the biggest risk faced by all investors. Although price risk specific to a stock can be minimized through diversification, market risk cannot be diversified away. Price risk, while unavoidable, can be mitigated through the use of hedging techniques • Price risk also depends on the volatility of the securities held within a portfolio. For example, an investor who only holds a handful of junior mining companies in his or her portfolio may be exposed to a greater degree of price risk than an investor with a well-diversified portfolio of blue-chip stocks. Investors can use a number of tools and techniques to hedge price risk, ranging from relatively conservative decisions such as buying put options, to more aggressive strategies including short-selling and inverse ETFs. Credit Risk • The risk of loss of principal or loss of a financial reward stemming from a borrower's failure to repay a loan or otherwise meet a contractual obligation. Credit risk arises whenever a borrower is expecting to use future cash flows to pay a current debt. Investors are compensated for assuming credit risk by way of interest payments from the borrower or issuer of a debt obligation. • The higher the perceived credit risk, the higher the rate of interest that investors will demand for lending their capital. Credit risks are calculated based on the borrowers' overall ability to repay. This calculation includes the borrowers' collateral assets, revenue-generating ability and taxing authority (such as for government and municipal bonds). Credit risks are a vital component of fixed-income investing, which is why ratings agencies such as S&P, Moody's and Fitch evaluate the credit risks of thousands of corporate issuers and municipalities on an ongoing basis. Risk Management Risk Derivatives Currency Risk • Forward • Futures • Options Interest Rate Risk • • • • Price Risk • Forward • Future • Options Credit Risk • Credit Derivative (Credit Options, Credit Default Swaps) Equity Risk • Future • Options • Equity Swaps Forward rate agreement Future contracts Swaps Options (Swaptions, Call, Floor, Collar) Speculation & Arbitrage Speculation Derivatives can be used to acquire risk, rather than to hedge against risk. Thus, some individuals and institutions will enter into a derivative contract to speculate on the value of the underlying asset, betting that the party seeking insurance will be wrong about the future value of the underlying asset. Speculators look to buy an asset in the future at a low price according to a derivative contract when the future market price is high, or to sell an asset in the future at a high price according to a derivative contract when the future market price is low. Arbitrage Locking the profit by simultaneously entering into contacts in multiple markets i.e. buy instrument in one market and sell in another market. Benefit from the spread in the markets. FUTURES - FUNDAMENTALS • A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price. • These derivatives are zero sum game, yet they allow a firms to hedge risk for which they have no expertise. • The value of a forward position at maturity depends on the relationship between the delivery price ( K) and the underlying price (ST) at that time. • For a long position this payoff is: ST - K • For a short position, it is: K - ST FORWARDS VS FUTURES Forwards • A forward contract is a customized contract between two entities, where settlement takes place on a specific date in the future at today's preagreed price. Futures • A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price. Futures contracts are special types of forward contracts in the sense that the former are standardized exchange-traded contracts. Primary difference Forwards and Futures • Forwards can be tailored to meet the specific needs of counter parties but have higher default risk and less liquidity. • Futures are standardized, so they are less likely to be exactly what two parties need; however, they trade on exchange, so the risk of default is minimal. Future Payoff Future Long Position When an investor goes long - that is, enters a contract by agreeing to buy and receive delivery of the underlying at a set price - it means that he or he is trying to profit from an anticipated future price increase. Future Short Position A speculator who goes short - that is, enters into a futures contract by agreeing to sell and deliver the underlying at a set price - is looking to make a profit from declining price levels. By selling high now, the contract can be repurchased in the future at a lower price, thus generating a profit for the speculator. Payoff Diagram Short Future P&L = K - St K 0 Price Long Future P&L = St - K K 0 Price Strategy for Hedging Currency Position Contractual Agreement Position Action Receiving foreign currency Long Sell Forward Contract Paying foreign currency Short Buy Forward Contract Future Strategies includes • To achieve target portfolio duration for bonds (Duration Management) and Beta For Stocks • Creating synthetic position such as convert long stock position into synthetic risk free investment or vice versa • Adjust the allocation of a portfolio across equity sector • Pre -investing using future OPTION - FUNDAMENTALS An option gives the buyer the right to buy from or sell to the writer a designated futures contract at the strike price at any time during the life of the option • Options are of two types - calls and puts. • Calls give the buyer the right but not the obligation to buy a given quantity of the underlying asset, at a given price on or before a given future date. • Puts give the buyer the right, but not the obligation to sell a given quantity of the underlying asset at a given price on or before a given date. Option Payoff Long Option Payoff The loss for the buyer of an Option is limited to the extent of premium paid by him for the right. This loss would accrue in the event of the option not being exercised by the buyer. The profit for the buyer would be dependant on the asset price in relation to the Strike rate. Short Option Payoff The seller of the option would receive an upfront premium which would be his gain from the option. However, in the event of the option being exercised by the buyer, the loss accrues would be to the extent of the difference between the asset price and the strike rate. Option Payoff - Diagram Put Option Call Option K 0 K St 0 St Option Strategies also includes • • • • • • • Covered Call Protective Put Bull Call Spread Bear Call Spread Bear Put Spread Long Straddle Butterfly Spread SWAP - FUNDAMENTALS • A swap is an agreement between two parties to exchange sequences of cash flows for a set period of time. • At the time the contract is initiated, at least one of these series of cash flows is determined by a random or uncertain variable, such as an interest rate, foreign exchange rate, equity price or commodity price. • Swaps help companies hedge against interest rate exposure by reducing the uncertainty of future cash flows. • Swapping allows companies to revise their debt conditions to take advantage of current or expected future market conditions. • Currency and interest rate swaps allow companies to take advantage of the global markets more efficiently by bringing together two parties that have an advantage in different markets. • There is some risk associated with the possibility that the other party will fail to meet its obligations, the benefits that a company receives from participating in a swap far outweigh the costs. Cash Flow and Market Value Risk Consideration • Cash flow risk is reduced by entering the swap because the uncertain future floating rate receipts on the investment are essentially converted to fixed receipts that can be more easily planned and budgeted. However, the low duration of the floating rate instrument is now converted to higher duration of fixed rate instrument. The market value will now fluctuate more as interest rate change • Duration - A measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Rising interest rates mean falling bond prices, while declining interest rates mean rising bond prices. The bigger the duration number, the greater the interest-rate risk or reward for bond prices. Swap Strategies includes • • • • Interest Rate swap Currency Swap Equity Swaps Commodity Swaps Credit Derivative Credit risk can be sold to another party. In return for a fee, another party will accept the credit risk of an underlying financial asset or institution. This party, called the credit protection seller, may be willing to take on this risk for several reasons. Perhaps the credit protection seller believes that the credit of an issuer will improve in a favorable economic environment because of a strong stock market and strong financial results. There are three types of credit risk: default risk, credit spread risk, and downgrade risk. • Default risk is the risk that the issuer may fail to meet its obligations. • Credit spread risk is the risk that the spread between the rate for a risky bond and the rate for a default risk-free bond (like U.S. treasury securities) may vary after the purchase. • Downgrade risk is the risk that one of the major rating agencies will lower its rating for an issuer, based on its specified rating criteria Credit Derivative Products • • • • Binary Credit options Credit Spread Option Credit Forward Credit Default Swaps Future / Forward Valuation Basics As per no arbitrage principle – the forward price determined makes the values of long and short position zero at contract initiation. A cash and carry arbitrage consist of buying the asset, storing the asset and selling the asset at future price when the contract expires. General form for calculating forward contracts • 𝐹𝑃 = 𝑆𝑜 (1 + 𝑅𝑓)𝑇 𝐹𝑃 • So = (1+𝑅𝑓)𝑇 Cash – and – carry Arbitrage At initiation of the contract • Borrow money for the term of the contract at market interest rates. • Buy the underlying asset at the spot price • Sell (short) a future contract at the current future price • If Future contract is equal to principal plus interest then there is no arbitrage. • If future contract is above the principal plus interest then there is opportunity of gain Bonds Forward without coupon Long position at initiation So - 𝐹𝑃 (1+𝑅𝑓)𝑇 During the Life of contract St - 𝐹𝑃 (1+𝑅𝑓)𝑇−𝑡 At expiration at initiation long and short position value is zero St - FP During the Life of contract At expiration (So – PVC) 𝐹𝑃 (1+𝑅𝑓)𝑇 (St – PVC) - Long position at initiation (So – PVD) - During the Life of contract (St – PVD) 𝐹𝑃 (1+𝑅𝑓)𝑇−𝑡 St - FP Currency Forward at initiation long and short position value is zero Currency Forward Contract (𝐼+𝑅𝑑𝑐)𝑇 So x (1+𝑅𝑓𝑐)𝑇 During the Life of contract 𝑆𝑡 (1+𝑅𝑓𝑐)𝑇−𝑡 𝐹𝑡 (1+𝑅𝑑𝑐)𝑇−𝑡 𝐹𝑃 (1+𝑅𝑓)𝑇−𝑡 St - FP at initiation long and short position value is zero 𝐹𝑃 (1+𝑅𝑓)𝑇 At expiration Bonds Forward with coupon Long position at initiation Equity Forward with dividends At expiration St - FT - at initiation long and short position value is zero Future / Forward Valuation Basics Future Contract Value Risk free rate Contract period Current price after 9m 101.5 − 104 3 1.04 12 SAR 104/4% 1 year SAR 101.5/- = −𝑆𝐴𝑅 1.4852 Short is in the money Swap Valuation Basics • • • • PV of FRA must be equal to Swap Fixed Rate Illustration Floating Rate Bond 4 year, Par Value SAR 1,000 Both Fixed and Floating rate notes have same par values to replicate the swap and principal values match at maturity • For Swap to have zero value at initiation, the notes must have same market price • 1000 = 𝐶 𝐶 𝐶 𝐶 1,000 + + + + 1+𝑅1 1+𝑅2 1+𝑅3 1+𝑅4 1+𝑅4 • C= 1 1+𝑅4 1 1 1 1 + + + 1+𝑅1 1+𝑅2 1+𝑅3 1+𝑅4 • C= 1 1+𝑅4 1 1 1 1 + + + 1+𝑅1 1+𝑅2 1+𝑅3 1+𝑅4 1− ∗ 1,000 1− • Value of Pay Fixed = PV (Floating) – PV (Fixed) • Value of Pay Fixed = PV (Fixed) – PV (Floating) SWAP Valuation Basics Notional $ 30,000,000 Term 1 year quarterly payment, Fixed Pay and receive variable Fixed Rate pay 6.052% Variable rate at initiation 5.5% 30 days passed PV factor 60 day Libor 6.0% 0.99010 150 day Libor 6.5% 0.97363 240 day Libor 7.0% 0.95541 330 day Libor 7.5% 0.93567 Quarterly payment per $ 0.06052 * 90 = $0.01513 360 Quarterly payment per $ 0.05500 * 90 = $0.01375 360 Days Cash Flows Discount Present Value 90 $ 0.01513 0.99010 $ 0.014980 180 $ 0.01513 0.97363 $ 0.014731 270 $ 0.01513 0.95541 $ 0.014455 360 $ 1.01513 0.93567 $ 0.949827 Total $ 0.993993 $ 0.01375 0.99010 0.0136138 $ 1.00000 0.99010 0.9901000 Total 1.0037138 Fixed Variable 90 Fixed Rate payer Swap Value 1.0037138 – 0.993993 $ 0.0097208 Swap Value $ 30,000,000 * $ 0.0097208 $ 291,624 Option Valuation Basics • intrinsic value of in-the-money options = the payoff that could be obtained from the immediate exercise of the option • for a call option: stock price – exercise price St • • for a put option: exercise price – stock price 𝑿 (𝟏+𝑹𝒇)𝑻−𝒕 𝑿 (𝟏+𝑹𝒇)𝑻−𝒕 - St the intrinsic value for out-the-money or at-the money options is equal to 0 • time value of an option = difference between actual call price and intrinsic value • as time approaches expiration date, time value • goes to zero Derivative Market – Brief Introduction Financial derivatives have emerged as one of the biggest markets of the world during the past two decades. History – 1848 - A group of Chicago businessmen formed the Chicago Board of Trade (CBOT) in 1848. The primary intention of the CBOT was to provide a centralized location (which would be known in advance) for buyers and sellers to negotiate forward contracts. 1865 - The CBOT went one step further and listed the first ‘exchange traded” derivatives contract in the US. These contracts were called ‘futures contracts”. 1919 - Chicago Butter and Egg Board, a spin-off of CBOT, was reorganized to allow futures trading. Its name was changed to Chicago Mercantile Exchange (CME). Initially, the Chicago Butter and Egg Board traded only two types of contracts, butter and eggs. Over several decades, it evolved into the Chicago Mercantile Exchange (CME or the "Merc") which now trades futures contracts and options contracts on over 50 products, from pork bellies to eurodollars and stock market indices. 1972 - The first exchange-traded financial derivatives emerged due to the collapse of fixed exchange rate system and adoption of floating exchange rate systems. To help participants in foreign exchange markets hedge their risks under the new floating exchange rate system. 1973 - The Chicago Board of Trade (CBOT) created the Chicago Board Options Exchange (CBOE) to facilitate the trade of options on selected stocks Mid 80’s - Financial futures became the most active derivative instruments generating volumes many times more than the commodity futures. Index futures, futures on T-bills and Euro- Dollar futures are the three most popular futures contracts traded today. Other popular international exchanges that trade derivatives are LIFFE in England, DTB in Germany, SGX in Singapore, TIFFE in Japan, MATIF in France, Eurex etc. Thirty Years of Financial Deregulation Transformed the World Economy into a Global Financial Casino • In 1970, about 95% of the capital in international exchanges was related to the real economy in some fashion, (that is they were either investments or trade of goods and services). • By 1990, however, the proportion of foreign exchange transactions that involved speculations or short-term investments reached about 98%, while only 2% involved the exchange of goods and services Warren Buffett once called derivatives, "financial weapons of mass destruction," Like all other financial instruments, derivatives have their own set of pros and cons, but they also hold unique potential to enhance the functionality of the the overall financial system Types of Derivative Contracts Underlying Asset Type of Derivative Contract Exchange Traded Futures Exchange Traded Options Equity Index Future Stock Future Interest Rate Interest rate Options on futures future linked to MIBOR Credit Bond Future Foreign Exchange Currency futures Index Option Stock Option Option Future on OTC Swap OTC Forward OTC option Equity Swap Back to Back repo Stock options agreement Warrants Interest rate swaps Forward agreement Bond Credit Default Swap Total Return Swap Repurchase agreement Credit option Currency forward Currency option Option on currency Currency swap futures rate Interest rate cap, floors & collars. Swaptions default Should My Company Use Derivatives? • Answer – Yes, provided one fully understand the complexity of financial derivatives contracts and the accompanying risks. • It provides risk reduction efficient mechanism • It provides value enhancing opportunities i.e increased returns. • It provides flexibility to manage different exposure i.e. it can be used with respect to commodity price, interest, exchange rates, and equity price. How do I buy and sell? • Buying or selling contracts can only be done through a financial intermediary. • Financial intermediaries meeting regulatory requirements who are member of an exchange can enter clients order into the market. • Before selecting an intermediary to process your order, review both fees structure and the services offered. It is vitally important to have real time information and tools to complete transactions completely and swiftly Contract Execution Flow THANK YOU