Building Great Boards, One 2x4 at a Time

advertisement

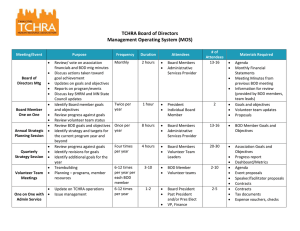

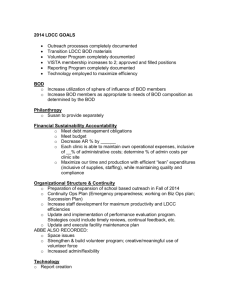

Dave Karlman DePrima Ventures dk@deprimaventures.com davekarlman.com 858.722.2232 2 Topics X 4 Slides BoA= Why, When and How BoD= 2 Board of Advisors 3 Why 1. Codify “strategies” 2. Creates safe harbor 3. Judged by the company you keep when raising capital Whe n 1. After PFF round but before seed round 2. Validation of business and revenue model 3. After creditability in the community- Meaningful work 4. Phase 1 search for generalists; Phase 2 search for vertical expertise 5. 10/10 rule How 1. Leverage the network +120 2. Accepted library of documents 3. Careful with on-line tools Board of Directors 4 Why 1. Life changes- Protect stakeholders/shareholders 2. BoD is the governing body 3. It’s not about control until 2x4s are nailed together incorrectly and the house is collapsing. 4. All major decisions ratified by the Board. Whe n 1. 2. 3. 4. 5. How 1. Directors are elected subordinated to the objectives of the organization 2. Professional organizations 3. Rules-of-engagement RR of Driven by capital infusion Seed and going forward Fixed number; negotiated Never invite FF on BoD Become a student- protocols 5 How To Think About It Early Stage: BoA is more helpful than a BoD Keep the primary objective in mind • Build BoA subordinated to the goals and objectives Cash compensation happens in BoD and only after you’re swimming in cash and usually never in a non-profit Equity- BoA- +/- 2%; BoD- +/-5% plus cash BoA- Ph. 1-Generalists: Ph. 2- Vertical expertise 6 Dave Karlman DePrima Ventures dk@deprimaventures.com davekarlman.com 858.722.2232