The long roots of the present crisis

advertisement

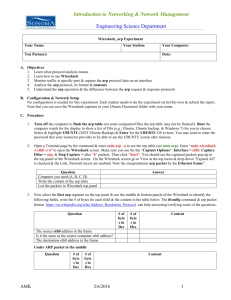

The long roots of the present crisis By Michael Roberts and Guglielmo Carchedi HM conference November 2013 US average rate of profit • Ten-year rolling average indexed 1947=100 210 200 190 180 170 160 150 140 2011 2008 2005 2002 1999 1996 1993 1990 1987 1984 1981 1978 1975 1972 1969 1966 1963 1960 1957 1954 1951 130 US average rate of profit 1982-2011 (%) 25.5 25.0 24.5 24.0 23.5 23.0 22.5 22.0 6% fall in ARP; 5% fall in rate of surplus value; and 3% rise in the organic composition of capital 19% rise in ARP; 24% rise in rate of surplus value; and 6% rise in the organic composition of capital 21.5 21.0 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 US: rate of surplus value and the organic composition of capital 0.63 1.44 1.42 0.61 Rate of surplus value 1.40 0.59 Organic comp of capital (HC) -RHS 1.38 0.57 1.36 0.55 1.34 1.32 0.53 1.30 0.51 1.28 0.49 1.26 0.47 1.24 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 World* and G7 average rate of profit (%) indexed 1963=100 100 95 * World = G7 plus BRICS 90 85 80 World ave 75 G7 ave 1963 1965 1967 1969 1971 1973 1975 1977 1979 1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 70 US average rate of profit for the productive sector and wage/profit ratio (%) 13.0 7.0 12.0 6.5 11.0 6.0 5.5 10.0 5.0 9.0 4.5 8.0 4.0 7.0 3.5 6.0 3.0 5.0 2.5 4.0 2.0 2010 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 1959 1956 1953 1950 1947 ARP Wages/profits RHS US corporate profits, real investment and GDP Q1-2001 to Q2-2012, $bn 2100 1900 1700 14000 Mass of profits peaks in mid-2006 Investment and GDP peak two years later 1500 13500 13000 1300 1100 900 700 Corporate profits Investment Profits turn up in Q3'08 and investment follows one year later GDP - RHS 500 12500 12000 11500 Jan-12 Jul-11 Jan-11 Jul-10 Jan-10 Jul-09 Jan-09 Jul-08 Jan-08 Jul-07 Jan-07 Jul-06 Jan-06 Jul-05 Jan-05 Jul-04 Jan-04 Jul-03 Jan-03 Jul-02 Jan-02 Jul-01 Jan-01 The Marxist multiplier STATE-INDUCED REDISTRIBUTION CAPITAL FINANCED (if Labour financed, wages fall and so does consumption, the opposite of Keynesian objective) SECTOR I (Means of production) Numerator falls, denominator rises, labour consumption rises, sector rate of profit falls STATE-INDUCED INVESTMENTS CAPITAL FINANCED OR LABOUR-FINANCED SECTOR II (consumption goods) SECTOR I (Producer of public works) Numerator unchanged, denominator rises, labour consumption rises, sector rate of profit falls State pays for public works valued at S - p, where p is profit for Sector I SECTORS I AND 2 NUMERATOR AND DENOMINATOR UNCHANGED CONSUMPTION RISES, ARP FALLS SECTOR II (rest of economy) State taxes profits in sector 2 which fall by S State receives public works valued at S - p + P* (new value) PROFITS FALL BY S - p , NUMERATOR OF ARP FALLS Sector I invests in more means of production and labour for public works FINAL OUTCOME FOR ARP DEPENDS ON MARXIST MULTIPLIER 1. Organic composition of capital unchanged; ARP unchanged 2. Organic composition of capital rises, ARP falls 3. Organic composition of capital falls, ARP rises - but only because inefficient capitals benefit, lowering future productivity and growth Global liquidity as % of world GDP 1989-2011 400 350 Derivatives (market value) 300 Securitised debt 250 Bank credit 200 Power money 150 100 50 0 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 Greek rate of profit and real investment since 2000 (indexed 2000=100) 160 150 140 130 120 110 ROP 100 Real inv 90 80 70 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 UK rate of profit and business investment since 2006 16.0 15.0 14.0 39000 Net return on capital (%) Business investment - RHS £bn 37000 35000 33000 13.0 31000 12.0 29000 11.0 27000 10.0 25000 Q2-12 Q1-12 Q4-11 Q3-11 Q2-11 Q1-11 Q4-10 Q3-10 Q2-10 Q1-10 Q4-09 Q3-09 Q2-09 Q1-09 Q4-08 Q3-08 Q2-08 Q1-08 Q4-07 Q3-07 Q2-07 Q1-07 Q4-06 Q3-06 Q2-06 Q1-06 ARP (%), OCC and ROSV (ratios) in Argentina, 1963-2007 6.0 45.0 OCC 5.0 ROSV ARP -RHS 40.0 4.0 35.0 3.0 30.0 2.0 25.0 1.0 0.0 20.0 63 65 67 69 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 Sources and methods • • • • • • • • • • • • Figure 1. The ARP has been smoothed into a ten-year rolling average. Figure 2. The US ARP measure is based on the whole economy. Profits = net national product (BEA, NIPA table XX) less employee compensation (BEA NIPA table 6.2) Constant capital = historic cost net fixed private non-residential assets (BEA, NIPA table 4.1) Variable capital = employee compensation (BEA NIPA table 6.2) Figure 3. The rate of surplus value =Profit divided by variable capital; organic composition of capital = constant capital divided by variable capital Figure 4. Data sources and methods can be found in Roberts M (2012). Figure 5. Profits are from NIPA tables 6.17A, 6.17B, 6.17C, 6.17D: corporate profits before tax by industry. In the first three tables, utilities are excluded. Fixed assets. The definition is “equipment, software, and structures, including owner-occupied housing” (http://www.bea.gov/national/pdf/Fixed_Assets_1925_97.pdf). The data considered in this paper comprise agriculture, mining, construction, and manufacturing (but not utilities, see above). Fixed assets are obtained from BEA, Table 3.3ES: Historical-Cost Net Stock of Private Fixed Assets by Industry [Billions of dollars; yearend estimates]. Wages for goods producing industries and are obtained from NIPA Tables 2.2A and 2.2B: wages and salaries disbursements by industry [billions of dollars]. Employment in goods producing industries is obtained from: US Department of Labor, Bureau of Labor Statistics, series ID CES0600000001. The money ARP is computed by dividing profits of a certain year by constant and variable capital of the preceding year conform the temporal approach. It is computed for the productive sectors. The best approximation to that are the goods producing industries. These are defined as agriculture, mining, utilities, construction and manufacturing. However, utilities are disregarded (see above). N.B. Constant capital includes only fixed and not circulating capital because of difficulties of estimating the latter on the basis of the available statistics. The inclusion of circulating capital would only depress the ARP further. See footnote 4 above.