UC Retirement Planning

advertisement

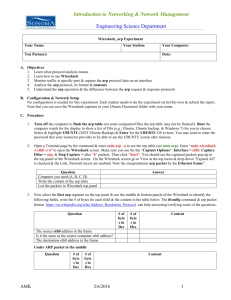

Welcome! The ARP and Supplemental Savings Susan Ratto, UC Retirement Plan Specialist Are you part-time? You must be full-time, 100% FTE, in order to enroll in the Alternative Retirement Plan (ARP). How does the ARP Work? You and UC contribute to a 401a. This is not a STRS plan. Health insurance and disability benefits are not included. The UC contributions are 100% vested and portable. You open an account with a vendor in addition to completing a Retirement Plan Election Form. There is a deadline of 120 days to elect the ARP. You may change vendors if you choose to do so. How much is contributed? Your Contribution 11% Increasing 1% yr UNTIl 2016 UC Contribution 9.5% to ARP and 4.5% to STRS Mitigating rate applies to ARP and STRS Defined Contribution Health Insurance Access is available for the eligible employees in the Defined Benefit Plan and the Combined plan, currently after 15 years of service credit. Access is not available for the STRS Defined Contribution Plan or the ARP. You have 120 days to elect the ARP! Submit the Retirement Election Form to HR before day 121! How do you elect the ARP? There are two steps. 1. Notify UC of your election 2. Open your 401a account with your vendor Note: You will default to the STRS Traditional plan until your ARP election has been processed. The STRS contributions will be sent to your ARP account once it is open. 1. UC Enrollment in the ARP Complete the Retirement Plan Election form which can be found at www.uc.edu/hr under forms. You must submit a hard copy with your signature. A copy or scan will not be acceptable. 2. Submit the completed form to Human Resources at ML 0039. 1. 2. VENDOR ARP ENROLLMENT 1. Select an ARP vendor: ARP vendors will contact you and you may also contact them. The vendors will meet at your convenience. 2. Open an account that can receive your contributions from UC. Additional Savings Options You cannot increase your contributions to OPERS or your ARP. However, you may open an additional 403b or 457 account for supplemental savings. How do you open a 403b account? 1. Complete the Salary Reduction Form at www.uc.edu. 2. Meet with one of 14 vendors to open an account. How do you open a 457 account? Contact Tom Bugher, CRC Ohio Deferred Compensation 1-877-644-6457 www.Ohio457.org Thank you for attending. Sue Ratto: Susan.ratto@uc.edu 558-1005