Insight into the Aged Care Reforms

advertisement

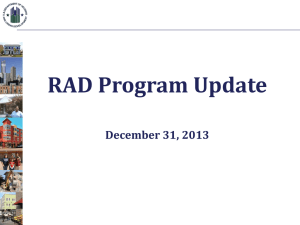

Insight into the Aged Care Reforms Linda Murray Insight into the Aged Care Reforms Agenda New Terminology Implications for couples Trigger Figures Over payment and underpayments Supported / Assisted Financial Rules Sales Ideas Policies and Procedures Prudential Requirements Insight into the Aged Care Reforms What is the new Terminology? Current New Acronym Accommodation Bond Refundable Accommodation Deposit RAD Periodic Payment Daily Accommodation Deposit DAP Income Tested Fee Means Tested Care Fee MTCF Lump Sum amount Paid by Supported Residents Refundable Accommodation Contribution RAC Daily Contribution made by Supported Residents Daily Accommodation Contribution DAC Insight into the Aged Care Reforms What are the Payment Options? Payment Options (Non Supported) Full RAD RAD & DAP (Combination) Full DAP RAD with a DAP drawdown RAD and other fees drawdown Payment Options (Supported) Full DAC Part RAC & DAC DAC drawdown from the RAC Insight into the Aged Care Reforms Your Price is Your Price Insight into the Aged Care Reforms New Financial Opportunity with residents that have reduced assets You are allowed to charge a RAD greater than their assets “Your Price is Your Price” Other than “Supported residents” you can ask everyone to pay your nominated RAD price Insight into the Aged Care Reforms RAD Required $400,000 Cost to Consumer Pre July 2014 Residents Total Assets Bond Paid Retention 01.07.13 $200,000 $155,000 $3,972 Indicative Two Year Estate Value $192,056 Assumptions: Residents left with $45,000 in assets Retention is $331 per month Cost to Consumer From 1st July 2014 Residents Total Assets RAD Paid $200,000 $155,000 DAP on $245k ($155k - $400k) $9,753 Indicative Two Year Estate Value $165,363 Assumptions MIR is 6.63% Retention is not taken from July 2014 Residents left with $45,000 in assets Projection is using compound interest on DAP Insight into the Aged Care Reforms Important Information when talking with families If the family decides to deduct their DAP from their RAD you are allowed to charge compound interest; subsequently their DAP will increase monthly. Let families know this or they may object once they see the RAD balance declining and the DAP value increasing! I recommend you provide an information sheet Insight into the Aged Care Reforms What is your preferred level of “not fully refundable”, Refundable Accommodation Deposit? Published Price RAD Paid DAP Deduction $400,000 $50,000 $63.57 6 Months $38,236.05 12 Months $26.076.71 18 Months $13,508.67 2 years $518.21 MIR used is 6.63% Compound Interest Applied Does not take into account other deductions such as the Means Tested Care Fee Insight into the Aged Care Reforms What about a higher “not fully refundable”, Refundable Accommodation Deposit? Published Price RAD Paid DAP Deduction $400,000 $100,000 $54.49 6 Months $89,916.62 12 Months $79,494.32 18 Months $68,721.72 2 years $57,587.03 3 Years $34,182.33 4 Years $9,177.87 MIR used is 6.63% Compound Interest Applied at MIR Does not take into account other deductions such as the Means Tested Care Fee Insight into the Aged Care Reforms How will you manage your bad debt risk? Be clear on your policy regarding low RAD’s and high DAP’s that are to be deducted from the RAD. There are risks if the RAD paid is low and the resident outlives the deposit. Remember 95% of families will do the right thing! MPIR from the 1st of July 2014 is 6.69% (Currently 6.63%) Insight into the Aged Care Reforms What about couples? The rule still applies whereby only ½ the asset less $45,000 (each) can be used towards a RAD deposit. They can pay any additional RAD via a DAP so it does not limit their ability to pay your price. Published RAD Value $400,000 Joint position Peter and Ann Murray Peter’s RAD Position $500,000 Bank (1/2 each) $250,000 $45,000 Minimum assets threshold -$45,000 Maximum RAD deposit Peter can pay Outstanding RAD $205,000 + DAP of $35.42 $195,000 They still have $295,000 in a joint bank account and you are NOT allowed to ask them to pay Peter’s RAD in full. In the event of overpayment you may be asked to repay the balance along with MIR penalty interest. Insight into the Aged Care Reforms Let’s Move In Together! Post July 2014 RAD $400,000 Joint Assets Value Family Home $500,000 Bank account $50,000 Total Assets $550,000 Staggered Entry Same Day Peter enters care Fully Supported $230,000 + DAP of $11,271 Anne enters care RAD $230,000 + DAP $11,271 $230,000 + DAP of $11,271 Assumptions: MIR used is 6.63% Residents left with $45,000 each ($90K in total) You need to judge each case on its own merit Your organisations <> 40% needs to be considered Consider moving them in on the same day Insight into the Aged Care Reforms Means Tested Care Fee Trigger Figures Minimum Means Tested Care Fee Non Homeowner Total cash Assets RAD Paid Daily MTCF Annual MTCF $995,000 $950,000 $40.20 $14,673.00 $895,000 $850,000 $34.20 $12,483.00 $795,000 $750,000 $29.21 $10,661.65 $595,000 $550,000 $18.22 $6,650.30 $545,000 $500,000 $15.47 $5,646.55 $495,000 $450,000 $12.72 $4,642.80 $445,000 $400,000 $9.98 $3,642.70 $395,000 $350,000 $7.23 $2,638.95 $345,000 $300,000 $5.24 $1,912.60 $295,000 $250,000 $3.86 $1,408.90 Above is a guide of the potential Means Tested Care Fee generated from the RAD + Age Pension + $45,000 remaining in the bank Assumptions Non Homeowner. Income includes: Age Pension and deemed income MTCF is subject to ACFI MTCF = Means Tested Care Fee $45k remaining in assets Minimum Means Tested Care Fee Home Owner Total cash Assets RAD Paid Daily MTCF Annual MTCF $995,000 $950,000 $48.67 $17,764.55 $895,000 $850,000 $43.17 $15,757.05 $795,000 $750,000 $37.68 $13,753.20 $595,000 $550,000 $26.69 $9,741.85 $545,000 $500,000 $23.94 $8,738.10 $495,000 $450,000 $21.19 $7,734.35 $445,000 $400,000 $18.45 $6,734.25 $395,000 $350,000 $15.70 $5,730.50 $345,000 $300,000 $12.95 $4,726.75 $295,000 $250,000 $10.20 $3,723.00 Above is a guide of the potential Means Tested Care Fee generated from the $154,179 Family Home + RAD + Age Pension + $45,000 remaining bank assets Assumptions Homeowner Income includes: Age Pension and deemed income only Payment subject to ACFI MTCF = Means Tested Care Fee $45k remaining in assets Insight into the Aged Care Reforms What happens . if it’s time to move! Insight into the Aged Care Reforms It’s time to move by choice If a resident wants to move from their room priced at $300,000 to a room with a published price of $400,000 you are allowed to charge them a higher RAD or DAP from the “Price Agreement date” Ref: Exposure draft fees and payment principles 26th May 2014 Insight into the Aged Care Reforms It’s time for an involuntary Move The move is necessary on genuine medical grounds OR The room becomes an Extra Service place and the resident does not wish to pay the Extra Service Fee OR The room is being repaired or redeveloped Ref: Exposure draft fees and payment principles 26th May 2014 Insight into the Aged Care Reforms It’s time for an involuntary Move If the moves is for less than 28 days there is no change to their fees and charges If the move is for longer than 28 days then there is no additional charge even if the new room has a higher published RAD price If the resident moves to a lower price you must only charge them the lower RAD and you must refund the difference. Failure to do so will incur MIR on the overpayment. Ref: Exposure draft fees and payment principles 26th May 2014 Insight into the Aged Care Reforms Supported and Partially Supported Residents Insight into the Aged Care Reforms Let’s Talk about RAC’s and DAC’s The Terminology used to explain the financial contribution required if you are a supported resident is Refundable Accommodation Contribution – (RAC) A lump sum payment for accommodation, just like a RAD Daily accommodation Contribution - (DAC) A contribution made on a regular basis, similar to a DAP Insight into the Aged Care Reforms Supported Residents Residents with assets between $45,000 and $154,179 and income above $24,731 may be certified as “Supported Residents” Asset Current cut off prior to July is $116,136 You will continue to receive government funding for these residents Insight into the Aged Care Reforms There are four types of RAC & DAC thresholds Refurbished > 40% = $52.49 Refurbished < 40% = $39.75 Not Refurbished > 40%= $34.20 Not Refurbished < 40% = $25.65 17.5% between 45,000 and $154,179 and 1% between 154,179 and $372,537 2% for amounts over 372,537 $160,000 Fees Payable by Different Classes of Resident (Singles) $154,179 (asset level at which accommodation supplement reduced to zero, if income < $24,731) $140,000 Partially supported residents $120,000 Assessable assets $100,000 $80,000 Non-supported residents Basic daily fee + Accommodation Payment (no supplement) + Care Contribution Pays basic daily fee + Small Accommodation Payment (some Accommodation Supplement) $60,000 $45,000 (Asset Free Area) $62,944 (Income level at which accommodation supplement reduced to zero, if assets <$45,000) $40,000 Fully supported $20,000 $0 Pays basic daily fee only No accommodation Payment (full Accommodation Supplement) No Care Contribution $0 $10,000 $20,000 $24,731 (Income Free Area) $30,000 $40,000 Assessable Income 50% of income over Income Free Area Graph Courtesy of DSS $50,000 $60,000 $70,000 Insight into the Aged Care Reforms Are You a Supported Resident? Accommodation Contribution Formula 50% of Income over the free threshold of $24,731 PLUS 17.5% of the value of assets between $45,000 & $154,179 PLUS An accommodation contribution equalling $52.49 or less determines if you are a Supported resident. Case Study One - Fred Part One – The DAC Calculation Fred has assets in the bank of $140,000 and an age pension. What will he be asked to pay? DAC Calculation Assets Calculation $ Amount $140,000 $45.67 ($95,000 x 17.5% / 364) Pension & Deeming $26,041.03 $1.79 (50% of income over $24,731 / 364) ($1,310.03 / 50% ) Fred’s DAC Payment $47.46 The accommodation contribution is less than $52.49 therefore Fred is a partially supported client and will be asked to contribute towards his cost of care via a contribution Case Study One - Fred Part Two – The RAC Calculation Fred now wants to know if he can pay part of his DAC as a lump sum (RAC). You now need to covert the DAC to a RAC RAC Calculation RAC Formula Equivalent RAC DAC of $47.46 x 365 / 0.0663 $261,280 (Refer previous slide for DAC calculation) What will Fred Pay? Fred decides to pay you a RAC of $95,000 His new DAC is $261,280 – $95,000 = $166,280 $166,280 x 6.63% = $30.20 (new DAC) Fred will pay $95,000 as a RAC and $30.20 as a DAC Other factors < > 40% position Refurbished Position Government will top up the funding as required MIR used for the RAC conversion Case Study Two - Jane Part One – The DAC Calculation Jane has bank assets of $100,000 and an age pension and an overseas pension of $100 per week. What will she be asked to pay? DAC Calculation Assets Calculation $ Amount $100,000 $26.44 ($55,000 x 17.5% / 364) Pension & Deeming and Overseas income Jane DAC Payment $28,041.06 $4.54 (50% of income over $24,731 / 364) ($3,310.06 / 50% = $4.54) $30.98 The accommodation Contribution is less than $52.49 therefore Jane is a supported client and will be asked to contribute towards her cost of care via a contribution Case Study Two – Jane Part Two – The RAC Calculation Jane now wants to know if she can pay part of her DAC as a lump sum (RAC). You now need to covert the DAC to a RAC RAC Calculation RAC Formula Equivalent RAC DAC of $30.98 x 365 / 0.0663 $170,553.54 (Refer previous slide for DAC calculation) What will Jane Pay? Jane decides to pay you a RAC of $55,000 Her new DAC is $170,553.54 – $55,000 = $115,553.54 $115,553.54 x 6.63% = $20.98 (new DAC) Jane will pay $55,000 as a RAC and $20.98 as a DAC Other factors < > 40% position Refurbished Position Government will top up the funding as required MIR used for the RAC conversion Insight into the Aged Care Reforms What’s your RAC and DAC policy? Consider sending residents (or E.P.A) to the Centrelink Office and request a copy of their income and assets across the counter to show to you Plus a “Stat Dec” confirming financial position Assist them to complete the Centrelink “Income and Asset” form as a matter of urgency Problem! If you overcharge the resident you will be asked to refund the overpayment plus MIR Insight into the Aged Care Reforms Selling . Ideas Insight into the Aged Care Reforms There are three fees that consumers may be asked to pay 1. A contribution towards their accommodation (Physical building including their bedroom) via a RAD or a DAP. 2. A contribution towards the cost of their laundry, electricity and meals. This is funded via the Daily Care Fee. 3. A contribution to cover the “cost of their care” via the Means Tested Care Fee. Insight into the Aged Care Reforms Government Contribution to Care “Are you aware that the government can fund up to $67,000 a year for someone with failing health within aged care?” “The government will assess your mum’s position and she may be asked to contribute something towards her care. The most she can ever be asked to pay in one year is $25,000 and as you can see the government, dependant upon mum’s health, pays significantly more than this. Insight into the Aged Care Reforms Qualifying Strategies 1. Does Mum live in the local area? 2. Does she live alone in her own home? 3. Does she receive any age pension? What is this information telling us? Insight into the Aged Care Reforms Information sheets Offer information sheets on the following topics: 1. Property Rules 2. Means Tested Care Fee rules 3. RAD & DAP explanation 4. Payment Option Examples 5. RAC & DAC Ask a family to initial your checklist confirming you have provided them with the appropriate information sheets Insight into the Aged Care Reforms Policies and. Procedures Insight into the Aged Care Reforms Your policies Have developed clear policies for your staff: RAD & DAP Policy Self Funded Retirees RAD Policy Admitting Supported Clients Means Tested Care Fee explanation Who do staff refer to if questioning it outside of their scope or becomes difficult. Are you accounts department trained to take calls? Insight into the Aged Care Reforms Mandatory Prudential Content . Insight into the Aged Care Reforms Mandatory Prudential Content From new Fees and Payment Principles 2014 (No.2) (Cth) A statement informing the person that if they request, you will provide the following information relating to the previous financial year to them within 7 days: a summary of how you use RADs and Accommodation Bonds; information about whether you have complied with the Prudential Standards and any other rules about the use of RADs and Accommodation Bonds; information about the number (if any) of RADs, Accommodation Bonds or Entry Contributions that were not refunded as per the Act’s time frames; if you have invested in financial products, information about objectives and asset classes you may invest in. Insight into the Aged Care Reforms Mandatory Prudential Content (Cont) . AND an audit opinion copy; and a copy of either - the Service’s most recent statement of audited accounts; OR your most recent statement of audited accounts if you operate more than one Service. If the person is paying by a RAD you must also provide them with a copy of their entry in the RAD register. Insight into the Aged Care Reforms Remember we are all in this together Insight into the Aged Care Reforms “Things work out for those who make the best of how things work out.” John Wooden