International Track

advertisement

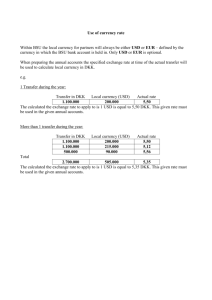

PROGRAM SPECIFICATION INTERNATIONAL FINANCIAL MANAGEMENT WEEKLY COURSE (30-HOUR) MARCH 2006 Instructor : Robert Dubil 1- Main Purpose Aims The course examines the impact of a firm’s internationalization on its decision-making process. We start with an overview of the global financial marketplace and examine the world’s trade and exchange rate arrangements. We study the functioning of the markets for currencies, international bonds, equities, and related derivatives and zero in on the arbitragebased linkages to develop a deep understanding of the environment faced by the chief financial officer of a multinational corporation. Then we change our focus to the firm’s own operations to learn how the firm measures its short and long-term foreign exchange exposure. We end by discussing the merits of operational and financial hedging by a multinational firm. Basic requirements To qualify the student will have been able to assess the multinational firm’s exposure to FX risks, examine the global market environment and financing alternatives it offers, and to formulate the adequate hedging strategy for the firm. Special features Students will gather global macroeconomic and financial markets data on the Internet. Students will also use MS Excel to solve homework assignments. These will provide an indepth view into the functioning of the institutional currency and bond markets. 2. Admissions Entry Requirements Necessary to have successfully passed the course of Financial Mathematics that provides the basic tools for financial calculus. 3. Learning Outcomes Knowledge and understanding in the context of the subject Macroeconomic background of the different trade and currency areas Knowledge of the arbitrage linkages in the international capital markets Ability to assess a firms economic currency exposure Ability to justify the choice of the hedging alternatives Cognitive skills Ability to interpret economic figures Ability to translate projects into mathematical calculations Ability to take risks and to justify such decisions Ability to value potential economic activity of a sector/country Subject-specific skills Ability to read a country’s balance of payments Ability to interpret capital market events Exchange rate determination and calculation of forward exchange rate Arbitrage-based calculus of fixed-income and currency linkages Ability to understand and use derivates like swaps and options General/transferable skills Ability to assess an economic situation and to form expectations Ability to separate economic and political statements Ability to take decisions in a risky context Ability to translate projects into figures and financial operations Ability to apply formulae/ read graphics Qualities, skills and capabilities profile Intellectual: Analytical and critical thought Ability to solve problems and to interpret data Openness to new methods and concepts especially regarding new methods of valuing investment decision Practical Research skills and methods Mastery of the latest instruments in capital markets Written presentation skills Personal and social Independence Planning skills Analytical learning skills 4. Learning and teaching methods Methods Lectures, Internet data gathering, interactive exercises and a mini-case study on transaction exposure, Excel assignment summarizing market linkages, final written exam Students are required to read all the assigned chapters and complete Assignment 1 before the start of the course Assessment: - Exercises and mini-cases (individual and/or team-work) 30% - Final written exam 60% - Multi-disciplinary exam 10% 5. Bibliography C. Eun and B. Resnick, “International Financial Management”, 3rd Ed., McGraw-Hill, 2004 R. Dubil, “An Arbitrage Guide to Financial Markets”, J. Wiley, 2004 T. O’Brien, “Global Financial Management”, unpublished reader, 2001 Files at: www.business.utah.edu/~finrd under ESC Rouen 06 www.economist.com www.ft.com www.ecb.int www.quotes.ubs.com 6- To pass the course the student needs at least to have understood correctly the following principles: 1- the balance of payments, in particular the relationships between current-account balance / capital account balance and the rate of exchange; 2- the structure of international financial markets, in particular the Eurodollar market; 3- the interest rate parity theory of the exchange rate; 4- the forward market for exchange rates and the market for derivatives, in particular interest rate swap – currency swap and options on exchange rates; 5- corporate revenue and profit exposure in monopoly and competitive environments 6- operational hedging International Financial Management Program Overview & Reading List Reading Assignment Part One : Global Macroeconomy 1- World Trade 2- International Monetary System 3- Balance of Payments ER-1 ER-2 ER-3 Part Two: Global Financial Markets and Corporate Financing Decisions 1- Spot and Forward Currency Markets ER-4&5; D 27-49, 64-66 23456- D 135-162 D 162-173; ER 138-43, 200-09 ER-5; D 175-81, 189-92 D 199-229; ER 143-9 ER-9; D 233-64 Forward and Futures Markets Interest Rate Forwards and Futures Covered Interest Rate Parity Swap Markets and Corp. Bond Issuance Currency Futures and Options Part Three: Corporate Investment, Exposure and Hedging 1- Revenue and Profit Exposure 2- Operational Hedging 3- To hedge or not to hedge? Reading Assignment Legend Textbooks: ER=Eun and Resnick; D=Dubil; OB=O’Brien; Reference hyphenated with a number=Chapter, eg. ER-5; Reference spaced with numbers=Page numbers, eg. ER 143-9. OB-5&6 OB-5&6 International Financial Management Assignment List Homework assignments are intended to prepare you for the final exam. They are a lot of work! Please work on them prior to the start of the course, so that you can have as few as possible left to finish during the week of the course. Work through all of them, but by 4:30 pm on Thursday, March 16, hand in the following problems (written or typed): Hmk1: 1, 2, 5; Hmk2: 4; Hmk3: Part 2; Hmk4: 6, 8; Hmk5: 1, 2; Hmk6: 2, 4, 5; Hmk7: 2. HOMEWORK 1 1. Eun/Resnick Problem 2, p.25, with X and Y exchanging textiles for food at free market terms of trade equal to 3.0, i.e 3 units of food for 1 unit of textiles. 2. Eun/Resnick Problem 2, p.25, with X and Y exchanging textiles for food at free market terms of trade equal to 3.0, i.e 3 units of food for 1 unit of textiles.In addition, assume that the rich country X imposes a 10% tariff on textiles from the poor country Y. How will the final consumption change? 3. What countries have adopted flat tax? How much tax do they collect pre- and postadoption of the flat tax? What has their GDP growth been pre- and post-flat tax? 4. Contrast the EU with the U.S. in terms of the free movement of labor, goods and capital. Be specific and concise. Write as many bullet points as possible. 5. Research macroeconomic statistics for North America (or the U.S. alone), Europe, Japan and China. Compare the economies of these four regions in terms of size (GDP), wealth (GDP per capita), trade and balance of payments trends. Summarize the stats you could find. HOMEWORK 2 1. From ER-2, pp.56-57: Questions 2, 6, 10. 2. Why do you think Britain did not join the euro in 2003? 3. Do all exercises in review1.doc again without looking at your class notes. 4. You purchase a 3-year $100,000 face value discount bond for $90,000. a. What annual yield are you locking in? b. What semi-annual yield are you locking in? c. What quarterly yield are you locking in? HOMEWORK 3 Part 1 Set up a spreadsheet bond.xls to compute the yield to maturity on bonds with different maturities and coupons. 1. Compute ytm on a 6-year 4.5% semi-annual coupon bond selling for 99.25. 2. Compute ytm on a 4-year 6% annual coupon bond selling for 102.31. 3. Compute the coupon rate on a 5-year annual bond yielding 5% and selling for 99. Part 2 You observe discount rates: 1-yr 3.5%, 2-yr 3.75% and 3-yr 4.00%, and par coupon rates of: 1-yr 3.5% and 2-yr 3.7454%. (Par rate means coup=ytm and price=100.) All rates are annual. 1. What should the 3-yr par coupon rate be? 2. A dealer quotes 4.20% for the 3-year par coupon rate instead of the rate you computed in 1. How can you profit? Part 3 From ER-3, p. 71: Questions 1, 3, 4, 8. HOMEWORK 4 Refer to ER-4, end-of-chapter problems. P2. Using Exhibit 4.4, calculate the one-, three-, and six-month forward cross-exchange rates between the Canadian dollar and the Swiss franc using the most current quotations. State the forward cross-rates in “Canadian” terms. P3. Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points. Spot 1.3431-1.3436 One-Month 1.3432-1.3442 Three-Month 1.3448-1.3463 Six-Month 1.3488-1.3508 P4. Using the spot and outright forward quotes in problem 3, determine the corresponding bid-ask spreads in points. P5. Using Exhibit 4.4, calculate the one-, three-, and six-month forward premium or discount for the Canadian dollar in European terms. For simplicity, assume each month has 30 days. P6. Using Exhibit 4.4, calculate the one-, three-, and six-month forward premium or discount for the British pound in American terms using the most current quotations. For simplicity, assume each month has 30 days. P7. Given the following information, what are the NZD/SGD currency against currency bidask quotations? Bank Quotations New Zealand dollar Singapore dollar American Terms European Terms Bid Ask Bid Ask .4660 .4667 2.1427 2.1459 .5705 .5710 1.7513 1.7528 P8. Assume you are a trader with Deutsche Bank. From the quote screen on your computer terminal, you notice that Dresdner Bank is quoting €1.0242/$1.00 and Credit Suisse is offering SF1.5030/$1.00. You learn that UBS is making a direct market between the Swiss franc and the euro, with a current €/SF quote of .6750. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have $5,000,000 with which to conduct the arbitrage. What happens if you initially sell dollars for Swiss francs? What €/SF price will eliminate triangular arbitrage? HOMEWORK 5 1. Spot US/EUR=1.2000, 3-month Forward US/EUR=1.2200, 3-month interest rates 4% in the U.S., 3.5% in EUR. You can borrow or lend EUR 10,000,000=USD 12,000,000. How do you lock in riskless profit? (CIRP) 2. Refer to the copy of futures markets quotations from the 10/4/2005 Wall Street Journal. You expect an inflow of ₤250,000 in March 2006. What US$ amount of inflow can you lock in by using the CME contract? How many contracts do you buy/sell? If the spot FX rate turns out 1.7650 in March, what will have been your total variation margin on the contracts? What amount will you obtain in the spot market? Show that you have in fact locked in the desired US$ amount. HOMEWORK 6 1. Do you think the fact that Japanese companies have enjoyed low interest rates at home (Toshiba can issue JPY debt at less than 1%) has given them an advantage over companies from high interest rate countries like the U.S. (Toshiba can issue USD debt at 3%)? What can the government do to level the playing field? 2. You entered into a 5-year $100 million USD-floating, AUD-fixed cross currency swap. You receive USD LIBOR+30 bp quarterly and you pay 5% annually in AUD. The spot FX rate is USD/AUD 0.65. Describe the cash flows assuming USD LIBOR will stay at 3%. 3. Consider the swap in 2. You also observe that interest rate swaps in the U.S. trade at 3.50% semi against quarterly LIBOR flat. Suppose you decide, in addition to the swap in 2 to receive (fixed) on a 5-year U.S. swap against LIBOR+30. Show your net cash flows graphically. 4. A year ago, you entered into a $200 million 6-year annual payment swap: receive 4% fixed USD and pay 5.2% fixed EUR. The spot FX rate at the time was 1.00 and it is still the same. However, 5-year rates now are 3% in the U.S. and 4% in Europe. How much do you have to pay/receive to “unwind” the swap? Putting it all together: 5. All rates are semi. Simple 30/360 day count (divide by 2). Six-month spot Libor rates and subsequent FRA rates trade at: USD SPOT FRAs 0x 6x 12 x 18 x 24 x 30 x 36 x 42 x 48 x 54 x 60 x 66 x 72 x 78 x 6 12 18 24 30 36 42 48 54 60 66 72 78 84 EUR 2.00 2.05 2.10 2.15 2.20 2.25 2.30 2.35 2.40 2.45 2.50 2.55 2.60 2.65 3.00 3.07 3.14 3.21 3.28 3.35 3.42 3.49 3.56 3.63 3.70 3.77 3.84 3.91 The spot FX rate is USD/EUR 1.18. Answer the following (assume $100 million notional for a swap, where applicable). a) Compute zero-coupon rates in both currencies. b) Compute forward FX rates. c) Compute 5- and 7-year par (interest rate) swap rates in both currencies. d) Describe the cash flows for a USD par interest rate swap (receive fixed, pay floating), assuming Libor rates in the future are exactly equal to the forwards. e) Consider a fixed-for-fixed currency swap, receive USD, pay EUR, with both rates equal to the computed par swap rates. Describe the cash flows. f) Compute the PVs for the USD receipts and EUR payments using the zero (discount) rates from a) and the current spot FX rate. Show that the PV of the entire swap in dollars is zero. g) Repeat f) using the forward FX rates in b) and only the zero rates for USD in a). Show that the PV of the entire swap in dollars is zero. HOMEWORK 7 1. Work through all numerical examples (UVM, UVC) in OB-5&6. Combine the treatment in the two chapters to compute revenue and profit exposures. 2. Work through Option puzzles 13-16. 3. Review case study from the last class period. Be able to draw the scenario graph.