Department of Energy (DoE)

advertisement

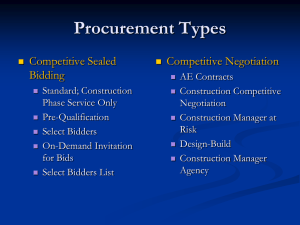

PPC-Energy: Update on Window 1 RE-IPP Procurement Programme. 07 June 2012 1 Presentation Content Introduction. RE-IPP Procurement Process Background. Overview of Evaluation Process (bid window 1). Sequence of event. Evaluation Composition. Preferred Bidder Results and MW allocation. Financial Evaluation. Bid Window 2 progress. 2 Introduction • The procurement documents were released on the 03 of August 2011 and compulsory bidders conference for the first and second window on the 14 of September 2011. • The document provides for procurement of 3725MW in five different rounds subject to the availability of the MW • The Department, under bid window one: – Received 53 Bids by the 4th of November – Announced 28 preferred bidders in December 2011 • With regards to bid window two: – Received 79 bids on the 5th of March 2012 – These bids amount to 3255MW whilst the cap was 1275MW 3 Procurement Process Background Procurement documents: Request for Proposals • Part A: General Requirements and Rules • Part B: Qualification Criteria • Part C: Economic Development Power Purchase Agreement • Wind PPA • Solar PPA • Small hydro PPA • CSP PPA…….etc Implementation Agreement • Contract between the IPP and the Department • Obligation for IPP to deliver on economic development • In buyer default – Department to pay the IPP 4 Procurement Process Background: Contractual Arrangement IPP Eskom Government Government Framework Support Agreement 5 Procurement Process Background Request for Proposal (RFP) RFP Part B • Requirements • Rules RFP Part A Qualification • Environment • Land • Economic Develop • Finance • Technical • Price • Capacity • Price • Job creation • Local content • Preferential Procurement • Enterprise Development • Socio-economic development RFP Part C Comparative Evaluation 6 PART C EVALUATION Price 70 % Project cost Rand/MW 30 % Economic Dev Job creation Socio -Economic Local content Preferential Procurement 7 OVERVIEW OF EVALUATION PROCESS (BID WINDOW 1) 8 Sequence of Events: Bid Window 1 Event Date Ministerial determination (in consultation with National Energy Regulator of South Africa) • 3, 725 MW of new generation capacity required by 2016 Programme launch • 31 July 2011 DoE issued a Request for Proposals Procurement uploaded on DoE website • 03 August 2011 Interested Bidders requested to register on a dedicated programme site: www.ipp-renewables.co.za Compulsory Bidders’ Conference • • 14 September 2011 Interested Bidders taken through the bidding process Drew interest from across the globe Close of 1st Bidding Window • • 04 November 2011 Evaluations ensued from 04 to 28 November 2011 Conducted by international and local financial, technical and legal experts Announcement of Preferred Bidders • • Q2 of 2011 07 December 2011 28 preferred out of 53 Projects need to reach financial close by June 2012 9 Evaluation Composition Evaluation team: • International reviewers • • • • • Legal evaluation team • • • • • • Bowman Gilfillan Edward Nathan Sonneberg Ledwaba Mazwai Webber Wentzel BKS Technical evaluation team • • Legal review – Linklaters (UK) Technical review – Blueprint consult Financial review – cross-moderation between the two Financial Advisory firms Governance review – Ernst & Young Mott Macdonald Financial evaluation team • • Ernst & Young PWC Evaluation Streams: • Legal Environment • • Legal Land • • • • Contributor status level 5 Compliance with threshold Financial • • Acceptance of the PPA Project structure Economic Development • • • Land right Notarial lease registration Proof of land use application Legal Commercial • • • Environmental Authorization Full and partial price indexation Technical • • Eligibility Energy resource 10 Renewable Energy IPP’s: Window 1 Preferred Bidder Allocation to Preferred Bidders: Window 1 Solar PV Solar CSP Wind Biomass Biogas Landfill gas Small Hydro Total MW MW 631.53 150.00 633.99 0.00 0.00 0.00 0.00 1415.52 Total Capacity - Bids Received Percentage Preferred Bidders 2127.66 66.5% Number of Passing Bids Allocation per Determination Still Available Percentage MW Percentage 43.6% 818.47 56.4% 75.0% 50.00 25.0% 34.3% 1216.01 65.7% 0.0% 12.50 100.0% 0.0% 12.50 100.0% 0.0% 25.00 100.0% 0.0% 75.00 100.0% 39.0% 2209.48 61.0% MW allocation per Determination 1450.00 200.00 1850.00 12.50 12.50 25.00 75.00 3625.00 28 11 Contracted Number of Jobs: Window 1 & Window 2 Compared. Jobs during construction Jobs during operations First Round 13 908 874 Second Round 22 590 1 371 12 FINANCIAL EVALUATION (BID WINDOW 1) 13 Introduction • Majority of bids to a generally high standard; • No bidder submitted a fully compliant Part B submission; • Significant number of “failures” related to non-material omissions and inconsistencies perhaps reflecting tight timeframe for bid preparation; 14 Financial Evaluation Key areas of shortcoming included: • Letters of support not provided by parent company &/or funders; • Rationale and quantum of success fees not fully described; • Limited information on hedging strategies; • Incomplete financial accounts for equity participants • Calculation of partial/fully indexed tariffs not done comprehensively. 15 Financial evaluation results Results post-clarification: Solar PV Wind CSP Hydro Total Pass (MW) 682 701 150 0 1533 No. Projects 21 10 2 0 33 Fail (MW) 357 233 0 4 594 No. Projects 16 3 0 1 20 16 Financial Analysis – Tariffs • Majority of bidders have priced at or just below the applicable technology price cap; • Similarly most bidders have shown a strong preference for a fully indexed tariff; • This may reflect bidder expectation that Round 1 would be undersubscribed. 17 Bidding Price Differential: Window 1 & Window 2 Compared. Technology 2nd Round Average 1st Round Average Difference Price Cap Solar Photovoltaic R 1 993.20 R 2 662.00 -25.1% R 2 850.00 Onshore Wind R 1 005.30 R 1 134.00 -11.3% R 1 050.00 Small Hydro R 1 030.00 R 1 030.00 0.0% R 1 030.00 Concentrated Solar Power R 2 512.00 R 2 686.00 -6.5% R 2 850.00 Landfill Gas R 840.00 R 840.00 18 OVERVIEW OF EVALUATION PROCESS (BID WINDOW 2) 19 Financial Investment: Bid Window 2 Number of Projects Net Capacity (MW) Total Project Cost (R' 000 000) 1 50 R 4 483 1 1 14 3 R 237 R 52 10 2 10 619 238 599 R 12 812 R 4 853 R 12 202 6 4 3 4 1 3 23 7 190 145 136 127 9 67 799 221 R 5 382 R 4 558 R 3 139 R 4 559 R 248 R 2 376 R 22 745 R 6 708 2 1 8 10 R 202 R 498 79 3 233 R 85 054 Concentrated Solar Power Northern Cape Landfill Gas Gauteng KwaZulu Natal Onshore Wind Eastern Cape Northern Cape Western Cape Solar Photovoltaic Eastern Cape Free State Gauteng Limpopo Mpumalanga North West Northern Cape Western Cape Small Hydro Free State Northern Cape Grand Total 20 Preferred Bidders Geographic Distribution 21 Thank You 22