Ch 15

advertisement

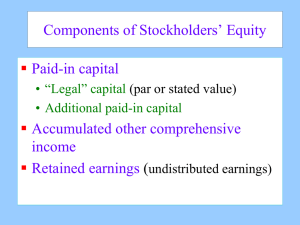

Stockholders’ Equity Chapter 15 Intermediate Accounting 12th Edition Kieso, Weygandt, and Warfield Chapter 15-1 Prepared by Coby Harmon, University of California, Santa Barbara Corporate Capital Common Stock Contributed Capital Account Preferred Stock Additional Paidin Capital Account Account Two Primary Sources of Equity Retained Earnings Account Less: Treasury Stock Assets – Liabilities = Equity Account Chapter 15-2 LO 2 Identify the key components of stockholders’ equity. The Corporate Form of Organization State Corporate Law Corporations must submit a Corporate Charter to the desired State of incorporation. A Corporate Charter includes 1) Articles of Incorporation and 2) ByLaws General Motors - incorporated in Delaware. U.S. Steel - incorporated in New Jersey. Chapter 15-3 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Common Stock - represent owners’ shares or interests in the business. Shareholders bear ultimate risk of loss & benefits. Common Stockholders’ rights include: 1. To share proportionately in profits and losses. 2. To share proportionately in management (the right to vote on major issues). 3. To share proportionately in assets upon liquidation. 4. To share proportionately in any new issues of stock of the same class—called the preemptive right. Chapter 15-4 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Par Value - Nominal value per share of Common Stock established in the Corporate Charter - *No relation to market value • The initial sale of stock cannot be below Par Value. The secondary market, however, can sell for whatever the market demands. • Par value was originally established to protect creditors. Owners could not withdraw ownership interests below Par Value of stock “Legal Capital”. • Today many states permit No-Par Stock. State law will establish the requirements. Chapter 15-5 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Ex) Assume a Corporation issues 100,000 shares of $10 par value Common Stock for $32 per share, prepare the necessary journal entry. DR 3,200,000 Cash Common Stock Paid In Capital – CS Chapter 15-6 CR 1,000,000 2,200,000 The Corporate Form of Organization Ex) Assume a Corporation issues 100,000 shares of No Par value Common Stock for $32 per share, prepare the necessary journal entry. Cash Common Stock Chapter 15-7 DR 3,200,000 CR 3,200,000 The Corporate Form of Organization Authorized Shares – Maximum number of shares to be issued per the charter. Selling more than Authorized amount requires a vote by the Board of Directors. Unissued Shares – Total number of shares that have never been issued. Issued Shares – Total number of shares that have been Issued [Outstanding Shares and Treasury Shares]. Outstanding Shares – Total shares of stock owned by stockholders on a given date. Treasury Shares – Stock that has once been issued and since purchased back by the company. Treasury stock is considered issued stock that is currently inactive. Chapter 15-8 LO 1 Discuss the characteristics of the corporate form of organization. The Corporate Form of Organization Authorized Shares = Issued Shares + Unissued Shares Outstanding + Treasury Shares Chapter 15-9 LO 1 Discuss the characteristics of the corporate form of organization. Corporate Capital Treasury Shares Treasury stock is considered inactive Issued Stock The Treasury stock account is a Contra Equity account reducing the overall value of equity Equity: Common Stock ($1 Par 100,000 shares issued 98,000 shares OS) Additional PIC Retained Earnings Treasury Stock (2,000 shares) Total Equity: Chapter 15-10 $100,000 264,000 411,000 (75,000) $700,000 LO 4 Describe the accounting for treasury stock. Corporate Capital Treasury Shares (Reacquisition of Shares) Corporations purchase their outstanding stock: • To improve the EPS and ROE ratios • To have shares available to distribute through Employee Benefit Plans • To maintain control of ownership in the company [perhaps to prevent an unwanted takeover] • To make a market in their stock Chapter 15-11 LO 4 Describe the accounting for treasury stock. Corporate Capital Common Stock [$5 par value, 500,000 shares authorized] [? shares issued, ? shares OS] $100,000 Paid in Capital - Common Stock $400,000 Retained Earnings $500,000 Treasury Stock [2,000 shares] ($36,000) Total Stockholders' Equity $964,000 How many Common Stock shares are issued? $100,000/$5 p/s = 20,000 shares issued How many Common Stock shares are outstanding? 20,000 issued – 2,000 Treasury = 18,000 shares outstanding Chapter 15-12 What is the average market price per share of Issued Common Stock? ($100,000 + $400,000)/20,000 = $25 p/s Preferred Stock Preferred Stock A special class of stock with specific rights over Common Stock Preferred Stock has some characteristics of Debt And some characteristics of Equity Chapter 15-13 LO 5 Explain the accounting for and reporting of preferred stock. Preferred Stock Preferred Stock 1. Has no voting Rights 2. Raises equity funds without diluting Common stockholders’ voting control 3. Has a fixed dividend rate which takes priority over Common stockholders when dividends are declared 4. Has priority over Common stockholders in case of asset liquidation. Chapter 15-14 LO 5 Explain the accounting for and reporting of preferred stock. Preferred Stock Example of Fixed Dividend Rate on Preferred Stock: If a company has $500,000 of 6% Preferred Stock outstanding, the Fixed Dividend Rate is: $500,000 * .06 = $30,000 per year Chapter 15-15 Preferred Stock Specific Features of Preferred Stock Cumulative Participating Convertible Callable Redeemable A corporation may attach whatever preferences or restrictions, as long as it does not violate its state incorporation law. Accounting for preferred stock at issuance is similar to that for common stock. Chapter 15-16 LO 5 Explain the accounting for and reporting of preferred stock. Preferred Stock Cumulative Preferred Stock - requires that if a corporation fails to pay a dividend in any year, it must make it up in a later year before paying any dividends to common stockholders. Participating Preferred Stock – shares ratably with the common stockholders in any profit distribution beyond the prescribed preferred stock rate. That is, 5 percent preferred stock, if fully participating, will receive not only its 5 percent return, but also dividends at the same rates as those paid to common stockholders if paying amounts in excess of 5 percent of par or stated value to common stockholders. Chapter 15-17 LO 5 Explain the accounting for and reporting of preferred stock. Preferred Stock Convertible Preferred Stock – allows stockholders, at their option, to exchange preferred shares for common stock at a predetermined ratio. Callable Preferred Stock - permits the corporation at its option to call or redeem the outstanding preferred shares at specified future dates and at stipulated prices. Redeemable Preferred Stock – has a mandatory redemption period or a redemption feature that the issuer cannot control. This type of Preferred Stock is more like debt than equity because it is a legal obligation to pay by a deadline date. FASB now requires this type of Preferred Stock to be reported as a liability. Chapter 15-18 LO 5 Explain the accounting for and reporting of preferred stock. Types of Dividends 1. Cash dividends. 2. Property dividends. 3. Liquidating dividends. 4. Stock dividends. Chapter 15-19 LO 7 Identify the various forms of dividend distributions. Types of Dividends Cash Dividends Board of directors vote on the declaration of cash dividends. A declared cash dividend is a liability. Companies do not declare or pay cash dividends on Treasury Stock. Chapter 15-20 LO 7 Identify the various forms of dividend distributions. Types of Dividends Property Dividends Dividends payable in assets other than cash. Before distribution, the company must restate at fair value the property it will distribute, recognizing any gain or loss. Chapter 15-21 LO 7 Identify the various forms of dividend distributions. Types of Dividends Liquidating Dividends Dividends that reduce stockholders’ Additional Paid In Capital If a company distributes a dividend in EXCESS of earnings, it will reduce Contributed Capital of stockholders [PIC account] Chapter 15-22 LO 7 Identify the various forms of dividend distributions. Types of Dividends Stock Dividends Issuance of own stock to stockholders on a pro rata basis, without receiving any consideration. Stock dividends are the redistribution of Equity between Retained Earnings and Contributed Capital When a stock dividend is less than 25 percent of the common shares outstanding, a company transfers the fair market value of the stock from retained earnings (small stock dividend). Chapter 15-23 LO 8 Explain the accounting for small and large stock dividends, and for stock splits. Types of Dividends Stock Dividends A stock dividend of more than 25 percent of the number of shares previously outstanding is called a large stock dividend. With a large stock dividend, transfer from retained earnings to capital stock the par value of the stock issued. Chapter 15-24 LO 8 Explain the accounting for small and large stock dividends, and for stock splits. Types of Dividends Stock Splits Reduces the market value of shares proportionally. No entry recorded for a stock split. Decreases par value and increases number of shares outstanding proportionally. Chapter 15-25 LO 8 Explain the accounting for small and large stock dividends, and for stock splits. Terminology US GAAP vs IFRS US GAAP IFRS Common Stock Share Capital Paid-In-Capital In Excess of Par/ Additional Paid In Capital Share Premium Preferred Stock Preference Shares Retained Earnings/ Reinvested Earnings Retained Earnings/ Retained Profits Accumulated Profit and Loss Accumulated Other Comprehensive Income General Reserve & Other Reserve Accounts Chapter 15-26