Income Redistribution in a Federal System of Governments

advertisement

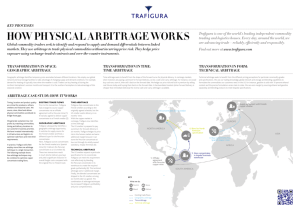

Capital Income Taxation, Corporate Taxation, Wealth Transfer Taxes and Consumption Tax Reforms Discussion Many decisions affected by taxation of capital income Savings Portfolio choice (tax arbitrage) Income shifting between tax bases International issues Consequences of a shift to consumption taxes Taxes and savings Efficiency implications seem small Risk-free interest rate close to zero, so little effects of behavioral responses on tax revenue: Size of behavioral response modest Lifecycle model forecasts large responses to taxes, But precautionary-savings model and behavioral anomalies forecast much smaller effects. Taxes and portfolio choice Huge variation in personal tax treatment of different forms of savings: Nominal income fully taxable: interest income Real income fully taxable: non-corporate real capital Reduced tax rate: dividends, capital gains Tax exempt: muni’s, implicit rent from O-O housing, human capital, assets held in TEE pension plans Subsidized: Assets held in EET pension plans Resulting tax arbitrage Common form for this arbitrage Those in high brackets borrow to buy more lightly taxed assets Tax exempt funds and low-bracket investors buy these bond issues Potential efficiency costs very large, as emphasized in Stiglitz (1985) Resulting role for the corporate tax Tax used to lessen distortion favoring corporate over non-corporate investments under the personal tax * t t (1 t )e m , To avoid distortions, need where t is the corporate tax rate, e captures any personal taxes on corporate income, while m is the statutory personal tax rate on non-corporate earnings Remaining distortions still large Huge variation in t across firms, and in m across investors, leaving many distortions Choice of organizational form Choice of debt vs. equity finance Transactions between corporate and noncorporate firms, e.g. equipment leasing or oildrilling tax shelters Efficiency and equity implications of tax arbitrage Gordon and Slemrod (1998,2004) find on net that little or no revenue is collected from existing taxes on capital income, implying large efficiency costs of these taxes Drop interest, dividends, and capital gains from tax base Replaces depreciation with expensing for new investments Existing taxes on capital income appear to benefit those in very high tax brackets As a result, existing taxes on capital income seem unappealing on both efficiency and equity grounds Income shifting between tax bases Income shifting between personal and corporate tax bases affects tax treatment of labor income as well as capital income By retaining entrepreneurial profits within a corporation, these earnings are taxed at t* rather than at rate m. Similar tax benefits for equity compensation of workers in closely-held corporations Corporate tax is then a backstop as well for the personal tax on labor income, leaving a tax rate equal to min(t*,m), as argued in Feldstein and Slemrod (1980) Evidence for such income shifting Observed responses to the Tax Reform Act of 1986 Major shift from C corporate to S corporate status Aggregate partnership income shifted from a large tax loss to a large tax profit Broader evidence in Gordon and Slemrod (2002) Implications of income shifting for tax policy Pressure to set t* close to the top m Suggests large potential efficiency costs from a reduction in t to 28%, given a top rate for m of 39.6% International issues Investments abroad favored over investments at home under domestic tax code: No domestic corporate taxes on FPI, and deferral of corporate tax for FDI Neutral taxation would require domestic corporate taxes at accrual on all shares owned by domestic investors. Of course, many barriers to doing this. International issues With income shifting in addition, large opportunities for tax avoidance by multinationals on domestic as well as foreignsource income Tax distortions yet larger due to expectation of future tax holidays at repatriation Would have even larger distortions favoring multinationals under a territorial tax system International issues Deferral per se, though, of no benefit when savings not taxable, assuming stable tax rates at repatriation. Simply equivalent to tax treatment of pension vs. wage income. Current tax rules then yield neutrality of tax on labor income if there are no net taxes on savings Advantages of consumption rather than income taxes With a consumption tax, no threat of avoidance of taxes on labor income through shifting income abroad, or shifting income between personal and corporate tax bases. No opportunities for tax arbitrage. Various forms of a consumption tax: VAT EET base under the personal tax for all forms of savings where income shifting possible Other implications of a shift to a consumption tax The corporate tax serves as a backstop for personal taxes on income. No need for such a backstop under a consumption tax (EET) base for the personal tax Tax on repatriation of foreign-source income also no longer needed to protect a consumption tax (EET) base. Conclusions Existing tax treatment of savings seems both inefficient and inequitable, encouraging tax arbitrage by those in high brackets and facilitating avoidance of tax on labor income A shift to a consumption tax base can alleviate these problems, and allow for a variety of other attractive tax reforms