FA2 Module 5. Interest concepts of future and present value

advertisement

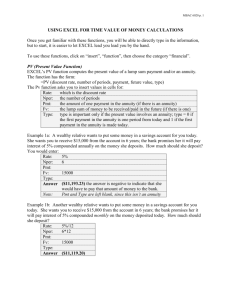

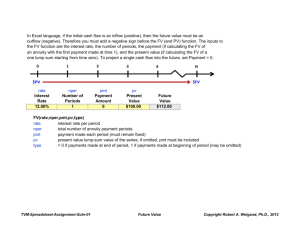

FA2 Module 5. Interest concepts of future and present value 1. Time value of money 2. Basic interest concepts 3. Present and future values a. Single payment b. Annuity (ordinary and due) 4. Applications 1. Time value of money Investors expect that money invested should grow, i. e., earn a return, over time. The future value (FV) of an investment earning some rate of return r, after n periods, is: FV = Investment X (1+r)n E. g., $100 invested at 10% will be worth: •After one year, $100 X (1.1)1 = $110 •After two years, $100 X (1.1)2 = $121 •After three years, $100 X (1.1)3 = $133 1. Time value of money (cont’d) The present value (PV) of a future cash flow is computed using the inverse of the future value function. FV = Original Investment X (1+r)n PV = FV/(1+r)n For example, suppose I can invest at a rate of 10%, and someone promises to pay me $100. If the cash is received: •Immediately, PV = $100/(1.1)0 = $100 •After one year, PV = $100/(1.1)1 = $91 •After two years, PV = $100/(1.1)2 = $83 1. Time value of money (basic intuition) FV = Original Investment (PV) X (1+r)n PV = FV/(1+r)n • the longer the time to maturity, the lower the PV (the greater the FV) • The higher the interest rate (r), the lower the PV (the greater the FV) 2. Basic interest concepts Vocabulary Principal: Amount borrowed Interest: Cost of borrowing principal (includes additional amount repaid to lender plus any legal fees, commissions, etc.) Interest expense: Cost of borrowing incurred by borrower Interest revenue: Amount in excess of principal earned by lender 2. Basic interest concepts Vocabulary Interest rate: Cost of borrowing expressed as a percentage of principal Interest period: Period of time (e. g., month, quarter, year) over which interest is calculated 2. Basic interest concepts Vocabulary Simple interest: Original principal outstanding for the period multiplied by interest rate; interest is earned only on the principal (this is very rare in business) Compound interest: Interest is computed on both the original principal and on past interest that has accumulated 2. Basic interest concepts Compound interest and interest periods The interest on a debt is a function of the interest rate (normally expressed as an annual rate) and the type of compounding (number of interest periods per year). The interest for any particular period is the annual interest rate divided by the number of interest periods per year, multiplied by the principal (plus accumulated interest) outstanding at the beginning of the interest period. 2. Basic interest concepts Compound interest example A8-40 (1): On Jan. 1, 20x1, $30,000 is deposited in a fund at 16% compound interest. At the end of 20x5, what will the fund balance be, assuming a. Annual compounding? b. Semi-annual compounding? c. Quarterly compounding? 2. Basic interest concepts Future value calculations in Excel The future value of a single amount in Excel is: =FV(rate,nper,,pv) Where FV is future value, rate is interest rate per period, nper is number of periods, and pv is the present value. Note ,, between nper and pv. pv is entered as a negative value. 2. Basic interest concepts Interest rate: Nominal vs. effective Loan agreements are typically described by the quoted (or nominal) interest rate and the type of compounding. The effective interest rate is the cost of borrowing that takes into account the effect of compounding. Example: A8-40 (1) revisited Example: Credit card charging 24% per annum, compounded monthly 3. Present and future values a. Single payment – future value The future value (FV) of a single payment is the value in nominal dollars of a sum of money invested to earn some rate of return (r), at a some future time. FV = PV x (1+r)n where n is the number of time periods between the present time and the future. A840(1) is a future value exercise. 3. Present and future values a. Single payment – present value The present value (PV) of a single payment is the present value of a sum of money to be received at some future time, when money can be invested to earn some rate of return (r). PV = FV/(1+r)n where n is the number of time periods between the present time and the future. Example: A8-40(2) 2. Basic interest concepts Example: Present value of a single payment A8-40 (2): On Jan. 1, 20x1, a machine is purchased at an invoice price of $20,000. The full purchase price is to be paid at the end of 20x5. Assuming 12% compound interest, what did the machine cost if compounding is a. Annual? b. Semi-annual? c. Quarterly? 2. Basic interest concepts Present value calculations in Excel The future value of a single amount in Excel is: =PV(rate,nper,,fv) Where PV is present value, rate is interest rate per period, nper is number of periods, and fv is the present value. Note ,, between nper and fv. fv is entered as a negative value. 3. Present and future values b. Annuities – ordinary and due An annuity is a series of uniform payments occurring at uniform intervals over a specified investment time frame, with all amounts earning compound interest at the same rate. An ordinary annuity is one in which the payments occur at the end of each period (e. g., loan payment). An annuity due is one in which the payments occur at the beginning of each period (e. g., rent payment). 3. Present and future values b. Annuities – future value The future value of a stream of cash flows can be viewed as the sum of the future values of a series of individual cash payments occurring at different points in time. 3. Present and future values b. Annuities – future value Example: A8-40 (5). On Jan. 1, 20x1, a company decided to establish a fund by making 10 equal annual deposits of $6,000, starting on Dec. 31. The fund will be increased by 9% compounded interest. What will be the fund balance at the end of 20x10 (i. e., immediately after the last deposit)? 3. Present and future values b. Annuities – future value in Excel The future value function of an annuity in Excel is =FV(rate, nper,pmt,,type) rate is the interest per period, nper is the number of periods, pmt is the amount of each payment, and type indicates type of annuity (0 = ordinary annuity; 1 = annuity due). pmt is usually entered as a negative number. 3. Present and future values b. Annuities – present value The present value of a stream of cash flows can be viewed as the sum of a series of individual cash payments occurring at different points in time, all discounted to their present values. The present value calculation involves calculating the present value of each of the cash flows. 3. Present and future values b. Annuities – present value Example: A8-40 (8). Ace Company is considering the purchase of a unique asset on Jan. 1, 20x1. The asset will earn $8,000 net cash inflow each Jan. 1 for five years, starting Jan. 1, 20x1. At the end of 20x5, the asset will have no value. Assuming a 14% compound interest rate, what should Ace be willing to pay for this unique asset on Jan. 1, 20x1? 3. Present and future values b. Annuities – present value in Excel The future value function of an annuity due in Excel is =PV(rate, nper,pmt,,type) rate is the interest per period, nper is the number of periods, pmt is the amount of each payment, and type indicates type of annuity (0 = ordinary annuity; 1 = annuity due). pmt is usually entered as a negative number. 4. Applications a. Loans Example: A8-37. On Jan. 1, 20x4, Terry Corporation borrowed $100,000 from the Canadian Bank. The loan will be repaid in five equal annual instalments, including both principal and compound interest at 10%; interest is compounded annually. Required. Compute the annual loan payment that would be made if (1) first payment is made Jan. 1, 20x4 or (2) first payment is made on Dec. 31, 20x4. Prepare a debt amortization schedule for each alternative. 4. Applications Solving for annuity payment in Excel We can solve for the annuity payment in Excel with the PMT function: =PMT(rate, nper,pv,,type) rate is the interest per period, nper is the number of periods, pv is the present value of the annuity, and type indicates the type of annuity (0 = ordinary annuity; 1 = annuity due). pv is usually entered as a negative number. 4. Applications b. Retirement planning My wife plans to retire in 15 years. She would like to make sure that we have sufficient retirement savings in place to generate retirement income of $40,000 per year for 25 years. The interest rate is 8%. How much would we need if: a. We want to set aside a sufficient lump sum of cash right now? b. We decide to make equal deposits over the next 15 years, at the beginning of each year? 4. Applications c. Buy now, pay later Jack and Jill bought themselves a “shabby chic” living room suite for $7,500 on January 1, 20x7. The Block Furniture Warehouse has agreed that J and J need not “pay a dime until Jan. 1, 20x9.” The relevant interest rate is 7%. Required 1. How much should the Block record as revenue at the date of sale (assume no collectibility problems)? 2. How much interest income should the Block record in 20x7, 20x8 and 20x9? 4. Applications d. Equipment rental On Jan. 1, 20x6, Lessee Ltd signed an agreement to rent a piece of equipment from Lessor for five years. Lessee will pay rent in the amount of $12,000 per year, payable at the beginning of each year. At the end of the five-year term, legal title to the equipment passes to Lessee. The equipment has a useful life of five years. Lessee can borrow money at a rate of 9%. Required: From an accounting point of view, is this transaction really a rental? How should Lessee record this transaction?