AP Macro: Unit 7 - South Hills High School

advertisement

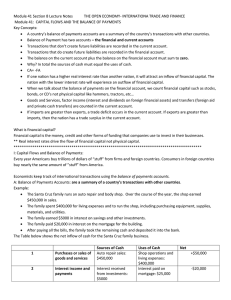

AP Macro: Unit 7 “The Open Economy: International Trade and Finance” Balance of Payments In a closed economy, economists keep track of transactions with the national income account (GDP). In an open economy, (with international trade) they keep track with the “balance of payments accounts.” Balance of Payments Definition: a summary of a country’s transactions with other countries Example: The Ryan family farm • $100,000 revenue from selling rhubarb • Spent $110,000 on purchase of machinery, buying food, paying bills, etc. • Received $500 in interest on bank account, but paid $10,000 interest on mortgage • Took out a $25,000 loan for farm improvements The Ryan Financial Year • Cash: spent $110,000; made $100,000 Net -$10,000 • Interest: spent $10,000; made $500 Net -$9,500 • Loans/Deposits: borrowed $25,000; deposited $5,500 after covering losses Net $19,500 • Balance $0 The Ryan’s Financial Year Sources of cash Purchases/sales of G&S Rhubarb sales: $100,000 Interest Payments Bank acct revenue: $500 Loans/deposits New loan: $25.000 Total $125, 500 Uses of cash Net Expenses: $110,000 ($10,000) Mortgage: $10,000 ($9,500) Bank deposit: $5,500 $19,500 $125,500 $0 Balance of Payments • When a U.S. resident sells a good, such as wheat, to a foreigner, that’s the end of the transaction. • But a financial asset, such as a bond, is different. That sale creates a liability in the future. • The balance of payments accounts distinguish between transactions that create liabilities and those that don’t. Current Account • Transactions that don’t create liabilities are part of the current account • This is primarily the balance of payments on goods and services • The difference between the value of exports and the value of imports (in Unit 2 we called this “net exports”) Financial Account • Transactions that involve the sale or purchase of assets, and therefore create future liabilities, are part of the financial account (we used to call this the capital account) Current / Financial Account • General Rule: Current Account + Financial Account = 0 • The sources of cash must equal the uses of cash • Remember the circular flow: one person’s (or country’s) expenses are another person’s (or country’s) income Payments to the rest of the world for assets Payments to the rest of the world for G&S (negative component of U.S. current acct) Rest of World United States Payments to the United States for G&S (positive component of U.S. current acct) Payments to the United States for assets The U.S. Balance of Payments in 2008 (billions of dollars) Sales/ purchases of G&S Factor income Transfers Current Account Balance Gov't Asset sales/purchases Private asset sales/purchases Financial Account Balance Payments from foreigners $1,827 $765 Pmts to foreigners $2,523 $646 $487 $530 ($43) $47 ($534) $581 $538 Total Note: -$167 is just a statistical error. Not bad when managing $3.5T! Net ($696) $119 ($128) ($705) ($167) Review Q: The current account plus the financial account is equal to: a. b. c. d. e. Zero One The trade balance The size of the trade deficit Sorry, I’ve been napping. Financial Account • Measures capital inflows from foreign savings that become available for domestic investment • Which brings us back to our good friend: the market for loanable funds • Let’s look at the loanable funds market in two economies: Shieldsville and Mocabeetown