Medical GAP Coverage

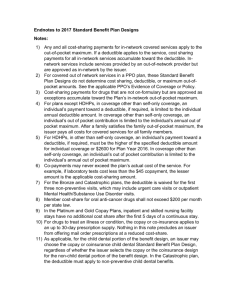

advertisement

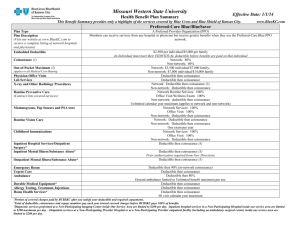

PLEASE MUTE YOUR PHONE THANK YOU! Oberlin Marketing Fort Wayne, IN (260) 486-9739 Medical GAP Coverage A product designed to help bridge the “gaps” in traditional insurance. A solution to rising healthcare costs. Helps employers save premium dollars and helps employees protect themselves against financial strain created by increased out of pocket costs. Healthcare Costs are out of control. Fifteen years ago, GAP was not needed. In today’s market, agents and their clients are being forced to find alternatives. The following slides give a great visual effect of the direction our group health market is headed. In order continue positive growth, agents and their clients must be willing to adapt to the changes. This slide shows how in just over 10 years, the cost of healthcare has risen almost 175%, with a good portion of that increase coming in the last 5 years. Inpatient Hospital Benefit - $500 - $10,000 annual maximum per insured person. - The max for an insured’s family is 3x the above coverage. * This coverage is for inpatient stays, inpatient surgery, inhospital physician charges, and emergency room treatment if admitted to hospital. Outpatient Hospital Benefit - 40%-70% of the inpatient hospital benefit per insured. - The family benefit is 3x this coverage as well. * This coverage is for services rendered in hospital emergency room, hospital outpatient facility, outpatient surgical facility, or MRI facility. Physician Office Visit - $10-$50 per visit per insured person; 1-3 visits per year. Ambulance Benefit (Accident Only) - $50-$350 per person. 3x the benefit per family. - Retention – When renewal cases have increases, GAP gives the agent another option to help renew the case. - New Business – When an agent can bring a fresh idea to a prospect that they have never seen before, it differentiates that agent from the competition. If the agent can show the employer a savings and keep the out of pocket expenses down, the odds of winning that case are much higher. - Commission – Agents and agencies will earn commissions when a GAP is sold. This is a way to earn additional money on top of the commission earned in the sale of the group case itself. Presentation of how gap fits with the proposed medical plan (21 enrolled lives) Renewal Medical Plan Proposed Alternate Plan with Gap Deductible $500 $4,000 Coinsurance 100% 100% Out-of-Pocket Max $1,500 $5,000 Monthly Premium (based on census) $17,505.87 $9,404.00 $8,101.87 Savings Created RECOMMENDED GAP PLAN Annual Commisions: Inpatient Hospital Max $5,000 Outpatient Hospital Max $3,500 Gap Monthly Premium $3,025.88 TOTAL COST OF PROPOSED PLAN WITH GAP INCLUDED $12,429.88 Net Savings $5,075.99 (29% savings) Major Medical: $7,560 (based on $30 per head) CMB Gap: $3,631 (48% extra commission) - No deductible with our gap plan - Outpatient benefit can go all the way up to $7,000 - Rates are extremely competitive. - Will pay benefits for deductibles, coinsurance AND copayments covered by the health benefit plan. - Family limit is 3x the insured benefit. (Opposed to 2x) - Guaranteed Issue with no pre-ex. Current Plan (37 Employees) Competitor Medical Bridge Crescent Medical Bridge $500 Deductible $500 Deductible Hospital Confinement = $1,000 Outpatient Surgery ONLY = $250 - $1,000 (This will pay out as low as $250 or as high as $1,000 depending on the type of surgery). Coverage Amount Emergency Room = $100 Ambulance = $100 Diagnostic Testing = can be added but significantly increases the rate. The benefit pays only $100-$200 depending on the test). Dr. Office Visit = $25 one time Underwriting Plan Type Rates _Birth in first nine months NOT covered. _Pre-existing conditions period of 12 months after the effective date of coverage. _Coverage not provided for employees over the age of 64. Indemnity - Pays a lump sum benefit, regardless of claim amount. $2,227 Inpatient Hospital Benefit = $1,000 Outpatient Benefit = $700 (covers surgery, emergency room visits, and radiological diagnostic testing. Will pay up to benefit max ($700) towards any deductible, copayment, or coinsurance amount covered by the Insured Person's Health Plan.) Ambulance = $100 Diagnostic Testing = Covered under Outpatient Benefit. This is very important as the average MRI costs over $1,000). Dr. Office Visit = $25 twice a year _No employee maternity exclusions _No Pre-existing condition exclusions _No age limit for employees _Policy is Guaranteed Issue Supplemental Medical Expense Plan (Traditional Gap) - Follows the Insured's Health Benefit Plan and only pays the applicable deductible, coinsurance, or copayment charge up to the benefit max. $1,620 This group switched to a $10,000 deductible plan with copays and per occurrence deductibles . They implemented a very common HRA plan that will pay a max of $8,500. The employees have to satisfy a $1,500 deductible before any benefit is paid out. The below chart shows why switching to a Crescent Medical Bridge Gap Plan may be a better option. Money Saver HRA Crescent Medical Bridge Gap First Dollar Coverage Employees must satisfy a $1,500 deductible before any money is paid out. Will not cover the per occurrence copays associated with hospital stays, outpatient surgeries, and outpatient diagnostics. No deductible. Gap will pay First Dollar for eligible expenses. This includes deductibles, copays, and coinsurance. This will also cover the $500 per occurrence for Hospital stays and the $250 per occurrence for outpatient surgery, as well as the $300 copay for outpatient major diagnostics. Coinsurance Plan usually has coinsurance built in which can increase the total out-of-pocket. No coinsurance. Gap pays first dollar. Aggregate Coverage Max Plan has a max coverage of $8,500 for Inpatient and Outpatient expenses combined. Inpatient = $10,000 Outpatient = $7,000 Monthly Rate based on census $5,791.27 $4,390.12 $1,401.15 savings What makes them different? Claim example using a typical shoulder injury followed by an MRI and surgery. Money Saver HRA Crescent Medical Bridge Gap MRI = $1,400 Plan has $300 Copay MRI = $1,400 Plan has $300 Copay Employee pays $300 Gap pays $300 copay Outpatient Surgery = $6,000 Plan has $250 per occurrence deductible. Money Saver has $1,500 deductible Outpatient Surgery = $6,000 Plan has $250 per occurrence deductible. Employee pays $250 per occurrence deductible Gap pays $250 per occurrence deductible Employee pays $1,500 Money Saver deductible Gap pays $6,000 for cost of surgery Total Cost for Employee = $2,050 Total Cost for Employee = $0 Gena Gilleo – (800) 486-9739 - Name and brief description of group. - Census with name, birthdate, and coverage level. - Copy of current and renewal plan including rates. - List of several alternate plans with higher deductibles and lower premiums. - We also need to know what state the business is headquartered in. - Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2005-2001 - Sally Pipes, President of the Pacific Research Institute. “Forbes Magazine” 10-10-2011