Master’s Economic Theory Comprehensive Examination

advertisement

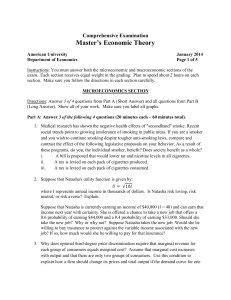

Comprehensive Examination Master’s Economic Theory American University Department of Economics June 2013 Page 1 of 5 Instructions: You must answer both the microeconomic and macroeconomic sections of the exam. Each section receives equal weight in the grading. Plan to spend about 2.5 hours on each section. Make sure you follow the directions in each section carefully. MICROECONOMICS SECTION Directions: Answer 3 of 4 questions from Part A (Short Answer) and all questions from Part B (Long Answer). Show all of your work. Make sure you label all graphs. Part A: Answer 3 of the following 4 questions (20 minutes each – 60 minutes total). 1. True, False or Uncertain and Explain. A local factory pays its workers $10 per hour and finds that the average product of labor is maximized when 50 workers are employed. Therefore, when 50 workers are hired, average variable costs is minimized and equal to $500. (Assume that labor is the only variable cost). 2. Michelle spends her weekly income of $30 on chocolate (c) and shampoo (s). Initially, when the prices are pc=2=ps (where pc is the price of chocolate and ps is the price of shampoo) she buys c=10 and s = 5. After the prices change to pc=1 and ps=3 she purchases c=6 and s=8. Draw her budget lines and choices in a diagram. Using revealed preference, discuss whether or not she is maximizing her utility before and after the price change. 3. Suppose a paper mill earns $500,000 when it pollutes a river, and that it can invest in abatement. The more it invests, as captured in the variable A, the less pollution there is. The effects of pollution are confined to a single farmer who earns in dollars: 200,000 400√ If bargaining is frictionless and the parties split the gains from any agreement equally, calculate the agreement reached between the mill and farmer if the mill has the right to pollute, as well as the post agreement profits of the mill and farmer. How does your answer change if the farmer has the right to set the level of abatement up to $250,000? 4. Show that a monopolist’s marginal revenue will be positive at a certain sales quantity only if the demand for the firm’s product is elastic at that quantity. Page 2 of 5 Part B: Answer both questions (45 minutes each – 90 minutes total). 1. Ariel’s Grotto produces burgers (q) according to the production function: q K L where K is the number of units of capital and L is the number of units of labor. (a) What restrictions must you impose on α and β to ensure that this production function obeys the law of diminishing marginal productivity? What restrictions must you impose to ensure that his production function exhibits decreasing returns to scale. (b) Assume that these restrictions hold. Define w as the price of a unit of labor, and r as the price of a unit of capital. Calculate Ariel’s Grotto long-run cost function, C(w,r,q). What is the firm’s marginal cost of production? (c) If this firm operates in a perfectly competitive environment, calculate its supply function. Illustrate the firm’s supply curve on a graph. (d) Union contract negotiations temporarily fix the Ariel’s Grotto labor force at 10 workers. Calculate the firm’s short-run cost function. (e) Illustrate on an isoquant/isocost graph and explain in words the relationship between the firm’s long-run and short-run cost function. 2. Consider a movie theater monopolist who faces the following demand curves for adults and children, respectively: 1,600 100 800 100 The firm has a cost function of: 1 200 a. What is the monopolist’s best price if discrimination is not possible? b. What is the monopolist’s best price(s) if discrimination is possible? c. What is the effect of discrimination on consumer surplus? d. Illustrate on a graph and explain how the relative elasticities of demand are related to the relative prices in the two markets. P MACROECONOMICS SECTION Directions: Answer both parts, A and B; there is some choice in each part. Points will be proportional to the time limits indicated. Part A – Short Answer Questions (Identifications): Choose three (3) of the following. For each one you choose, you must give a definition and briefly discuss the significance of the concept for macro theory or policy. You may provide examples, but note that these do not substitute for definitions. Time limit: 10 minutes each (30 minutes total). 1. 2. 3. 4. 5. 6. 7. 8. 9. Zero lower bound Monetary neutrality Natural rate of output Speculative attack Phillips curve Disinflation Wage setting equation (WS) Golden rule level of capital J-curve Part B – Long Answer Questions (Problems/Models) Choose two (2) of the following. Time limits: 60 minutes each (120 minutes total) 1. Many countries will move to monetary contraction over the next many years. Analyze the situation of contractionary monetary policy for any three (3) of the following cases, assuming a short-run analysis. Your analysis can be mainly graphical and must include detailed explanations. You may include equations if you wish. Also, you must show the changes on the central bank balance sheet where relevant. a. Closed economy IS-LM model (with the traditional LM curve). b. IS-MP model, closed economy, where MP is the “monetary policy” curve assuming the central bank targets the interest rate. c. Open economy IS-LM model, with free capital mobility (so that the interest parity relation holds) and a flexible exchange rate. Explain in detail the role of the interest parity condition. d. Open economy IS-LM model, with free capital mobility (so that the interest parity relation holds) and a fixed exchange rate. You must explain in detail the role of the interest parity condition. (Part B continues on the next page) Page 4 of 5 2. Analyze the short-run and medium-run effects of each of the following on output and the price level, using the IS-LM model and the aggregate-supply/aggregate-demand model (AS-AD). Be sure to explain how the economy adjusts from the new short-run equilibrium to the new medium-run equilibrium, discuss in detail the role of price expectations, and assess whether the theoretical adjustment process is realistic or not in each case. You may assume that the economy starts in an initial medium-run equilibrium at the “natural” output level Yn in each situation. a. A negative supply shock, such as a rise in the price of oil. b. A reduction in the level of unemployment benefits. c. A positive shock to aggregate demand, due to a rise in business confidence. 3. (a) Derive the Solow Growth model (neoclassical growth model) algebraically. (b) Explain intuitively the steady-state equilibrium condition in the Solow Growth model. (c) Use the graph of the Solow model to analyze the effects of each of the following changes (considered separately) on long-run equilibrium: (i) A fall in the growth rate of the population (ii) A rise in the saving rate (iii) A decline in the rate of technical progress For each case, what is the change in the growth rate of output, output per worker, and output per effective worker? Summarize and explain the reasoning. (d) Finally, consider whether or not a policy to reduce the saving rate would be a good idea (e.g. is it possible for an economy to have too much capital?). 4. (a) Derive the endogenous growth model (Y = AK model). (b) How is this model affected by the following events, considered separately: (i) A fall in the initial level of K. (ii) A rise in the saving rate. Provide a detailed graphical analysis and thorough economic explanations in each case. (c) In what ways is the endogenous growth model preferable to the Solow model? 5. Many countries are pursuing a policy of fiscal austerity. (a) Explain fiscal austerity. What has been the rationale for fiscal austerity? (b) Consider the closed economy IS-LM and AD-AS model and analyze the short run and medium run implications of fiscal austerity for real GDP, interest rates and the price level. Provide a detailed explanation. (c) What are the implications for your analysis if the economy is in a liquidity trap? Demonstrate with new graphs and a new explanation. (d) Use the equation for the government budget constraint to discuss the potential long run consequences for the debt/GDP ratio. Be specific. (e) Are there any special aspects of the US economy that affect the risks presented by the already accumulated debt? Explain. Page 5 of 5 6. Consider the open economy with flexible exchange rates. Analyze the short run consequences for the home economy when there is a: (a) fiscal expansion in the foreign economy. (b) monetary expansion in the foreign economy. Use the open economy IS-LM model along with interest parity condition. Explain all changes. Summarize the effects on home economy real GDP, interest rates and the exchange rate in each case.