Chapter 7: Money Markets

advertisement

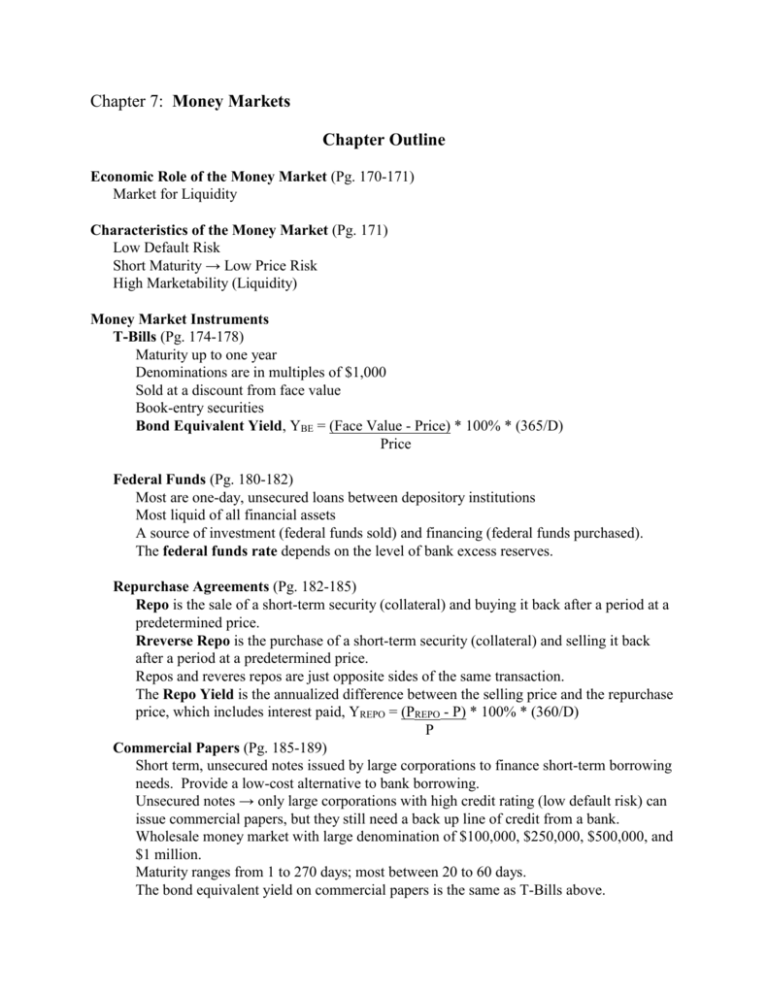

Chapter 7: Money Markets Chapter Outline Economic Role of the Money Market (Pg. 170-171) Market for Liquidity Characteristics of the Money Market (Pg. 171) Low Default Risk Short Maturity → Low Price Risk High Marketability (Liquidity) Money Market Instruments T-Bills (Pg. 174-178) Maturity up to one year Denominations are in multiples of $1,000 Sold at a discount from face value Book-entry securities Bond Equivalent Yield, YBE = (Face Value - Price) * 100% * (365/D) Price Federal Funds (Pg. 180-182) Most are one-day, unsecured loans between depository institutions Most liquid of all financial assets A source of investment (federal funds sold) and financing (federal funds purchased). The federal funds rate depends on the level of bank excess reserves. Repurchase Agreements (Pg. 182-185) Repo is the sale of a short-term security (collateral) and buying it back after a period at a predetermined price. Rreverse Repo is the purchase of a short-term security (collateral) and selling it back after a period at a predetermined price. Repos and reveres repos are just opposite sides of the same transaction. The Repo Yield is the annualized difference between the selling price and the repurchase price, which includes interest paid, YREPO = (PREPO - P) * 100% * (360/D) P Commercial Papers (Pg. 185-189) Short term, unsecured notes issued by large corporations to finance short-term borrowing needs. Provide a low-cost alternative to bank borrowing. Unsecured notes → only large corporations with high credit rating (low default risk) can issue commercial papers, but they still need a back up line of credit from a bank. Wholesale money market with large denomination of $100,000, $250,000, $500,000, and $1 million. Maturity ranges from 1 to 270 days; most between 20 to 60 days. The bond equivalent yield on commercial papers is the same as T-Bills above. 2 Negotiable Certificates of Deposit (Pg. 189-191) Large denomination time deposits Issued by banks to offset declining demand deposits as a source of funds Negotiable - may be sold and traded before maturity Issued at face value with an “add on” rate paid over the face value Maturity up to 6 month Banker’s Acceptance (Pg. 191-194) Time drafts - orders to pay in the future to finance international trade Drafts are drawn on and accepted by bank → direct liability of bank Standard maturities of 30, 60, or 90 days - maximum of 180 Sold at a discount 3 Chapter Key Points 1. The money market is a market for liquidity. It is a collection of markets where short-term, marketable obligations with little chance of default are bought and sold. The money markets are where businesses, government, financial institutions, and investors store liquidity, fund liquidity, and adjust liquidity. Also, the money markets are where the Federal Reserve conducts its monetary policy. 2. The economic role of money markets is to provide an efficient means for lenders and borrowers to adjust their liquidity positions. Money markets are important to commercial banks for adjusting their liquidity position and as a source of funds. 3. There is a broad spectrum of financial securities that comprise the money markets. The general characteristics of money market securities are (a) low default risk, (b) short-term maturity, and (c) high marketability (liquidity). 4. The key players in the money markets are commercial banks, the Federal Reserve, Treasury Department, dealers and brokers, and corporations. 5. The close substitutability between money market securities explains why short-term interest rates tend to move together over time.