Procentní metoda rozpoznávání zisku a tr*eb

advertisement

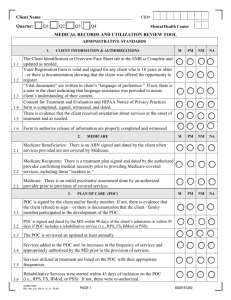

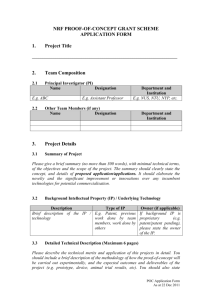

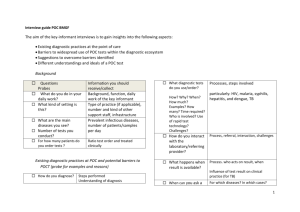

Úvod do procentní metody rozpoznávání zisku a tržeb FIR 2013 Profit recognition in construction KEY BALANCE SHEET ACCOUNTS (CASH BASIS) KEY BALANCE SHEET ACCOUNTS USING THE BILLINGS METHOD • Accounts receivable, accounts payable, and inventory accounts are basic items reported in the balance sheet when using the accrual-billings method. In addition, an account is utilized to reflect WORK IN PROGRESS that has not been billed. Such an account would embrace payrolls paid, materials installed, and other project costs that have not yet been billed to the client. These expenses are considered to be a current asset and are summarized in the account called work in progress. POC method of profit and revenues recognition KEY ACCOUNTS USING THE POC METHOD In the case of the percentage-of-completion method, the key balance sheet accounts must account for the amount of underbilling and overbilling. • Underbilling is a situation in which the value earned (based on POC) exceeds the amount billed, • generating an asset Overbilling is a situation in which the value earned (based on POC) is less than the amount billed, generating a liability. The POC method provides for recognition of income (on the basis of earned value) at the end of each accounting period. Revenues are recorded in the project billings account and expenses in the work in progress account as work progresses. At the end of each accounting period, income flows for all projects appear on the income statement and the balance sheet when the POC method is used. The accounts to reflect overbilling or underbilling on projects are updated at the end of each accounting period.