slides - Global University Venturing

advertisement

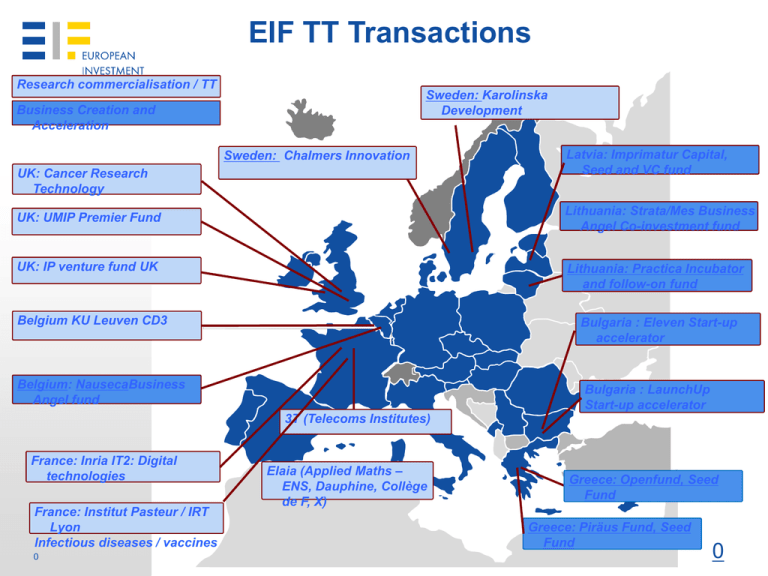

EIF TT Transactions Research commercialisation / TT Sweden: Karolinska Development Business Creation and Acceleration Sweden: Chalmers Innovation UK: Cancer Research Technology Latvia: Imprimatur Capital, Seed and VC fund Lithuania: Strata/Mes Business Angel Co-investment fund UK: UMIP Premier Fund UK: IP venture fund UK Lithuania: Practica Incubator and follow-on fund Belgium KU Leuven CD3 Bulgaria : Eleven Start-up accelerator Belgium: NausecaBusiness Angel fund Bulgaria : LaunchUp Start-up accelerator 3T (Telecoms Institutes) France: Inria IT2: Digital technologies France: Institut Pasteur / IRT Lyon Infectious diseases / vaccines 0 Elaia (Applied Maths – ENS, Dauphine, Collège de F, X) Greece: Openfund, Seed Fund Greece: Piräus Fund, Seed Fund 0 Knowledge Transfer Strategic Partnership Partners Established in Rome - 16 June 2010 – link with LTIC Open initiative to jointly design Knowledge Transfer solutions EIB Group and public long-term financial institutions from Austria, Finland, France, Germany, Italy, Poland, Spain, Sweden, Turkey, UK Work on IP, POC, Business Angels 1 EU 2020 Agenda: Europe's Social Market Economy for the 21st Century Plan for Action Technology Transfer ■ Remove obstacles to knowledge transfer (excessive risk, lack of financial resources, lack of qualified human resources) by ■ facilitating access to adequate financial resources, financial structuring, technology risk assessment and ■ encouraging the private sector to invest Active EIF support of EU core objectives through Tech Transfer initiatives 2 Proof of Concept is key to the EU innovation ecosystem ■ POC dedicated instrument addresses weak link in EU2020 Strategy: match research and market Beyond traditional linear thinking of research commercialisation – towards innovation networks and ecosystems Design based on concrete EIF experience in this challenging market segment Market failure: EC funding on non pari-passu terms is critical to setting up PoC fund 3 Key features Investment Facility (not a subsidy programme) Imperative of commercialisation: industry/investment community is involved from the earliest stages Rigorous governance: professional, independent decision-making at every step Legal robustness, simple, cost-effective 4 Investment strategy Geographical coverage EU with pre-agreed targets for countries of the sponsors Investments targets Proof-of-Concept funding (POC compartment EUR 20-200k/investment, POC+ compartment up to EUR 750k/investment) Seed equity, up to EUR 3m per investment Deal flow Leading EU academic partners Deal Flow hub in target countries (East, South)? 5 Investing in Europe’s academic POC gap Technology Transfer Finance Facility Preferred Partner JRC-RTD / EC LTIC / KTSP ~ 1500 PROs without systematic / access to POC investment – no grants Key value adds amounts (up to EUR 3m in three stages) speed (< 2 months decision time) investment rigour 6 Pan-European Proposal under consideration by by EC RTD At the centre of an ecosystem Strategically compelling scope and perspective – competition amongst Europe’s best IP sharing/cross licensing training /mobility/exchange of good practices /innovation entrepreneurship training start with ICT-focussed platform need for BusDev / coaching offer 6