Chapter 2

Principles of Accounting

Analyzing Business

Transactions

Slide

1-1

Measurement Issues

Slide

1-2

Measurement Issues

Question: Are the following events recorded in the

accounting records?

Discuss

Event

Criterion

Record/

Don’t Record

Slide

1-3

Purchased a

computer.

product

design with

potential

customer.

Pay rent.

Is the financial position (assets, liabilities, or

stockholders’ equity) of the company changed?

Measurement Issues

Recognition

Note 1 - Summary of Significant Accounting Policies:

“We recognize sales for commercial airplane deliveries as

each unit is completed and accepted by the customer.”

Once Boeing reaches final agreements with customers, it

receives deposits from them for the airplanes they have

ordered.

Question: Is this event recorded in the accounting

records of Boeing?

Slide

1-4

Measurement Issues

Ethics and Measurement Issues

Slide

1-5

Accounting Transactions

Transaction Analysis

Assets

=

Liabilities

+

Owners’ Equity

Capital

Revenue

Slide

1-6

Withdrawal

Expense

The Account

Account

Record of increases and decreases

in a specific asset, liability, equity,

revenue, or expense item.

Debit = “Left”

Credit = “Right”

An Account can

be illustrated in a

T-Account form.

Slide

1-7

Account Name

Debit / Dr.

Credit / Cr.

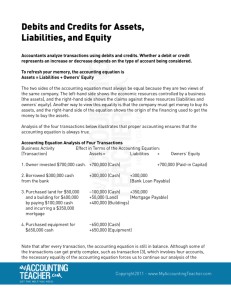

Debit and Credit Procedures

Double-entry accounting system

Each transaction must affect two or more

accounts to keep the basic accounting equation

in balance.

Recording done by debiting at least one account

and crediting another.

DEBITS must equal CREDITS.

Slide

1-8

Debit and Credit Procedures

If Debits are greater than Credits, the account

will have a debit balance.

Account Name

Debit / Dr.

Transaction #1

$10,000

Transaction #3

8,000

Balance

Slide

1-9

$15,000

Credit / Cr.

$3,000

Transaction #2

Debit and Credit Procedures

If Credits are greater than Debits, the account

will have a credit balance.

Account Name

Debit / Dr.

Transaction #1

Balance

Slide

1-10

$10,000

Credit / Cr.

$3,000

Transaction #2

8,000

Transaction #3

$1,000

Dr./Cr. Procedures for Assets and Liabilities

Assets

Debit / Dr.

Credit / Cr.

Normal Balance

Liabilities – Credits

should exceed debits.

Chapter

3-23

Liabilities

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter

3-24

Slide

1-11

Assets - Debits should

exceed credits.

The normal balance is on

the increase side.

Dr./Cr. Procedures for Stockholders’ Equity

Owner’s investments and

revenues increase owners’ equity

(credit).

Owners’ Equity

Credit / Cr.

Debit / Dr.

Withdrawals and expenses

decrease owners’ equity (debit).

Normal Balance

Chapter

3-25

Capital

Debit / Dr.

Chapter

3-25

Slide

1-12

Withdrawals

Credit / Cr.

Debit / Dr.

Normal Balance

Normal Balance

Chapter

3-23

Credit / Cr.

Dr./Cr. Procedures for Revenue and Expense

Revenue

Debit / Dr.

Credit / Cr.

Normal Balance

Chapter

3-26

Expense

Debit / Dr.

Normal Balance

Chapter

3-27

Slide

1-13

Credit / Cr.

The purpose of earning

revenues is to benefit the

owners.

The effect of debits and

credits on revenue accounts

is the same as their effect

on owners’ equity.

Expenses have the opposite

effect: expenses decrease

owners’ equity.

Debits and Credits Summary

Liabilities

Normal

Balance

Debit

Normal

Balance

Credit

Assets

Credit / Cr.

Normal Balance

Chapter

3-24

Owners’ Equity

Credit / Cr.

Debit / Dr.

Debit / Dr.

Debit / Dr.

Credit / Cr.

Normal Balance

Normal Balance

Chapter

3-23

Expense

Debit / Dr.

Revenue

Chapter

3-25

Credit / Cr.

Debit / Dr.

Normal Balance

Chapter

3-27

Slide

1-14

Credit / Cr.

Normal Balance

Chapter

3-26

Debits and Credits Summary

Balance Sheet

Asset = Liability + Equity

Debit

Credit

Slide

1-15

Income Statement

Revenue - Expense =

Debits and Credits Summary

Review Question

Debits:

a. increase both assets and liabilities.

b. decrease both assets and liabilities.

c. increase assets and decrease liabilities.

d. decrease assets and increase liabilities.

Slide

1-16

Debits and Credits Summary

Review Question

Accounts that normally have debit balances are:

a. assets, expenses, and revenues.

b. assets, expenses, and equity.

c. assets, liabilities, and withdrawals.

d. assets, withdrawals, and expenses.

Slide

1-17

Slide

1-18

Summary of the Accounting Cycle

1. Analyze business transactions

Slide

1-19

9.

2. Journalize the

transactions

8.

3. Post to ledger accounts

7. Prepare financial

statements

4. Prepare a trial balance

6.

5.

Accounting Cycle

Slide

1-20

Accounting

Cycle

Slide

1-21

Accounting

Cycle

Slide

1-22

Copyright

“Copyright © 2009 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.”

Slide

1-23