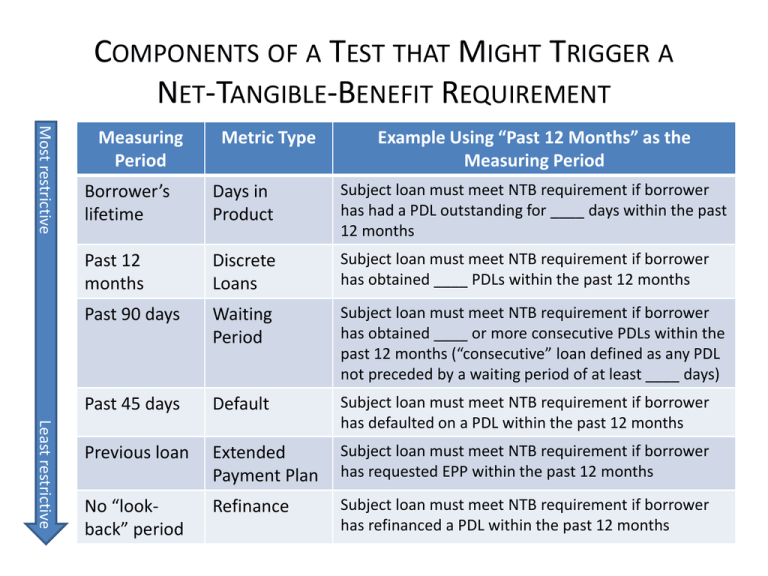

Possible Triggers for Net Tangible Benefit Test

advertisement

COMPONENTS OF A TEST THAT MIGHT TRIGGER A NET-TANGIBLE-BENEFIT REQUIREMENT Most restrictive Measuring Period Metric Type Example Using “Past 12 Months” as the Measuring Period Least restrictive Borrower’s lifetime Days in Product Subject loan must meet NTB requirement if borrower has had a PDL outstanding for ____ days within the past 12 months Past 12 months Discrete Loans Subject loan must meet NTB requirement if borrower has obtained ____ PDLs within the past 12 months Past 90 days Waiting Period Subject loan must meet NTB requirement if borrower has obtained ____ or more consecutive PDLs within the past 12 months (“consecutive” loan defined as any PDL not preceded by a waiting period of at least ____ days) Past 45 days Default Subject loan must meet NTB requirement if borrower has defaulted on a PDL within the past 12 months Previous loan Extended Payment Plan Subject loan must meet NTB requirement if borrower has requested EPP within the past 12 months No “lookback” period Refinance Subject loan must meet NTB requirement if borrower has refinanced a PDL within the past 12 months BORROWER’S REPRESENTATIONS THAT MIGHT SATISFY AN NTB REQUIREMENT • Compared to an existing PDL or other consumer loan, the subject PDL: Improve Credit Terms • lowers APR; • extends maturity date; or • reduces monthly debt service. • Borrower is unable to meet fixed expenses because borrower’s income has varied due to: • self-employment; • commission; or Smooth Cash Flow • overtime. • Borrower has experienced a variable expense, the non-payment of which would cause: • loss of income (e.g., repair of a car needed to commute to work); Avoid Undesirable • embarrassment or inconvenience (e.g., back-to-school clothes or supplies); or Result of Non• default penalties (e.g., late fee, NSF fee, or utility re-connect fee). Payment EXAMPLE OF A NET-TANGIBLE-BENEFIT WORKSHEET Loan Information Statement By initialing by the one or more items below, the borrower hereby represents that he or she will receive the following benefit(s) by obtaining this payday loan: ____ Lower my APR on an existing payday loan from ____% to ____%. ____ Extend the due date of an existing payday loan from _________ to __________. ____ Reduce the payment amount of an existing payday loan from $__________ to $__________. ____ Allow me to match my income and expenses this month despite a variance in my income due to (select all that apply): ____ self-employment income; ____ commissions; ____ overtime; other (explain) __________________________________________. ____ Allow me to pay a variable expense, the non-payment of which would cause (select all that apply): ____ loss of income; ____ embarrassment or inconvenience; ____ default penalties; or other (explain) ___________________________________________. ___________________ Borrower _________________ Date