Product Presentation (1)

advertisement

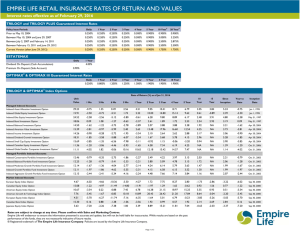

PREMIER FINANCIAL ALLIANCE FINANCIAL PLANNING PRESENTATION The Road To Financial Freedom THREE ENEMIES OF YOUR MONEY “ T I P ” HOW MONEY WORKS TYPES OF MONEY INSURANCE MARKET THREATS TO YOUR FINANCIAL SECURITY THE REVOLUTIONARY SOLUTION THE SECRET OF MONEY THREE ENEMIES OF YOUR MONEY TAXES THREE ENEMIES OF YOUR MONEY INFLATION THE SILENT KILLER OF YOUR MONEY THREE ENEMIES OF YOUR MONEY PROCASTINATION HIGH COST OF WAITING HOW MONEY WORKS Rule of 72 Divide 72 by the interest rate to estimate the number of years it takes for your money to double. Age 4% Money Doubles Every 18 Years 29 47 65 $10,000 $20,000 $40,000 Age 8% Age 12% Money Doubles Every 9 Years Money Doubles Every 6 Years 29 38 47 56 65 29 35 41 47 53 59 65 $10,000 $20,000 $40,000 $80,000 $160,000 The person with the most “doubles” wins. * These hypothetical examples are for illustrative purposes only and do not represent any particular investment vehicle. The Rule of 72 is a mathematical concept that approximates the number of years it would take to double the principal at a constant rate of return. The performance of investments fluctuates over time, and as a result, the actual time it will take an investment to double in value cannot be predicted with any certainty. $10,000 $20,000 $40,000 $80,000 $160,000 $320,000 $640,000 TYPES OF MONEY FREE MONEY • 401K, LOTTERY TAX FREE MONEY • ROTH IRA • LIFE INSURANCE TAX DEFFERED MONEY • 401K • IRA TAXABLE MONEY • EVERYTHING ELSE INSURANCE MARKET TEMPORARY LIFE INSURANCE PERMANENT LIFE INSURANCE (RENTING) (BUYING) TERM LIFE • EXPIRES AFTER CERTAIN TIME RETURN OF PREMIUM • EXPIRES AFTER CERTAIN TIME WHOLE LIFE UNIVERSAL LIFE VARIABLE UNIVERSAL LIFE • RATE OF RETURN 3%-3.5% • RATE OF RETURN 4%-5% • TIED WITH STOCKS EQUITY INDEX • RATE OF RETURN 2%-12% UNIVERSAL • AVERAGE 7.3%-8.3% LIFE THREATS TO YOUR FINANCIAL SECURITY PREMATURE DEATH Households saying they own enough life insurance to replace their income for only 2.8 years. ILLNESS Every 40 seconds someone in the US suffers a stroke. Every minute an American will die from a coronary event1. . DISABILITY One in 5 working Americans suffers the effects of a disability for more than six months during his/her working career2. LONG-TERM CARE The U.S. Bureau of Census estimates that by 2060 as many as 24 million people will need long term care services. OUTLIVING YOUR MONEY People are living longer and longer, but they are saving less and less. Most Americans retire in poverty. 73.8% of Americans 65 and older retire on a combined income of private pension and Social Security of $10,000 less a year3. 1. 2. 3. American Heart Association, American Stroke Association, Heart Disease and Stroke Statistics, 2008 Commissioners Group disability table and U.S. Bureau of Census Social Security Administration, 1996 ACCELERATED BENEFITS RIDERS • ABR 1- Terminal Illness • Resulting in death within two years • (1 year in VT and PA) • Lump-sum distribution (discounted from death benefit) • Funds can be used for anything • No additional cost • No elimination period ACCELERATED BENEFITS RIDERS • • ABR 2 - Chronically ill Unable to perform 2 of 6 ADLs • Activities of Daily Living • • • • • • • • • • Bathing Continence Dressing Eating Toileting Transferring Cognitive Impairment Short-term or long-term memory impairment Loss of orientation to people, places or time Deductive or abstract reasoning impairment Max. benefit calculated as 24% of the net death benefit (actual payment is discounted) in any calendar year • Funds can be used for anything • No additional cost • Policy must be I/F for 2 years ACCELERATED BENEFITS RIDERS • ABR 3 - Critical Illness • • • • • • • Heart Attack Stroke Cancer End stage renal failure Major organ transplant ALS (Lou Gehrig’s disease) Blindness • Lump-sum distribution (discounted from death benefit) after 30 • • days Funds can be used for anything No additional cost Form series 8165(0703) Life Event Story WHAT THE WEALTHY KNOW THAT MANY PEOPLE DON’T According to the Federal Reserve, the richest 10% Americans own over half of the tax-free investment gains built up in life insurance1. 50th to 90th Top 10% percentile own 55.1% Own 38.4% Has Life Insurance Has Life Insurance Families in bottom half of net-worth percentiles own just 6.5% of these tax-free assets! 1. Federal Reserve, 2007 THE EQUITY INDEX CONCEPT WHOSE TIME HAS COME DOWNSIDE PROTECTION UPSIDE POTENTIAL However, during the years when the stock market is down, your equity indexed account will not lose any money. When the stock market is up, an equity indexed product will return to you a portion of the stock market gain. 09/1998-09/2010 $170,000 . $156,857 $156,857 $149,160 $150,000 $156,867 $140,930 $136,937 $160,747 $145,542 $145,749 $125,155 $130,000 $120,909 $125,080 $110,000 $134,091 $127,344 $125,080 $117,033 $108,789 $111,033 $115,090 $106,268 $100,770 $99,228 $100,000 $95,952 $90,000 S&P500 $78,869 $70,000 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 •The graph is based on actual S&P 500 data and actual credited rates for the period shown on one of our indexed annuity products. These results should not be an indication that Indexed Annuities will outperform the S&P 500. This simply demonstrates the effectiveness of Indexed Annuities in years when the S&P 500 was negative. CASH VALUE Upside growth potential - Interest credit is tied to the S&P 500 Index - S&P 500 Index – A dynamic index that consists of the 500 largest companies in the US such as Exxon, Disney World, Walt Mart, Citigroup, Microsoft, McDonalds… etc. Downside protection - Equity Index concept guarantees you could never lose your cash value due to a decline in the index Accessibility - Tax free access after the 1 st year via loans