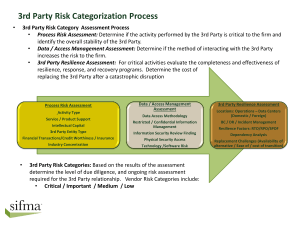

the insurance industry

advertisement

A DECADE’S JOURNEY THROUGH THE INSURANCE INDUSTRY (AND WHAT THE NEXT DECADE HOLDS…) Joe Plumeri Chairman and CEO, Willis Group Holdings plc IISA/SAIA/FIA Conference Sun City, South Africa – June 11, 2012 THE LESSONS OF HISTORY …IN BUSINESS From this… …to this! 2000 2012 1 HOW DID WE GET THERE? From memories… 1912 …to dreams 2009 2 IT WASN’T EASY IN A DECADE OF UPHEAVAL… Man-Made Disasters: Natural Catastrophes: Regulatory Upheaval: 2001: 9/11 - Largest single property, aviation & WC loss. 2011: Costliest year ever for nat cat losses -- $105 bn insured losses. 2004-2005: Age of Spitzer brings $3 bn in fines. 2008: Global financial crisis – 389 banks failed; how many insurers? Lessons Learned: Contract Certainty & stick to your knitting 2005: 2nd costliest year with insured losses of $101 bn. Lessons Learned: The importance of resiliency & analytics Today: Solvency II implementation cost €2-3 bn over 5 years. Lessons Learned: The importance of transparency & ERM 3 …ALL IN THE DECADE OF THE BLACK SWAN 8 of the top 10 costliest insurance losses in the past 30 years occurred in the last decade! Event Year Total Insured Losses 1. Hurricane Katrina 2005 $74.7 billion 2. Tōhoku quake and tsunami 2011 $35 billion 3. Hurricane Andrew 1992 $25.6 billion 4. September 11 Attacks 2001 $23.8 billion 5. Northridge Earthquake 1994 $21.2 billion 6. Hurricane Ike 2005 $21.5 billion 7. Hurricane Ivan 2004 $15.3 billion 8. Hurricane Wilma 2005 $14.5 billion 9. Thailand Flooding 2011 $12 billion 10. Christchurch Earthquake 2011 $12 billion 2010 Eyjafjallajökull Volcano: Cost airlines €150m a day for 6 days Source: Swiss Re 4 PLUMERI’S TOP 10 RISKS: 6 10 9 8 Reputation Piracy Cyber Security 5 4 3 2 1 Regulation and Compliance Market Cap Risk Pandemics Terrorism Climate Change 7 Cost and Globalization Availability of Credit 5 NEW TYPES OF RISK PROLIFERATE “The top 5 risks on the minds of business leaders today aren’t easily solved by purchasing insurance. Traditional risks… wind, earthquake, flood – aren’t even in the top 30 anymore.” -- Hank Watkins, Lloyd’s December 19, 2011 Lloyds Risk Index 2011 – Top 5 Risks 1. Loss of customers 2. Talent and skills shortages 3. Reputational risk 4. Currency fluctuation 5. Changing legislation All difficult or impossible to insure Demanding resiliency 6 TODAY’S GLOBAL INSURANCE INDUSTRY Today our industry is facing a perfect storm of: Top 10 Risks Facing Global Insurance Industry (2011): Heavy regulatory demands on capital and solvency vs need to run a profitable business 1. Regulation Continuing global macro economic uncertainty 4. Investment performance Low interest rates impacting investment performance 6. Talent A continued soft market – excess capacity and stiff competition; surge in mega catastrophe claims 8. Corporate governance 2. Capital 3. Macro-economic trends 5. Natural catastrophes 7. Long tail liabilities 9. Distribution channels 10. Interest rates Source: PwC/CSFI 7 THE INSURANCE INDUSTRY: WE OWN RESILIENCE Insurance industry proven its own resilience throughout the decades. Focus on extreme 1:200 year events – made us more resilient to catastrophe and shocks from mother nature and markets. Transforming the scale, depth and quality of insight about the risks facing our clients and how to manage and transfer them. Our market is fully operational – testament to the strength and resilience of this capital market. 8 FOR OUR INDUSTRY: A ONCE IN A LIFETIME OPPORTUNITY Our responsibility as an industry: – To “own” resilience… – To lead using our expertise and resources to address long term risks… – To be an industry building sustainable and predictable growth in the face of new risks… – To bring knowledge, expertise, products and services as risk and uncertainty grows… – To establish resilience as an aspirational purchase Insurance is the vehicle for delivering resilience rather than a transaction; to bring risk management and analytical services to our clients. 9 THE EMERGING GLOBAL MIDDLE CLASS The big story of the 21st Century is the rise of a new global middle class, most of it in Asia. Relentless rise Middle class population as % of world total 60 Two billion more people will join the middle class by 2030. 50 They will accumulate property and income, and rival the U.S. consumer in spending. A business opportunity this large is unprecedented. 40 They will want to protect their lives, property and income, too – the insurance opportunities are huge. 10 1820 90 1913 38 50 Greatest need will be in cities. Source: Surjit Bhalla, “The Middle Class Kingdoms of India and China” 30 20 0 60 80 90 2000 06 10 THE NEXT DECADE: AFRICA’S ERA? Over the past decade, the number of middleclass consumers in Africa has grown 60% to 313 million Offshore expansion strategies South African insurers are focusing on: e.g. Mozambique & Angola 34% of Africans are firmly entrenched in the new middle class, spending between Rest of Africa $2 and $20 a day. By 2060, African middle class will be 1.1 bn Asia strong On par with Chinese and Indian middle classes. South America 2nd fastest-growing economy in the world. Huge potential for global investors. Africa now has more mobile-phone China subscribers than entire U.S. population Source: WSJ, The Economist Europe and USA The emerging African Middle Class will contribute to an emerging Golden Age for Insurance! 0 5 10 15 20 25 Number of companies Source: PwC 11 30 SOUTH AFRICA: GATEWAY TO THE CONTINENT Global brands using South Africa as a “foothold for continental expansion”: Wal-Mart paid $2.4 billion to buy 51% of South Africa's Massmart Holdings Ltd U.S. Yum Brands Inc. to invest $74 million in 100 new KFC outlets in Africa in 2012, and will double the number of stores to 1,200 by 2014 Ford Motor invested $500 million in its SA operations in 2011 British Vodafone now owns 65% of Vodacom, SA's largest mobile phone operator Source: WSJ South African insurance market will lead the way as the dominant market in Africa, accounting for 90% of regional life premium volume and half of the regional non-life premium volume. "Yes, there are risks to doing business in Africa. However, here in Africa, right now the rewards could be as vast as the continent itself." Donald H. Gips U.S. Ambassador to South Africa 12 ANYTHING IS POSSIBLE… 13 A DECADE’S JOURNEY THROUGH THE INSURANCE INDUSTRY (AND WHAT THE NEXT DECADE HOLDS…) Joe Plumeri Chairman and CEO, Willis Group Holdings plc IISA/SAIA/FIA Conference Sun City, South Africa – June 11, 2012