file pdf - Borsa Italiana

advertisement

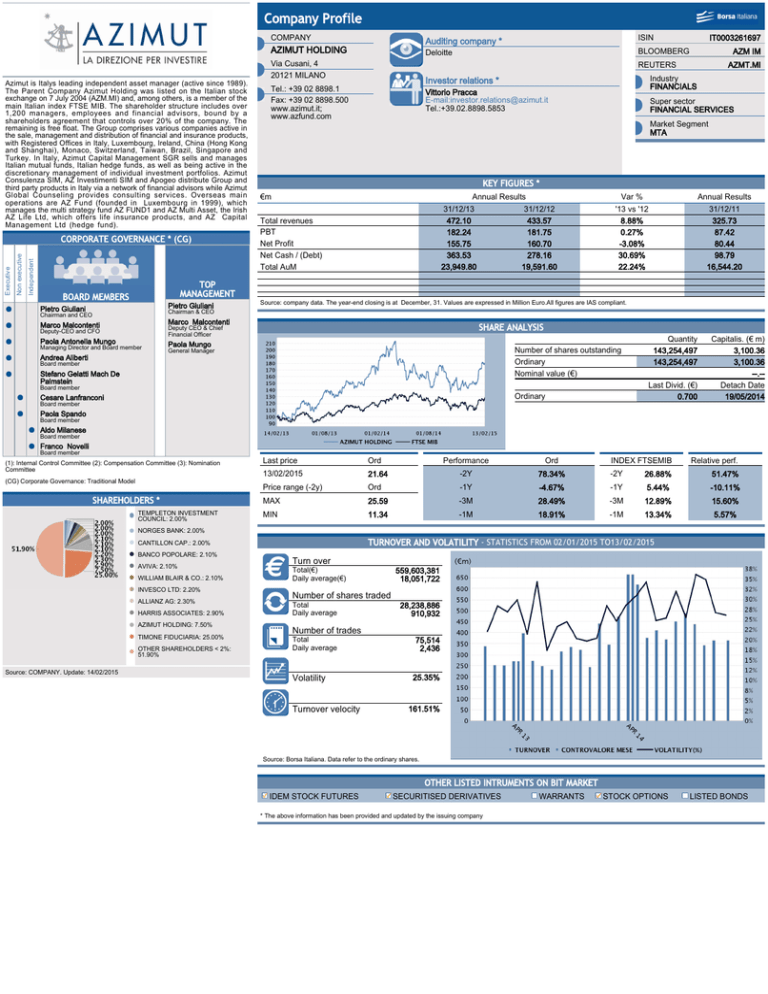

Company Profile COMPANY Auditing company * ISIN AZIMUT HOLDING Deloitte BLOOMBERG Via Cusani, 4 20121 MILANO Azimut is Italys leading independent asset manager (active since 1989). The Parent Company Azimut Holding was listed on the Italian stock exchange on 7 July 2004 (AZM.MI) and, among others, is a member of the main Italian index FTSE MIB. The shareholder structure includes over 1,200 managers, employees and financial advisors, bound by a shareholders agreement that controls over 20% of the company. The remaining is free float. The Group comprises various companies active in the sale, management and distribution of financial and insurance products, with Registered Offices in Italy, Luxembourg, Ireland, China (Hong Kong and Shanghai), Monaco, Switzerland, Taiwan, Brazil, Singapore and Turkey. In Italy, Azimut Capital Management SGR sells and manages Italian mutual funds, Italian hedge funds, as well as being active in the discretionary management of individual investment portfolios. Azimut Consulenza SIM, AZ Investimenti SIM and Apogeo distribute Group and third party products in Italy via a network of financial advisors while Azimut Global Counseling provides consulting services. Overseas main operations are AZ Fund (founded in Luxembourg in 1999), which manages the multi strategy fund AZ FUND1 and AZ Multi Asset, the Irish AZ Life Ltd, which offers life insurance products, and AZ Capital Management Ltd (hedge fund). Independent Non executive Executive CORPORATE GOVERNANCE * (CG) IT0003261697 AZM IM REUTERS Industry FINANCIALS Investor relations * Tel.: +39 02 8898.1 Fax: +39 02 8898.500 www.azimut.it; www.azfund.com AZMT.MI Vittorio Pracca E-mail:investor.relations@azimut.it Tel.:+39.02.8898.5853 Super sector FINANCIAL SERVICES Market Segment MTA KEY FIGURES * €m Annual Results 31/12/13 31/12/12 472.10 433.57 182.24 181.75 155.75 160.70 363.53 278.16 23,949.80 19,591.60 Total revenues PBT Net Profit Net Cash / (Debt) Total AuM Var % '13 vs '12 8.88% 0.27% -3.08% 30.69% 22.24% Annual Results 31/12/11 325.73 87.42 80.44 98.79 16,544.20 TOP MANAGEMENT BOARD MEMBERS Pietro Giuliani Pietro Giuliani Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.All figures are IAS compliant. Chairman & CEO Chairman and CEO Marco Malcontenti Marco Malcontenti Deputy-CEO and CFO Deputy CEO & Chief Financial Officer Paola Antonella Mungo Paola Mungo Managing Director and Board member SHARE ANALYSIS Number of shares outstanding Ordinary Nominal value (€) General Manager Andrea Aliberti Board member Stefano Gelatti Mach De Palmstein Last Divid. (€) 0.700 Board member Ordinary Cesare Lanfranconi Quantity 143,254,497 143,254,497 Capitalis. (€ m) 3,100.36 3,100.36 --.-Detach Date 19/05/2014 Board member Paola Spando Board member Aldo Milanese Board member Franco Novelli Board member (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * TEMPLETON INVESTMENT COUNCIL: 2.00% Last price Ord Performance Ord 13/02/2015 21.64 -2Y 78.34% -2Y INDEX FTSEMIB 26.88% Relative perf. 51.47% Price range (-2y) Ord -1Y -4.67% -1Y 5.44% -10.11% MAX 25.59 -3M 28.49% -3M 12.89% 15.60% MIN 11.34 -1M 18.91% -1M 13.34% 5.57% NORGES BANK: 2.00% TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 CANTILLON CAP.: 2.00% BANCO POPOLARE: 2.10% AVIVA: 2.10% WILLIAM BLAIR & CO.: 2.10% INVESCO LTD: 2.20% ALLIANZ AG: 2.30% HARRIS ASSOCIATES: 2.90% AZIMUT HOLDING: 7.50% TIMONE FIDUCIARIA: 25.00% OTHER SHAREHOLDERS < 2%: 51.90% Source: COMPANY. Update: 14/02/2015 Turn over Total(€) Daily average(€) 559,603,381 18,051,722 Number of shares traded Total Daily average 28,238,886 910,932 Number of trades Total Daily average 75,514 2,436 A Volatility 25.35% A Turnover velocity 161.51% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company WARRANTS STOCK OPTIONS LISTED BONDS