investment policy guidelines

advertisement

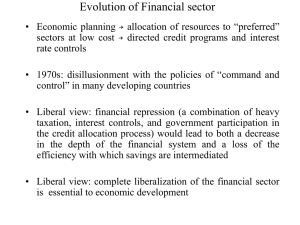

Investment Policy – RRBs/SCBs/CCBs Satyajit Dwivedi Member of Faculty CAB, Pune ACA-TM-37 (v2.2-20-Nov-10) Front Office • Deals in securities (Buy, Sale, & Repo Deals) • Putting the bids in the auctions of Tbills and other securities • Maintenance of deal records including the tapping of telephonic conversation ACA-TM-37 (v2.2-20-Nov-10) Mid Office • Risk Monitoring • Risk Measurement • Risk Management • Management Information System • Formulation and review of investment policy and guidelines for transactions in securities • Submission of reports to the top executives Board & • Maintenance of data base and updating front office with relevant information ACA-TM-37 (v2.2-20-Nov-10) Back Office • Inter Bank settlements of funds borrowed or lent • Settlement of Call/ Notice/ Term/ CD/ CP/ REPO/ TBills/ NCD • Physical verification of securities • Monitoring brokers’ turn-over • Reconciliation of RBI current A/c and constituents, own SGL investment portfolio • Interest collection on NCDs / Bonds • Dividend collection on shares or units • Follow-up on concurrent, inspection reports ACA-TM-37 (v2.2-20-Nov-10) statutory and RBI Investment Policy - Introduction • Recaptalisation of RRBs/Cooperatives & Turn around strategy • Allowed to invest their surplus in Money Market and Capital Market instruments • Major shift in the approach of the banks • Liquidity angle to Earnings angle • Change in the composition of investment portfolio • Securities scam and collapse of banks • Quality of Investment portfolio - direct bearing on the health of the bank ACA-TM-37 (v2.2-20-Nov-10) Need for Investment Policy • Banks undertake transactions in securities • on their own investment account or on behalf of their clients • Irregularities were noticed – Harshad Mehta Scam • A committee under the chairmanship of Shri Janakiraman was appointed (RBI guidelines (RPCD.RF. BC. 17/A4-92/ 93 dated 04.09.1992) to all banks for framing Investment policy. Banks to frame policy and constitute Investment Committee.) ACA-TM-37 (v2.2-20-Nov-10) Broad Contents of the Policy • Broad investment objectives • Delegation of powers for investments • Guidelines for portfolio composition • Authority to put through the deals • Procedure for obtaining sanction • Procedure for investment • Various prudential exposure limits • Internal Control System • Accounting Standards • Audit Review and Reporting System ACA-TM-37 (v2.2-20-Nov-10) Objectives • • • • Complying with Regulatory Requirements Maximising the Yield Optimising mix of current and permanent securities Optimising maturity profile and maintaining adequate liquidity • Optimising composition and minimising credit risks • Minimising Tax Liabilities • Profit Planning ACA-TM-37 (v2.2-20-Nov-10) Delegation of Powers • • • • BoD to delineate the powers of various authorities Aim is to facilitate smooth and quick investment decisions Key Factor – Time Available for taking decision Should constitute an Investment Committee to take investment decisions • Bank to have a reporting system to report to the top management on weekly basis, the details of transactions in securities/ other investment transactions. ACA-TM-37 (v2.2-20-Nov-10) Valuation of Securities & Provisioins • Follow the accounting procedure, valuation of investments etc., as per RBI norms (RPCD.BC. 154/07.02.08/ 94-95 dated 23 May 1995) & make provisions for depreciation/ loss • Amortisation of Premium paid on permanent investment over the remaining period of maturity of security • Half yearly review of investment portfolio (as of 30 September and 31 March) - place before Board within one month - forward approved report to RBI/ NABARD by 15 November and 15 May. ACA-TM-37 (v2.2-20-Nov-10) Valuation of Securities & Provisioins • Profit made on sale of Investments transfer to Investment Fluctuation Reserve & loss to P & L A/c • preparing funds flow statement to arrive at the surplus funds available for investment on a daily basis. • classified investments into NPAs in accordance with RBI instructions and provision, made or not made. • The limit for sanction of advances against share and debentures to individuals should not exceed Rs.10 lakh ACA-TM-37 (v2.2-20-Nov-10) Delegation of Powers • Investment in call money market - delegated to dealers - instant decision • Inter Bank Deposits - GM / CEO • Other Investment Decisions - Investment Committee • Power to be specific, clear and unambiguous • Different limits for different authorities and different instruments ACA-TM-37 (v2.2-20-Nov-10) Delegation Principles • Higher the amount higher the level • More the time higher the level • Online deals at lower levels (call) • Negotiated Market at higher levels • Spot market lower levels • T + market at higher levels ACA-TM-37 (v2.2-20-Nov-10) Portfolio Composition • SLR & Non-SLR Investments SLR Investments – GOI Securities – Treasury bills – State Govt. Securities – Central Govt. guaranteed bonds – State Govt. guaranteed bonds – Other approved securities ACA-TM-37 (v2.2-20-Nov-10) Non- SLR Investments • Bonds issued by PSUs, FIs, Banks • Equity shares and Debentures • Certificate of Deposits (CDs),Commercial Papers (CPs) etc. • Units of UTI ACA-TM-37 (v2.2-20-Nov-10) Diversification • Maturity-wise investment requirement to be mentioned • Short term : less than 5 years • Medium Term : 5 - 10 years • Long Term : more than 10 years • Maturity pattern of investments to match with maturity pattern of surplus cash ACA-TM-37 (v2.2-20-Nov-10) Contd.. • Security-wise policy How much to be invested in which type of securities • Industry-wise composition relates to investments in corporate debentures and shares • Overall portfolio to be governed by RBI / NABARD Guidelines / bye-laws ACA-TM-37 (v2.2-20-Nov-10) Exposure Norms – Coops. • Investments in PSU bonds to have RBI's permission and not to exceed 10% of the bank's deposits at the end of previous year • Coops. not to invest in shares of other cooperative institutions • Discretioiary invstments by Coops. not to exceed 5% of non-SLR surplus funds. (Monthly average WFs of previous year MINUS monthly average loans MINUS 35% of DTL) ACA-TM-37 (v2.2-20-Nov-10) Exposure Norms - RRBs • Investments of non-SLR not to exceed 50% of refinance, or 25% of the aggregate deposits at the end of the preceding year, whichever is higher • Deployment of surplus non-SLR funds in the credit portfolio of sponsor banks not exceed 15% of fresh lendings during the year. • Loans granted to a company together with investments made in its shares should not exceed 15% of capital funds. • Investment of surplus non-SLR funds in shares and debentures of corporate companies and units of MFs not to exceed 5% of the incremental deposits ACA-TM-37 (v2.2-20-Nov-10) Procedure for obtaining approval Note to contain • Surplus funds, period for which available • Existing position of SLR investment vis-a-vis statutory requirement • Non-SLR investment vis-a-vis exposure norms stipulated • Availability of investments in the market • Various risks involved • Yielding pattern of different types of securities ACA-TM-37 (v2.2-20-Nov-10) Procedure for Investment Investment in G-Secs • If SGL Facility available, the transactions in G-Secs should be put through SGL A/c only • Ensure that sufficient balance is available in the a/c before issue of SGL Transfer form • Purchasing bank to issue cheques only after receipt of SGL Transfer form • The form should be signed by two authorised officials ACA-TM-37 (v2.2-20-Nov-10) Contd.. • Should be in the standard format prescribed by RBI and serially numbered • Penal action in case the SGL form bounces back • Amount of SGL form will be debited to the current account of the selling bank • In the event of overdraft, penal interest will be charged - 3% over above DFHI’s call rate ACA-TM-37 (v2.2-20-Nov-10) Contd.. • In case of bouncing on 3 occasions, the bank will be debarred from trading with the use of SGL facility for 6 months • If after restoration of the facility, any SGL form bounces again, the bank will be permanently debarred from the use of SGL facility ACA-TM-37 (v2.2-20-Nov-10) Dealings through brokers • Role of broker - restricted to that of bringing the two parties to the deal together • Banks should not undertake any purchase or sale transactions with broking firms on principal to principal basis • While negotiating the deal, the broker is not obliged to disclose the identity of the counter party of the deal • On conclusion he should disclose the counter party ACA-TM-37 (v2.2-20-Nov-10) Contd.. • The contract note to contain the name of the counter party • Settlement of deals - funds & securities settlement between the banks • Broker should have no role to play • Banks not to give power of attorney to brokers to act on their behalf • With the approval of top management, the bank to prepare a list of approved brokers ACA-TM-37 (v2.2-20-Nov-10) Contd.. • List to be reviewed annually or more often if warranted • Clear cut criteria to be laid down for empanelment • Only brokers registered with NSE or BSE or OTCEI should be utilised for acting as intermediary • Verification of creditworthiness, market reputation, etc. ACA-TM-37 (v2.2-20-Nov-10) Contd.. • A record of broker-wise deals and the brokerage paid to be maintained • Disproportionate part of the business should not be transacted with one or two brokers • Limit of 5% of the total transactions (both purchases and sales) entered into by a bank during a year should be treated as the upper contract limit for each approved broker • Banks to fix aggregate contract limit for each of the approved brokers ACA-TM-37 (v2.2-20-Nov-10) Prudential Exposure Norms • Specify single investment exposure norms • Composition of investment under different categories of investment • Types of SLR and Non-SLR investments and their limit • Non-SLR investments – Shares, Debentures, PSU Bonds, MF Units, CPs & CDs • Stop Loss Limit ACA-TM-37 (v2.2-20-Nov-10) Internal Control System • Clear functional separation of (a) trading (b) settlement, monitoring and control and (c) accounting • Trading desk to prepare a Deal Slip for every transaction • Contain the nature of the deal, name of the counter party, direct deal or through a broker, name of the broker, details of security, price, contract date and time ACA-TM-37 (v2.2-20-Nov-10) Contd.. • Deals slips to be serially numbered and accounted properly • No substitution of the counterparty once the deal is concluded • The security sold / purchased cannot be substituted • The Accounts Section to write their books independently based on the vouchers passed by the back office ACA-TM-37 (v2.2-20-Nov-10) Contd.. • Maintain records of SGL transfer forms issued, received and whether balances as per bank's books reconciled at quarterly intervals with balances in the books of PDO of RBI • The reconciliation to be checked by internal audit/ Inspection Department of the bank. • Reporting system to report the details of transactions in securities, bouncing of SGL forms, etc, on a weekly basis ACA-TM-37 (v2.2-20-Nov-10) Reports to be generated ACA-TM-37 (v2.2-20-Nov-10) Audit Review & Reporting • Banks to undertake a half-yearly review of their investment portfolio • Put up the review note to the Board within one month • Report to indicate adherence to the laid down policy, procedures and RBI guidelines • A copy of the review note to be sent to RBI / NABARD by 15 November / 15 May ACA-TM-37 (v2.2-20-Nov-10) Audit Review & Reporting • Concurrent Audit to be conducted on treasury transactions • Audit report to be placed before Chairman & M D every month • Concurrent Audit Reports to be sent to NABARD, DoS, Head Office • Investment Policy to be placed before the Board for approval ACA-TM-37 (v2.2-20-Nov-10) Thank You ACA-TM-37 (v2.2-20-Nov-10)