EC3027 Corporate Social Responsibility

advertisement

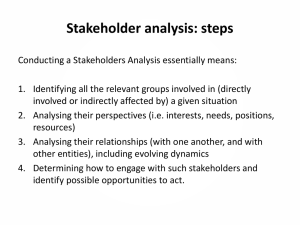

6BU004 Corporate Social Responsibility and Ethics Session 3: Stakeholder theory and CSR William Scarff and Dr Silke Machold Reader in Governance and Ethics Session objectives To understand meaning(s) of ‘stakeholder’ To compare different perspectives on nature of ‘firm’ To evaluate different categorisations and prioritisations for stakeholders To identify different ‘strands’ of stakeholder theory To assess implications of stakeholder theory for CSR Group activity In groups of 4, draw up a list of who you consider to be ‘stakeholders’ in IPW Metropolia. Explain why you would consider these stakeholders. Definitions of ‘Stakeholders’ “Those groups without whose support the organization would cease to exist” (Stanford memo 1963) “any group or individual who can affect or is affected by the achievement of the organization’s objective” (Freeman, 1984: 46) “bear some form of risk as a result of having invested some form of capital, human or financial, something of value, in a firm.” (Clarkson, 1994:5) “are or which could impact or be impacted by the firm/organization” (Brenner, 1995:76) Definitions cont. Narrow versus broad definitions: Narrow definitions focus on direct relevance to firms’ economic objectives, broad definitions recognise that very wide range of groups and individuals affect or are affected by firm Claimants versus influencers: Some define stakeholders as those that both affect and are affected by firm, others define it as either/or Actual versus potential stakeholders: Limitation of stakeholder dependent on whether actual relationship exists, issue of involuntary stakeholders Form of stakeholders: Human beings (or subset of these) versus non-human entities Perspectives on the firm Stockholder/ Shareholder perspective Friedman 1970 Jensen and Meckling 1976 Fama and Jensen 1983 Pound 1993 La Porta et al. 2000 Jensen 2002 Stakeholder perspective Freeman 1984 Freeman and Evan 1988 Jones 1994 Donaldson and Preston 1995 Mitchell et al. 1997 Freeman and Phillips 2002 Blair and Stout 1999 Shareholder perspectives on firm Primarily based on principal-agent view of firm (articulated by Jensen and Meckling 1976, Fama and Jensen 1983) Firm is a ‘nexus of contracts’ (Jensen and Meckling 1976:310) between shareholder (principals) and managers (agents) – premise of separation of ownership and control Primary responsibility of managers is to maximise wealth to shareholders, managers have ‘fiduciary’ duty to shareholders Stakeholder perspectives on firm Firm viewed as multilateral contract: managers contract with multiple stakeholders, not just shareholders (Freeman and Evan 1988), Contracts can take various forms but include social and psychological contracts, managers are agents of all stakeholders Alternatively, firm viewed as bundle of firm-specific investments made by participants in team production (Blair and Stout, 1999) Managers have duties and responsibilities to all stakeholders, fiduciary duties apply not only to shareholders Objective is to balance pursuit of profit with legitimate interests and ethical rights of stakeholders Problems with stakeholder perspectives Debate over ‘fiduciary’ duties – should shareholders be privileged over other stakeholders? ‘too many cooks, too many stews’ (Child and Marcoux, 1999:218): A/ are there not too many stakeholders to manage? B/ in which decisions should you involve stakeholders - possibility of decision-making paralysis? Prioritisation of stakeholders (stakeholder mapping) Power C Keep satisfied D Key players A Minimal effort B Keep informed Level of interest Source: Johnson, Scholes and Whittington, 2005: 182 Group activity: Using you list of stakeholders in IPW Metropolia map their priority to IPW Metropolia using the Johnson et al. stakeholder map. What problems you have encountered in using the model? Prioritisation of stakeholders cont.: Who or what really counts Power Legitimacy Urgency Source: Mitchell, Agle, Wood, 1997: 872 Mitchell et al. (1997) salience attributes (pp.865ff.) Power: “a relationship among social actors in which one social actor, A, can get another social actor, B, to do something that B would otherwise not have done.” (Dahl, 1981:1), “..to impose its will in the relationship” (Mitchell et al, 1997:865) Legitimacy: “a generalised perception or assumption that the actions of an entity are desirable, proper, or appropriate within some socially constructed system of norms, values, beliefs and definitions. (Suchman, 1995: 574) Urgency: “the degree to which stakeholder claims call for immediate action. “(Mitchell et al, 1997: 867) – compelling, driving imperative LEGITIMACY POWER Dominant stakeholder Dormant stakeholder Discretionary stakeholder Definite stakeholder Dependent stakeholder Dangerous stakeholder Non-stakeholder Demanding stakeholder URGENCY Strands within stakeholder theory Donaldson and Preston (1995) identify 3 strands: 1. Descriptive stakeholder theory: model which describes what the organisation is: constellation or network of cooperative and competitive interests (Jones 1994, Donaldson and Preston 1995, Frooman 1999, Agle et al. 1999): least developed empirically Strands within stakeholder theory cont. Instrumental stakeholder theory: Relationship between practice of stakeholder management and achievement of corporate objectives: i.e. certain financial outcomes more likely if stakeholder management is practiced (Donaldson & Preston 1995, Jones 1995, Berman et al. 1999, Orlitzky 2003): much contested and some conflicting results until meta analysis by Orlitzky (2003) showed link between CSR and financial performance Strands within stakeholder theory cont. Normative stakeholder theory: Stakeholders are persons or groups with an interest in the corporation (regardless of whether corporation has interest in them!), interests of all stakeholders therefore should be of intrinsic value: corporations have moral responsibility/duty to take account of stakeholders (Donaldson and Preston 1995, Phillips 1997): normative means ‘should’ – but little evidence that this is what organisations do on practice Implications of stakeholder perspective for CSR Objective of firm is not simply to maximise value to shareholders but manage/balance different interests and rights of stakeholders Firms need to identify and prioritise stakeholders (most commonly accepted are employees, customers, environment and community – what about others with power and legitimate interest?) Question is how to manage stakeholders – involvement in decisions?, representation (e.g. boards)? Stakeholder theory has three strands (descriptive, instrumental and normative) – descriptive is least researched and normative has little empirical support Later sessions will look at main stakeholder groups in more detail Key reading Carroll, A.B., Buchholtz, A.K. (2009) Business & Society: ethics and stakeholder management. 7th edition, Mason, Ohio: Thomson SouthWestern. Donaldson, T., Preston, L.E. (1995) “The stakeholder theory of the corporation: concepts, evidence and implications”, Academy of Management Review, (20) 1, pp. 65-91. Mitchell, R.K., Agle, B.R., Wood, D.J. (1997) “Toward a theory of stakeholder identification and salience: defining the principle of who and what really counts”, Academy of Management Review, (22) 4, pp. 853-886. Additional reading Jensen, M.C. (2002) “Value maximization, stakeholder theory, and the corporate objective function”, Business Ethics Quarterly, (12) 2, pp. 235-256. Freeman, R.E., Evan, W.M. (1990) “Corporate governance: a stakeholder interpretation”, Journal of Behavioral Economics, (19) 4, pp. 337-359. Frooman, J. (1999) Stakeholder influence strategies, Academy of Management Review, 24 (2): 191-205. Goodpaster, K.E. (1991) “Business ethics and stakeholder analysis”, Business Ethics Quarterly, 1, pp. 53-73. Jensen, M.C., & Meckling, W.H. (1976) Theory of the firm: managerial behaviour, agency costs, and ownership structure, Journal of Financial Economics, 3(4), pp. 305-360 Jones, T.M. (1995) “Instrumental stakeholder theory: a synthesis of ethics and economics”, Academy of Management Review, (20) 2, pp. 404-437. Machold, S., Ahmed, P.K., Farquhar, S. (2008) Corporate Governance and Ethics: A Feminist Perspective. Journal of Business Ethics, 81(3): 665-678. Marcoux, A.M. (2003) “A fiduciary argument against stakeholder theory”, Business Ethics Quarterly, (13) 1, pp. 1-24. Orlitzky, M., Schmidt, F., Rynes, S. (2003) Corporate social and financial performance: a meta analysis, Organization Studies, 24 (3): 403-441. Phillips, R.A. (1997) “Stakeholder theory and a principle of fairness”, Business Ethics Quarterly, (7) 1, pp. 51-66. Smith, H.J. (2003) The shareholder vs. stakeholder debate. MIT Sloan Management Review, Summer 2003: 85-90. Starik, M. (1994) ed. “The Toronto conference: reflections on stakeholder theory”, Business and Society, 33, pp. 82-131.