Document

advertisement

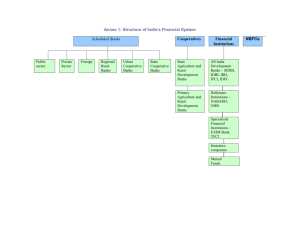

Cooperative credit society Cooperative credit society are used as mobilizing rural saving and stimulating agricultural investment 44% of the institutional credit is accredited to Cooperative Credit society in India They are established as Cooperative and under the Ministry of Cooperation ROLE OF RBI The All India Rural Credit Survey Committee assigned crucial role to the RBI in building up the cooperative credit organization. • To draw schemes in collaboration with Government of India and the State Government • To provide fund to the state government for contribution to the share capital of the cooperative credit societies. Two funds were set up under RBI Act 1. The National Agricultural Credit (long term operation) Fund and 2. National Agricultural credit (stabilizing) Fund. RBI was appointed as an active agency to promote CCS. RBI developed the credit norms and rationalized the lending process Two types of credit societies emerged: 1. Primary Agricultural credit society 2. Cooperative credit banks a. State Cooperative Agricultural and rural development bank b. Primary Cooperative Agricultural and rural development bank Organizational structure Coop Banks Primary Urban Coop Banks Rural Cop Banks Sht. Term. Cr. Str 2 tire str. 3 tire str. CCB Long term Cr. Str Unitary Str. Federal Str. PCARDB PAC PAC PCB Primary Agricultural Credit Societies (PACS) : They have been to provide grass root level credit disbursement in rural areas. They depend on borrowings from higher organization. Urban Cooperative Credit (PCBs): established to increase banking habit with lower and middle income group people. They operate through primary cooperative banks (PCB) State Cooperative Banks: They are in the three tire system (top part) and meet short and medium term credit. There are 28 such organizations in India. Central Cooperative Banks (CCBs): They form the middle tire in the tree tire system. The provide short term credit. Role of Credit Cooperative Societies: 1. Provide grass root level rural and urban credit. 2. Develop thrift habit 3. Take part in short term and mid term credit expansion 4. Assist NBARD in Micro Finance 5. Act as a central point of disbursement for all rural and urban short and mid term refinance