ubd_chee_brunei_inc_..

advertisement

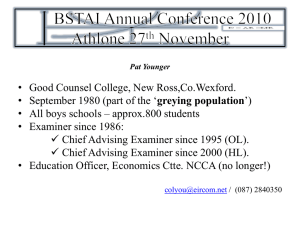

STATE INCORPORATED AND PRIVATISATION POLICY Dr. Chee Kim Loy (Associate Professor) Faculty of Business, Economics and Policy Studies, (FBEPS) UBD OUTLINE OF PRESENTATION State Inc and Privatisation Policy: A Development Management’s Perspective A Framework for Managing Privatisation (national level) A Case Study of Malaysia’s Experiences Main messages… Global recovery, though still fragile, is now underway, and developing countries are likely to grow faster than rich countries. The Doha Agenda has the potential to speed growth, raise incomes, and reduce poverty, and all countries have an interest in its success. But to realize this potential, governments have to tackle inequities in the world trading system – and to forge an agreement than benefits the poor. The rich countries: a moderate recovery... Real GDP, percent change 5 High income countries 4 Forecast 3 2 East Asia financial crisis 1 4 05 20 3 2 00 20 99 98 97 96 95 94 93 92 91 89 19 90 88 87 86 85 84 83 82 1 2001 downturn Early 1980s recession 19 81 0 Early 1990s recession Global prospects The rich countries: investment now Realrising.... fixed investment, percent change at annual rates 8 Japan 4 0 -4 Euro Area -8 -12 United States -16 Q2 01 Q3 01 Q4 01 Q1 02 Q2 02 Q3 02 Q4 02 Q1 03 Q2 03 The developing countries: a robust outlook Real GDP, percent change for developing countries Forecast 5 Early 1980s debt crisis 4 3 2001 Global downturn 2 East Asia financial crisis 1 1990s recession Transition countries 4 05 20 3 2 1 99 20 00 98 97 96 95 94 93 92 91 90 19 89 88 87 86 85 84 83 82 19 81 0 CONCEPTS AND PERSPECTIVE Concept of State Inc Concept of Privatisation Development Management’s Perspective 1 State Incorporated: A Definition It is a national development strategy to accelerate economic (esp. industrial) development through formal and informal cooperation and collaboration between the government and the private business sector. The private sector is believed to be the main generator of economic growth; the close alliance is to facilitate the expansion of the private sector. MALAYSIA INCORPORATED “The Malaysia Inc concept, therefore, requires that the private and public sectors see themselves as sharing the same fate and destiny as partners, shareholders and workers within the same ‘corporation’, which in this case is the Nation. The ‘corporation’ will prosper if its commercial and economic arm, that is the private sector does its best... while optimizing its returns on investment. The service arm …the Government will provide all the support it needed.” Dr, Mahathir, PM of Malaysia, 1984. PRIVATISATION: DEFINITIONS Narrow Definition The sale of public assets to private shareholders ( i.e. 100% or at least majority share) Broader Definition Changing the status of a business, service or industry from state, government or public to private ownership or control THREE MAIN APPROACHES TO PRIVATISATION Change in ownership of an enterprise (or part of it) from public to the private sector Liberalisation or deregulation, of entry into activities previously restricted to public sector Provision of a good/service is transferred from public to private sector, while retaining ultimate responsibility for supplying it GOALS OF DEVELOPMENT POLICY IN DEVELOPING COUNTRIES Economic Growth Political Stability Social Welfare Cultural Values Sustainable Development DEVELOPMENT POLICY’S PERSPECTIVE Economics’ Perspective Political Perspective Market based State based Development Management’s Perspective ‘Strategic Pragmatism’ based STATE vs MARKET DEBATE IN DEVELOPMENT POLICY “The consequences of an overzealous rejection of government have shifted attention from the sterile debate state vs market to a more fundamental crisis in state effectiveness…… “State-dominated development has failed, but so will stateless development. Development without an effective state is impossible” World Development Report, 1997 THE CONTEXT OF DEVELOPMENT MANAGEMENT POLITICAL IDEOLOGY GLOBALISATION IMPACTS FISCAL CRISIS SOCIO- CULTURAL VALUES ICT TRANSFORMATION ECONOMIC / ORGANIZATION THEORY TENSION TRADITIONAL PUBLIC / DEVELOPMENT ADMINISTRATION PARADIGM SHIFT IN DEVELOPMENT MANAGEMENT ( e.g. STATE INCORPORATED) MANAGERIALISM MANAGING GOVERNMENT ACTIVITIES FOR DEVELOPMENT PRIVATISATION CONTRACTING FOR SERVICES DE-REGULATIONS / RE-REGULATIONS VOLUNTARY / NONPROFIT ORGANISATIONS ORG. NETWORKS/ PARTNERSHIPS IMPROVING BUREAU-CRATIC MANAGEMENT ‘Market-Friendly’ Development Model: (World Bank- IMF) Emphasis on the virtue of market with minimal intervention by the state Market conforming economic policies of the government Focusing on closer integration with the world economy Stress on ‘state effectiveness’ in the role of the government in development TWO-PART STRATEGY OF AN EFFECTIVE STATE Matching state’s role to its capabilities Reinvigorating the state’s capability EAST ASIAN DEVELOPMENT MODEL AN EXAMPLE OF A REGION WITH ‘EFFECTIVE STATES’ ’ IN ACHIEVING RELATIVELY HIGH LEVEL OF ECONOMIC AND SOCIAL DEVELOPMENT IN RECENT DECADES (1960-2000) AMONG THE LESS DEVELOPING COUNTRIES OF THE WORLD. The ‘Strategic Pragmatism’ Development Perspective Period: 1970s-1997 The East Asian development ‘miracles’ Vigorous economic roles and selective state interventions Strategic but not total integration with the world economy Industrial policy to guide the market towards planned structural change (e.g.State Inc and privatisation policy) What is Industrial Policy? “It means the initiation and coordination of government activities to leverage upward the productivity and competitiveness of the whole economy and of particular industries in it. Above all, positive industrial policy means the infusion of goal-oriented, strategic thinking into public economic policy….it is the logical outgrowth of the changing concept of comparative advantage” Johnson, 1984 State Inc: Various Examples Japan Inc Korea Inc Taiwan Inc Singapore Inc (GLC) Malaysia Inc China Inc (?) END OF PART I A FRAMEWORK FOR MANAGING PRIVATISATION A FRAMEWORK FOR MANAGING PRIVATISATION Planning and Goal Setting Programme Development Structural Reforms Implementation FRAMEWORK FOR PLANNING AND IMPLEMENTING PRIVATISATION DEFINE PRIVATISATION MACROPOLICY REFORMS Economic Political Governmental SET SCOPE OF PRIVATISATION PLANNING & GOAL SETTING CHOOSE ORGANISATIONAL STRUCTURE CREATE CONDITIONS FOR PRIVATISATION AGENCY SUCCESS ASSESS POTENTIAL ADVANTAGES & ADVERSE IMPACTS PROGRAM DEVELOPMENT STRUCTURAL REFORMS DEVELOP STRATEGIC MANAGEMENT PLAN IMPLEMENTATION INSTITUTIONAL REFORMS Market Private Sector Civil Society CHOOSE APPROPRIATE METHODS ASSESSMENT AND FEEDBACK DEVELOP MANAGEMENT REQUIREMENTS AND PROCEDURES Planning and Goal Setting Defining privatisation Determining the scope of privatisation Choosing the organizational structure Creating the conditions for agency success Assessing potential advantages Assessing potential adverse impacts Programme Development Developing a Strategic Management Plan Choosing appropriate methods of privatisation Structural Reforms Enacting Economic and Political Reforms Developing Institutional Capacity Implementation Management Requirements Management Procedures Management of Social Issues A Final Quote on Privatisation “Although privatisation is an essential instrument for transforming government-controlled economies into market-oriented systems and for making established market economies more efficient, it is neither a panacea for all government’s ill nor sufficient to ensure economic progress. Privatisation is most effective when it is part of a broader programme of economic policy reforms and institutional development” D.Rondinelli (1996) END OF PART 2 MALAYSIA INC AND PRIVATISATION POLICY ( a Case Study ) Malaysia Inc and Privatisation Policy: Presentation Outline The Political Development Context The Growth and Performance of State Owned Enterprises (SOEs) The Formulation of Malaysia Inc ‘Privatising’ Malaysia Political Context of Malaysia Inc and Privatisation Policy 1957-69 1970-81 ‘NEP: The Second Decade- The Era of Privatisation - First Phase’ 1991-97 ‘NEP: The First Decade-The Public Enterprises Era’ 1982-91 ‘Bargain of 1957’: The Alliance laissez-faire Policy Mahathir’s Vision 2020: The Era of Privatisation -Second Phase Post-1997 Adaptation to New Realities of Globalisation Size and Structure of SOE Sector in Malaysia-1990 1,158 SOEs -Total Paid-up Capital $23 billion About 25% of GDP 396 (or 34%) were 100% Government-owned 429 (or 37%) were majority owned 333 (or 30%) were minority equity stake Government equity share was 70.3% ($16.7 billion) About equal share between Federal and State Governments Debt-equity ratio of 180% as compare with Relative Performance of SOEs 1980-1988 Year Profitable ‘80 81 82 83 84 85 86 87 88 (%) 61 60 54 58 58 52 52 53 60 Unprofitable 39 40 46 42 42 48 50 47 40 About 12-19% of these SOEs were ‘sick’ companies i.e. with negative shareholders’ fund and 24-30% were not making profits at all! Major Reasons for Poor Performance Internal microeconomic weaknesses in the sector rather than the failure of the macroeconomic environment Management weaknesses Poor or non-existing shareholder discipline Poorly designed incentives structures Easy access to soft finances, poor resource allocation Operational inflexibility Malaysia Inc: 1984-1990 – Phase I Use the concept to formulate an effective framework for carrying out administrative reforms in the Malaysian public service. It enabled the public sector to identify the private sector as their main client and to zoom in on specific components of the private sector that required specialised support to earmark improvements to their own administrative systems and processes used in the interface wit the private sector. Malaysia Inc : 1991- 2001 Phase II New Mechanisms and Structures Malaysian Business Council (MBC),1991 PM as Chairman Members from public, private and NGOs Development Administrative Circular No 9 ,1991 Formalise a comprehensive /integrated approach The Malaysian Incorporated Officials Committee(MIOC) Chaired by the Chief Secretary Members from public, private sectors and NGOs Agency-based Consultation Panels Dialogue Sessions Some Encouraging Results 1998 Survey by the Political and Economic Risk Consultancy Ltd (PERC) placed Malaysian public service as the 3rd most businessfriendly in Asia 1997 World Competitiveness Report by the Geneva-based International Institute for Management ranked Malaysia Government as the 4th most competitive in the world PRIVATISATION POLICY of MALAYSIA PRIVATISATION POLICY Concept and Methods of Privatisation Key Success Factors of Privatisation Privatisation Policy and Practices in Malaysia A Brief Profile Malaysia Privatisation Master Plan ( 1991) Privatisation Achievements Key Success Factors Criticisms Privatisation in Malaysia: A Brief Profile Started in 1983: Guidelines on Privatisation 1991: Privatisation Masterplan (PMP) By late 1990s More than 400 projects implemented Saving in capital expenditure - about $130 billion Proceeds from sales of assets/equities - $22 billion Reduction of about 105,000 public servants After 1997 Additional features of privatisation Potential of more projects from Multimedia Super Corridor (MSC) Malaysia’s Privatisation Masterplan (PMP) FIVE OBJECTIVES FOUR MAIN MODES OF IMPLEMENTATION SIX RECOMMENDATIONS Five Objectives of PMP Relieving the financial/administrative burden of the government Improving efficiency and productivity Facilitating economic growth Reducing the size and presence of the public sector Helping to meet the National Development Policy Six Recommendations Privatisation should be part of a comprehensive process of economic liberalisation reform; Privatisation strategies have to be more carefully tailored to meet national objectives; The machinery for policy implementation has to be improved; Appropriate reforms to the legal framework are needed; Enhance official and public support for the programme; Careful management of staff sensitivities. Four Main Modes of Implementation Sale of assets or equity Lease of assets Management contract Built-operate-transfer (“BOT”) Built-operate-own (“BOO”) for new infrastructure Built-transfer(“BT”) Arguments for Privatisation Policy in Malaysia Reduce financial/administrative burden of the government Promote competition, improve efficiency and increase productivity Stimulate private entrepreneurship and investment Reduce the presence and size of the public sector, with its monopolistic tendencies and bureaucratic support Help to achieve NEP/NDP objectives Privatisation Achievements NOTE Privatisation is only one major component of a broad structural reform programme Economic success of a country cannot be attributed to privatisation alone. Reducing Financial and Administrative Burden Saving in capital expenditure $130 billion Sales of Assets/equity $ 22 billion Lease rentals Reduction in public service payroll 105,000 persons (Telecoms, Electricity, Postal – 65% of total) Efficiency/Productivity Gains: Some Cases Telekom Malaysia Bhd After 4.0 35 9.3 60 Return on Assets(%) Speed of Access (services) Before Projek Lebehraya Utara Selatan Revenue per employee ($) Traveling Time(hours) 77.7 15.4 217.6 7.5 Penang Port Sdn Bhd Gross Annual Profit Av. Container Throughput (in 1000’s TEU) 24.14 331 41.48 386 Promoting Competition Monopoly status to limited competition Fixed telephony services and cellular phone (5 companies) Independent power producers (11 companies) Innovative services from Pos Malaysia Bhd. Facilitate Economic Growth Corporate expansion and greater utilisation of growth opportunities through private sector motivation Reduce public sector budget and reduce infrastructure bottlenecks Efficiency gains release resources for corporate expansion and multiplier effects in the economy The 882 km North-South Highway was completed 14 months earlier Effect on the capital market Improvement in KL Stock Exchange Meeting National Development Policy Targets Enhance role and participation of the Bumiputra community Benefit other Malaysians through collaboration and joint-venture projects Create new class of entrepreneurs e.g. in infrastructure projects and automobile manufacturing Distinctiveness of Malaysia Privatisation Policy Balance between NEP interventionism and against the laissez-faire ideals of privatisation UMNO (and allies)/ has become a key player as a party through corporate ownership and holding companies Encouraging FDI-led development, allowed for rapid emergence of shorter term capital flows/portfolio type rather than longer term productive investment Key Success Factors Strong commitments and realistic approach Adoption of new administrative procedures Systematic and coordinated policy implementation General acceptance by Malaysian public through effective communication Private sector capacity and enthusiastic support Implementation Issues Increase in Tariff Rates or Service Charges Regulatory System Bumiputra Participation Legislation: Amended or New Greater Transparency Economic Downturn Economic Crisis: Additional Measures Special focus on projects which contribute to economic recovery Implementation of contracts in phases Use of more local contents - building materials and equipments Financing from local banks and financial institutions for new projects Criticisms of Malaysia Inc and Privatisation Malaysia Inc viewed as ‘Crony Capitalism’ Dominance of Partial Divestiture – a reflection of Malaysia Inc Policies Best of both worlds or worst of both worlds! Privatisation has been most successful with regard to Bumiputra wealth acquisition but not to other aspects of NEP’s equity objectives Criticisms of Malaysia Inc and Privatisation…con’t Privatisation has encouraged rentseeking behaviour associated with political involvement by government in business affecting investment priorities and activities Criticism….con’t May undermine public welfare as a result of the strengthening of private monopolistic interests Alternatives to privatisation policy have not been critically examined Competition and enterprise reforms are the key to economic efficiencies not ownership per se CHALLENGES AHEAD What further lessons can we learn from the East Asian development in recent years (1997-2001)? From ‘miracles’’ to ‘mirage’? What lessons can Brunei learn from these East Asian countries to manage her development agenda effectively? THANK YOU