4. Leaving Cert Economics

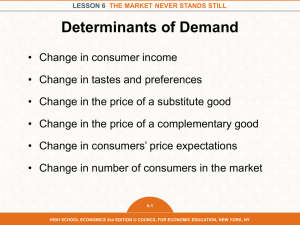

advertisement

Pat Younger • • • • Good Counsel College, New Ross,Co.Wexford. September 1980 (part of the ‘greying population’) All boys schools – approx.800 students Examiner since 1986: Chief Advising Examiner since 1995 (OL). Chief Advising Examiner since 2000 (HL). • Education Officer, Economics Ctte. NCCA (no longer!) colyou@eircom.net / (087) 2840350 5th Year Economics • • • • • Stimulate thinking and critical awareness Challenge student’s existing opinions and views Take time to show the breadth of economics Encourage students to watch the news / current affairs Consider / use the following articles: The Economic Problem The ghostly poor who are all around – Nuala O’Faolain We have failed miserable to create a fair society – John Lonergan Capitalism – A Love Story (Michael Moore) Course Outline – Possibility? Year Sept 1 Oct Nov Dec Jan Feb Mar Apr May Topic 1 Intro Topic 2 Continued Topic 4 Inflation Topic 5 Topic 1 Topic 3 Topic 4 Topic 5 Topic 5 Topic 5 Intro. To Micro: D&S Costs of Production Intro. To Markets Imperfect Topic 3 National Income Elasticity Topic 2 Budgeting. Taxation , Debt, Money & Banking National Income Privatisation 2 Utility Topic 5 Topic 6 Topic 6 Topic 7 Topic 8 Oligopoly FOP Market Trade and The EU Economic Growth & Population Employment and Emigration Price Discrim. PC Monopoly Topic 2 Development Topic 9 Economic Aims, Policies & Conflicts Overflow Competition Course Outline – Possibility? Sept Oct Nov Dec Jan Feb Mar Apr May Topic 1 Topic 2 Topic 3 Topic 4 Topic 1 Topic 3 Topic 4 Topic 5 Topic 5 Introduction Government Budgeting, Taxation Borrowing, National Debt Privatisation National Income Money & Banking Demand, Supply & Markets Elasticity Costs Markets Markets Monopoly Imperfect Competition Privatisation Nationalisation Nationalisation Topic 2 Government Budgeting, Taxation Borrowing, National Debt Privatisation Nationaliastion Topic 2 Topic 5 Utility Markets Perfect Competition Course Outline – Possibility? Topic 1: Introduction to Economics Topic 2: Utility • • • • • • • • • What is economics? How an economic system works (market economy) Types of economic systems (China & Communism) Free Enterprise (How a market economy works) Disadvantages of Free Enterprise (revision test) Topic 2: Government in the Economy • • • • • Reasons for government involvement Budgeting (worksheet: how to reduce a CBD) Taxation (Universal child benefit) Privatisation & Nationalisation (article) The National Debt (Test + solutions / revision worksheet Topic 3: National Income • • • Measurement & Uses of National Income (textbook template + templates for testing) Keynesian Determination of National Income (textbook template + multiplier questions) Circular Flow of National Income Example 1: How to allocate income Example 2 Substitution and Income Effect Definitely or possibly a Giffen Good Topic 3 : Elasticity • Revision questions Topic 4: Costs of Production • A template for teaching costs Topic 5: Markets • Diagrams (see 2009 HL Q2 (b) (alcohol advertising) Topic X: Development of Economic Thought • • A template for introducing it How to summarise the key ideas Introduction to Course • What is economics? (allocation of scarce resources) • How an economy system works Introduce Circular Flow of Income • Functions of an economic system: What ? How? For Whom? • Types of Economic Systems: Free Enterprise Characteristics / Advantages / Disadvantages • Disadvantages: Give rise to reasons for Government Involvement in the economy Introduction to Economics Incom es for supplying F.O.P's FIRMS HOUSEHOLDS Incomes Output Spending on the output of firm s Tax GOVERNMENT Savings Governm ent Expenditure Investm ent FINANCIAL INSTITUTIONS Im ports Exports FOREIGN MARKETS Free Enterprise (use 2007 HL exam) Characteristics: Market mechanism: resources are allocated through the market / price mechanism. Ownership of factors or production: nearly all factors of production are privately owned. Limited government interference: government exists to supply public goods; provide a legal framework within which markets can work and prevent the creation of monopolies. Decentralised decision making: the allocation of resources; the decisions on what to produce; how to produce and who gets the commodities: decided by individuals /entrepreneurs. Motivated by Self-Interest: consumers, producers and property owners are motivated by this. [Consumers aim to maximise their utility / Producers aim to maximise profit / Owners of factors aim to maximise their return] Free Enterprise Economic Advantages Reduced inequalities in society / More even distribution of wealth: The government may place great emphasis on providing all citizens with a minimum standard of living e.g. subsidising essential food. Provision of essential services: The state may provide those services to citizens which it considers vital such as health care, education, public infrastructure. Economies of scale: The large scale of production may mean that the firm benefits from economies of scale. The government may be more efficient in the provision of those commodities which require a large capital investment e.g. energy generation ; roads etc. Full employment Historically centrally planned economies were able to achieve full employment while those economies consider free enterprise suffered from unemployment. Economic Disadvantages Shortages in goods and services: Because the state may limit prices there may be excess demand and so shortages develop and the available goods may be allocated by a queuing system Restricted choice / freedom for individuals: Workers may be allocated particular jobs or in particular areas and maybe restricted in their ability to change jobs by state requirements. Consumers will have little say in what is produced and what is available may be quite restricted. Inefficiency: Because there is little incentive for enterprise and innovation, individuals and firms are not encouraged to take risks, work harder or innovate. Low economic growth:: As all individuals are not motivated by self-interest this may result in reduced economic activity resulting in poor economic growth rates. Bureaucracy / Corruption / High Taxes: With so many decisions to be made it may mean that the system becomes over bureaucratic further reducing incentives to work / or be innovative. Taxes may have to rise to fund the administration involved. Corruption may develop within society. Introduction contd • Use the disadvantages of a free enterprise economic system as an introduction to the Government in the Economy • Arising from the disadvantages of free enterprise: What are the reasons why the government chooses to become involved in the economy? Redistribution of wealth / provision of essential services / creation of jobs / best use of scarce resources etc. ************************** This approach to introducing the course can be used to introduce concepts such as: Scarcity / opportunity cost / Creation of wealth – and its measurement Karl Marx / John Maynard Keynes / Adam Smith Markets: demand & supply / the factor market and product market (in other words an outline of the course) National Income 3 sections 1. 2. 3. Measurement & Uses of National Income (Income / Output/ Expenditure) Keynesian Determination of National Income (Y=C+I+G+X-M) Circular Flow of National Income Measurement Think of the economy in sectors (Agriculture, Industry & Services) Consider a factor of production supplying itself to each sector Each FOP produces a good or provides a service (Output) Each FOP receives an income (Income) Each FOP spends its income on the goods & services it needs (Expenditure) National Income Relationships Net Domestic Product at Factor Cost +/- Net Factor Income from the rest of the world Net National Product at Factor Cost + Capital Depreciation_____________________ Gross National Product at Factor Cost + Indirect Taxes - Subsidies_______________________________ Gross National Product at Market Prices Irish & foreign factors Irish factors only at the cost to the fop’s at the prices paid in mkt National Income Uses of National Income Limitations 1. Indication of alterations in our standard of living Any change in our national income figures will indicate the level of economic growth, or otherwise, within the country from one year to the next, and give a general indication of changes to the standard of living, if any. Used by trade unions to justify wage demands. Population changes If national income grows at a slower rate than population, then national income per head decreases and the average standard of living will fall. Hence population changes must be considered with changes in national income when assessing a country’s economic performance. 2. Means of comparing the standard of living in different countries. We can use the national income statistics to compare the standard of living in our country with that of other countries. Inflation/deflation An increase in prices will increase national income but standard of living may fall. So changes in national income must be compared with changes in prices to determine the impact on standard of living / economic performance. 3. Assists the government in formulating economic policy. Governments have a greater influence on the development and growth of the economy. To effectively plan for this governments’ need information about our economy such as that provided by the National Income statistics. 4. Evaluate economic policy To assess changes to the economy and economic changes in the various sectors, and to provide a benchmark against which progress can be monitored, it is useful to have national statistics. 5. EU Budget Contributions / Benefits The wealth revealed in our national income statistics will determine the contribution (if any) which Ireland must make to the EU budget. The figure will also be used within the EU to determine those countries which require financial aid from the EU and the amount of that aid. Employment / Unemployment If a person is unemployed rising national income will not necessarily mean that this person’s average standard of living is rising. Levels of taxation When considering a person’s standard of living one should take into account rates of income tax and levels of indirect tax within the country. An increase in either of these may result in a drop in a person’s standard of living. Measures flow of wealth not welfare Rising GNP may be accompanied by changing working or living conditions which may cause a loss of welfare e.g. traffic congestion and so a person’s standard of living may fall. Teaching Economics - Advice Do • Use relevant Stimulus material – from the newspaper / TV / radio • Use worksheets to introduce or consolidate a topic • Encourage critical discussion / thinking • Use Ordinary Level questions to stimulate discussion • Use the textbook where appropriate. • Practice answering questions / drawing diagrams. Don’t • Rely on the textbook alone. • Despair! • the language involved is new and complex at the beginning! • Expect that students will ‘get the hang’ of it immediately – be prepared for ‘the wall’. • It takes time to understand the concepts Student Learning Personal Responsibility • • • • • • • Need to concentrate in class – crucial to understanding. Suitable Homework: best to review class work Next Class: recap yesterday’s work Use worksheets – where appropriate Current TV / Radio / local news: is anything in the news? Organisation: of class notes / handouts / worksheets With Class tests: re-correct and show how marks can be gained through statement / explanation + giving examples Websites • • • • • • • • www.bized.co.uk www.tutor2u.com www.centralbank.ie www.cso.ie www.irlgov.ie/finance www.adbusters.org www.s-cool.co.uk/default.asp www.examinations.ie