Supply Side policies

advertisement

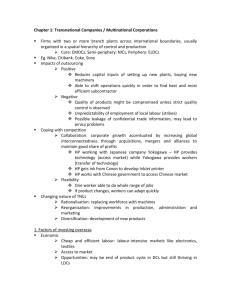

Supply Side policies AS Economics Managing the economy Managing the economy Fiscal policy Monetary policy Supply side policy Supply Side Policies • Aimed to increase the country’s AS and shift the LRAS to the right • Combined with AD policies, they aim to meet government macroeconomic targets • Supply side policies can be private or public sector, e.g. improvements in productivity in the private sector Price Level LRAS1 LRAS2 Supply side policies aimed at shifting LRAS to the right RO Supply Side Policies 1. Labour market measures – improving education and training, reducing trade union powers, profitrelated and performance related pay, encouraging more flexible pension arrangements 2. Tax reforms – reducing the tax burden and replacing direct with indirect taxes 3. Welfare reform – reducing state benefits to encourage employment rather than benefits and reducing the unemployment trap Supply Side Policies (2) 4. Industrial and competition policy – privatisation, deregulation, contracting out 5. Financial and capital market measures – deregulating financial markets, greater competition amongst banks and building societies, encouraging saving and share ownership, promoting entrepreneurship • Overall, supply side can be categorised into policies focused on the labour market or product market What factors affect supply? • Supply side policies seek to increase long run aggregate supply and so increase the productive potential of the economy. • They aim to do this by increasing the quantity and quality of resources 2 main approaches to SS policy • Free market approach (new classical) – by raising work incentives, removing restrictions on firms and increasing competitive pressures • Interventionist approach (Keynesian) – seeks to shift the LRAS curve to the right through government intervention in markets to correct market failure Work debate • How has the government encouraged people into work? • How could this be extended? Free market SS policies • Reducing direct taxes e.g. income and corporation tax – encourages increases in quality and quantity of labour and capital. Lower tax encourages more working and training to gain higher paid jobs. Should encourage those out of work to seek work if it is beneficial to them. Corporation tax reduction will increase the funds that firms have available to spend on R&D and new capital, thereby increasing LRAS. Free market SS policies • Cutting benefits – if benefits are cut, together with a decrease in income tax, then this should encourage more people to move into the job market, by making it more financially attractive to work • Paying benefits for ‘job seeking’. Some people argue that tying benefits to actually seeking employment will in turn lead to more people joining the labour market Free market SS policies • Reforming trade unions – some unions act as a monopoly to the management, a de facto monopsony, could also be achieved if the union represents all workers. This can push wage rates about the equilibrium level. • Free market economists argue that union power should be reduced to stop people being priced out of the market (Thatcher in 1980s) Free market SS policies • Privatisation – big in the 1980s when the government privatised industries. Free market economists believe that firms work better in the private sector and more competition leads to increased supply. • Deregulation – removing laws and regulations to restrict competition • Competition policy – to make markets more economically efficient Interventionist supply side policies • Education and training – greater quantity and quality of education should raise labour productivity and mobility. If the government does not intervene in education then not enough resources will be used and it will be underused and underprovided (merit good with positive externalities) Interventionist supply side policies • Investment grants – profit incentive by firms might mean that in the short term firms do not invest. These grants aim to increase the quantity and quality of investment • Regional policy – aims to regenerate areas of deprivation and increase infrastructure, schools, hospitals and housing where there is a shortage Effectiveness of SS policies • If a country becomes capable of producing at a lower costs then the BOP position should improve • Trend growth rate should rise • Unemployment should be lower as labour is more flexible • Increasing productive capacity should also reduce the risk of inflation – the output can rise without causing a rise in the price level Effectiveness of SS policies • • • • Can be influenced by other factors; Takes time to have effect (education) Expensive (education, training, healthcare?) Workers and producers may respond in an unintended ways e.g. Firms > more dividends than investment, workers> reduce hours after income tax is cut • No guarantee they will work: Education – does not always lead to higher standards; privatisation does not always lead to increased competition